Written by 0xBrooker

Continuing the decline from last week, after breaking through the upper edge of the "Trump bottom" at $110,000, accompanied by a sudden increase in macroeconomic uncertainty, BTC, which stabilized and rebounded last week, experienced another collapse, plummeting 10.04% this week, breaking through two key technical support levels: the lower edge of the upward channel of this bull market and the 360-day moving average.

Although the US government has reopened, funds have not yet flowed out of the Treasury Department's accounts, and commercial bank reserves remain low, leading to increased short-term liquidity tensions.

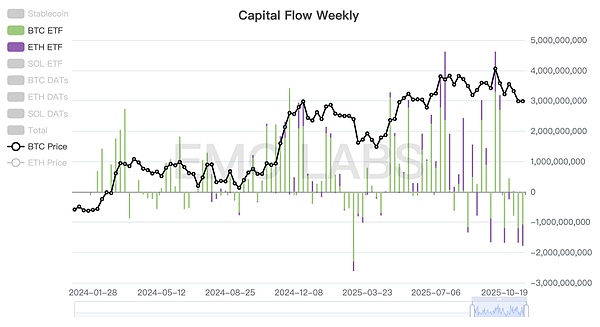

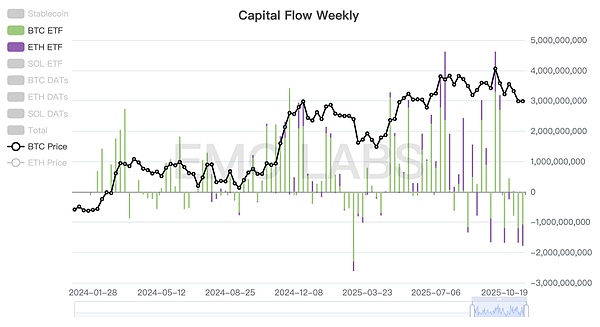

In the medium term, the number of hawkish voting members of the Federal Reserve continues to increase, and the probability of a rate cut in December has fallen below 50%. The market is flooded with selling pressure; long-term holders are continuously taking profits, and short-term holders are selling at a loss. The BTC ETF channel recorded its second-highest single-day sell-off in history. Buyers exist, but are extremely passive, and all technical support appears to have lost its effectiveness. With the lower edge of the ascending channel and the 360-day moving average effectively broken, BTC has technically entered a bear market. If, in the coming weeks, funds fail to flow back sufficiently and selling pressure persists, making it difficult for the BTC price to return above key technical indicator levels and confirm a valid breakdown on the weekly chart, then the current BTC bull market that began in 2022 will likely officially come to an end. The US government just restarted its operations this week and will release the September CPI next week. However, due to the lack of data collection during the shutdown, the October CPI will be permanently missing. This significantly diminishes the objectivity of the Fed's December interest rate decision. Non-farm payroll data has been delayed for several weeks. The weekly ADP data released on the 11th showed that in the four weeks ending October, the private sector averaged a net weekly loss of 11,000 jobs, a shift from an increase of 14,250 jobs per week earlier in October, turning negative and indicating a possible reversal in hiring momentum. This is "good news" for interest rate cuts. However, the Federal Reserve continues to adopt a hawkish stance. Following hawkish comments from three voting members late last week, three more hawkish voting members joined this week. This directly led to a continuous decline in the probability of a December rate cut, falling from an initial 90% to 44% by Friday, essentially pricing in another pause in the December rate cut. Regarding short-term liquidity, due to the government shutdown, the Treasury's TGA account accumulated nearly a trillion dollars, causing SOFR to remain high. Liquidity tightness reached a recent high on Friday, with the Nasdaq falling continuously, breaking below the 60-day moving average on Friday, down more than 6% from its high. However, due to touching a strong support level, the Nasdaq experienced a sharp V-shaped recovery during the session, ultimately closing up 0.13%, near last Friday's low and above the 50-day moving average. Currently, the recent correction in US stocks can be characterized as a "valuation correction in overvalued AI concept stocks against the backdrop of tight liquidity and a lower probability of a December rate cut." For the overall turbulent year of 2025, no greater systemic risk is currently apparent in the US stock market. The crypto market is in a dire situation compared to US stocks. After three consecutive days of declines, Friday saw a further sharp drop of 5.13%, with both the decline and trading volume approaching those of October 10th, making it the second worst day of this downturn.

BTC Daily Chart

Since July, long positions have initiated the third wave of selling in this round, and the selling pressure has increased in the last four weeks after the BTC price began to adjust downwards. This is often a characteristic of the transition between bull and bear markets. This week, the volume of long and short positions transferred to exchanges for selling remained at a high level, but slightly lower than last week. However, exchanges have shifted from outflows to inflows, which may make the market trend even weaker in the future. However, there was a severe shortage of funds to absorb the selling pressure. It can be seen that for most trading days last week, both BTC ETF and ETH ETF were being sold off, and the scale remained at a high level.

Among the major buyers this week,BTC ETF channel has turned to selling. According to media information, DATs companies Strategy and BMNR were still buying in the market this week, but they couldn't support the market alone. Ultimately, both BTC and ETH ended the week with significant declines.

Among the major buyers this week,BTC ETF channel has turned to selling. According to media information, DATs companies Strategy and BMNR were still buying in the market this week, but they couldn't support the market alone.

Alex

Alex

Alex

Alex Weiliang

Weiliang Catherine

Catherine Kikyo

Kikyo Catherine

Catherine Catherine

Catherine Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex