美检方调查Tether是否违规?华尔街日报曝料,Tether官方强烈否认

据《华尔街日报》消息,美国检察官正在调查Tether是否违反制裁及反洗钱法律,指控USDT可能被非法组织滥用。对此,Tether及其首席执行官断然否认调查存在,称公司一直与执法机构密切合作,斥责报导毫无证据。

Alex

Alex

Original title: The Ugly

Author: Arthur Hayes, founder of BitMEX; Translator: Deng Tong, Golden Finance

"The Ugly" is the first of three articles. "The Good" will focus on the rise of political meme coins. "The Bad" will discuss the risk that US cryptocurrency holders face being deceived by the Trump administration in terms of cryptocurrency regulatory policies.

Disclaimer: I am an investor and advisor to Ethena, the parent company of the $USDe stablecoin I mentioned many times in this article.

"Stop - keep thirty meters on this slope", that's what my guide instructed me when he suddenly slowed down while we were skiing on a dormant volcano a few weeks ago. Before that, it had been cold to climb the slope. But at 1600m, something changes.

As we stop together on the ridgeline, my guide says, “The last section gives me a stomach churning. The avalanche risk is too high, so we’ll ski from here.” I feel differently as I detect subtle yet profound changes in the snowpack. This is why I always ski with a certified guide. A seemingly innocuous patch of terrain could seal me in a frozen tomb. One never knows if skiing a particular terrain will trigger an avalanche. Still, if the perceived probability is outside one’s comfort zone, it’s wise to stop, reassess, and change course.

For at least the first quarter, in my first post of the year, I showed the world my optimism. But as January ended, my excitement faded. I was distracted by the subtle shifts in the levels of central bank balance sheets, the pace of bank credit expansion, the relationship between the US 10-year Treasury/stock/Bitcoin prices, and the crazy $TRUMP memecoin price action. This feeling is similar to how I felt in late 2021, just before the crypto markets hit bottom.

History doesn’t repeat itself, but it always rhymes. I don’t believe this bull cycle is over; however, looking at forward-looking probabilities, I think it’s more likely that we see Bitcoin prices fall to $70,000-$75,000 and then rise to $250,000 by the end of 2025 than continue higher without a substantial correction. As a result, Maelstrom has increased his Ethena $USDe stake to record levels and continues to take profits on several altcoin positions. We remain net long, but if my feeling is correct, then we have a lot of capital ready to buy dips in Bitcoin and big dips in many quality altcoins.

With bullish sentiment so high right now, a pullback of this magnitude would be unwelcome. Trump continues to say the right things via executive orders, improve sentiment by pardoning Ross Ulbricht, and inspire crypto spirits with his recent memecoin launch. But aside from the memecoin launch, these things were mostly expected. The rest of this article will discuss the charts and monetary policy announcements that led me to reduce my Maelstrom cryptocurrency holdings.

There are two firm views that influence my view of U.S. monetary policy:

- The 10-year Treasury yield will rise to between 5% and 6% and will cause a mini financial crisis.

- The Federal Reserve Board hates Trump but will do what is necessary to protect the financial system under the U.S. rule.

Let me explain the interplay between these two views.

The dollar is the world's reserve currency and U.S. Treasury bonds are the reserve asset. This means that if you have extra dollars, buying Treasury bonds is the safest place to store them and earn a yield. Accountants consider Treasury bonds to be risk-free, and therefore, financial institutions are allowed to borrow money and assets using almost unlimited leverage. In the end, if the value of Treasury bonds falls rapidly, the accounting fairy tale will turn into an economic nightmare and systemically important financial players will go bankrupt.

The 10-year Treasury bond is the benchmark for pricing most medium- to long-term fixed income instruments, such as mortgages or car loans. It is the most important asset price in the dirty fiat system, and that is why the 10-year yield is so important.

