DeFi data

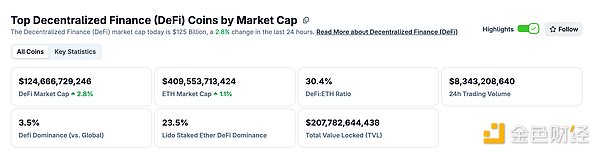

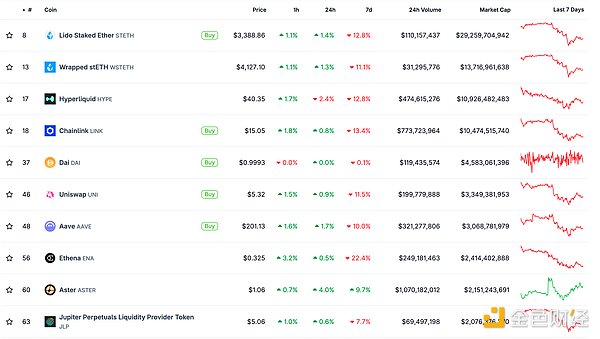

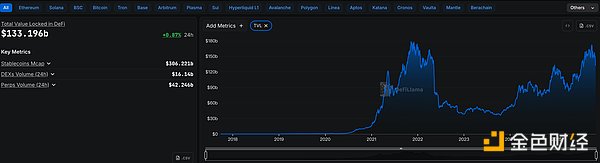

1. Total market value of DeFi tokens: 124.666 billion US dollars

DeFi Total Market Cap Data Source: coingecko

2. Trading volume of decentralized exchanges in the past 24 hours: $83.43

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

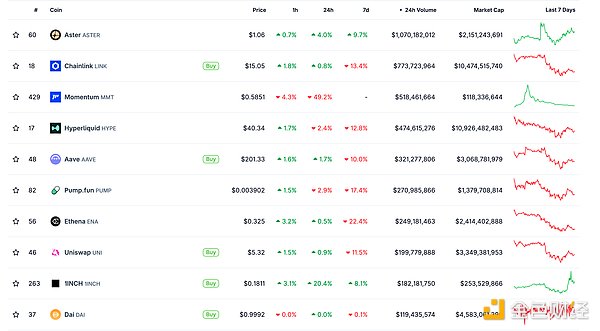

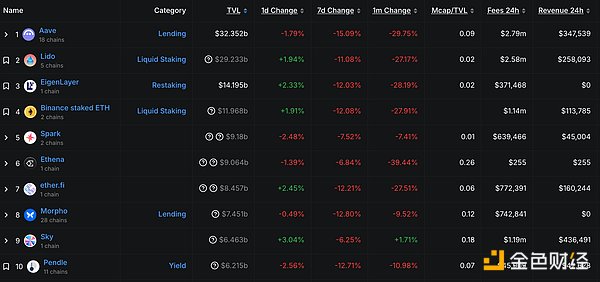

3. Assets locked in DeFi: $133.196 billion$133.196 billion

Top 10 DeFi Projects by Locked Assets and Total Value Locked. Data Source: defillama

NFT Data

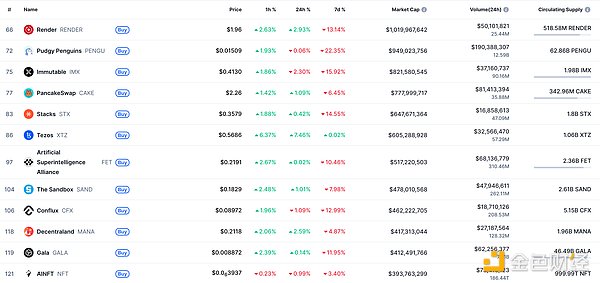

1. Total Market Value of NFTs: $13.331 billion

alt="B8g7ThKNOmiAkbg16mOmlyeLnDnteKNpYmvFsti7.png">

NFT Total Market Capitalization, Top Ten Projects by Market Capitalization Data Source: Coinmarketcap

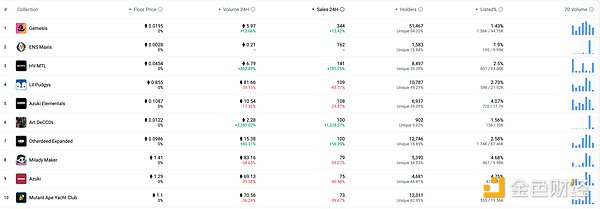

2.24-hour NFT Transaction Volume: $1.565 billionUSD

![]()

Top 10 NFTs by Sales Growth in the Last 24 Hours. Data Source: NFTGO

Toutiao

Switzerland Plans to Allow the Issuance of Stablecoins Domestically

The Swiss government has launched a consultation process to allow the issuance of stablecoins domestically, marking a significant step towards a "crypto future": in the future, trust in Switzerland's reliability can be reflected not only in "numbered bank accounts" but also through blockchain tokens.

