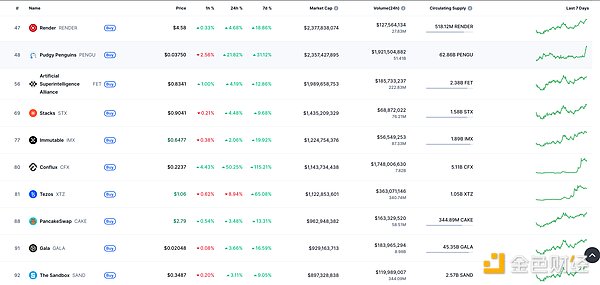

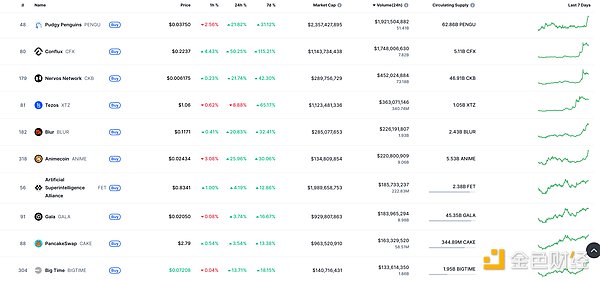

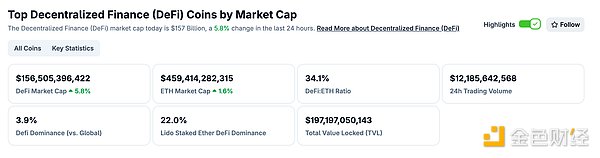

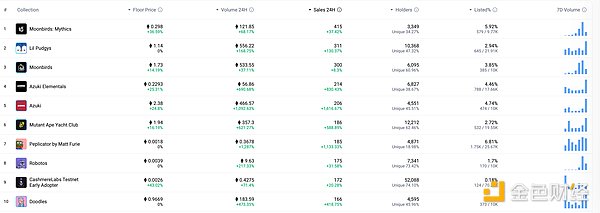

DeFi data

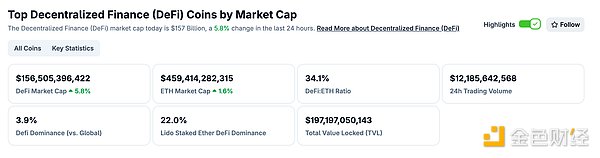

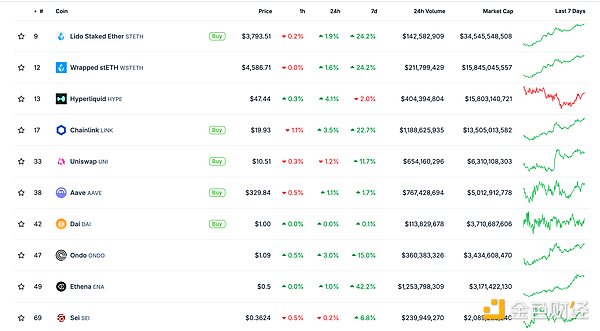

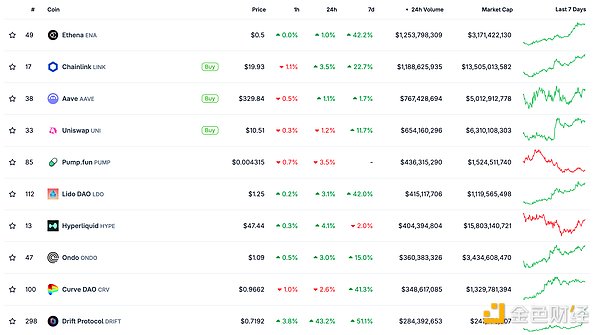

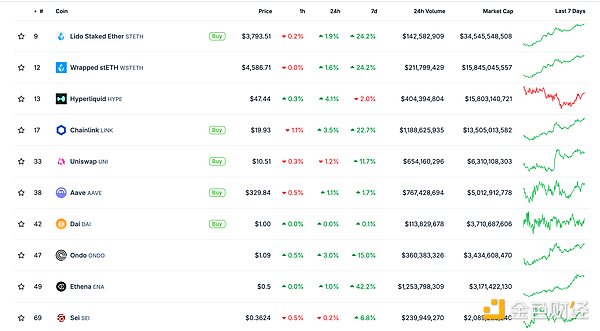

1. Total market value of DeFi tokens: 156.505 billion US dollars

DeFi total market value data source: coingecko

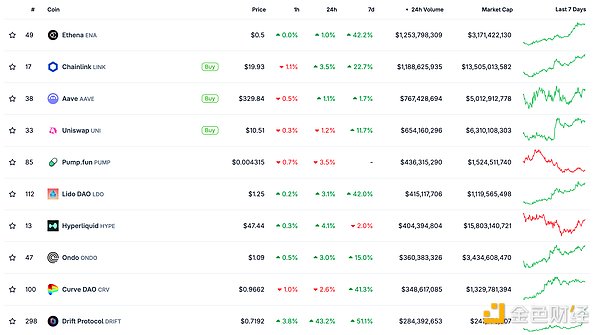

2. The transaction volume of decentralized exchanges in the past 24 hours was 12.177 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

