DeFi data

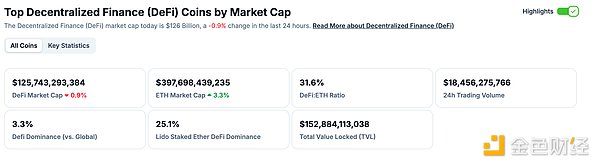

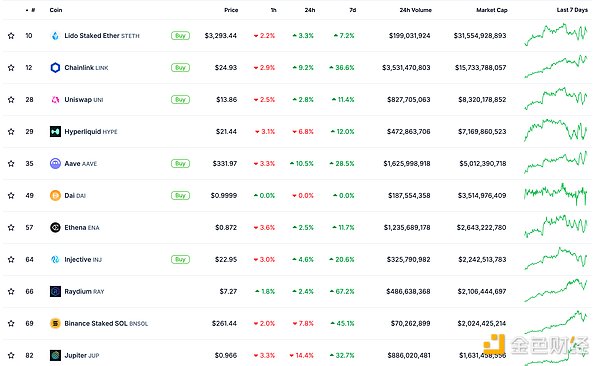

1. Total market value of DeFi tokens: 125.743 billion US dollars

DeFi total market value data source: coingecko

2. The transaction volume of decentralized exchanges in the past 24 hours was 18.456 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

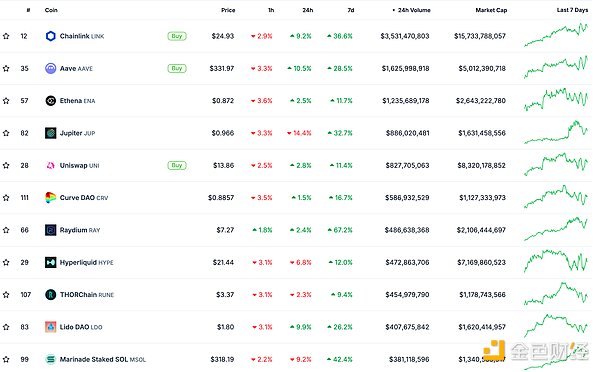

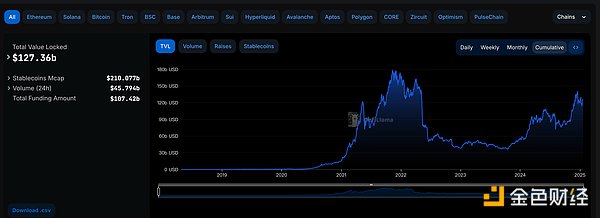

3. Assets locked in DeFi: 127.36 billion US dollars

src="https://img.jinse.cn/7344818_watermarknone.png" title="7344818" alt="Stwr3BKhXR3lHFpb31z6rmpjMnyPW2NwKdr4dzxj.png">

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

NFT data

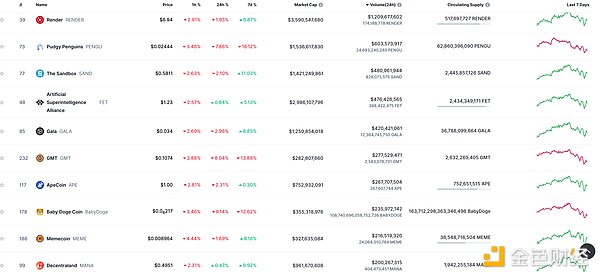

1. Total market value of NFT: 34.082 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

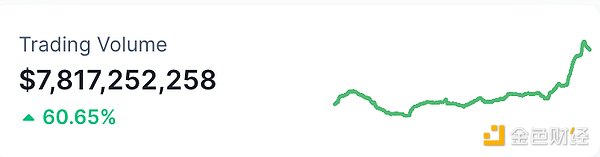

2. 24-hour NFT trading volume: 7.817 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

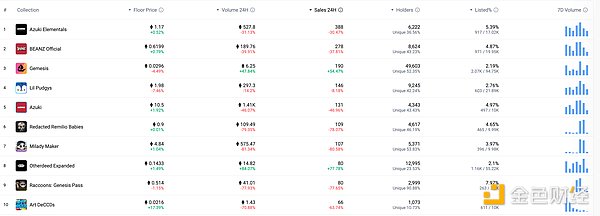

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

Forbes: Trump's issuance of Meme coins has caused major legal disputes

Forbes published a column commenting on Trump's issuance of Meme coins. Forbes said that Trump's issuance of Meme coins may trigger a constitutional crisis.

