Source: Grayscale; Compiled by: Tao Zhu, Golden Finance

After the U.S. Securities and Exchange Commission approved a spot Ethereum exchange-traded product, some investors may want to learn more about the second-largest crypto asset. [1] Grayscale Research expects that the new product may allow more investors to understand the concepts of smart contracts and decentralized applications, thereby understanding the potential of public blockchains to transform digital commerce. Below we have compiled 10 common questions that investors may ask about Ethereum, whether they want to understand the basics or deepen their understanding of the network and its ecosystem.

Q: What are the main differences between Bitcoin and Ethereum? How does Ethereum differ from other assets in the smart contract platform cryptocurrency field?

A: Bitcoin's current main use is as a store of value, while Ethereum's main use is as a platform for decentralized applications.

In 2009, Bitcoin became the first public blockchain and the first investable blockchain token. Today, Bitcoin can be considered an asset and digital alternative to gold. In 2015, Ethereum applied the concept of public blockchains to smart contracts (self-executable computer code), creating an entirely new category within the crypto asset class with entirely different use cases than Bitcoin.

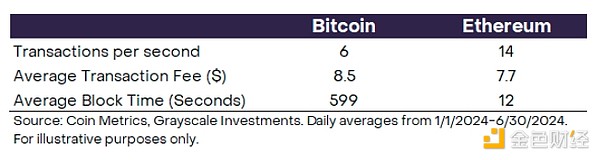

Ethereum can be likened to a decentralized version of Apple’s App Store, as it provides a foundational platform for applications to be built. These decentralized applications (dApps) range from financial applications to games to identity tools. Compared to Bitcoin, Ethereum currently allows for higher transaction throughput, lower average block times, and roughly the same level of transaction fees for users (Figure 1).

Chart 1: Bitcoin vs. Ethereum

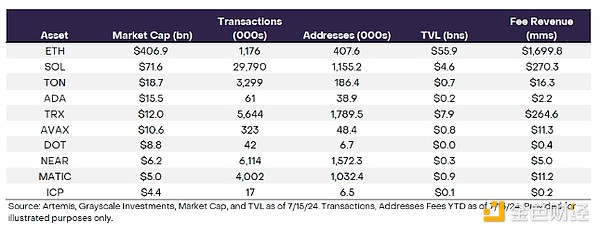

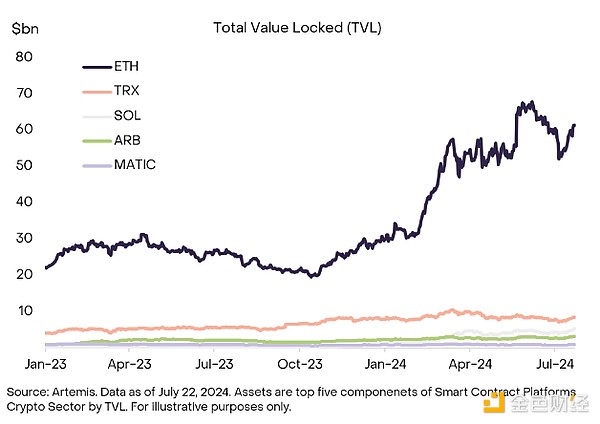

Since Ethereum and Bitcoin have completely different primary use cases, they belong to different market segments in Grayscale’s cryptocurrency industry framework. Bitcoin belongs to the currency cryptocurrency industry, while Ethereum belongs to the smart contract platform cryptocurrency industry, among many other industries. Ethereum leads other assets in the industry in terms of fundamental metrics, such as market capitalization, total locked value (TVL), and fee revenue (Chart 2).

Figure 2: Basic information of the top 10 smart contract platforms by market capitalization

Q: How much will the supply of Ethereum (ETH) [2] increase, and what determines the issuance rate?