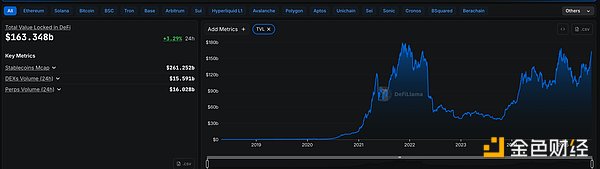

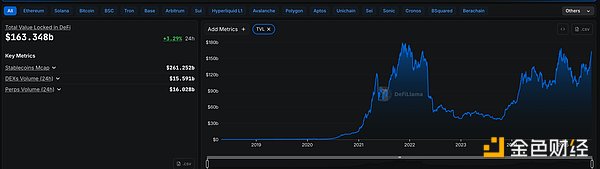

3. Assets locked in DeFi: 163.348 billion US dollars

src="https://img.jinse.cn/7385324_watermarknone.png" title="7385324" alt="DNMqwY2yZNijMxdxdFOoTFF1KpyefRUhuhbJPrHu.png">

Top ten rankings of DeFi projects with locked assets and locked-in amounts Data source: defillama

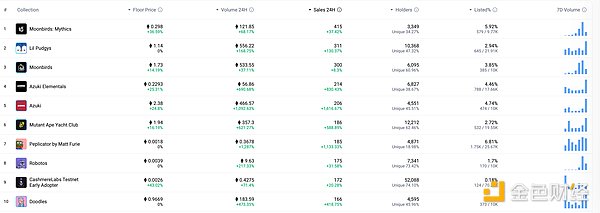

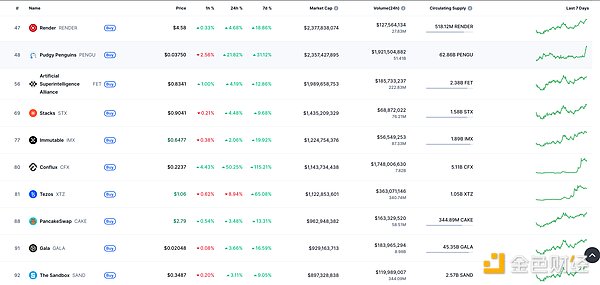

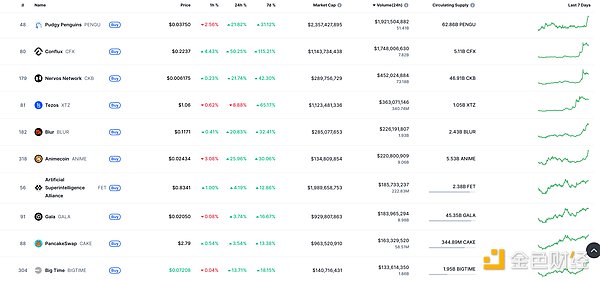

NFT data

1. Total market value of NFT: US$26.234 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 7.751 billionUSD

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

3. Top NFTs in 24 hours

Top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

US media: Trump administration reviews Musk’s company contracts

According to US media reports on the 20th, after the relationship between US President Trump and billionaire Musk broke down, the Trump administration has begun to review the contracts between Musk’s Space Exploration Technologies Company (SpaceX) and multiple federal government agencies. The Wall Street Journal reported that the U.S. General Services Administration required the Department of Defense, NASA and other government agencies to fill out forms to report their cooperation with SpaceX and understand whether competitors in the same industry can complete the same work more efficiently. Preliminary assessments show that most government contracts are difficult to cancel due to SpaceX's dominant position in rocket launches and low-orbit satellite services. Earlier, Trump said on social media that the easiest way to save federal spending is to "terminate" government contracts signed with Musk's company. Musk fully supported Trump in the 2024 U.S. presidential election, but the two sides have recently had serious disagreements over issues such as the "big and beautiful" tax and spending bill, and have engaged in a "war of words."

NFT Hotspots

1. A user had NFTs worth $1.23 million stolen due to a phishing transaction

Golden Finance reported that according to ScamSniffer monitoring, a user lost Uniswap V3 Position NFTs worth $1.23 million due to signing a phishing transaction. Subsequently, these NFTs were transferred to the phishing contract and the related assets were also extracted.

2. More than 40 fat penguin NFTs were traded in the past hour, and the floor price rose by 15.6%

Golden Finance reported that according to market data, more than 40 fat penguin NFTs were traded in the past hour, of which two whale addresses purchased 9 and 12 NFTs respectively. Affected by this, the floor price of fat penguin NFT rose by 15.6% in 24 hours and is now reported at 16.6ETH.

3. The total NFT transaction volume of the entire network exceeded 31 million US dollars in the past 24 hours, an increase of nearly 200%

Golden Finance reported that according to CoinGecko data, the total NFT transaction volume of the entire network reached 31.085 million US dollars in the past 24 hours, an increase of 195.1%.

