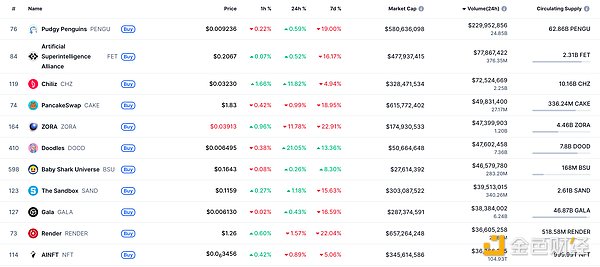

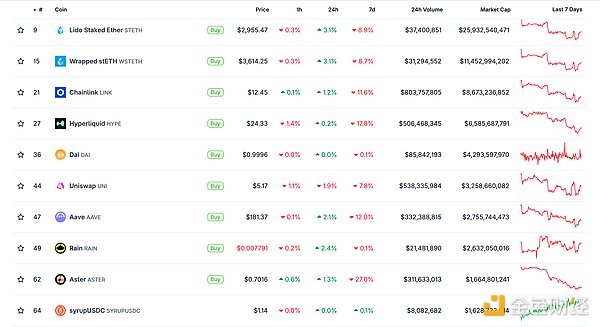

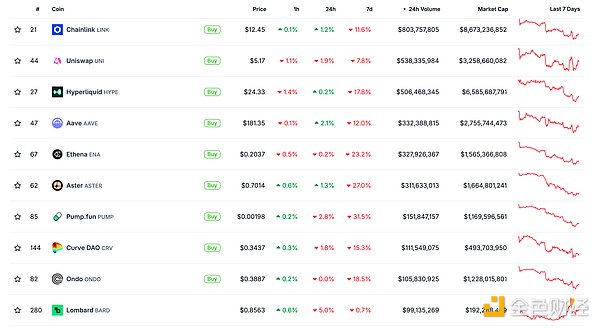

DeFi data

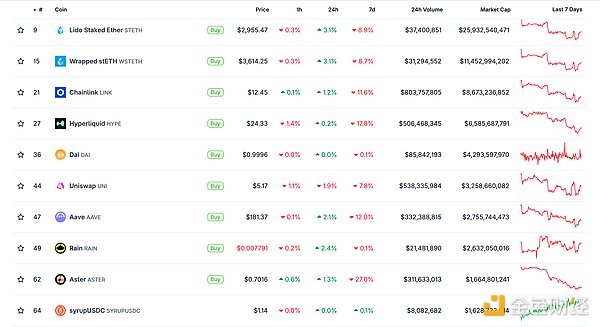

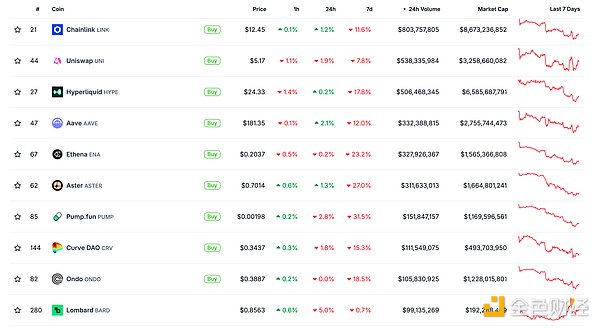

1. Total market value of DeFi tokens: 102.826 billion US dollars

DeFi Total Market Cap Data Source: coingecko

2. Trading volume of decentralized exchanges in the past 24 hours: $65.54