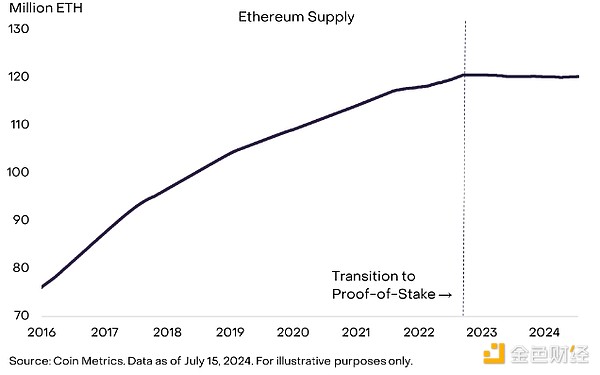

A: Since the transition to Proof of Stake (PoS) in 2022, the supply of ETH has remained basically unchanged. The issuance rate is determined by block rewards and transaction fees.

In 2022, Ethereum underwent a major upgrade, known as the “merge,” which included a shift from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism. Prior to the merge, Ethereum’s supply had barely changed since the merge and the shift to PoS (Figure 3). As with Bitcoin, limited ETH supply growth supports its value as a scarce digital asset.

Figure 3: ETH supply remains largely unchanged since September 2022

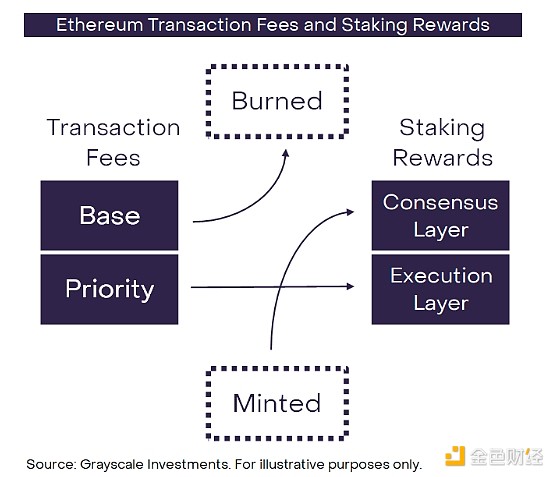

ETH issuance is affected by block rewards and transaction fees. Block rewards are newly minted ETH distributed to validators, contributing to inflation. Transaction fees, or gas fees, consist of a base fee (deflationary) and a priority fee (as a reward to validators) (neutral for inflation).

Q: What is "gas" on the Ethereum network? What is Ethereum network fee revenue? How does it provide value to token holders?

A: Transaction fees on Ethereum are called "gas" and can be considered network revenue. Token holders receive revenue through a mechanism similar to equity dividends and buybacks.

Ethereum network fee revenue comes from gas, which is a fee paid in ETH for executing transactions and using applications on the Ethereum network. Gas is necessary to help regulate network usage: without some type of transaction cost, the network could be flooded with junk transactions.

Gas fees consist of two parts: the base fee and the tip. Similar to stock buybacks, the base fee is “burned”. It removes ETH supply from circulation. In this way, an increase in transaction volume can help benefit all token holders. Similar to staking dividends, tips are distributed as rewards to validators. The difference in this case, however, is that validators help secure the network by processing transactions and maintaining the blockchain (Figure 4).

Figure 4: Ethereum supply dynamics through burning and staking

Gas fees are critical to the operation of the Ethereum network because they provide economic incentives for validators and stakers to participate in network security. By directly tying network usage to the value of ETH, network fee revenue plays a key role in Ethereum's value accumulation mechanism, benefiting token holders, validators, and the entire network ecosystem.

Q: What is the appeal of Ethereum to developers building on the network? What are the largest applications on Ethereum? A: Ethereum is attractive to developers because of network effects and network security. Most of today’s largest decentralized applications (dApps) have financial use cases. Ethereum is attractive to developers building on its network for a number of reasons. First, Ethereum benefits from a larger network effect than other chains in the Grayscale Smart Contract Platform crypto space. Ethereum leads in number of applications (~4,700 dApps in total) and has the largest developer community (~580 developers per week), demonstrating a strong environment for application interoperability and innovation. [4] Ethereum also leads its competitors with $54 billion in TVL, a key indicator of ecosystem liquidity (Figure 5). [5] These advantages put Ethereum in a particularly good position to retain and attract new developers.

Figure 5: Ethereum leads competitors in TVL, a key indicator of liquidity

Ethereum also leads the industry in network security, which we believe has helped it gain the trust of users and developers. The theoretical cost of attacking the Ethereum network is prohibitive. For example, controlling 51% of the network to perform a majority attack would require a significant amount of computing power and financial resources, making such an attack economically infeasible. [6] The extensive decentralized network of nodes further helps strengthen network security by ensuring redundancy and eliminating single points of failure.

