Source: Grayscale; Compiled by Wuzhu, Golden Finance

Abstract

Polymarket is a prediction market and groundbreaking web application that is a classic example of how blockchain technology can help improve transparency, accessibility, and trust in markets and information.

Polymarket allows participants to allocate funds to event contracts (e.g., who will win an election). Prediction markets provide timely and often directionally accurate probabilities of specific events, potentially helping investors, policymakers, and/or business leaders make decisions.

Unlike other prediction markets, Polymarket runs on a blockchain - Polygon, which is part of the Ethereum ecosystem and smart contract platform crypto sector.

Given the growing distrust of the media, Grayscale Research believes that Polymarket has the potential to become a "source of truth" by leveraging the transparency and record-keeping of blockchain technology, the market's incentive mechanism, and the collective wisdom of users.

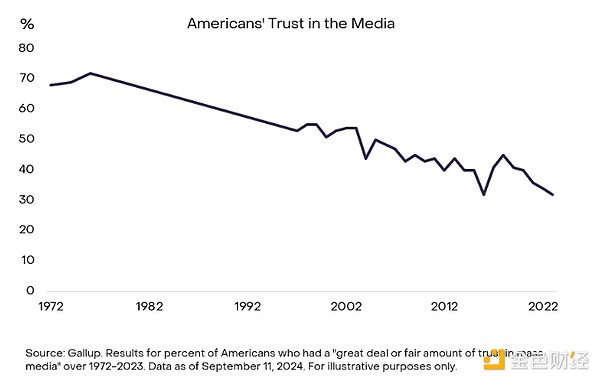

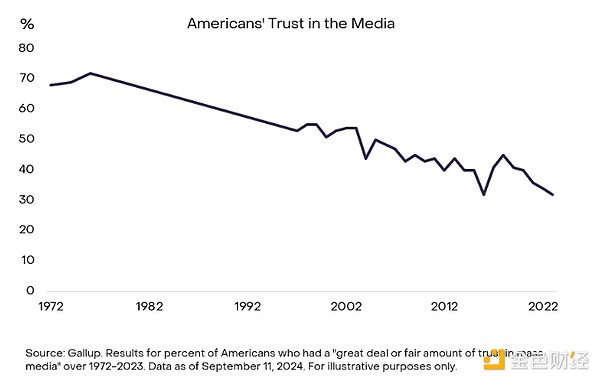

Policymakers often need access to timely and accurate information, but according to a recent poll (Figure 1), trust in the media in the United States is at its lowest point in the past 50 years. Amid rising levels of misinformation,[1] nearly three-quarters of American adults believe the news media contributes to political polarization, and nearly half express little or no trust in the media’s ability to report the news fairly and accurately. [2]

These trends raise several questions: Is it possible to obtain truly unbiased information? How can fact-based reporting be incentivized? How do we balance truth and reality when profit-driven motivations may fuel one-sided narratives or undermine accuracy?

Figure 1: Declining trust in the media suggests the growing importance of prediction markets

Over the past two decades, technology and financial incentives have reshaped the traditional media landscape, and policymakers appear to be looking for alternatives. Grayscale Research believes that prediction markets can be part of the solution—especially those that leverage the power of blockchain technology.