Given that every financial crisis since 1913 (the day the Fed was founded) has been “solved” by printing dollars, leverage has been building up in the system for over a century. As a result, the execution yields when large financial institutions fail are gradually decreasing. When the 10-year Treasury briefly broke that level, former US Treasury Secretary Bad Gurl Yellen initiated a policy of issuing more and more T-bills as a covert way of printing money. The direct result was a drop in the 10-year Treasury yield to 3.60%, a local low for this cycle.

If 5% is the level, why did the yield rise from around 4.6% to over 5%? To answer this question, we need to understand who the marginal large buyers of Treasury bonds are.

It is well known that the United States is issuing debt at a rate unparalleled in the history of the empire. The total debt now stands at $36.22 trillion, up from $16.70 trillion at the end of 2019. Who is buying this crap?

Let’s look at the usual buyers.

The Federal Reserve – The Fed ran a money-printing shenanigans called Quantitative Easing (QE) from 2008 to 2022. It bought trillions of dollars in U.S. Treasuries. However, starting in 2022, it turned off the printing presses, which is called quantitative tightening (QT).

U.S. Commercial Banks – They were getting hammered buying Treasuries at all-time highs before being hit by temporary inflation and the Fed’s fastest rate hikes in 40 years. Worse, in order to comply with the pesky capital adequacy rules set by Basel III, they can’t buy Treasuries unless they pledge more expensive equity. As a result, their balance sheets are fully utilized and they can’t buy more Treasuries.

Major Foreign Surplus Countries – I’m talking about oil exporters like Saudi Arabia and commodity exporters like China and Japan. As the dollars they earn from global trade surge, they have not been buying U.S. Treasuries. For example, China’s trade surplus as of November 2024 is $962 billion. During the same time frame, China’s holdings of Treasuries have fallen by about $14 billion.

Given that the U.S. has shoved Treasuries down the throat of the world’s financial system, there has not yet been a debt crisis.

Let’s applaud the relative value (RV) hedge funds. These funds, which are domiciled in places like the UK, the Cayman Islands, and Luxembourg for tax reasons, are marginal buyers of Treasuries. How do I know? The most recent Treasury Quarterly Refinancing Announcement (QRA) clearly states that they are marginal buyers of yield-constrained Treasuries. Moreover, if you read the monthly TIC reports published by the Treasury, you’ll see that the aforementioned places have accumulated significant holdings.

Here’s how the trade works. Whenever a cash Treasuries trade at a discount to its corresponding listed futures contract, the hedge funds can profit from the basis arbitrage. [1] The basis is so small that the only way to make money is to trade billions of dollars in notional amounts. Hedge funds don't have that much idle cash, so they need to turn to the banking system for leverage. The hedge fund buys the bonds with cash, but before the cash is delivered, a repurchase agreement (repo) is made with a large bank. The hedge fund delivers the bonds and receives cash. This cash is then used to pay for the bond purchase. Voila, the hedge fund bought the bonds with someone else's money. The only money the hedge fund paid was the margin at a bond futures exchange like the CME.

In theory, RV hedge funds can buy an endless amount of treasure, provided the following conditions are true:

- The bank has enough balance sheet capacity to facilitate the repo.

- The repo yield is affordable. If the yield is too high, the underlying trade will not be profitable and the hedge fund will not buy the Treasury. - Margin requirements remain low. If a hedge fund has to pay more margin to hedge its bond purchases using futures contracts, it will buy fewer bonds. Hedge funds have limited capital; if much of it is tied up in trading, they will trade less. RV hedge fund buyers are at risk due to the factors above. Bank Balance Sheet/Repo Yields: Under Basel III, balance sheets are a finite resource. Supply and demand dictate that the closer supply gets to exhaustion, the higher the price of balance sheet space. So as the Treasury issues more debt and RV hedge funds do more underlying trades, which requires more repo, using more balance sheet, at some point the price of overnight repo spikes. Once that happens, the buying stops abruptly and the Treasury market starts to collapse.