In addition, the total market value of NFTs in the entire network exceeded 6 billion US dollars, with a 24-hour increase of 18.1%.

4. A certain address purchased 45 CryptoPunk NFTs at 5 am today

Golden Finance reported that OpenSea data showed that a certain address purchased 45 CryptoPunks series NFTs at 5 am today.

1. Analyst: Ethereum is expected to reach about $8,000 by early 2026. 2. Analyst: Ethereum is expected to reach about $8,000 by early 2026.

3. Analyst: Ethereum is expected to reach about $8,000 by early 2026.

4. Analyst: Ethereum is expected to reach about $8,000 by early 2026.

5. Analyst: Ethereum is expected to reach about $8,000 by early 2026.

6. Analyst: Ethereum is expected to reach about $8,000 by early 2026.

7. Analyst: Ethereum is expected to reach about $8,000 by early 2026.

Golden Finance reported that according to Cointelegraph, analyst Gert van Lagen pointed out that Ethereum (ETH) is in the "final surge" stage and may move towards the $8,000 price level. He found that ETH's current price structure is strikingly similar to the bull market pattern of the Dow Jones Index in 1980.

The analysis is based on the "textbook expansion diagonal" figure. This expanding trumpet shape has provided strong support for Ethereum's major rebound since mid-2022. ETH is currently trading between the upper and lower boundaries of the pattern and is expected to reach the upper boundary of about $8,000 in early 2026.

Technically, ETH has re-established the multi-year rising trend line as support and consolidated within an ascending triangle pattern. If the horizontal resistance zone of $3,900-4,150 is broken, it may trigger a rise to $7,150, close to the target price of the trumpet shape.

Analysts say that macroeconomic factors such as the expected Fed rate cuts and continued ETH ETF inflows may support this upward trend.

2. U.S. stocks related to Ethereum reserves generally rose before the market opened, with SharpLink Gaming up more than 9%

Golden Finance reported that according to market data, as the price of Ethereum (ETH) reached a new high in 2025 yesterday, U.S. stocks related to Ethereum reserves generally rose before the market opened, including: Gamesquare Holdings up 3.95%, BTCS up 8.22%, Bitmine Immersion Technologies up 4.6%, SharpLink Gaming up 9.04%, and Bit Digital up 3.13%.

3.QCP Capital: Ethereum performance drives the start of the altcoin season, and institutions are leading this round of gains

Golden Finance reported that QCP Capital stated in its weekly market report released on July 21 that multiple altcoin season indicators have exceeded 50, reaching the highest level since December last year, and the open interest of ETH perpetual contracts has jumped from US$18 billion to US$28 billion in a week, indicating that the altcoin season may have officially started.

QCP pointed out that the leaders of this cycle are institutional investors. Benefiting from the clarification of the stablecoin regulatory framework brought about by the implementation of the GENIUS Act, corporate finance has begun to increase its holdings of L1 public chain tokens such as ETH, SOL, XRP and ADA, similar to the role of BTC in the financial configuration of Strategy and Metaplanet.

If ETH obtains SEC approval for its pledged spot ETF in the next few months, it may attract funds from BTC ETF to ETH, further releasing the potential for returns. In fact, the daily net inflow of ETH spot ETF has exceeded BTC for two consecutive days last week, showing that institutions have a surge in interest in ETH, and BlackRock is also confident in its pledged ETH ETF.

In addition, the call spread trading in the ETH options market is active, and the call spread positions expiring in September and December are established in large volumes, highlighting the market's optimism about the fourth quarter.

The current BTC market dominance has fallen from 64% to 60%, and the ETH market share has risen from 9.7% to 11.6%. If the trend continues, a new round of altcoin season may have begun. QCP said it will continue to pay attention to relevant signals and update trends as soon as possible.

4.Solana's market value exceeds Intel, and its global asset market value ranking rises to 218th

Golden Finance reported that according to 8marketcap data, Solana's market value exceeded US$101.9 billion, surpassing Intel and ranking 218th in global asset market value.

5.Matrixport: Ethereum rises strongly due to Asian buying, institutional allocation and DeFi recovery

Golden Finance reported that Matrixport released a daily chart analysis saying that the recent altcoin market has been driven by the Asian market, among which Ethereum (ETH) and Ripple (XRP) have performed outstandingly. Ethereum continues to strengthen under the catalyst of multiple potential positive factors, and market sentiment remains positive even if the network Gas fee remains low. At present, ETH's funding rate has risen to double digits, coupled with the continuous inflow of futures positions and ETF funds, the market heat is gradually heating up, although the current overall level is still in a moderate range.

Last week, we analyzed the performance of Ethereum in various trading sessions around the world. Since then, the influence of the Asian market has become more and more significant, and it has led to a strong rise in ETH over the weekend. However, this round of market is not only driven by speculative funds and institutional allocations, but the recovery of DeFi activity has also become an important driving force for Ethereum's rise.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to increase risk awareness.

Jasper

Jasper