Author: Michael Zhao, Grayscale; Compiler: Deng Tong, Golden Finance

Abstract

Supply Impact: Bitcoin will be halved around April 2024. Despite challenges to miner revenue in the short term, underlying on-chain activity and positive market structure updates make this halving different on a fundamental level.

Miner positioning:Faced with reduced block reward income and high production costs, miners are ready to issue stocks/bonds and Reserves are sold to raise funds in an attempt to relieve short-term financial pressures.

On-chain activity continues to grow: The emergence of Ordinals inscriptions has revitalized on-chain activity, with more than 59 million as of February 2024 Non-fungible token (NFT) collectibles were inscribed, generating over $200 million in transaction fees for miners. This trend is expected to continue thanks to renewed developer interest and continued innovation in the Bitcoin blockchain.

Market Impact of Bitcoin ETFs: Continued adoption of Bitcoin ETFs can significantly absorb selling pressure by providing a new, stable source of demand. It is possible to reshape Bitcoin’s market structure, which would be positive for the price.

As the 2024 halving approaches, Bitcoin has not only survived; It is constantly evolving. The structure of the Bitcoin market is evolving as spot Bitcoin ETFs gain landmark approval in the U.S. and flows change. In this article, we’ll take a deeper look at the halving – what it is, why it matters, and its historical impact on Bitcoin’s performance. We will then examine the current state of Bitcoin and why it looks so different from a year ago.

What is halving?

New Bitcoins are generated through a process called "mining," in which computers solve computationally intensive problems to receive block rewards in the form of new Bitcoins. Bitcoin issuance is limited by design—approximately every four years, mining rewards are “halved,” which effectively cuts the issuance of new coins in half (Exhibit 1).

Chart 1: Bitcoin supply schedule

Source: Bitcoinblockhalf. com. Bitcoin’s supply schedule has remained unchanged since its inception.

This deflationary feature is fundamentally attractive to many Bitcoin holders. While the supply of fiat currencies depends on central banks and the supply of precious metals is affected by natural forces, Bitcoin’s issuance rate and total supply have been dictated by its underlying protocol since its inception. A fixed total supply combined with a gradually decreasing inflation rate not only creates scarcity but also embeds currency into Bitcoin Characteristics of contraction.

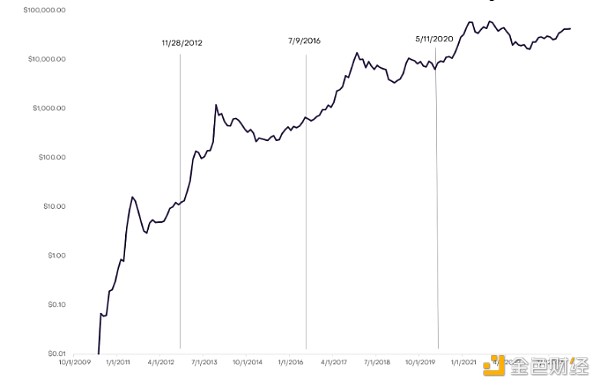

Besides the obvious supply impact, the buzz surrounding the Bitcoin halving Significant excitement and anticipation also stems from its historical correlation with Bitcoin price increases (Chart 2):

Chart 2: Minus Bitcoin prices tend to rise after half a year

Source: Glassnode, as of February 6, 2024.

However, it is important to understand that a post-halving Bitcoin price increase is not guaranteed. Given the high level of anticipation for these events, if a price increase is inevitable, rational investors may buy in early, thereby driving up the price before the halving occurs. This creates problems for frameworks such as stock-to-flow models. While it creates visually appealing charts by correlating scarcity with price increases, the model ignores the fact that this scarcity is not only predictable but also known well in advance. This can be confirmed by looking at other cryptocurrencies with similar halving mechanisms, such as Litecoin, which did not consistently see a price increase after the halving. This suggests thatWhile scarcity does sometimes affect price, other factors also come into play.

These periods appear to coincide with major macroeconomic events rather than just Attribute the post-halving price increase to the halving itself. For example, in 2012, the European debt crisis highlighted Bitcoin's potential as an alternative store of value during economic turmoil, causing its price to surge from $12 to $1,100 in November 2013. Likewise, the 2016 ICO boom—which raised more than $5.6 billion in capital invested in altcoins—also benefited Bitcoin indirectly, pushing its price from $650 to $20,000 by December 2017. Dollar. Most notably, widespread stimulus measures during the 2020 COVID-19 pandemic fueled inflation concerns, potentially prompting investors to turn to Bitcoin as a hedge, with its price rising from $8,600 to $68,000 by November 2021 Dollar. These macroeconomic uncertainties and the search for alternative investment options appear to coincide with periods of increased interest in Bitcoin, coincidentally around the time of the halving. This pattern suggests thatWhile the halving exacerbates Bitcoin’s scarcity, the broader economic context and its impact on investor behavior The impact could also have a serious impact on the price of Bitcoin.