Quite simply, the more volatile an asset is, the higher the margin requirements. When bond prices fall, volatility rises. If bond prices fall/yields rise, volatility (look at the MOVE index) spikes. When that happens, margin requirements on bond futures increase and RV hedge fund bond buying quickly decreases.

These two factors interact in a reflexive way. The question then becomes, is there a way to use monetary policy to sever the Gordon knot and allow RV hedge funds to continue financing the Treasury?

Of course, our monetary masters can always implement accounting gimmicks to fix the financial crisis. In this case, the Fed could suspend the Supplementary Leverage Ratio (SLR). Suspending the SLR in relation to Treasury holdings and related repo allows banks to use unlimited leverage.

After the SLR waiver, here’s what happens:

- Banks can buy as many Treasuries as they want without pledging any capital, freeing up space on their balance sheets.

- With an unrestricted balance sheet, banks can facilitate repos at affordable prices.

The Treasury gains two more marginal buyers: commercial banks and RV hedge funds.

Bond prices rise, yields fall, margin requirements fall. Boom, happy days.

If the Fed is really feeling generous, it can stop QT and resume QE. That’s three marginal buyers.

What I wrote is not news to the Fed or the Treasury. The banking community has been begging for years for an SLR waiver like the one they got during the 2020 flu crisis. The latest Treasury Lending Advisory Committee (TABCO) report makes it clear that they need an SLR exemption and the Fed needs to start QE again to fix the Treasury market. The only thing missing is the political will of the Fed, so I take the second view.

The comments of former and current Fed Governors and the Fed's actions during the Biden presidency lead me to believe that the Fed will do everything in its power to thwart Trump's agenda. However, there are limits to the Fed's obstruction. If the failure of large financial institutions or the solvency of the Empire itself requires changes in bank regulations, lowering the price of money, or printing money, then the Fed will not hesitate to act accordingly.

Here are two quotes, the first from former Fed Governor William Dudley (who served as president of the New York Fed from 2009 to 2018), the second from Powell:

U.S. President Donald Trump’s trade war with China continues to undermine business and consumer confidence and worsen the economic outlook. This manufactured disaster has put the Fed in a dilemma: Should it mitigate the damage by providing offsetting stimulus, or refuse to cooperate? … Officials can make it clear that the central bank will not bail out an administration that repeatedly makes poor choices on trade policy, making it clear that Trump will face the consequences of his actions … Some even argue that the election itself falls within the Fed’s purview. After all, Trump’s reelection arguably poses a threat to the U.S. and global economies, the Fed’s independence, and its ability to achieve its employment and inflation goals.

– The Fed Should Not Coddle Donald Trump, William Dudley

When asked at the policy meeting press conference how the Fed views Trump’s recent victory, Powell said that “some did take a very preliminary step to start incorporating highly conditional estimates of the impact of policy on the economy into their forecasts.”This is interesting. Before the election, one set of economic estimates was used to lower rates and help Harris, but now a different set of estimates is being considered because of Trump’s victory. In fact, the Fed should have used the same estimates in the months leading up to the election. But what do I know? I’m just a crypto fool.

In the beginning, inflation was temporary. Remember? Powell claimed in all seriousness that the inflation spike caused directly by the most money printing in the shortest period of time in US history was just a blip that would soon go away. Four years later, inflation has been running above their own manipulated, stupid, dishonest inflation measure. They use this sophistry to prevent the inevitable rate hikes from starting until 2022, knowing that it could lead to a financial crisis or recession. They are not wrong; the Fed is directly responsible for the regional banking crisis of 2023.

Then the Fed plays dumb. Yellen completely nullifies their monetary tightening campaign by issuing more T-bills to exhaust the Reverse Repurchase Program (RRP) starting in September 2022. At least the Fed can oppose the Treasury since they are supposedly independent of the federal government.

The Fed pauses rate hikes in September 2023, when inflation is still above target. In September 2024, they fuel money printing by initiating a rate cut cycle. Is inflation below their target? Not yet.

