Hackers, bring spring breeze to Binance?

If you pay attention to the cryptocurrency circle, the hacker incident on February 21 should not be unfamiliar. On February 21, Bybit said that the exchange was hacked and 499,000 ETH worth up to 1.46 billion US dollars were stolen. Not only did it set a record for the largest amount of hacker attacks, it also became another symbolic event of the current bull market from prosperity to decline. After the incident, Bybit successfully raised funds to overcome this difficulty with a combination of rapid response, active handling, and market appeasement.

Afterwards, the North Korean hacker group was accused of being the mastermind behind the incident. Although Bybit mobilized resources to guard against it, on March 4, the funds were still completely cleaned through the mixer. Although there are unsatisfactory expenses, the customer's losses can be filled, and the exchange is still very strong. Losing a year's profit is not a matter of life and death.

I thought the matter would come to an end, but unexpectedly, the storm resurfaced, OKX suffered an unexpected disaster, and Binance became the biggest winner.

On March 17, OKX suddenly announced that after consultation with regulators, it took the initiative to temporarily suspend DEX aggregator services in order to carry out more security upgrades to prevent further abuse. Affected by this, the relevant limit orders and cross-chain orders will be automatically revoked. OKX said that the specific recovery time will depend on the progress of the upgrade. During this period, users can still trade by jumping to third-party protocols, and other services of the OKX Web3 wallet will not be affected.

This release has made the market explode. The OKX Web3 wallet is undoubtedly the leader among the exchange wallets in this round. It has always been known for its smooth experience and exquisite UI design. The DEX aggregation is one of the core functions. It aggregates 300+DEXs and can provide users with trading services with low thresholds and low slippage. According to the announcement released by OKX, as early as June last year, the number of active users of the OKX Web3 wallet in a single week exceeded 4.6 million, and by December 5 last year, the number of OKX wallet users had increased by 991% worldwide. It is enough to see that the wallet is not only an important traffic moat for OKX, but also a key tool for attracting new users.

For such an important DEX function as the wallet, why is it closed?

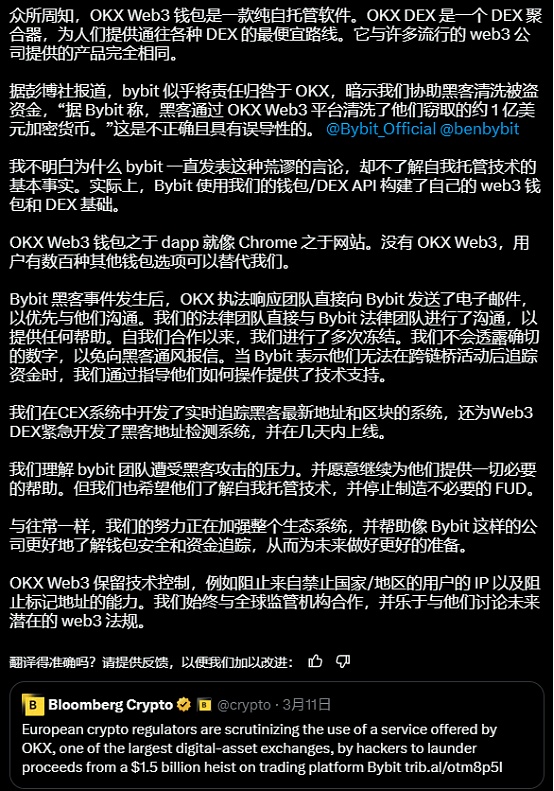

To discuss the reasons, we have to go back to a report by Bloomberg. On March 11, Bloomberg reported on the Bybit hacking incident, which mentioned that "European cryptocurrency regulators are reviewing the use of a service provided by the crypto exchange OKX because Bybit said hackers have used the OKX Web3 platform to launder part of the stolen money from Bybit, amounting to $100 million."

