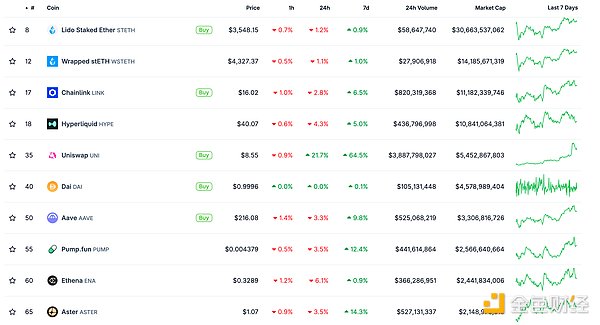

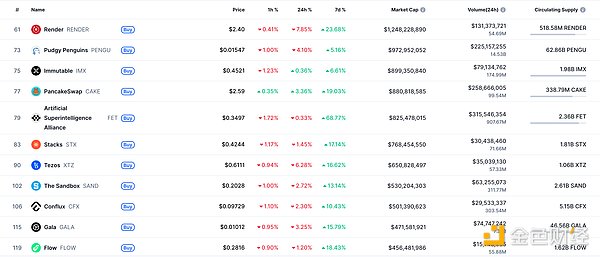

DeFi data

1. Total market value of DeFi tokens: 133.343 billion US dollars

2. Trading volume of decentralized exchanges in the past 24 hours: $122.96

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

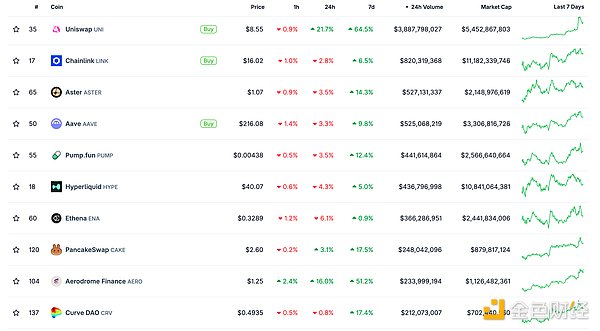

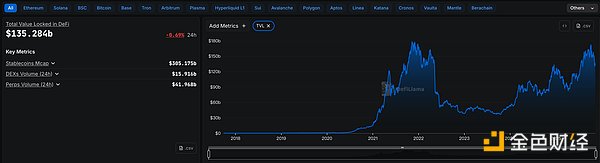

3. Assets locked in DeFi: $135.284 billionbillion

![]() Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

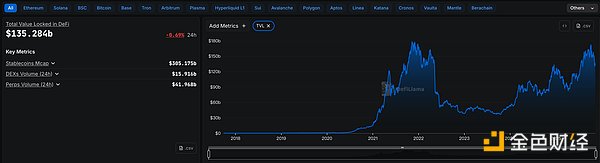

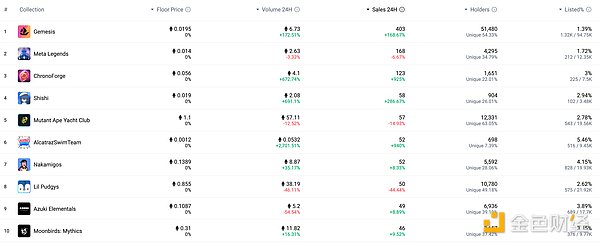

NFT Data

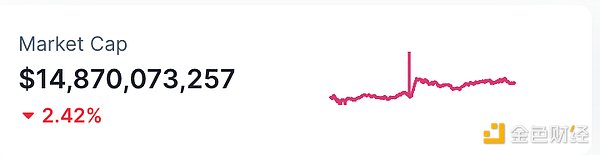

1. Total Market Cap of NFTs: $14.87 Billion

alt="X3EG85P3Nuk3vmpjIgW9IM7c66bWtYUraPqvrkma.png">

NFT Total Market Capitalization, Top Ten Projects by Market Capitalization Data Source: Coinmarketcap

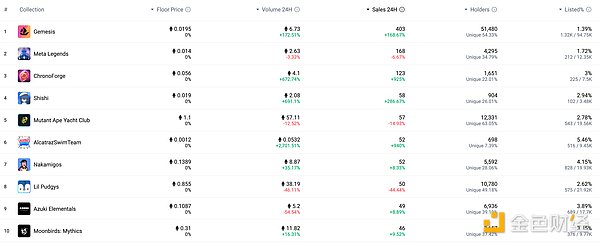

2.24-hour NFT Transaction Volume: $2.349 billionUSD

![]()

Top 10 NFTs by Sales Growth in the Last 24 Hours. Data Source: NFTGO

Toutiao

Uniswap Team Proposes to Introduce Protocol Fees

Jinse Finance reports that Devin Walsh, Executive Director and Co-founder of the Uniswap Foundation, announced that he and Uniswap founder Hayden Adams have jointly proposed a governance proposal to introduce protocol fees and implement them throughout the entire [system/process].

MEME Hot Topics

1. Argentine Judge Orders Freezing of Assets Related to LIBRA, the Meme Coin Backed by President Milei

According to market news, Argentine Judge Marcelo Giorgi has ordered the freezing of assets related to the LIBRA scandal, which is backed by President Milei, imposing an indefinite "prohibition on the disposal" of the property and financial assets of Hayden Davis and two cryptocurrency operators (Argentine Orlando Mellino and Colombian Favio Rodriguez). The cryptocurrency wallets of these two operators have been found to have suspicious activity and are currently under judicial review.