The Fed talks a lot about keeping inflation in check, but when it becomes a political imperative to keep government money flowing at affordable prices and stimulate financial asset markets, the Fed acts. It becomes a political imperative because the Biden administration was screwed from the start. In hindsight, the claim that Biden is a fraud may also be true. Regardless, in order to prevent the Republicans from taking back the House and Senate and Trump from winning reelection in 2024, the Fed did whatever it took to prevent a financial and economic crisis.

In some cases, the Fed went beyond the call of duty to help the Democrats. For example, in response to the regional banking crisis in early 2023, the Fed created the Bank Term Funding Program (BTFP). The rate hike regime and subsequent bond crash led to a financial disaster, with banks losing money on the Treasury bonds they purchased at all-time high prices between 2020 and 2021. The Fed took notice of this corruption and, after letting three crypto-friendly banks fail to appease Pocahontas (U.S. Senator Elizabeth Warren), it essentially backstopped $4 trillion worth of Treasury bonds and mortgage-backed securities on the balance sheets of U.S. banks.

In hindsight, BTFP may have been an overkill. However, the Fed wants markets to have no doubt that it will preemptively fire the printing presses at full steam if there is a significant threat to the financial system under American rule.

Powell is a traitor because he was appointed by Trump in 2018. This is not surprising, as the full force of Trumpism was weakened by a group of disloyal lieutenants during his first term. Whether you think this is a good or bad thing is irrelevant; the point is that the relationship between Trump and Powell is toxic at this point. After Trump's recent victory over Biden, Powell immediately quelled any doubts about a possible resignation; he intends to serve until May 2026.

Trump has often argued that the Fed must lower interest rates to make America great again. Powell responded, in his way, by saying that the Fed is “data dependent,” meaning they do whatever they want and tell the interns in their basement to make up some economic mumbo jumbo to justify their decisions. Remember DSGE, IS/LM, and the Ricardian equivalence? All of that is bullshit unless you work in the Marriner Eccles building.

How did Trump get the Fed on his side? He allowed a mini financial crisis to happen. Here’s one possible solution:

Continue to run huge deficits, which would require the Treasury to issue lots of debt. It’s telling that Trump chose Elon Musk to lead a meme department with no real power. Musk wouldn’t be as rich as he is without the billions of dollars the government has given Tesla in the form of subsidies and tax breaks. The Department of Government Efficiency (DOGE) is not a federal department because creating one requires congressional approval. It’s a glorified advisory role that reports to Trump. Musk’s power is purely meme. Memes are powerful, but they won’t cut health benefits and defense spending; only direct action by lawmakers can accomplish those difficult tasks. Why would a politician do this and jeopardize their reelection chances in 2026?

An immediate fight over the debt ceiling. Presumptive Treasury Secretary Bessant has many tools to head off a shutdown date. Yellen used them in the summer of 2023 when she was fighting the debt ceiling. Drawings from the Treasury General Account (TGA) provide fiscal stimulus to markets and keep the government well-funded for months; this delays the point at which politicians must reach a compromise to allow the Treasury to borrow again. Bessant can sit on the sidelines and not spend the TGA money. The Treasury market will grind to a halt, and nervous traders will sell Treasury bonds because they fear a default.

This recipe for a flammable cocktail will quickly push the 10-year Treasury yield above 5%. If Bessant confirms the debt ceiling date, and his department does not cut the TGA to keep the government running for a few months, this could happen in a matter of days.

As Treasury yields soar, the stock market will plunge, and some large financial institutions in the US or abroad will come under great pressure.The Fed will be in a political dilemma, and in order to save the system, they will do some or all of the following:

- Provide SLR exemptions for Treasury bonds

- Cut interest rates significantly

- Stop QE

- Restart QE

Trump will then praise the Fed for its commitment to the US, and financial markets will re-energize.