It seems to be no problem, but in fact it is suspected of shifting the blame. BYbit's statement can undoubtedly be abbreviated to "hackers use OKX Web3 to launder stolen money" for outsiders, especially regulators who pay relatively little attention to technology, that is, OKX Web3 can be used as a tool for money laundering, which deserves high attention. Coincidentally, just a month ago, on February 18, OKX just announced that it had obtained the EU's MiCA license. At the same time, other exchanges such as Bybit are still queuing up for applications.

The newly approved license led to a massive hacking incident, and European supervision quickly came. In response to Bybit's remarks, OKX's boss Xu Mingxing was quite dissatisfied. On March 11, he issued a long article to respond, saying that Bybit has been making absurd remarks, and OKX has cooperated with Bybit many times before to freeze hacker funds, and even provided technical support and guidance. He understands its difficulties, but hopes that Bybit will stop spreading FUD, which seems to accuse Bybit of being ungrateful.

But if we say whether OKX is wronged or not, from a technical point of view, it is indeed a bit wronged. Although the hacker address of the on-chain tool is displayed as an OKX Web3 agent, it is well known that OKX Web3 is a self-hosted wallet, and OKX DEX is an aggregator that provides users with efficient liquidity by implementing the aggregation services of other DEXs. It is just a tool that does not host any assets, nor is it a trading subject. It only provides intermediary services. From the perspective of product attributes, OKX DEX is no different from other aggregator products. In his response, Xu Mingxing also bluntly stated that Bybit used the API of OKX wallet/DEX to build its own wallet and DEX foundation.

Responses are responses, and the pace of supervision has started, and it is difficult to stop. The EU is still in the process of technological exploration, does not have a deep understanding of technology, and is always known for its cautious attitude. Therefore, on March 17, OKX had no choice but to suspend the function of DEX because of technical upgrades in cooperation with supervision. Subsequently, Xu Mingxing also forwarded that OKX Web3 has launched a number of anti-abuse control measures, including prohibiting IP access to restricted markets and real-time blacklist address detection and interception systems. In the final analysis, we still need to strictly prevent the outflow of black money.

The EU's regulatory actions affect more than just one exchange. For other exchanges that want to apply for licenses, they must also make plans early. According to the news from AB Kuai.Dong, a big V on the X platform, after the closure of OKX DEX, many exchanges worked overtime to rectify their businesses, including splitting the exchange wallet into an independent APP. The wallet APP will no longer have DEX and cross-chain functions, and will no longer provide official financial management such as CeDeFi. In short, the issuing and operating entities need to be completely isolated from the exchange.

In fact, if we return to the traditional financial sector, the isolation of the issuing and operating entities from the exchange is a necessary measure in risk control. Each sub-segment should be relatively independent, such as trading, custody, settlement, etc. But in the field of encryption, for the convenience of use, DEX and CEX are basic operations, and the business model of exchange + Web3 wallet has been proven to be effective by the market, otherwise it would not trigger the exchange's wallet research and development fever. The sudden separation of the two sides not only increases the operation steps for users, affects transaction efficiency, but also goes against the previously established mental habits of use.

But in the long run, with the increasing compliance level of the industry, the separation of entities is also a realistic path. Now it is led by large exchanges, and it is very likely that other exchanges will follow suit, unless the exchange chooses not to follow the compliance path. However, if compliance is the general trend, the risks of small exchanges that do not follow up should not be underestimated. Of course, in the short term, it only affects OKX Web3 itself.

Both OKX and Bybit were killed, and the luckiest one was Binance. Before the hacking incident, Binance was facing fierce competition from the two. Not only was it overtaken by the bold Bybit in the contract derivatives market, but it was also inferior to OKX in on-chain products and tools, especially on the wallet side. As we all know, wallets are good things and are the primary traffic entrance for users to enter Web3. However, Binance's own wallets are either complained about the old pages or the poor experience. It was not easy to innovate the Alpha section, but it was seamlessly grafted by friendly companies. It was very frustrating.