MEME Hot Topics

1. GoPlus: Creator of Meme Coin "Binance Life" Only Profited $4,000

According to Jinse Finance, GoPlus disclosed that the creator of the BSC chain-based MEME coin "Binance Life" only profited about $4,000 from the project, missing out on the huge profit opportunity of the token's potential market capitalization of up to $500 million. It is reported that after deploying the "Binance Life" token on October 4th, the creator, following his usual "flooding" strategy, cleared out all the tokens in two transactions within 20 seconds, profiting about $4,000. However, a few hours later, the token suddenly surged, reaching a market capitalization of $500 million, with a daily trading volume as high as $410 million.

Spurred by this, the creator subsequently created 359 tokens in the following period, averaging 51 per day, including 292 Chinese MEME tokens similar to "Binance Alipay" and "Binance Avenue," attempting to replicate the success of "Binance Life," but none of them yielded significant returns.

DeFi Hot Topics

1. Ethereum DeFi Giants Jointly Establish EPAA Advocacy Alliance

According to Jinse Finance, citing Cointelegraph, major DeFi protocols in the Ethereum ecosystem, including Aave Labs, Curve, Lido Labs, and Uniswap Foundation, have jointly established the Ethereum Protocol Advocacy Alliance (EPAA) to coordinate policy efforts and educate legislators about the Ethereum ecosystem. The alliance emphasizes the importance of its establishment in balancing the "excessive influence" of centralized crypto entities in policymaking.

EPAA, supported by the Ethereum Foundation, will engage with policymakers through four means: contributing technical expertise, creating practical resources, coordinating strategic engagement, and identifying areas of shared technical interest. These agreements reportedly safeguard over $100 billion in non-custodial assets.

2. Ethereum Foundation Launches Founders Lab Mentorship Program

On November 6th, the Ethereum Foundation launched the Founders Lab mentorship program, providing one-on-one guidance to support founders' development. The first batch of mentors includes Base founder Jesse Pollak and Sandeep Nailwal, among others. The event will be held at Devcon on November 18th and 19th.

3. Mastercard Partners with Ripple and Gemini to Explore Blockchain Payment Innovation

According to Jinse Finance, The Block reports that Mastercard is collaborating with Ripple and Gemini to explore using the RLUSD stablecoin on the XRPL blockchain to settle fiat card transactions. This collaboration will be one of the first cases of a regulated US bank using a public blockchain and a regulated stablecoin to settle traditional card transactions.

Gemini has launched an XRP-based credit card, issued through WebBank, and plans to participate in the RLUSD settlement program. In addition, Mastercard recently partnered with Chainlink to allow consumers to directly convert fiat currency to cryptocurrency on-chain, and reached an agreement with Humanity Protocol to provide users with credit and loan services based on open finance technology.

4. Balancer Releases Preliminary Report on Vulnerability Attack: Exploited Rounding Error in BatchSwap Transactions

According to Jinse Finance, Balancer released a preliminary report on a vulnerability attack, stating that Balancer V2's composable stable pool was attacked on multiple chains (including Ethereum, Base, Avalanche, Polygon, Arbitrum, etc.) on November 4th. The vulnerability stems from a rounding error in the EXACT_OUT transaction within batchSwap, which attackers exploited to manipulate pool balances and withdraw assets. This incident only affected Balancer V2's composable stable pool; Balancer V3 and other pool types were unaffected.

5.Jito's on-chain financial data is now available on the Binance app

According to Jinse Finance, Token Terminal disclosed that Jito's on-chain financial data is now available on the Binance app.

Disclaimer: Jinse Finance, as a blockchain information platform, publishes articles for informational purposes only and does not constitute actual investment advice. Please establish sound investment principles and be sure to enhance your risk awareness.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Hui Xin

Hui Xin Jasper

Jasper Jasper

Jasper Davin

Davin Hui Xin

Hui Xin Jasper

Jasper Jixu

Jixu Davin

Davin Joy

Joy