Source: Grayscale; Compiler: Deng Tong, Golden Finance

Abstract:

Building a diversified portfolio becomes more difficult due to lower bond returns, the concentration of returns in stocks, higher correlations between assets, and macro risks.

At Grayscale, we believe that crypto asset classes can be a useful ingredient in building effective investment portfolios. Bitcoin and other digital assets have historically provided high returns (high risk) and low correlation to public equities. This means they have the potential to contribute to portfolio returns and portfolio diversification.

Cryptocurrency is a volatile asset class, so a little goes a long way. Our analysis shows that A cryptocurrency allocation of approximately 5% helps maximize investors' risk-adjusted returns span>, they would otherwise hold a balanced portfolio of stocks and bonds, although allocations to cryptocurrencies also tend to increase portfolio risk.

Investors should consider their own circumstances and financial goals before investing in cryptocurrencies. This asset class should be considered high risk and may not be suitable for investors with short-term capital needs and/or high risk aversion.

When assembling a portfolio of financial assets, some standard advice is often given to the average investor: Have a diversified portfolio of stocks and bonds, often holding more in the early years stocks, hold more bonds as you get closer to retirement, use tax-advantaged accounts when possible, avoid trying to time the market, and look for the best investment products in each category. If both stocks and bonds generate healthy, uncorrelated returns, this advice should lead to good results.

But today’s investors face a new set of challenges. On the one hand, the long decline in inflation that began around 1980 has ended. In this environment, bonds may struggle to generate returns comparable to those of the past four decades. Additionally, many assets are now more correlated, so investors often lose out on Some of the diversification benefits that come from owning these assets simultaneously. Large institutional investors have attempted to address these challenges by entering private asset markets (e.g., private equity, real estate, venture capital) or using leverage (i.e., borrowing money to increase returns), but these options are often not available Ordinary savers.

At Grayscale, we believe that crypto asset classes can be a solution to these challenges when considering modern, future-proof financial portfolios. Bitcoin and other digital assets are high-risk/high-reward potential investments that anyone can invest in on the public market, and generally have a low correlation to stocks. Grayscale Research believes thata moderate allocation to crypto asset classes in a diversified portfolio may help improve total and risk-adjusted returns, It will also reduce portfolio risk. Every investor has unique goals and should consider their own circumstances, but an analysis from Grayscale Research shows that A cryptocurrency allocation of approximately 5% may help optimize the risk-adjusted returns of a typical portfolio.

Five challenges facing modern investors

For the previous generation For U.S. investors, holding a balanced portfolio of domestic assets (usually a 60/40 mix of stocks and bonds) works well. For example, over the four decades from 1980 to 2019, a 60/40 portfolio of U.S. stocks and government bonds generated an annualized return of 8.6%—more than twice the return of cash. [1] In Grayscale Research, we see several reasons why it may be harder for contemporary investors to find high returns and diversified strategies in traditional markets.

1. The bond bull market is over. In 1979, Paul Volcker's Federal Reserve decided to get serious about lowering inflation. These efforts were successful: Inflation peaked in 1980, and long-term Treasury yields peaked the following year (Chart 1). Over the next few decades, both inflation and bond yields fell steadily, and bond returns fluctuated wildly. [2] We believe we are now in a different regime: one with higher inflation, more volatility, and policies explicitly pursued by the Fed that sometimes result in inflation above target. Rising inflation could be detrimental to fixed-income returns, with investors buying U.S. Treasuries losing about 1% annually since 2019. [3] Bonds will remain an important part of many investors' portfolios, but the long bull market that began in the early 1980s appears to be over.