The report said that although the new SEC chairman who is about to be nominated may introduce crypto-friendly policies, the relevant basic legal principles remain unchanged, and the personality and policy preferences of SEC leaders cannot override established securities laws. The Supreme Court's Howey test has been the cornerstone of securities regulation for 75 years and is not affected by individual governments and political appointments. Although the SEC's enforcement focus may change under new leadership, its statutory obligation to apply the Howey test remains absolutely unchanged. This enduring framework for evaluating investment plans is independent of any chairman's crypto-friendly stance or industry relationship.

The launch of the TRUMP Meme coin exposes a fundamental tension in contemporary American politics. Although Trump has positioned himself as a supporter of the cryptocurrency industry and promised to make the United States the "global cryptocurrency capital," the structure and timing of his own digital token project indicate that his fusion of personal enrichment and political power is worrying. The concentration of token ownership in companies associated with Trump, coupled with the fact that the issuance time is just before the inauguration, raises questions about whether this represents real support for cryptocurrency innovation or is just a clever attempt to further monetize the presidency.

MEME Hotspots

1. Trump's wife issued the Meme coin MELANIA, and the circulating market value has now exceeded 7.5 billion US dollars

Trump's wife Melania said on social media in the early morning that people can now buy the Meme coin MELANIA. Data shows that the circulating market value of MELANIA is currently 7.58 billion US dollars. Trump forwarded the information. He had previously issued his own exclusive cryptocurrency TRUMP. The coin plunged after his wife announced the issuance of MELANIA, briefly fell below $40, and then rebounded, and now it has risen to $42.

2. Messari founder suggested that Trump fire those who issued Melania coin, saying it may damage his reputation

Golden Finance reported that Ryan Selkis, a loyal fan of Trump and founder of Messari, publicly called on Trump on social media, suggesting that he fire those who recommended the launch of the Melania project today. Selkis pointed out that the project has the following problems:

The project team lacks professional capabilities

It may cause significant economic losses and damage to goodwill

The project decision did not fully consider Trump's interests

3. Trump Bitcoin Conference organizer: TRUMP is a shitcoin

Golden Finance reported that Bitcoin Magazine, the organizer of Trump's Bitcoin Conference, said on the social platform that TRUMP is a shitcoin.

Bitcoin Magazine was a well-known pro-Trump media during the election. During its official event, the Bitcoin 2024 Conference, it invited Trump to the stage and give a speech. In the speech, Trump announced plans such as launching a strategic Bitcoin reserve, ensuring that the United States will become the world's encryption center and Bitcoin superpower, and firing the SEC chairman, which opened up the Trump administration's encryption-friendly policy.

DeFi hot spots

1. Data: The total value of assets transferred by deBridge in the past three days reached 397 million US dollars

Golden Finance reported that according to official data, due to the popularity of Meme coins such as TRUMP over the weekend and the surge in on-chain activities, the total value of assets transferred by deBridge in the past three days reached 397 million US dollars, and the number of cross-chain transactions exceeded 43,800.

2. Vitalik: If the Ethereum Foundation pledges ETH, it will have to take a stand when hard forks are controversial

On January 20, Ethereum co-founder Vitalik Buterin posted on social media about the suggestion that the Ethereum Foundation could pledge its ETH. He said that historical concerns are: 1. Regulatory issues; 2. If the Ethereum Foundation pledges itself, it actually forces us to take a stand on any future controversial hard forks. Regulatory issues have been reduced compared to before, but there are still problems with the Ethereum Foundation staking itself. There are definitely ways to minimize this, and we have been exploring these methods recently.

3.Vitalik: Ethereum Foundation is exploring the payment of foundation budget through staking rewards

Golden Finance reported that Ethereum co-founder Vitalik said in response to someone else's tweet that the Ethereum Foundation is exploring the payment of foundation budget through staking rewards.

4.TheBlock Editor-in-Chief: Maybe Ethereum should become Solana's L2

Golden Finance reported that TheBlock Editor-in-Chief Tim Copelan wrote on the X platform that maybe Ethereum should become Solana's L2. Previously, many industry insiders expressed dissatisfaction with Ethereum's L2 route, believing that L1 should be fully expanded, but long-term expansion still requires more solutions. Vitalik Buterin even updated his X avatar to Milady 9286 to "save Ethereum".

5.Curve founder: Ethereum Foundation should abandon L2 route and focus on expanding L1

Golden Finance reported that Curve Finance founder Michael Egorov wrote in X that the Ethereum Foundation's top priority should be to abandon the Layer2-centric roadmap and focus on expanding Layer 1.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

Aaron

Aaron

Aaron

Aaron Jasper

Jasper Jasper

Jasper Kikyo

Kikyo Clement

Clement Hui Xin

Hui Xin Clement

Clement Jasper

Jasper Catherine

Catherine Clement

Clement