While the future macroeconomic environment remains uncertain (although we have our own ideas), what is certain is the impact of the halving on the Bitcoin supply structure. Let’s dig a little deeper.

Miner threat

The halving is a challenge for Bitcoin miners. As Bitcoin issuance decreases from 6.25 BTC to 3.125 BTC per block, the revenue miners receive from block rewards is effectively cut in half. In addition, expenses are increasing. Hash rate is a measure of the total computing power used to mine and process transactions on the Bitcoin network. It serves as a proxy for mining difficulty and is a key input in calculating miner fees. In 2023, the seven-day average hashrate surged from 255 exahashes per second1 (EH/s) to 516 EH/s, an increase of 102%, significantly exceeding the 41% increase in 2022 (Exhibit 3). The surge was driven in part by rising Bitcoin prices throughout 2023, as well as companies purchasing more efficient mining equipment in response to positive market conditions, underscoring the escalating challenges faced by miners. The combination of declining revenues and rising costs could put many miners in a tight spot in the short term.

Chart 3: Computing power reaches a record high in 2023

Source: Glassnode, as of December 31, 2023.

While this scenario may seem dire, there is evidence that miners have long been preparing for the financial impact of the halving. There was a clear trend in Q4 2023 of miners selling their Bitcoin holdings on-chain, likely to build liquidity ahead of block reward reductions (Chart 4). Additionally, major financing efforts such as Core Scientific's $55 million equity offering, Stronghold's $15 million equity raise, and Marathon Digital's ambitious $750 million hybrid equity raise underscore the industry's aggressive stance on strengthening reserves . Together, these measures suggest that Bitcoin miners are well-positioned to weather the coming challenges, at least in the short term. Even if some miners exit the market entirely, the resulting drop in hashrate could lead to an adjustment in mining difficulty, potentially lowering the cost per Bitcoin for remaining miners and keeping the network balanced.

Chart 4: Changes in miners’ net positions (30D changes in Bitcoin held in miners’ addresses)

Source: Glassnode, as of February 7, 2024.

While the reduction in block rewards poses challenges, Ordinals in the Bitcoin ecosystem Inscription and Layer2 projects are growing in role and have recently emerged as promising use cases. These innovations may increase transaction throughput and increase network transaction fees, providing a glimmer of hope for miners.

Ordinals Inscription

As we discussed before, Ordinals Inscription ("ORDI") represents groundbreaking innovation in the Bitcoin ecosystem. Digital collectibles ranging from simple images to custom “BRC-20” tokens can be uniquely “inscribed” to a specific Satoshi (the smallest unit of Bitcoin, as each Bitcoin can be divided into 100 million Satoshi). This new dimension of Bitcoin’s utility has spurred significant growth: To date, more than 59 million assets have been credited, generating over $200 million in transaction fees for miners (Exhibit 5).

Chart 5: Daily and cumulative registration fees (USD)

Source : Glassnode, as of February 7, 2024.

The surge in network fees has had a profound impact, especially on November 20, 2023, when transaction fees on the Bitcoin network exceeded those on the Ethereum network for the first time in recent history transaction fees. Since the emergence of Ordinals, miners have repeatedly received over 20% of transaction fees from inscription fees. Even compared to total NFT transaction volume on other chains, Bitcoin became the dominant NFT transaction volume in November and December 2023 (Chart 6), a development that few expected at the end of 2022.

Chart 6: NFT transaction volume by chain

Source: The Block, Cryptoslam, as of February 7, 2024.

Ordinals’ success has had its own impact on the Bitcoin network. As block rewards decrease over time, the question of how to incentivize miners to protect the network becomes more pressing. With Ordinals transaction fees already accounting for approximately 20% of miners’ total revenue, this emerging trend in Ordinals activity currently provides a new way to maintain network security through increased transaction fees.

However, this success also brings scalability challenges, as users will have to bear higher transaction fees. This may prevent users from performing basic transactions such as transferring money. Additionally, Bitcoin's architecture limits programmability, which creates further limitations in developing complex applications that can use these ordinal numbers. This situation highlights the need for scalable solutions that can accommodate both increased throughput for efficient transactions and expanded use cases such as trading NFTs and BRC20 tokens.