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

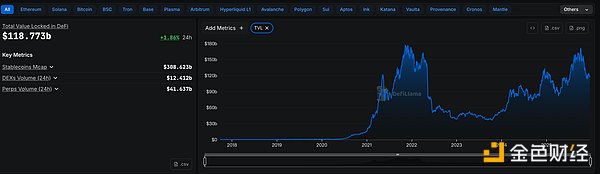

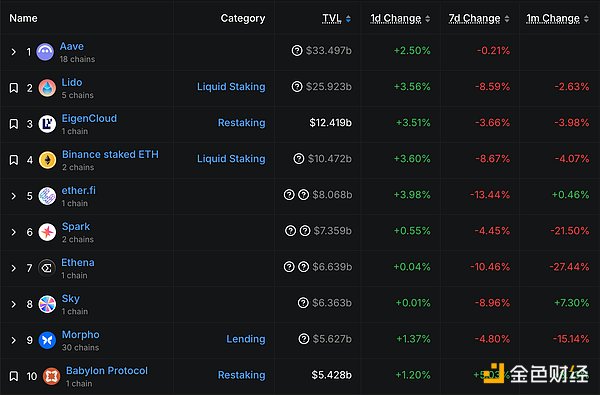

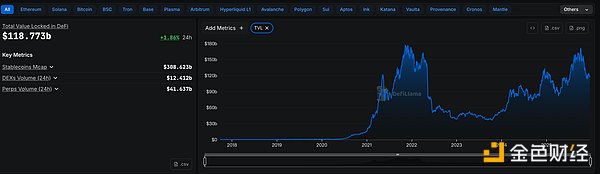

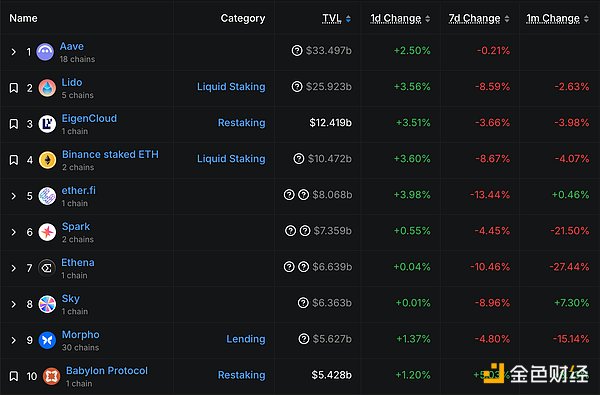

3. Assets locked in DeFi: $118.773 billion$118.773 billion

Top 10 DeFi Projects by Locked Assets and Total Value Locked. Data Source: defillama

