Author: Daii Source: mirror

Today's crypto market is a bit strange. Institutions and retail investors seem to live in different worlds. Their perceptions of the current market are completely opposite.

1. Why is there such a big contrast between institutions and retail investors?

Institutional investors are very optimistic about cryptocurrencies. Institutions have been buying and buying since the beginning of this year. Various ETFs and companies have cumulatively purchased about 104,000 bitcoins. You have to know that the Bitcoin network has only "minted" 18,000 new bitcoins this year.

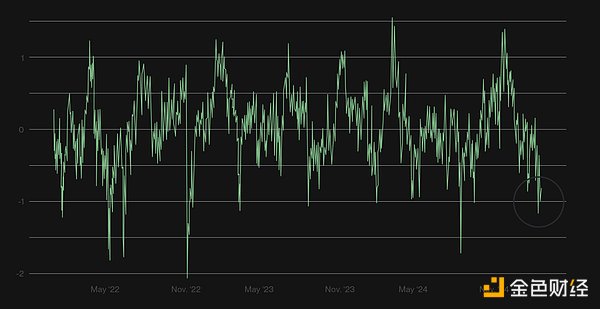

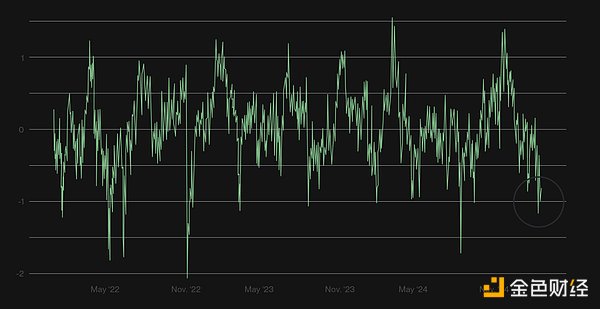

Retail investors are immersed in disappointment. Bitwise Chief Investment Officer Matt Hougan said that according to the latest crypto sentiment index, retail investment sentiment is close to a historical low.

Although Bitcoin has risen by nearly 5% since the beginning of the year, the performance of other crypto assets has been disappointing. In addition to XRP, Solana, BNB, more altcoins including ETH have negative returns (see the figure below). Therefore, it is not surprising that retail sentiment is low.

However, Matt Hougan believes that the spring of altcoins is coming. Maybe this is not a comfort, it may really be the case, but I think there are better strategies for retail investors to choose from. That is to follow the strategy and learn from institutional investors.

2. More institutions are entering the market?

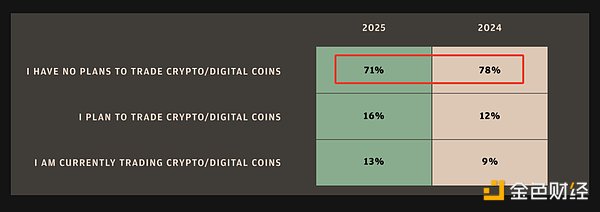

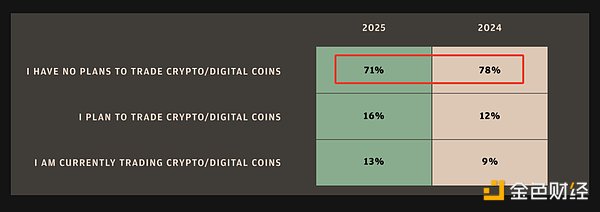

In fact, following the strategy is also becoming the choice of more institutions. According to the latest survey by JPMorgan, the number of institutional traders who "have no plans" to participate in cryptocurrency trading this year has decreased from 78% last year to 71%. In other words, it is possible that 7% more institutional traders will start cryptocurrency trading in 2025. In other words, 29% of institutional traders may start cryptocurrency trading this year.

So, what are institutional investors who have already started crypto trading doing?