Chart 1: The long-term decline in bond yields has ended

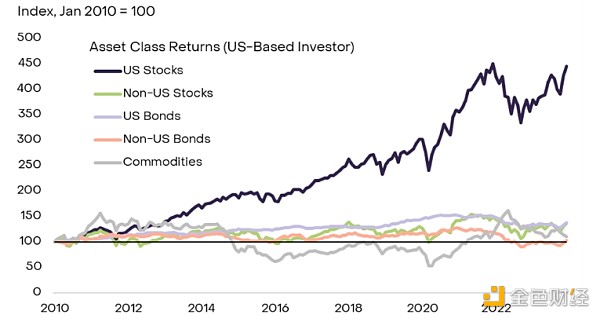

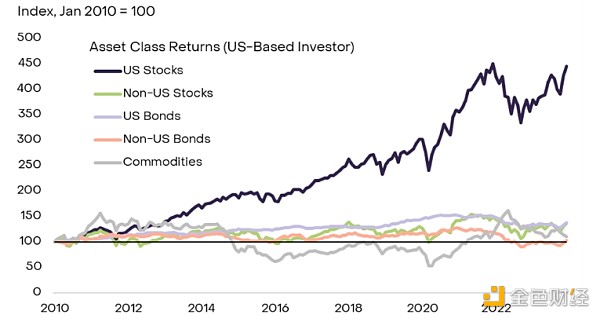

2. Stock returns are getting narrower. Despite the recent underperformance of bonds, stocks continue to generate solid returns. The problem is that these benefits become extremely limited. Among the major asset classes, only U.S. stocks have produced impressive returns since 2010, the period since the 2008-09 financial crisis (Exhibit 2). Furthermore, only a handful of stocks are still doing better in the U.S. stock market. For example, last year, the "Magnificent 7" giant tech stocks (AAPL, MSFT, AMZN, NVDA, GOOGL, META, and TSLA) were up 107%, while the remaining 493 stocks in the S&P 500 were up just 5%. [4] Investors in the U.S. cap-weighted index are now highly focused on the prospects of these seven companies.

Chart 2: US stocks are the only game

3. Higher correlation. By holding a basket of low-correlated assets, investors may achieve better risk-adjusted returns than holding any individual asset. However, correlations between assets increase, so investors see increasingly smaller diversification benefits: stocks are more correlated with bonds, and international stocks are more correlated with U.S. stocks (Exhibit 3). As cross-asset correlations rise, it becomes more difficult to build a portfolio with attractive risk-adjusted returns. [5]

Exhibit 3: Increased correlation means reduced diversification benefits

4. The public market is shrinking. Although the U.S. economy has grown over time, the number of public companies has not. According to the World Federation of Exchanges, the number of publicly traded companies in the United States peaked in 1997 and has mostly declined since then (Exhibit 4). [6] Initial public offerings (IPOs) can be a way for investors to gain exposure to innovative companies with relatively high return potential (sometimes with low correlation to other stocks). However, for a variety of reasons, an increasing number of companies are avoiding listings or delisting (i.e., being acquired and taken private). While institutional investors may still be able to access these opportunities in private markets, most individual investors are not.

Chart 4: Innovative companies favoring the private equity market

5. Macro risks are rising. Economists call the period from the mid-1980s to the 2008-09 financial crisis the "Great Moderation": a period of strong GDP growth and mild recession, low and stable inflation, and an openness to free trade and capital flows. increasing levels and a lull in economic growth. America’s geopolitical dominance. Needless to say, these macro conditions are good for investors. Unfortunately, we believe that the coming years may bring less favorable economic and political outcomes. Today's investors may have to contend with higher and more volatile inflation, large government debt burdens, and higher tariffs and frictions in international capital flows that could impact portfolio returns.

Cryptocurrencies can be a useful ingredient in modern investment portfolios

Public blockchains are a breakthrough revolutionary technology that we expect will eventually transform the global financial system. From an investment perspective, savers tend to consider the risk and return characteristics of blockchain-based tokens that are part of this new asset class. While there are many different tokens, each with their own use cases, overall their return characteristics suggest that investing in the crypto asset class may help investors overcome some of the challenges of today’s modern portfolio construction.

