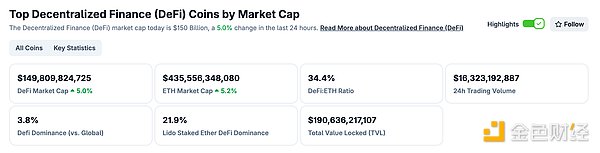

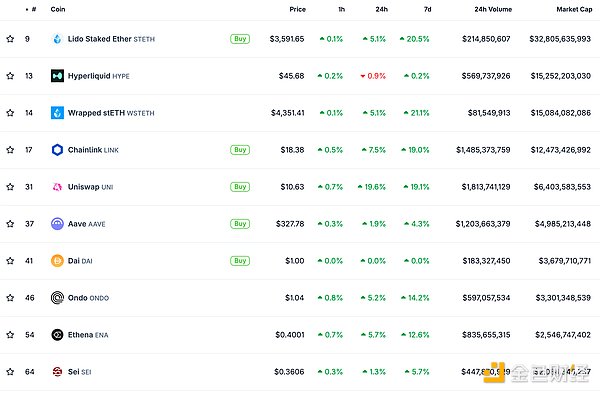

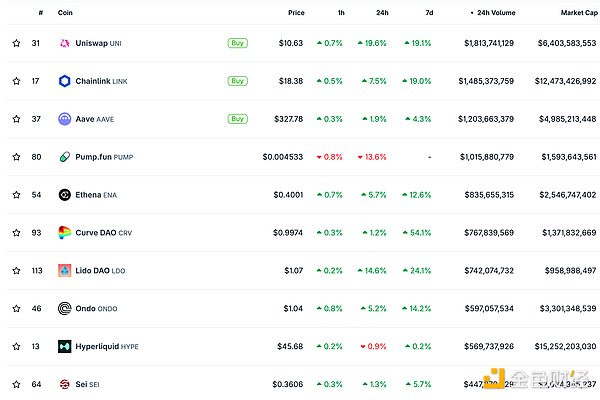

DeFi data

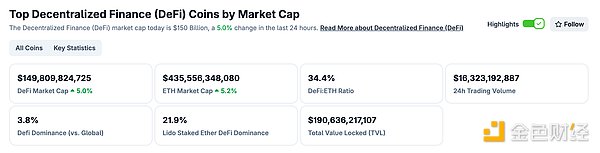

1. Total market value of DeFi tokens: 149.809 billion US dollars

DeFi total market value data source: coingecko

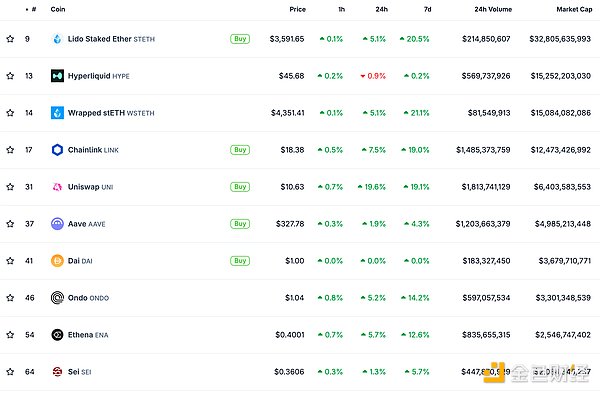

2. The transaction volume of decentralized exchanges in the past 24 hours was 16.323 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

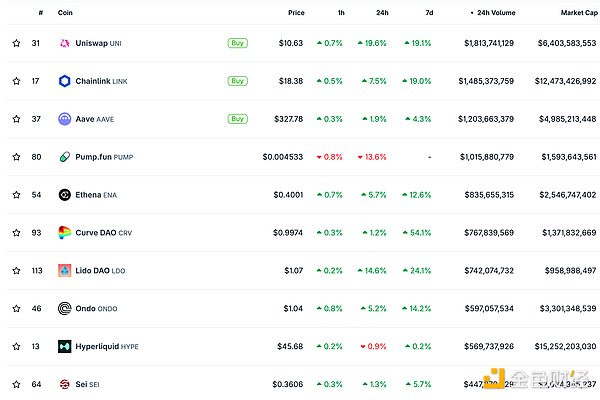

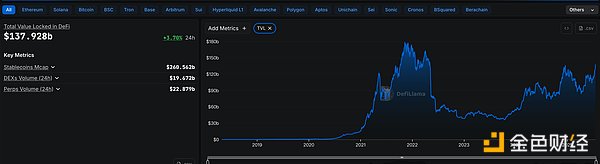

3. Assets locked in DeFi: 137.928 billion US dollars

src="https://img.jinse.cn/7384796_watermarknone.png" title="7384796" alt="LgtD077cvRVqbdTf6rs5yPiCaHmKFLLwBUWacncs.png">

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

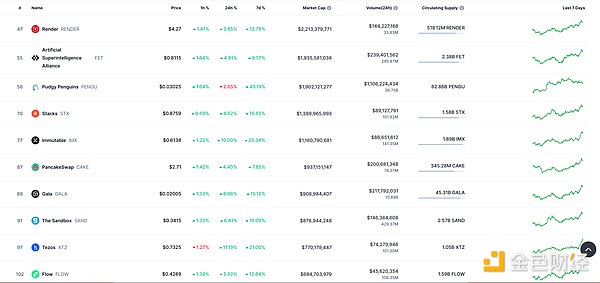

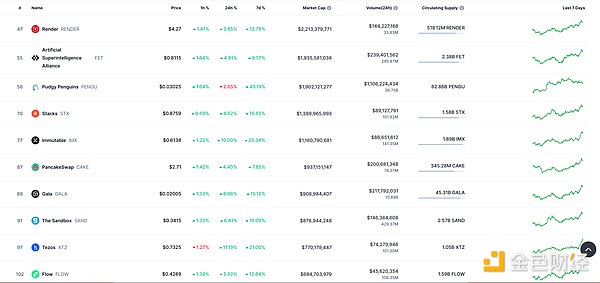

NFT data

1. Total market value of NFT: US$23.785 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 4.35 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