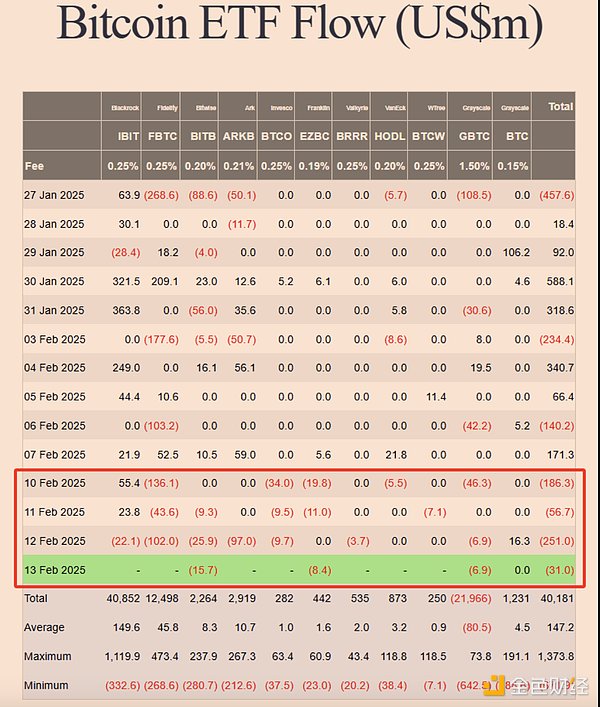

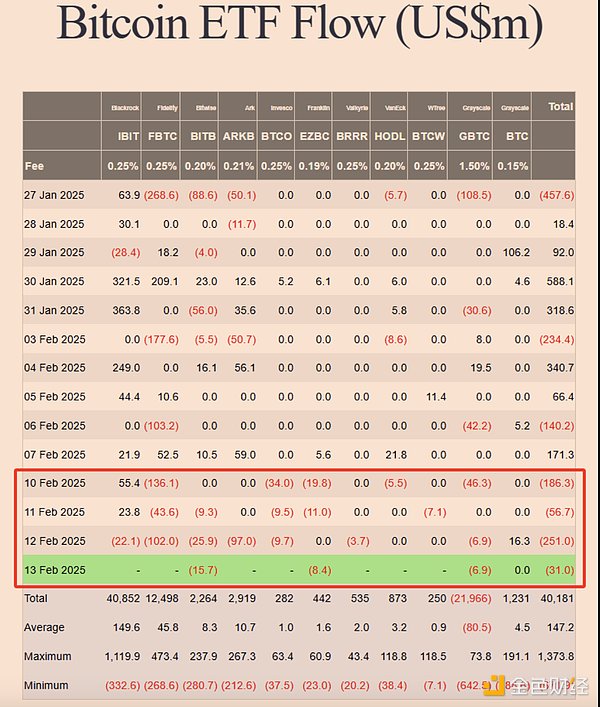

The question is, with so many institutions, who should we learn from? However, you should also know that there are high-level institutional retail investors, and there are also low-level retail institutions. For example, in recent days, retail institutions have begun to sell Bitcoin ETFs, and there has been a net outflow for 4 consecutive days, with a total amount of more than 500 million US dollars (see the figure below).

However, don't worry, the departure of retail institutions has not had much impact on the market. Because large institutions have been taking advantage of the opportunity to reduce their positions after the price of Bitcoin fell (see the figure below).

IntoTheBlock Data shows that on February 5, when Bitcoin was trading below $97,600, large institutions (whales) bought more than 39,620 BTC in one day, worth more than $3.79 billion.

I think we should learn from these institutions and buy when others are afraid. For example: Goldman Sachs should be a good example to learn from.

3. Why learn from Goldman Sachs?

As a leading global investment bank, Goldman Sachs' historical investment performance has demonstrated the extraordinary wisdom of contrarian investment, especially during the financial crisis. During the 2008 financial crisis, Goldman Sachs made significant profits by purchasing undervalued assets during market panic through accurate market judgment and asset allocation. Its unique vision and firm belief enabled it to recover quickly and achieve substantial growth after the crisis.

In addition, Goldman Sachs' successful investments in multiple emerging markets, such as its early optimism about China's economic rise, have brought it considerable returns. In the field of cryptocurrency, Goldman Sachs also made early arrangements and launched cryptocurrency investment products to capture the growth potential of emerging assets such as Bitcoin.

Goldman Sachs' investment philosophy emphasizes long-term perspectives and judgments on market cycles, and firmly believes in contrarian investment strategies. Buying when the market is sluggish and selling when it is overheated helps it to move forward steadily in multiple market fluctuations. Therefore, retail investors can learn from Goldman Sachs' strategies, especially when market sentiment is low, dare to enter the market, seize investment opportunities, and gradually realize capital appreciation.

4. Goldman Sachs "sweeps"?

In the fourth quarter of last year, Goldman Sachs accelerated its crypto layout, and it is not an exaggeration to describe it as sweeping.

In the fourth quarter of 2024, Goldman Sachs significantly increased its holdings in Bitcoin ETFs. Specifically, its holdings in Blackstone's iShares Bitcoin Trust (IBIT) increased from $600 million in the previous quarter to more than $1.5 billion, an increase of 177%.

Goldman Sachs' investment in the Ethereum ETF surged from $22 million in the previous quarter to $476 million, an increase of 2,000%. This increase is astonishing and shows Goldman Sachs' strong confidence in Ethereum's future growth potential. Specifically, Goldman Sachs purchased two major Ethereum ETFs, Blackstone's iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH), with about half of its funds invested in these two funds.

To summarize, Goldman Sachs has invested nearly $2 billion in cryptocurrency ETFs, with a 3:1 ratio of Bitcoin to Ethereum. You should have no problem copying this homework, of course, you have the advantage of buying spot directly over Goldman Sachs.

Conclusion

In general, Goldman Sachs' investment strategy fully reflects the wisdom of contrarian investment. It has performed well in the field of cryptocurrency through precise market judgment and bold layout. For retail investors, learning from Goldman Sachs's practices, especially daring to enter the market when the market is down, will not only help seize investment opportunities, but also reap rich returns in the future market recovery. Rather than going with the flow, it is better to draw on the successful experience of institutions, adopt more far-sighted investment strategies, and steadily achieve wealth appreciation.

Catherine

Catherine