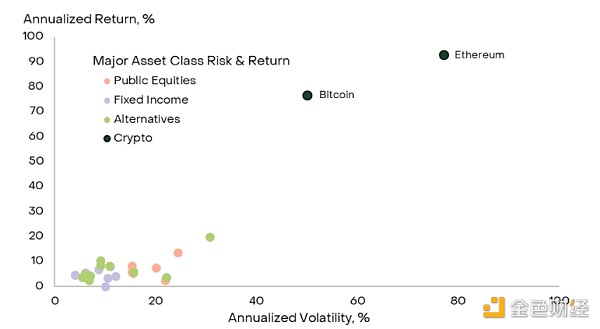

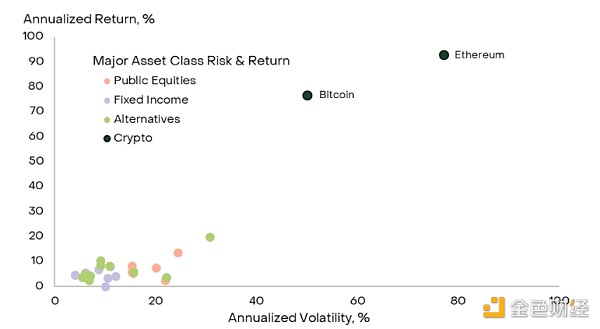

In traditional asset markets, investors face a well-known trade-off between risk and return (Exhibit 5). [7] For example, fixed income assets typically offer lower returns at lower risk, while equity markets offer higher returns at higher risk. To help improve the risk/return trade-off, many institutional investors in recent years have allocated to private markets (e.g., private equity, real estate, venture capital), or adopted strategies that combine borrowing/leverage to enhance returns (e.g., risk parity). These methods often work well, but are not always suitable for individual investors.

Exhibit 5: Familiar trade-offs between risk and return for traditional assets

From a risk/return perspective, the crypto asset class expands the opportunity set for individual investors (Exhibit 6 ). For example, Bitcoin has an annualized return of approximately 50% and an annualized volatility of approximately 75%; Ethereum Risk/Reward The range is even further. [8] Historically, venture capital offers the highest risk/highest potential reward among traditional assets. These investments have generated an average annualized return of about 20%, with annualized volatility of about 30%. [9] Cryptoassets expand the range of risks and rewards available to public market investors. In other words, for investors willing to take on more risk, the crypto asset class has the potential to deliver higher total returns in the form of liquid instruments widely available on exchanges.

Exhibit 6: Cryptocurrencies expand the risk/reward spectrum of public markets

Additionally, the returns on Bitcoin and other crypto-assets are comparable to those on public stocks. The correlation is relatively low (Chart 7). For example, if Bitcoin has high returns but is highly correlated with stocks, including it in a portfolio may improve total returns but not risk-adjusted returns. The fact that it generates high returns and low correlation means that Bitcoin can benefit investment portfolios through higher returns and better diversification.

Figure 7: Bitcoin also brings the benefits of diversification

A little crypto goes a long way

When building a portfolio, investors Typically consideration is given to total return (whether certain financial goals will be achieved in the future) and risk-adjusted returns (whether its returns provide adequate compensation for the risk). Because cryptocurrencies are a relatively high-risk/high-reward potential asset class, adding them to a portfolio will generally increase expected total returns (and thus portfolio risk). Therefore, we consider the amount that yields the highest expected risk-adjusted return under certain assumptions (although adding any cryptocurrency allocation may result in greater portfolio volatility).

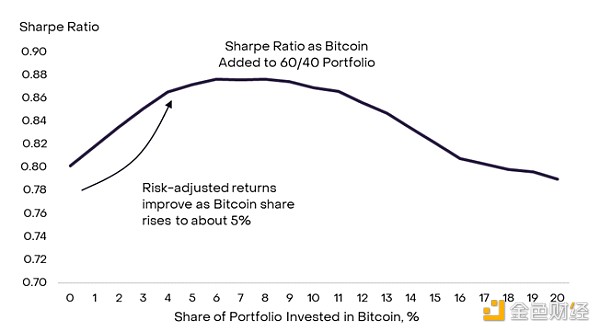

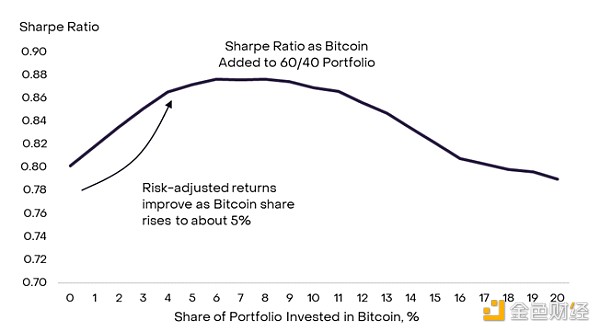

Specifically, Grayscale Research considered a hypothetical investor holding a classic 60/40 stock and bond portfolio and simulated their expected returns using Monte Carlo methods (details See technical appendix for information). We then considered how adding Bitcoin to this portfolio (proportionately subtracted from a 60/40 mix of stocks and bonds) would change its Sharpe ratio (a measure of risk-adjusted returns). [10] From a risk/return perspective, the portfolio with the highest Sharpe ratio can be considered optimal. Due to its longer history, we use Bitcoin as the representative digital asset in this exercise rather than other tokens.