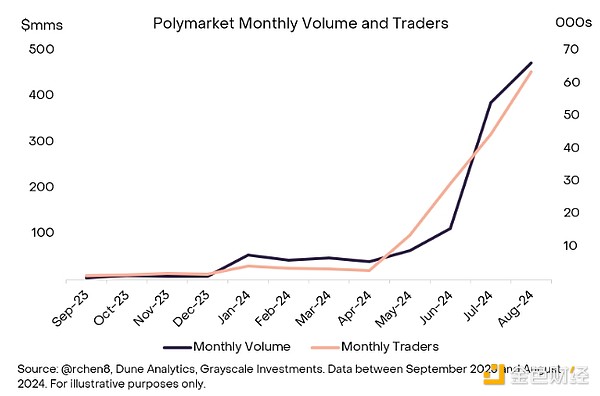

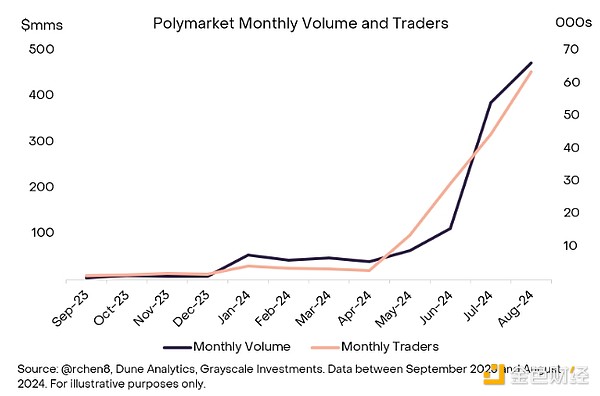

Polymarket is a blockchain-based prediction market[3] that has become the leading source of probabilities for the 2024 U.S. presidential election this cycle. The platform has seen rapid growth in adoption (see Figure 2), increasing credibility in mainstream media, and its presidential election market odds were recently added to the Bloomberg Terminal. [4] Given growing distrust of the media, Grayscale Research believes that Polymarket has the potential to become a “source of truth” by leveraging the transparency and record-keeping of blockchain technology, market incentives, and the collective wisdom of its users.

Figure 2: Polymarket sees massive growth in 2024

The Power of Prediction Markets

A prediction market (or information market) is a platform where participants can buy and sell shares that represent predictions about the outcomes of future events. These contracts can be on almost any subject, such as politics, sports, pop culture, science, or macroeconomics. Prediction markets typically offer binary options on specific outcomes (such as "yes" or "no"). For example, participants might bet on whether a particular candidate will win an election. If the likelihood of a candidate winning increases, the value of a "yes" stock increases, while if the likelihood of winning decreases, the value of a "no" stock increases.

These dynamics create market-driven probabilities of a given event occurring, reflecting the collective wisdom of the participants.

Once the outcome of an event is known, the market processes the results, and participants who bet correctly are paid, while participants who bet incorrectly lose the money they invested. Regardless of personal biases, participants are financially incentivized to provide accurate predictions, as correct predictions result in profits, while incorrect predictions result in losses.

Prediction markets have their roots in early political betting, dating back to 1503, when bets on the election of the next Pope were recorded. [5] By 1884, election betting was a major Wall Street activity, but it declined with the advent of modern polling in the early 20th century. [6] In the past few decades, modern prediction markets have emerged, including traditional platforms such as PredictIt and Kalshi, as well as blockchain-based platforms such as Augur and Polymarket.

Originally based on the concept of price signals proposed by Friedrich Hayek in 1945, prediction markets are efficient at aggregating information and often outperform traditional forecasting methods. [7] While there are concerns about manipulation, these markets are generally self-correcting and have historically been fair given economic incentives.

While these prediction markets are effective, they are not without risks; event-based contracts recently faced regulatory scrutiny from the U.S. Commodity Futures Trading Commission (CFTC), which proposed a ban on contracts that predict political outcomes, citing public interest concerns (see the Appendix for more on economic theory, history, and regulation). [8]Polymarket Takes OffPolymarket is one of the first prediction markets (either centralized or decentralized) to gain widespread adoption in the modern world. During the 2024 election cycle, Polymarket’s trading volume grew from $73 million in 2023 to $1.37 billion so far in 2024 (Exhibit 2). In addition, the platform has become a data source that journalists from media outlets such as The Wall Street Journal, CNN, and Bloomberg have begun to use to provide thoughtful analysis of topical and sometimes controversial topics and gauge public sentiment. The platform also saw a significant increase in website traffic, from 1.4 million visits in June 2024 to 13.8 million in August 2024. [9]

