By W3C DAO

After years of bashing cryptocurrencies, US investment bank Goldman Sachs has finally admitted it was wrong about the asset class. Not in words, but in actions.

The investment giant, which manages nearly $3 trillion in client assets, is buying a lot of Bitcoin and Ethereum exchange-traded funds (ETFs).

In just a few months, the investment bank has increased its ETH holdings by 2,000% and its Bitcoin ETF holdings by 114%.

Goldman’s about-face on digital assets reminds crypto proponents of the saying: “First they ignore you, then they laugh at you, then they fight you, and then you win.”

It can be said that despite the decline in cryptocurrency prices so far in February, institutional adoption is clearly on the rise.

Goldman Sachs Increases Cryptocurrency Investment

According to regulatory documents submitted to the U.S. Securities and Exchange Commission, Goldman Sachs purchased nearly $1.28 billion worth of iShares Bitcoin Trust (IBIT) and $288 million worth of Fidelity Wise Origin Bitcoin Fund in the fourth quarter of 2024. The documents show that Goldman Sachs also holds $3.6 million worth of Grayscale Bitcoin Trust (GBTC).

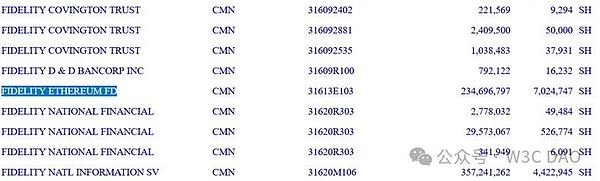

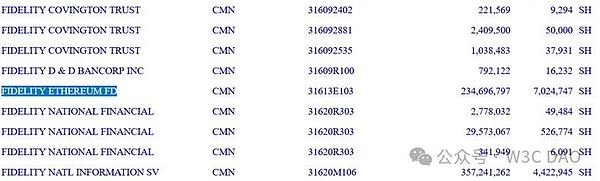

In the same quarter, Goldman Sachs increased its holdings in Ethereum ETFs from $22 million to $476 million through BlackRock's iShares Ethereum Trust and Fidelity Ethereum Fund.

The investment bank's first foray into cryptocurrency ETFs was in the second quarter of 2024, when it purchased $418 billion worth of Bitcoin funds.

The firm's buying spree in the fourth quarter was likely triggered by the election of pro-cryptocurrency Donald Trump as president, who pledged to transform the United States into the blockchain capital of the world.

Earlier in the second half of 2024, when David Solomon, CEO of Goldman Sachs Group, was interviewed and asked whether Goldman Sachs could start trading cryptocurrencies, Solomon said: "You have to ask the regulators this question. Currently, as a regulated banking institution, we are not allowed to hold cryptocurrencies such as Bitcoin; we provide advice to clients around these technologies and these issues, and will continue to do so, but from a regulatory perspective, our ability to take action in these markets is currently extremely limited. But if the regulations change, we will consider participating in cryptocurrency transactions."

Not only that, Goldman Sachs is in talks with potential partners and plans to spin off its digital asset platform into a new company for large financial companies to create, trade and settle financial instruments through blockchain technology.

Mathew McDermott, global head of digital assets at Goldman Sachs, said in an interview that the bank is in talks with multiple market participants about the plan while continuing to expand the platform's capabilities and develop new business use cases. McDermott said plans for the new company are in the early stages, but the long-term goal is to complete the spin-off within the next 12 to 18 months, subject to regulatory approval.

In addition, McDermott said Goldman Sachs is seeking to provide its clients with secondary market trading facilities for private digital asset companies. He said this could make it easier for family offices and other clients seeking liquidity to access funds while allowing buyers to enjoy discounts in the private market. He added that the bank is also looking to resume its Bitcoin-backed lending activities.

Other traditional institutions

More and more traditional institutions will join this trend in the foreseeable future.

Since adding BTC to its balance sheet, Bitcoin finance company Metaplanet's share price has soared. The Tokyo-listed stock has risen nearly 4,800% in the past 12 months. The rally coincides with the company's first purchase of Bitcoin in April 2024. As of early February 2025, the company had purchased 1,762 BTC, worth about $171 million. Metaplanet plans to hold up to 21,000 BTC by the end of 2026, which could make it the world's second-largest Bitcoin finance company after Michael Saylor's Strategy. The ambitious plan includes raising up to 116 billion yen (about $745 million) to finance more Bitcoin purchases.

Back to MicroStrategy, it recently announced a name change to Strategy to emphasize its cryptocurrency-centric business. The announcement stated that the company will now conduct business under the name Strategy. The brand simplification is a natural evolution of the company, reflecting the company's focus and broad appeal. The new logo includes a stylized "B" that represents the company's Bitcoin strategy and its unique position as a Bitcoin financial company. The brand's main color is now orange, representing energy, wisdom and Bitcoin.

Canadian bank Bank of Montreal (BMO) recently quietly purchased about $150 million in spot Bitcoin ETFs. Among them, about $139 million was invested in BlackRock's iShares Bitcoin ETF, and the remaining about $11 million was diversified in three other funds.

Not only that, Morgan Stanley Financial Advisors said that they would allow them to offer Bitcoin ETFs to some clients, which is the first among major Wall Street banks. According to people familiar with the matter, the company's approximately 15,000 financial advisors can begin soliciting eligible clients to buy Bitcoin ETFs. Morgan Stanley is one of the world's largest wealth management companies, and its move is the latest sign of mainstream financial acceptance of Bitcoin.

U.S. banking giant Wells Fargo has also previously disclosed its investment in multiple Bitcoin ETFs, making it the latest major financial institution to join the cryptocurrency field...

Looking to the future

Looking to the future, the popularity of cryptocurrencies will reshape the financial landscape. Traditional financial institutions such as Goldman Sachs continue to increase their holdings of digital assets, indicating their recognition and confidence in their value. With the continuous advancement of technology and the gradual opening of the regulatory environment, blockchain technology will bring new business models and opportunities. Although market volatility remains, the increase in institutional adoption means that cryptocurrencies will be increasingly accepted and adopted by the mainstream. In the future, the financial market will be more diversified and innovative, and the potential of digital assets will be gradually released, bringing unprecedented opportunities to investors and companies. We should keep an open mind and welcome the arrival of this change.

Weatherly

Weatherly