Exhibit 8 shows the results of our baseline simulation. As Bitcoin is added to a classic 60/40 portfolio in small increments, expect the Sharpe ratio to rise initially. The reason is that while Bitcoin is a more volatile asset, it has higher returns and a lower correlation with traditional assets. The Sharpe ratio continues to rise until Bitcoin reaches about 5% of the total portfolio, and then begins to level off. After this point, increasing Bitcoin allocations is no longer expected to improve risk-adjusted returns.

Exhibit 8: Hypothetical risk-adjusted returns rise as Bitcoin is added to 60/40 portfolio

Of course, this is just a simulation under a specific set of assumptions, and it cannot A guarantee that future returns will reflect past returns. To stress-test our results, Grayscale Research varied the expected returns, volatility, and correlations of the three assets (see Technical Appendix for details). Each of these scenarios results in a slightly different amount of Bitcoin, resulting in a portfolio with the highest Sharpe ratio, and investors should consider this uncertainty before allocating to the asset class. In general, if the optimal portfolio provides higher returns, lower volatility, and lower correlation with traditional assets or a combination of these attributes, then it will hold more Bitcoins.

In our baseline simulation and stress test, our hypothetical simulations show that for an investor who would otherwise hold a classic equity portfolio, adding approximately 5% of the portfolio % allocation to Bitcoin results in the highest risk-adjusted returns on average, despite higher portfolio volatility and bonds. Cryptocurrency is a volatile asset class, so a little goes a long way.

Buy and "Hold"

It should be emphasized that investing in digital assets may not be suitable for everyone. In this analysis, we consider a representative investor holding a classic 60/40 portfolio. However, there are actually many types of investment portfolios that can meet different financial needs. For example, some investors hold a portfolio of low-volatility assets because their capital is earmarked for upcoming expenses (such as a home purchase or college tuition). Cryptocurrencies are a highly volatile asset class that can generate strong returns over time, but also in the short term Loss of significant value. In addition, some investors favor income-producing assets such as fixed-income securities or dividend-paying stocks. While some cryptoassets will generate income, in most cases the returns will be low compared to the volatility of the asset -Cryptocurrencies are an asset class held primarily for capital appreciation.

Although there are some exceptions, analysis by Grayscale Research shows that traditional A balanced portfolio can achieve higher risk-adjusted returns with a modest allocation to cryptocurrencies (approximately 5% of total financial assets). Because cryptocurrencies are a high-risk/high-reward potential asset class with low correlation to equities, cryptoassets can help investors overcome some of the portfolio construction challenges they currently face. Allocating to cryptocurrencies doesn't change other conventional thinking about portfolio construction, including reducing portfolio volatility as you approach retirement, using tax-advantaged accounts when possible, and avoiding trying to time the market (i.e., buy and "hold").

Technical Appendix

To determine the appropriate share of Bitcoin in a portfolio, we simulated expected returns using Monte Carlo methods. Specifically, for each incremental addition of Bitcoin to a 60/40 portfolio (ranging from 0% to 25%), we simulated 1,000 random portfolios over 60 months (i.e., 26,000 five-year simulations ). We then calculate the average return, volatility, and Sharpe ratio for each share of Bitcoin in the portfolio (e.g., the average Sharpe ratio when Bitcoin’s share of the portfolio is 0%, 1%, 2%, etc. ).

A key element of this analysis is to consider the impact of cryptocurrencies’ correlations with other asset classes, as this determines their diversification benefits in a portfolio context. Simulating correlated random variables involves more advanced statistical techniques. To adjust for the correlation between Treasuries, the S&P 500, and Bitcoin, we employ the Iman-Conover method. This method is useful because it is able to change the correlation structure of a set of variables while preserving their respective marginal distributions.

The key steps involved in this method are:

Ranking transformation: Transform the data into a uniform distribution by replacing the value of each variable with its ranking.

Normalization and conversion to z-scores: These rankings are normalized and then converted to z-scores, aligning them to the standard normal distribution.

Correlation Adjustment: We then adjust these z-scores using Cholesky decomposition of the target correlation matrix, aligning the data with our desired correlation structure.

Convert back to original scale:Finally, the adjusted z-scores are converted back to the original scale of the data, ensuring that the original distribution characteristics of each variable are maintained.