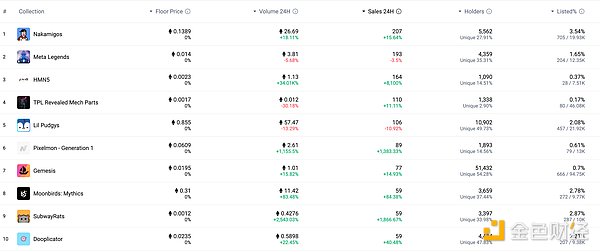

NFT Data

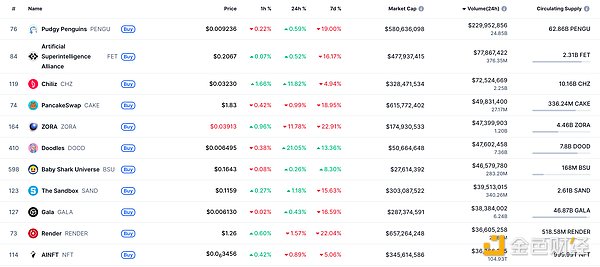

1. Total Market Cap of NFTs: $9.449 billion

![]() 2.24 hours NFT trading volume 1.383 billion US dollars

2.24 hours NFT trading volume 1.383 billion US dollars

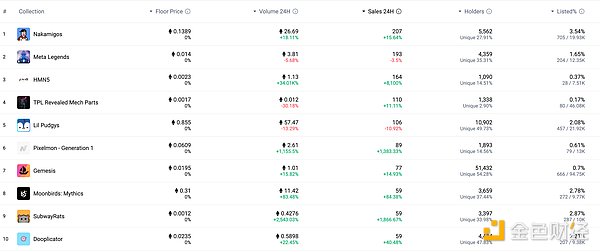

3. Top NFTs in 24 Hours

Top 10 NFTs by Sales Growth in 24 Hours Data Source: NFTGO

Headlines

US Senate Approves Mike Selig as Chairman of the US CFTC

DeFi Hotspot

According to Jinse Finance, Ethereum developers have named the next upgrade after Glamsterdam "Hegota," which combines the Bogota upgrade of the execution layer and the Heze upgrade of the consensus layer. The Bogota upgrade continues the tradition of naming updates after the Devcon host city, while Heze is named after a star. It is reported that the main EIP for Hegota will be determined in February, while the development of Glamsterdam (Ethereum's first planned upgrade in 2026) is still ongoing.

2. Starknet Integrated into NEAR Intents' Chain-Abstracted Exchange Network According to Jinse Finance, StarkWare announced on its X platform that Starknet has been integrated into NEAR Intents' chain-abstracted exchange network. Users can exchange for over 120 native assets across approximately 25 chains with STRK using just a few clicks. This is only the first phase.

3. Solana Ecosystem DEX Lifinity Decides to Phase Out, $43.4 Million in Assets to be Distributed to Token Holders According to Jinse Finance, market sources indicate that the Solana ecosystem DEX Lifinity has decided to phase out operations. The proposal passed almost unanimously, and the protocol will enter the shutdown process. Facing increasingly fierce competition from prop AMMs, Lifinity has submitted a governance proposal to its community regarding the protocol's continuation. According to the proposal, approximately $42 million worth of treasury assets in the Lifinity DAO will be consolidated into USDC and distributed pro rataly to LFNTY token holders.

In addition, the team's remaining $1.4 million in development funds will also be allocated. The community estimates that, based on the treasury's book value, holders are expected to receive between $0.9 and $1.1 per token. LFNTY and veLFNTY holders are advised to convert their tokens to xLNFTY before redemption. The xLNFTY to USDC redemption feature is expected to launch in approximately nine days, provided it passes a Sec3 security audit. Since its launch in February 2022, Lifinity has processed over $149 billion in trading volume, becoming the fifth largest DEX in Solana's history.

4. Base Chain Capacity Upgrade: Block Gas Limit Increased to 375 Million Gas/Block

According to Jinse Finance, Base Build announced on the X platform that Base Chain has undergone a capacity upgrade, with the block gas limit now increased to 375 million gas/block. With increased activity, this translates to a burst capacity increase of approximately 25% and an average throughput increase of approximately 4% to 5%.

Furthermore, Base has increased the minimum base fee from 0.0002 gwei to 0.0005 gwei to enhance chain functionality. At the minimum base fee, the cost of a typical transaction is less than one-tenth of one cent ($0.01).

5.Aptos' New Proposal Introduces Quantum-Resistant Signatures as an Optional Account Signature Type

Jinse Finance reported on Thursday that Aptos released a proposal, AIP-137, to introduce quantum-resistant signatures, aiming to address the network's reliance on digital signatures for ownership confirmation, transaction authorization, and overall security.

While existing encryption schemes remain secure for traditional computers, researchers warn that sufficiently powerful quantum computers could one day be able to forge these schemes, potentially retroactively compromising account security.

If the proposal passes governance review, AIP-137 will introduce SLH-DSA (a hash-based digital signature scheme standardized as FIPS 205) as an optional account signature type. This would make Aptos one of the earliest blockchains to natively support quantum-resistant accounts. However, existing accounts will not be affected; quantum-resistant accounts will only be available as an option for users. Previously, it was reported that Solana would collaborate with Project Eleven to build quantum-resistant signatures.

Disclaimer: Jinse Finance, as a blockchain information platform, publishes articles for informational purposes only and does not constitute actual investment advice. Please establish sound investment principles and be sure to enhance your risk awareness.

Jasper

Jasper