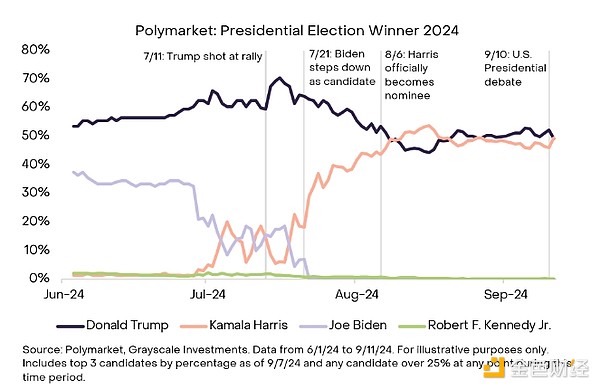

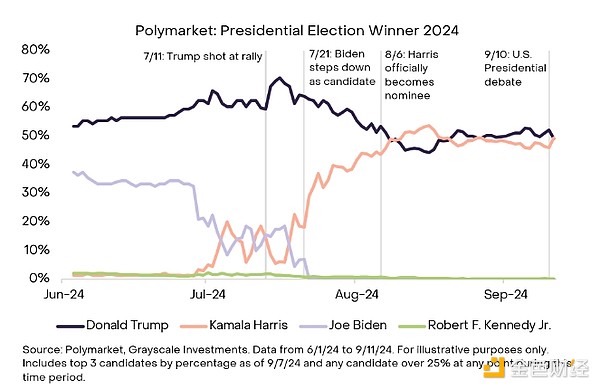

This year’s U.S. presidential election fueled interest in Polymarket, driven by highly unpredictable scenarios such as Trump’s assassination or Biden dropping out of the race to endorse Harris (Exhibit 3). As shown in the chart below, the U.S. presidential election winner market on the platform reflects political odds swings based on these events. This particular market absorbs the largest amount of liquidity on the platform, with $776 million in trading volume as of September 4. [10]

Figure 3: U.S. presidential election cycle winner markets attract the strongest trading activity

In addition to increasing trading volume and liquidity as attention increases on the November U.S. election, Polymarket recently added renowned statistician and journalist Nate Silver to the team as an advisor and announced a funding round with investors including Ethereum founder Vitalik Buterin and Peter Thiel’s Founders Fund. [11]

How Polymarket Benefits from Blockchain Technology

Polymarket is an application on the Polygon blockchain, part of the Ethereum ecosystem and the crypto arm of Grayscale’s smart contract platform. Blockchain technology provides Polymarket with a number of advantages.

Polymarket combines smart contracts with decentralized decision making to resolve contracts. These services are provided by the UMA protocol, a cryptographic oracle (see Grayscale Glossary). UMA records each event-based contract and its resolution on-chain. In the event of a disagreement, UMA facilitates resolution through community voting — all of which is also recorded on-chain. This mechanism helps ensure that market disputes are resolved without interference from centralized, arbitrary, or potentially biased parties.

In addition, blockchain provides payment channels that enable 24/7 global accessibility. This allows virtually anyone in the world to access the Polymarket platform without barriers and at low cost — unlike many centralized or Web 2.0 applications.

Platforms with Staying Power

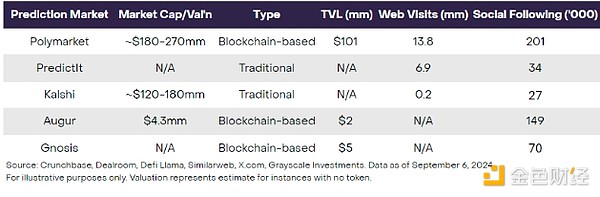

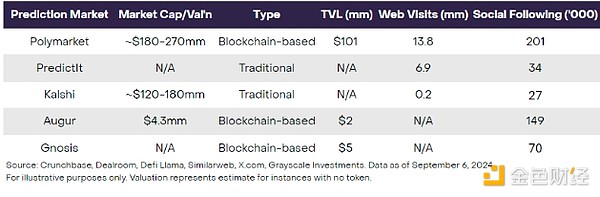

Polymarket has reached new levels of coverage with its frequent news citations and large content following (see Figure 4). Today, its liquidity advantage and network effects theoretically create a more efficient market than competing platforms. Grayscale Research believes that this provides Polymarket with a considerable moat, making it more attractive to potential users.