The problem I described above could turn into a crisis caused by uncertainty about the debt ceiling now or later; the timing is up to Trump. The longer the crisis begins under Trump, the more likely he and his Republican Party will be blamed for a crisis that is largely due to the leverage accumulated during the Biden administration. In transactional terms, Trump must fix it once and for all. Voters must blame Biden and the Democrats, not Trump and the Republicans, for the crisis — otherwise Trumpism and Make America Great Again will become another stillborn American political movement that lasts less than two years until the Democrats return to power in the 2026 midterm elections.

The money printing spurt will come, but only if the Fed stands with Team Trump. The Fed is not the only game in town; is the banking system creating credit?

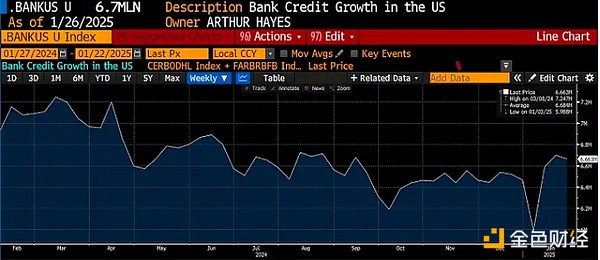

No, as you can see from my custom bank credit index, it is the sum of bank reserves and other deposits and liabilities held by the Fed.

Credit must flow. If the pace of credit creation disappoints, the market will give back Trump’s shock. Let’s move on to China.

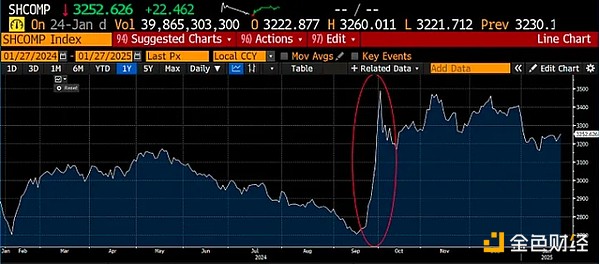

In the third quarter of last year, the People’s Bank of China (PBOC) announced a series of measures aimed at stimulating the economy. They cut bank reserve requirements, began buying Chinese government bonds (CGBs), and helped local governments refinance their debt burdens, to name just a few. This triggered a wild rally in the A-share market.

If your TikTok-swiping brain can’t figure out when the PBOC and the central government announced their reflationary policies, I circled them for you. Above is the Shanghai Composite Index.

I have pointed out that the Chinese government was prepared to let the RMB depreciate if necessary, as a result of the RMB credit expansion program.

The USD/RMB was allowed to appreciate, which meant that the USD would strengthen and the RMB would weaken. Everything went according to plan, but in early January, the Chinese government changed course.

On January 9, the People's Bank of China announced that it would end its bond purchase program. As can be seen in the above chart, the People's Bank of China intervened in the market and began to manipulate the RMB to strengthen. On the one hand, the central bank could not use RMB domestically to ease financial conditions, and on the other hand, it could destroy RMB to strengthen the currency.

The Bank of Japan (BOJ) fulfilled its promise to continue raising interest rates. In their most recent meeting, they raised the policy rate by 0.25% to 0.50%. The consequence of the rate normalization program is that the central bank's balance sheet growth has stagnated.

With the policy rate rising, Japanese Government Bond (JGB) yields have also reached their lowest level in nearly 15 years.

The quantity of money is growing much slower than in modern times, while its price is rising rapidly. This is not a good time for the price of fiat-priced financial assets to rise.

USD/JPY is topping out. I believe USD/JPY will reach 100 (weaker USD, stronger JPY) in the next 3-5 years. As I have written extensively, the strengthening of the yen has caused Japanese companies to repatriate trillions of dollars in capital, and anyone who has borrowed in yen has had to sell assets as their holding costs have soared. The main concern in the fiat financial markets is how this sell-off will negatively impact Treasury prices. This is a long-term structural headwind that Bessent must deal with. It will eventually be dealt with using printed dollars issued through some kind of swap line facility, but until then, the pain must be felt to provide the political cover to provide the needed monetary support. Eroding Correlations

I have already explained why fiat liquidity conditions in the USD, RMB, and JPY are not conducive to price appreciation in fiat financial assets. Now, let me explain what this means for Bitcoin and crypto capital markets.