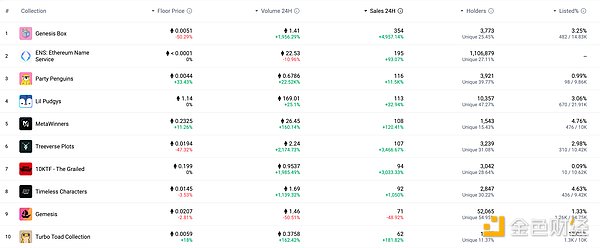

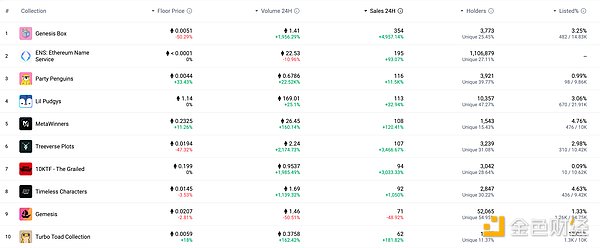

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

The U.S. House of Representatives passed all three cryptocurrency bills

Golden Finance reported that on Thursday local time, the U.S. House of Representatives passed all three cryptocurrency-related legislations, including the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act.

The CLARITY Act and the Anti-CBDC Surveillance State Act will be sent to the Senate for deliberation.

The GENIUS Act is expected to be signed into law by Trump on Friday local time.

MEME Hotspots

1.Four.meme: A portion of the monthly fee income will be invested to purchase high-potential tokens launched by the platform

Golden Finance reported that Four.meme issued an announcement stating that part of the monthly platform fee income will be used to strategically purchase high-potential tokens launched through the platform and provide liquidity and marketing support for outstanding projects. All purchases will be transparently recorded through publicly shared transaction IDs. Four.meme said that the focus of this decision is to empower builders who are committed to long-term growth and meaningful innovation, rather than short-term hype or speculative funds.

DeFi hotspots

1.dYdX completes its first external acquisition, acquiring the encrypted social trading platform Pocket Protector

Golden Finance reported that the decentralized derivatives trading platform dYdX announced the acquisition of the encrypted social trading platform Pocket Protector, which is its first external acquisition. The deal will merge most of Pocket Protector's engineering team into dYdX, while co-founders Eddie Zhang and Kaiser Kinbote will also join dYdX as president and head of growth, respectively. Antonio Juliano, founder and CEO of dYdX, said Pocket Protector has a total of 9 employees.

Pocket Protector was founded last year and has received $7 million in financing from investors such as Electric Capital and Dragonfly. The platform's core product is a Telegram-based trading robot that allows users to trade with friends, follow top traders, and get real-time trading ideas. It has also developed an iOS app that is currently in closed beta - but Juliano said the app will not be released publicly after the acquisition.

2. Crypto legislation has made progress, and Ethereum ETF has set records for capital inflows and trading volume

Golden Finance reported that as key cryptocurrency legislation supported by Trump has made progress, U.S. exchange-traded funds tracking Ethereum have set records for capital inflows and trading volume. Investors poured $727 million into the nine ETFs on Wednesday after a lackluster start to the year, while trading volume among them hit $2.6 billion as the price of ether rose. Open interest in CME ether futures also hit a new high, a sign that institutional demand for the second-largest cryptocurrency is increasing. Ether's gains further bolstered the momentum of cryptocurrency bulls, who have been betting since the November election that a second Trump term would usher in a new era of looser cryptocurrency regulation. Overall, their bets have paid off: Bitcoin, the leading cryptocurrency, surged to a record high of $123,205 on Monday.

3. Ondo Finance's on-chain treasury bond token USDY is about to be officially launched on the Sei network

According to official news, RWA tokenization platform Ondo Finance announced that its flagship product, the United States Dollar Yield (USDY), will be officially launched on the Sei network, becoming the first on-chain treasury bond asset deployed on this ultra-high-speed Layer 1 blockchain. USDY has been deployed on multiple blockchains, with a TVL of more than $680 million, providing an annualized yield of 4.25% (updated monthly), and is aimed at individual and institutional investors around the world (excluding the United States), combining the liquidity advantages of stablecoins with the high-level investor protection mechanism in traditional finance.

4. BlackRock iShares Ethereum ETF submits pledge application

Golden Finance reported that BlackRock iShares Ethereum ETF submitted a pledge application. According to a document filed on Thursday, the application was submitted by Nasdaq in accordance with SEC Rule 19b-4. 21Shares and Grayscale have also submitted similar proposals to introduce pledge functions for their Ethereum ETFs.

5.dYdX Foundation: Since the launch of the repurchase plan, a total of $1.87 million worth of DYDX tokens have been repurchased

Golden Finance reported that the dYdX Foundation tweeted that since the launch of the DYDX repurchase plan in March, 2.86 million DYDX tokens have been repurchased, worth $1.87 million. The next round will repurchase 593,570 DYDX tokens, and 100% of the repurchased tokens will be used for staking.

As previously reported, on March 24, dYdX officially announced that it would use 25% of the net fees of the dYdX protocol to repurchase DYDX tokens from the open market every month to further strengthen its long-term commitment to the ecosystem.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to raise your risk awareness.

Edmund

Edmund