Figure 4: Polymarket leads prediction market competitors on most key metrics

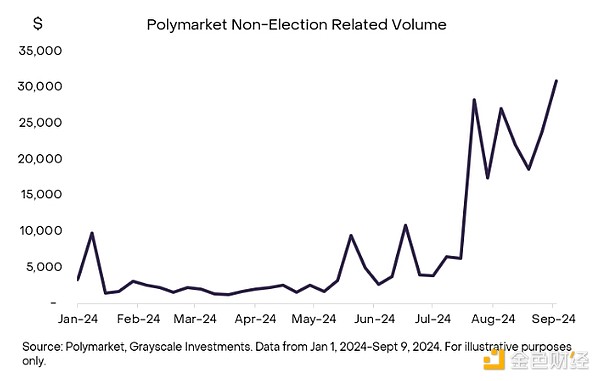

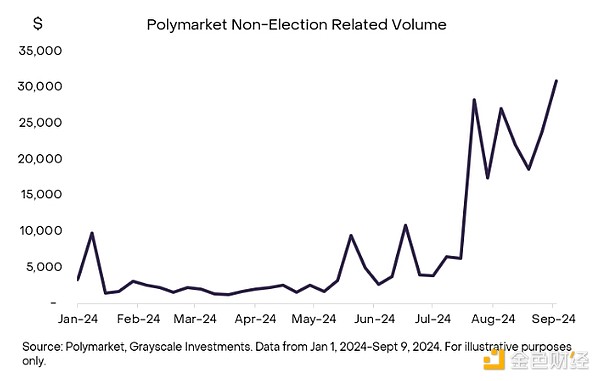

While Polymarket relies primarily on election-related volume, it has also seen recent growth in other content (Figure 5), driven in part by interest in the 2024 Olympics. As of September 7, 2024, five of the top ten markets by volume were not election-related, including Super Bowl odds, Federal Reserve rate cuts, and the highest-grossing movies of 2024. [12]

Nevertheless, election-related contracts account for the majority of activity, including over 70% of total weekly volume since June. [13] Therefore, Polymarket is likely to be able to take advantage of the two-month window leading up to the U.S. election to maximize interest in its platform. After the election, we believe there is a huge opportunity for Polymarket to leverage its growing content coverage and current position as the go-to prediction market to drive trading volume into new sectors such as sports, pop culture, and science. This will be critical if the platform hopes to continue to grow after the November election.

Figure 5: Polymarket’s non-election-related trading volume has increased since July 2024

Risks and Considerations

Polymarket faces certain risks, especially in terms of regulation.In 2022, Polymarket was fined by the CFTC for offering a market without proper registration. As of 2022, the platform appears to be taking measured steps, but the regulatory status of prediction markets remains up in the air due to a proposed CFTC ban on election-related event outcomes in 2024. Additionally, the recent activity and enthusiasm may fade once the election is over.

Conclusion

Polymarket has become one of the best examples of a use case gaining adoption in the crypto ecosystem based on organic growth. Today, there is no Polymarket token or airdrop drive yet—just a product with features that resonate with users.

At a time when many crypto apps are considered too confusing or too technical for non-crypto native users, Polymarket stands out by providing a direct purpose and an intuitive, familiar user experience. It has also been able to do what most crypto apps cannot—start to attract attention and mainstream credibility from traditional institutions and media.

Notably, Polymarket is leading with technology and products rather than tokens and commercialization, allowing users and media to recognize its value without necessarily knowing that blockchain technology is used on the back end.

The Grayscale Research team has previously written about how the 2024 US election could be a “crypto election,” with crypto increasingly becoming a relevant issue in campaign trials. The attention paid to crypto applications, especially against the backdrop of declining trust in the media and rising polarization, highlights the potential role of Polymarket—and, more broadly, the role of blockchain technology—in providing a reliable, transparent alternative to finding the truth amid the noise.

Appendix

History: Early modern prediction markets include historical projects such as the Iowa Electronic Market, DARPA’s Policy Analysis Market, and game currency platforms such as HSX.com. Several new companies have emerged over the past decade, including PredictIt, which was founded in 2014 by Victoria University of Wellington. In 2018, Kalshi, a centralized prediction market regulated by the CFTC, was founded, while Augur became the first decentralized prediction market on Ethereum. In 2020, Polymarket launched on the Polygon blockchain.