This Iman-Conover is helpful in our analysis because it can realistically simulate how different assets (especially Bitcoin) interact in a portfolio under various relevant scenarios.

For our benchmark statistics, we chose Bitcoin return data from 2014 onwards. This choice is based on the observation that around 2014 the Bitcoin return distribution became more stable and approached a normal distribution (Chart 9). For stocks and bonds, the baseline distribution is measured since 1980.

Chart 9: Bitcoin’s return distribution has become more stable since 2014

When simulating the return distribution we analyzed, we assumed positive returns for all assets, including Bitcoin state distribution. This assumption is a standard approach in financial modeling and provides a balance between simplicity and realism. However, we acknowledge that real-world returns, especially for assets like Bitcoin, may not strictly follow a normal distribution. For Bitcoin, historical returns (especially using data prior to 2014) show evidence of positive skewness (Chart 10). This is a rare and attractive property for pro-risk asset classes (i.e., most pro-risk asset classes have negative skewness). If we incorporate Bitcoin's positive skewness into the analysis, then all else being equal, the optimal portfolio allocation would be greater than 5%.

Chart 10: Bitcoin’s historical returns show positive skew

As discussed in the main text, we stress-tested our results with various alternative scenarios, reflecting Uncertainty about the distribution of future returns for stocks, bonds, and Bitcoin, as well as the correlation between these assets (Exhibit 11). Overall, our stress tests support the finding that an average allocation to cryptocurrencies of approximately 5% in a portfolio may be appropriate.

Exhibit 11: Our stress testing shows that an average cryptocurrency allocation of 5% is optimal

[1] ;Returns exclude fees and are based on index returns; You cannot invest directly in the index; Asset returns are based on the S&P 500 Price Return Index and the Bloomberg-Barclays U.S. Treasury Total Return Index; Annual data from 1980 to 2019; Cash returns are based on S&P U.S. Treasury Bill Total Return Index since 1990; estimated based on the Fed's 3 million Treasury bill yield data in previous years.

[2] Over this period, Treasury coupon yields above cash increased Treasury returns by 1.9% per year, while yields The long-term decline is increasing by another 1% per year.

[3] Calculated by Grayscale Research based on Bloomberg-Barclays U.S. Treasury Total Return Index.

[4] Calculated by Grayscale Research using Bloomberg data as of December 31, 2023. Grayscale Research subtracts the contribution of the seven largest stock returns from the total index return.

[5] For more background, see "Global Stock Market Linkages Reduce Diversification Potential," Karen Lewis, Federal Reserve Bank of Dallas Economic Newsletter, February 2012.

[6] For more background, see "The U.S. Listing Gap," Craig Doidge, G Andrew Karolyi, and Rene Stulz , NBER Working Paper Series, May 2015.

[7] Charts 5 and 6 are based on index returns; you cannot invest directly in indices; indices include: S&P 500 Index , Nasdaq 100 Index, Russell 2000 Index, MSCI ACWI, MSCI World, MSCI EM, Bloomberg-Barclays Global Aggregate Index, Bloomberg-Barclays U.S. Aggregate Index, Bloomberg-Barclays U.S. Corporate Index, Bloomberg -Barclays U.S. High Yield Index, Bloomberg-Barclays Euro Index Composite, Bloomberg-Barclays Japan Composite, Bloomberg-Barclays Emerging Markets U.S. Composite, JPMorgan GBI-Emerging Markets Global Diversified, Deutsche Bank Cross Asset CTA Trends, Deutsche Bank Emerging Markets FX Equal Weights, S&P/GS Indices, GSAM FX Spreads, FTSE Ventures, Advanced Research Risk Parity, Preqin Capital Private Equity, Preqin Capital Real Estate and Hedge Fund Research 400.

[8] Source: Grayscale Investments Based on Coin Metrics data; Bitcoin returns from January 2014 to December 2023 ; Ethereum returns from January 2019 to December 2023. For the best assets, their early history of returns and volatility can inflate investor expectations. For more Bitcoin, see the appendix for more details on the asset's historical return distribution.

[9] Based on FTSE Venture Capital Index from January 1996 to December 2023. Returns do not include fees. Indexes are not managed and it is not possible to invest directly in an index.

[10] We assume zero cash returns in our simulations.

JinseFinance

JinseFinance