The use cases for decentralized applications on Ethereum range from finance/tokenization to gaming and NFTs. Applications built on Ethereum based on metrics like users, fees, and TVL include Lido and Uniswap. Lido is a liquidity staking solution that enables users to stake their ETH while maintaining liquidity by issuing derivative tokens (stETH). Uniswap is a decentralized exchange that enables peer-to-peer trading of various crypto assets without intermediaries. Both use Ethereum as a settlement layer and are designed to perform secure and decentralized transactions.

Q: Ethereum is a modular blockchain design, what does this mean?

A: Ethereum's modular design means that different types of blockchain infrastructure (multiple software "layers") work together to provide an end-user experience.

Blockchains can be thought of as a type of digital infrastructure. Just like infrastructure in the physical world, they can experience congestion. For example, in May 2022, Ethereum network congestion increased, causing the average daily gas fee for a single transaction to reach $196. [7] When network congestion increases, gas fees also rise, which can crowd out many types of network activity. As a result, Ethereum pursues a modular (or layered) design philosophy in which different types of blockchain infrastructure work together to provide an end-user experience.

Ethereum’s modular design divides the network into specialized parts, such as execution (processing transactions), data availability (storing transaction data), and consensus (ensuring that all transactions are valid). This approach allows for targeted innovation and updates without disrupting the entire network, enabling Ethereum to address its scalability challenges while still maintaining its network security.

This design contrasts with Solana’s monolithic approach, in which each function (execution, data availability, and consensus) is handled in a single layer to optimize for speed, efficiency, and consistency.

Q: What are Ethereum Layer 2 ? How do they connect to the Ethereum mainnet?

A: Ethereum Layer 2 is a scaling solution built on top of Ethereum that can execute transactions at a lower cost.

Because Ethereum has a modular design, it can separate transaction execution from transaction settlement. Therefore, Ethereum Layer 2 processes transactions, batches them together, and then sends a compressed version back to the main network (Ethereum mainnet or Layer 1) for settlement. Through this batching process, Layer 2 can provide users with higher throughput and lower costs compared to transactions executed on the main chain, while still relying on the security of the Ethereum network.

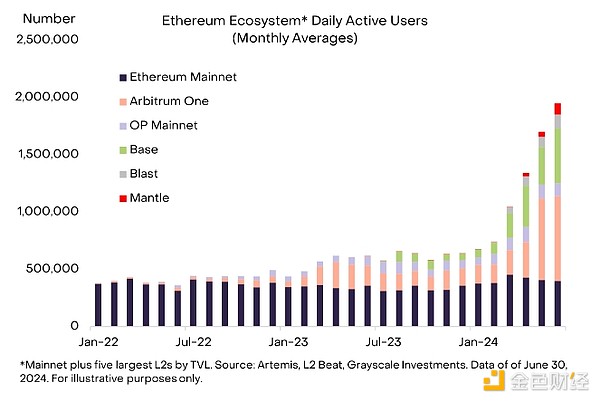

Today, there are a variety of Layer 2 scaling solutions, including Optimistic Rollups (such as Optimism and Arbitrum) and ZK Rollups (such as Starknet and ZkSync). From a blockchain activity perspective, Layer 2 networks have enabled significant expansion of the Ethereum ecosystem; Layer 2 now accounts for approximately two-thirds of the total activity in the Ethereum ecosystem (Figure 6).

Figure 6: Ethereum Layer 2 Activity Grows Significantly

Layer 2 adoption can be attributed in part to Ethereum’s recent Dencun upgrade. With this upgrade in March 2024, Ethereum significantly reduced its data costs by providing designated storage space for Layer 2 on the mainnet. This allows Layer 2 to reduce its transaction fees, and in some cases, Ethereum Layer 2 can be as affordable and accessible as Solana.

Q: How does Ethereum reach consensus and how is network security measured?