Economic Theory:The economic theory behind prediction markets derives from Friedrich Hayek’s concept of price signals, which efficiently aggregate and disseminate information in an economy. [14] Robert Shiller’s research on macro markets such as TIPS and GDP warrants shows how financial instruments can hedge economic risk and capture collective expectations, similar to the role of prediction markets in predicting outcomes. Research shows that prediction markets are highly accurate, often outperforming traditional forecasting methods due to their ability to aggregate a variety of information. [15] Concerns about manipulation (such as candidates betting on themselves) are generally overstated, as these markets can quickly self-correct. [16] Additionally, prediction markets are generally unbiased and can capture collective beliefs without being significantly influenced by individual behavior. [17]

Regulation:Event-based contracts have historically been regulated by the CFTC, which prohibits any contracts that “involve illegal activity” or activity that is “contrary to the public interest.” In 2024, the CFTC proposed a rule that would prohibit event contracts involving political outcomes, attempting to classify them as contracts “contrary to the public interest.” [18]

How it works:Here is a brief overview of the components of Polymarket:

Conditional Token Framework (CTF):Polymarket uses Gnosis’s CTF to tokenize binary outcomes on the Polygon Network into ERC1155 tokens. This allows collateral to be split into outcome tokens and merged after settlement.

Hybrid Order Book Model:Polymarket uses a hybrid decentralized order book model, also known as a central limit order book (CLOB). The model involves operators providing off-chain matching and ordering services, while settlement and execution of trades occur on-chain in a non-custodial manner. This setup also includes the option to trade using an automated market maker (AMM).

Decentralized Oracles (UMA):Polymarket primarily utilizes UMA’s optimistic oracle to resolve markets (Pyth is also used for certain markets). In the event of a dispute over the outcome of a particular event, UMA token holders vote to determine the correct outcome.

Auditing Proposals:The Polymarket team is currently responsible for reviewing new event-related proposals, acting as a necessary centralized participant to ensure that event contracts are worded correctly.

USDC Markets:Markets primarily use USDC as the underlying collateral. This stablecoin-based approach simplifies trading and provides a stable medium of value for market participation.

Polygon Settlement Layer:Trading and settlement of market resolutions on Polymarket occur on-chain on the Polygon Network.

Currently, Polymarket charges a small fee (2%) from winning bets, but does not take this fee home as revenue, but instead rewards liquidity providers. In addition, a small portion of this fee is used to pay transaction fees on the Polygon blockchain. Users also pay a small gas fee when depositing and withdrawing funds. Polygon's founders have also hinted at adding additional fees at some point in the future. [19] To date, Polymarket has subsidized some of the growth of market makers on its platform, paying over $3 million in USDC rewards to liquidity providers to increase liquidity depth. [20]

References

[1] The Economist

[2] AP News as of May 2023

[3] A prediction market (or information market) is a platform where participants can buy and sell stocks that represent predictions of the outcomes of future events.

[4] Polymarket has seen significant traction during this election cycle, growing to XX in volume year-to-date in 2024 and being widely cited in media outlets including The Wall Street Journal, CNN, and Bloomberg.

[5] Rhode, Strumpf. "The Long History of Political Betting Markets."

[6] Rhode, Strumpf. “The Long History of Political Betting Prediction markets have evolved from early political betting to modern platforms such as PredictIt, launched in 2014 by Victoria University of Wellington. In 2018, Kalshi, a centralized CFTC-regulated prediction market, was founded, while Augur became the first decentralized prediction market on Ethereum. In 2020, Polymarket launched on the Polygon blockchain, adding to a diverse landscape that includes historical projects such as the Iowa Electronic Marketplace, the DARPA Policy Analysis Market, and gaming currency platforms such as HSX.com.

[7] Hayek. "The Use of Knowledge in Society."

[8] "Statement on Pre diction Markets", Kenneth Arrow, 2007.

[9] Similar Web

[10] Polymarket

[11] The Block

[12] Polymarket

[13] Dune Analytics

[14] Hayek. "The Use of Knowledge in Society."

[15] Wolfers, 2004

[16] Snowberg, 2012

[17] Berg, 2018

[18] [19] Cointelegraph

[20] < a href="https://messari.io/report/yes-or-no-on-polymarket">Messari

JinseFinance

JinseFinance