In response, the community is exploring paths similar to those taken by Ethereum, such as Layer 2 Rollup, to enhance scalability and usability. Growing interest in taproot-enabled wallets (Figure 7), which offer greater programmability with enhanced privacy and efficiency features, demonstrates collective action to address these challenges. As transaction fees on the Bitcoin main chain continue to rise, the development of Layer 2 networks is a possible step.

Chart 7: Taproot adoption rate (%)

Source: Glassnode, As of February 7, 2024.

As we discussed in our previous article on Ordinals, The resurgence of Ordinals and the introduction of the BRC-20 token catalyzed a cultural shift within the Bitcoin community, attracting a new wave of developers interested in the network’s expanding possibilities. This shift is arguably one of the most important developments for Bitcoin, as it not only diversifies the ecosystem but also reinvigorates the community with new perspectives and innovative projects.

Among the existing Layer 2 (L2) solutions, some have been quietly laying the foundation for this evolution for years. Stacks is a platform that stands out for introducing fully expressive smart contracts to Bitcoin. It facilitates the development of a variety of decentralized applications (dApps) that leverage Bitcoin’s security, enabling everything from DeFi to NFTs. These dApps represent the forefront of Bitcoin’s transition to a multi-faceted ecosystem capable of supporting a variety of blockchain-based applications.

ETF Flow

In addition to generally positive on-chain fundamentals , Bitcoin’s market structure looks favorable for post-halving prices. Historically, block rewards have brought potential selling pressure to the market, with all newly mined Bitcoins potentially being sold, impacting the price. Currently, 6.25 Bitcoins are mined per block, which equates to about $14 billion per year (assuming a Bitcoin price of $43,000). To maintain current prices, $14 billion in annual corresponding buying pressure would be required. After the halving, these requirements will be reduced in half: only 3.125 Bitcoins will be mined per block, equivalent to a reduction of $7 billion per year, effectively easing selling pressure (Chart 8).

Chart 8: Halving reduces issuance by US$7 billion

Source : Grayscale Research, as of February 7, 2024.

In general, ETFs are allocated to a broader range of investors, financial advisors and capital markets A network of traders provides access to Bitcoin, which may ultimately lead to increased mainstream adoption. Following the approval of U.S. spot Bitcoin ETFs, initial net inflows into these newly launched products reached approximately $1.5 billion in the first 15 trading days alone, absorbing almost the equivalent of post-halving Three months of potential selling pressure. While the explosive growth in net flows in the first few days may be due to initial excitement and pent-up demand, assuming net inflows remain stable while the Bitcoin ecosystem continues to adopt and mature, ETF flows could offset the ongoing sell-off from mining issuance. pressure. Sensitivity analysis of daily net inflows in the range of $1 million to $10 million suggests that the reduction in selling pressure may reflect another reduction Half of the impact will fundamentally and positively change the market structure of Bitcoin2.

Conclusion

Bitcoin has not only weathered the storm of the bear market, but has grown stronger over the past year, challenging outdated notions. While Bitcoin has long been hailed as digital gold, recent developments suggest that Bitcoin is evolving into something much more. Bitcoin has shown its resilience, driven by a surge in on-chain activity, underpinned by significant market structural momentum, and underpinned by its inherent scarcity. The Grayscale Research team will closely track developments before and after the April 2024 halving, as we believe Bitcoin’s future is bright.

Notes

1. The number of hashes per second represents the total amount of hashes (or guesses) currently used by miners to mine Bitcoin. The greater the hashes per second, the more computing power applied by Bitcoin miners.

2. Assuming a Bitcoin price of $43,000, 3.125 Bitcoins issued per block, and 144 blocks mined per day, the network has issued approximately $19 million in Bitcoins. Assuming there is a daily net inflow of $10 million into the ETF product, if you divide the daily net inflow ($10 million) by the number of Bitcoins issued daily ($19 million), you will get approximately 50%, which is consistent with another example. The effect is similar. In addition, because the trades have not actually been executed, the results may understate or overcompensate for the impact, if any, of certain market factors (such as lack of liquidity). In general, simulated trading programs also suffer from the fact that their design is based on hindsight. Hypothetical simulation performance results are based on a model that uses inputs based on assumptions about various conditions and events and provides hypothetical rather than actual results. As with all mathematical models, the results can vary significantly depending on the values of the given inputs, so relatively small modifications to any assumptions can have a significant impact on the results.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Weiliang

Weiliang Bernice

Bernice JinseFinance

JinseFinance Coindesk

Coindesk Cointelegraph

Cointelegraph