Federal prosecutor Eduardo Taino applied for this measure, and a technical report from the relevant departments, including the Financial Investigation and Illegal Asset Recovery departments, supported the request and recommended prosecution of the three individuals. The judge determined that the case met the requirements of reasonable suspicion and the risk of delay, and approved the asset preservation request. Investors have suffered losses of approximately $100 million to $120 million as a result of this incident.

The judge emphasized that the injunction is only valid for a strictly necessary period and ordered the National Securities Commission to be notified to expand the asset freeze to all relevant platforms within Argentina. Furthermore, prosecutors discovered that 42 minutes after Milei posted a tweet with Davis about a selfie, Davis transferred $507,500 through Bitget, which may constitute indirect bribery.

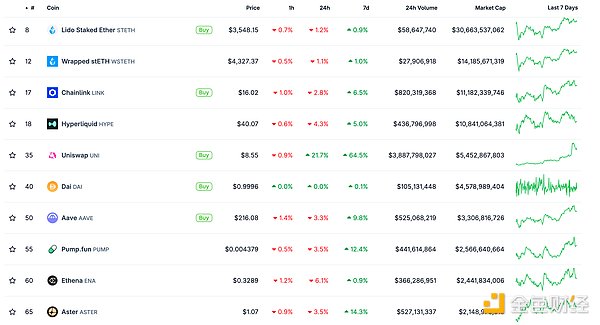

DeFi Hot Topics

1. Lido Proposes Automatic Buyback with LDO/wstETH Liquidity

November 11th news: According to the Lido governance forum, community member steephouse proposed deploying LDO/wstETH positions in Uniswap v2-style LPs through NEST to buy back and remove circulating LDO. The LPs are held by Aragon Agents. The proposal sets trigger conditions: ETH price above $3,000, annualized revenue exceeding $40 million, allocation of 50% of the amount exceeding the threshold, single execution limit of 2% of the total price impact, and a 12-month rolling cap of $10 million. Current estimates are approximately $4 million annualized, at least 12 transactions, with a maximum deployment of 100 wstETH per transaction.

The process includes loading NEST via EasyTrack, purchasing LDO with Stones v2, minting LPs with wstETH, and returning LP tokens to the Aragon Agent.

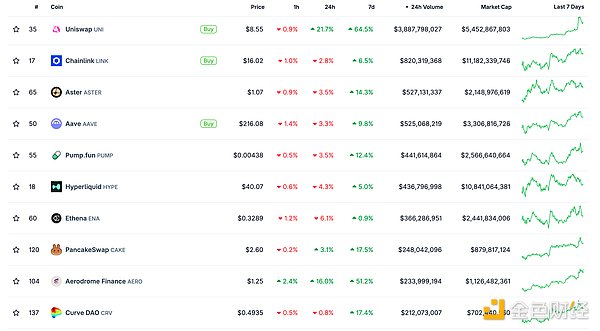

2. Matrixport: UNI May Usher in a New Catalyst

According to Jinse Finance, Matrixport released a daily chart analysis stating that UNI has historically experienced a phased catalyst approximately every 8 months. The upcoming "UNInitiation" mechanism and protocol fee switch, if successfully implemented, will align token burning with incentives, allowing protocol activity to be more directly reflected in UNI's market performance. Although the details of fee allocation have not yet been finalized, the direction is basically clear: based on the current scale, Uniswap's annualized transaction fees are close to $3 billion, and even partial implementation will bring substantial benefits to UNI.

3. Berachain Announces Address Information Affected by BEX/Balancer V2 Vulnerability, Plans to Launch Claim Channel This Week

Jinse Finance reports that Berachain has published an article on its X platform announcing information on addresses and token balances affected by the BEX/Balancer V2 vulnerability, including addresses directly deposited into BEX and addresses deposited through vault providers such as Infrared. Berachain stated that there may be slight differences in the calculation of returned funds, and plans to launch a claim page later this week. However, the returned funds will not include funds provided to white-hat hackers. Further investigation and feedback on the distribution of recovered funds will continue until the final recovery claim takes effect.

4. Analysis: Uniswap's Fee Switch May Cause a Large Number of Fraudulent Pools on Base to "Disappear"

November 11th news: Data analyst jpn memelord stated that a major effect of Uniswap's fee switch is to make fraudulent liquidity pools (such as honeypots and automated rugs) disappear overnight, because these pools rely on the protocol's zero fee rate.

According to rough estimates, about half of Uniswap's trading volume on Base may fall into this category. Official unfiltered data shows that Uniswap's trading volume on Base in 2025 was $208.07 billion, but after adding some filtering conditions, the non-fraudulent trading volume was only $77.38 billion.

5. Ethereum Foundation Advances dAI 2026 Roadmap, ERC-8004 and x402 as Key Directions

November 11th news: Davide Crapis, head of the EF dAI Team, announced that he is working with the Ethereum Foundation (EF) management to develop the dAI Team 2026 roadmap. The goal is to build Ethereum into a global decentralized settlement and collaboration platform for AI, enabling autonomous intelligent agents to complete the interaction of identity, assets, and data under publicly auditable rules.

Davide Crapis also expressed gratitude to the expanding community surrounding the ERC-8004 and x402 protocols, stating that these two standards are becoming neutral specifications for "agenti ccommerce," and solicited opinions from teams building related applications on the areas they should prioritize supporting.

Disclaimer: Jinse Finance, as a blockchain information platform, publishes articles for informational purposes only and should not be considered actual investment advice. Please establish sound investment principles and be sure to enhance your risk awareness.

Jasper

Jasper