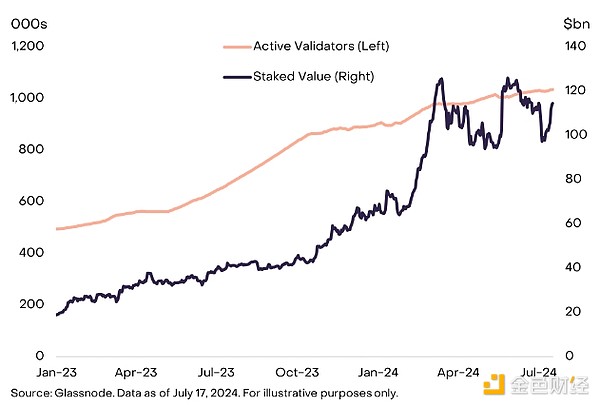

A: Ethereum reaches consensus through a proof-of-stake algorithm. Network security can be measured in different ways, including the value of staked ETH and the number of validators.

Originally, Ethereum reached consensus through proof-of-work, similar to Bitcoin. However, in 2022, Ethereum transitioned to a PoS network through a "merge" upgrade. The upgrade aims to increase the efficiency and scalability of the network while reducing energy consumption by 99%. [8]

The PoS consensus used by Ethereum is different from PoW in that it selects who has the right to confirm the next block based on the value of the staked tokens, rather than through competition between miners. In the PoS consensus mechanism, validators must stake in increments of 32 ETH to be eligible to confirm blocks and receive rewards. [9]

Ethereum network security can be measured by the total amount of ETH staked on the network, currently valued at $112 billion (Figure 7). This represents the entire ecosystem's economic commitment to network security (also known as Ethereum's security budget). Another measure is the number of validators, currently around 1 million, which reflects the decentralization of the Ethereum network. [10]

Figure 7: Network security measured by validators and staked value

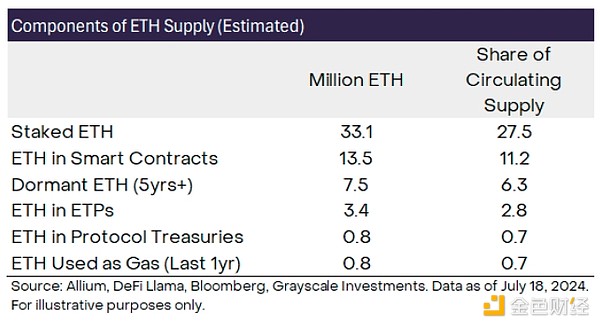

Q: What is the ownership distribution of ETH holders? A: As of mid-July 2024, ETH ownership can be divided into the following different categories: staked ETH (27%), ETH in smart contracts (11%), dormant ETH (6%), ETH held in ETPs (~3%), ETH in treasury bonds (0.7%), and ETH used as gas annually (0.7%). See Figure 8 for more details. Grayscale Research believes that approximately 17% of ETH supply can be classified as idle or relatively illiquid. According to data analytics platform Allium, this includes about 6% of ETH supply that has not moved in over five years, and about 11% of ETH supply that is “locked” in various smart contracts (such as bridges, wrapped ETH, and various other applications). In addition, 27% of ETH supply is staked.

In addition to these categories, $2.7 billion of ETH is spent on gas for network transactions each year. [11] At current ETH prices, this represents an additional 0.7% of supply. There are also a number of protocols that hold large amounts of ETH in their treasuries, including the Ethereum Foundation ($1 billion worth of ETH), Mantle (~$750 million ETH), and Golem (~$519 million ETH). [12] Overall, ETH in protocol vaults accounts for about 0.7% of supply. Finally, 3.4 million ETH (about 3% of total supply) is deposited in ETH ETPs.

Overall, these categories account for nearly 50% of ETH supply (Exhibit 8), although the categories overlap partially (e.g., ETH in protocol repositories may be staked).