This time, the removal of OKX DEX undoubtedly gave Binance a good opportunity to overtake. Business wars are simple and unpretentious, and opportunities are fleeting. Management has come out to recommend. He Yi is active in the KOL comment area, recommending his own wallet and saying give it a chance. Binance also acted quickly and quickly announced that wallet transactions and exchanges will be free of fees within 6 months. This wave of strong publicity still ushered in a certain volume, and some users began to try to use Binance wallets. But the problem does exist. James, a user on X, said that he bought 5,000U BOB on Binance Alpha. Although the transaction was smooth, he lost 1,200U. In this regard, He Yi was also very generous and promised to compensate for serious losses within 24 hours.

For now, Binance has caught this wave of traffic. Of course, in addition to Binance, there are many other friendly companies scrambling for traffic. Bitget Wallet launched a one-week recharge incentive activity with a prize pool of 90,000 US dollars, and UniversalX also made efforts to recommend KOLs. In the final analysis, a good experience can make the product go further.

After this incident, some people in the market jokingly called Binance the "son of luck" and successfully surpassed two major competitors at an unexpected node. It is hard to say whether it is the son of luck, but Binance has been very proud recently. Last week, in addition to the wallet promotion this week, Binance was still exciting last week. Not only did it earn $2 billion and connect with the UAE royal family, CZ's "elusive" MEME finally got on the right track.

CZ finally mastered the gameplay of MEME. At 2:38 pm on the second day after the financing news was announced, Binance's Chinese official account posted a MEME picture of the editor wearing Arabic clothing on social media. Later, CZ retweeted the tweet with the text "Mubarak". The MEME market immediately heard the news, and for a time, Four.meme launched dozens of tokens with Mubarak as the ticker.

I thought CZ, who didn't understand MEME, might be another wave, but CZ started his own rhythm. First, he forwarded the leading coin in many coins, and then continued to expose the MEME. On March 15, Binance alpha launched Mubarak. Even on the night of March 16, CZ's public wallet bought 1BNB of $Mubarak. A series of operations directly made Mubarak's market value exceed 130 million US dollars. Netizens jokingly said that BSC had a few more A8 players.

After finding a way and a method, CZ and He Yi started the MEME test field, forwarding memes and pictures from time to time, and personally hyping MEME. Let's not talk about MEME for now, but this round of operations has really benefited the BSC ecosystem. According to the data of @hoidya, an on-chain analyst, BSC's TVL has continued to grow for 4 days since March 13, and DEX trading volume and average transaction fees have also risen to a weekly high. More intuitive is the price of BNB, which is rising against the trend even in the unstable market, from $507 on March 11 to a maximum of $643, and now stabilized at $616.

This attempt was just a small test for CZ, and it was at this time that CZ truly understood the importance of the attention economy. In today's market, liquidity is highly dependent on the macro market, and the attention economy is an indispensable task for every public chain. In this regard, the well-known KOL Crypto Wei Yu also expressed his opinion, "CZ's idea is correct. The core of the revival of BSC lies in the dual-wheel drive, stabilizing BNB price expectations as the cornerstone, and continuously creating new memecoins with explosive communication power as fuel, and through split-disk liquidity management 'old coins are replaced by new ones at low levels' to maintain ecological debt control, so that retail investors can repeatedly reinvest in the hundred-fold narrative rotation instead of being trapped. ” Interestingly, as early as 2023, CZ had made a statement that he would not invest in MEME. As time goes by, CZ is no longer the CEO of Binance, but the growth of BNB is still on his shoulders. It may not be his wish to become a MEME manufacturing machine, but as Binance's number one spokesperson, it is still his responsibility to enter the community and lead growth.

It is sad that the controversial Binance finally heard the long-lost applause, but it was because its competitors were hit hard and the founder finally managed MEME. Is this a blessing or a curse for the industry? The cryptocurrency circle, which is floating in the tide of the times, may have no time to think about this issue.

Alex

Alex

Alex

Alex Brian

Brian Kikyo

Kikyo Brian

Brian Brian

Brian Kikyo

Kikyo Bernice

Bernice Brian

Brian Kikyo

Kikyo Xu Lin

Xu Lin