Figure 8: Staked ETH accounts for a large portion of total ETH supply

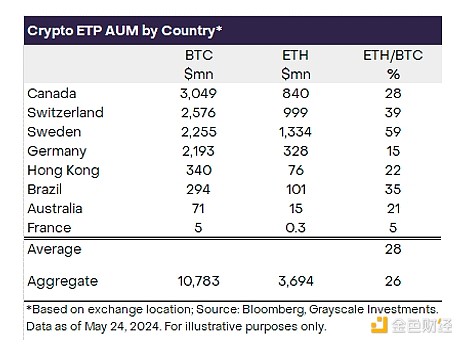

Q: How much money might flow into US Ethereum ETPs? A: Grayscale Research estimates that inflows into US Ethereum ETPs could be equivalent to around 25%-30% of Bitcoin ETP assets, or $3.5 billion to $4 billion in the first four months. Outside the US, both Bitcoin and Ethereum exchange-traded products (ETPs) are listed, with assets in Ethereum ETPs accounting for around 25%-30% of Bitcoin ETP assets (Chart 9). On this basis, Grayscale Research’s working assumption is that net inflows into US-listed spot Ethereum ETPs will be 25%-30% of spot Bitcoin ETP net inflows to date, or around $3.5 billion to $4 billion in the first four months or so (25%-30% of the $13.7 billion in spot Bitcoin ETP net inflows since January).

Figure 9: Outside the US, Ethereum ETP AUM accounts for 25%-30% of Bitcoin ETP AUM

Ethereum’s market cap is about one-third (33%) of Bitcoin’s, so our assumption implies that Ethereum net inflows as a percentage of market cap may be slightly smaller. While we believe this is a reasonable working assumption, the estimate is uncertain and there is a risk that US-listed spot Ethereum ETPs may have higher or lower net inflows. In the US market, ETH futures-based ETPs only account for about 5% of BTC futures-based ETP assets, although we believe this is not representative of the relative demand for spot ETH ETPs.

Q: What opportunities and challenges does the Ethereum network face in the future?

A: Ethereum benefits from strong network effects and liquidity advantages. At the same time, it also faces certain challenges, including Layer 2 centralization and increasing competition from other smart contract platforms.

Ethereum benefits from several fundamental positives. Most importantly, Ethereum's network effects and liquidity advantages make it conducive to retaining and attracting new developers, applications, and users. Ethereum also generates the most network fee revenue of its kind (more than $2 billion in 2023), which demonstrates Ethereum's maturity, ability to monetize its user base, and advantage in attracting validators and network security stakers. Overall, Ethereum has the largest network security budget at 33 million ETH (currently worth $112 billion). This is particularly important for use cases that require a high level of security, such as stablecoins and tokenized financial assets.

Ethereum ETPs could increase institutional willingness to hold ETH as an asset and adopt technology on the Ethereum blockchain. We are already seeing progress in this regard, as the list of Wall Street firms building tokenized funds now includes Goldman Sachs and BlackRock, which is developing its BUIDL fund on Ethereum. [14]Beyond traditional finance, the spot approval of Ethereum ETPs could have an impact on broader retail awareness of Ethereum, inflows of ETH assets, and adoption of the Ethereum network.

At the same time, Ethereum faces several challenges. For example, most Layer 2 is currently centralized. To fully realize its potential as a truly permissionless decentralized ecosystem, Ethereum Layer 2 will need to be decentralized over time. In addition, network fee revenue on the Ethereum mainnet has recently declined as network activity transitions to Layer 2. This highlights the importance of Ethereum continuing to grow its fee revenue. This can be achieved through i) modest growth in Layer 1 activity, paying higher transaction costs, or ii) significant growth in Layer 2 activity, paying lower transaction costs.

Ethereum faces increasing competition in the smart contract platform crypto space. To maintain its dominance in the competitive market space, Ethereum will need to leverage its strengths, attract more users and increase fee revenue.

References

[1] CoinMarketCap as of July 22, 2024

[2] “ETH” refers to the native token on the Ethereum blockchain

[3] Coin Metrics

[4] Dapp Radar and Artemis

[5] Breaking BFT: Quantifying the Cost to Attack Bitcoin and Ethereum

[7] Bitinfocharts

[8 ] as of July 9th, 2024

[10] Beaconcha.in

[11] This reflects the amount of Ethereum used as gas in the transaction. This value is denominated in ETH (see Figure 8).

[12] Defi Llama, as of 7/18/2024

[13] Artemis, as of July 22, 2024

[14] Coindesk

Huang Bo

Huang Bo

Huang Bo

Huang Bo Huang Bo

Huang Bo Miyuki

Miyuki JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance Huang Bo

Huang Bo decrypt

decrypt Cointelegraph

Cointelegraph