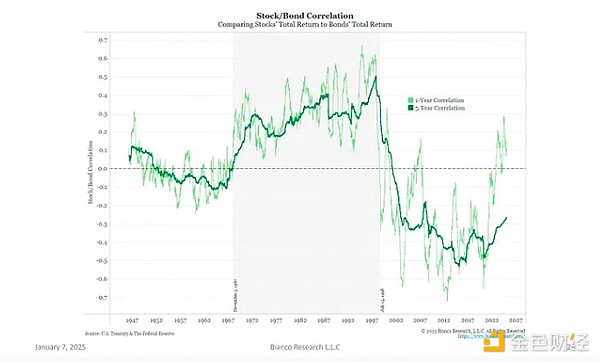

We need to discuss what bond investors are worried about in Pax Americana. I will spend some time drawing conclusions from an excellent chart produced by Bianco Research that shows the price correlation of stocks and bonds over the 1-year and 5-year periods.

Inflation was the nightmare of American investors from the 1970s to the early 2000s. Therefore, stock and bond prices were correlated. As inflation raged and had a negative impact on the economy, investors sold bonds and stocks at the same time. After China joined the World Trade Organization in 2001, the situation changed. American capitalists could outsource the US manufacturing base to China in exchange for better corporate profits at home, and growth rather than inflation became the main concern. In this case, falling bond prices meant that growth was accelerating, so stocks should do well. Stocks and bonds became uncorrelated.

As you can see, the one-year correlation surged in 2021, when inflation re-emerged during the COVID-19 crisis and hit a 40-year high. In the early stages of the Fed's rate hike cycle that began in early 2022, bond prices fell in lockstep with stocks. The relationship between stocks and bonds reverted to that of the 1970s-2000s. Inflation was the biggest concern.

This was clearly shown by the performance of the 10-year Treasury when the Fed paused rate hikes in September 2023 and began cutting rates in September 2024, when inflation was still above its 2% target.

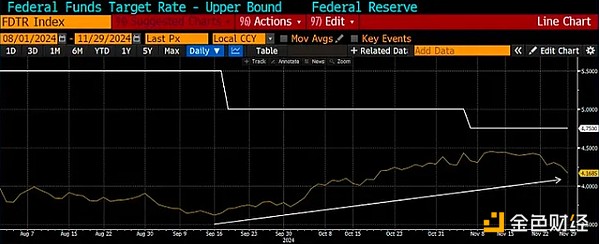

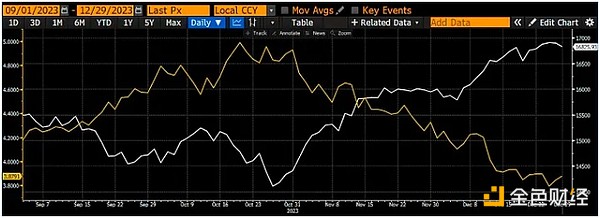

Three charts below: Fed Funds Rate Cap (white) vs. 10-Year Treasury Yield (yellow)

As you can see, the market is worried about inflation because yields are rising even though the Fed is easing monetary conditions.

Contrast the first two charts with the last rate cut cycle, which began in late 2018 and ended in March 2020. As you can see, yields fell when the Fed cut rates.

No matter what anyone says, money prices always affect fiat assets. Tech stocks are very sensitive to interest rates. You can think of them as a bond with an infinite maturity or duration. Simple math tells you that when you increase the discount rate on an infinite cash flow, its present value goes down. This math comes to the fore when the financial dysfunction yields hit the strike price.

The chart above shows the Nasdaq 100 (white) versus the 10-year U.S. Treasury yield (yellow). At around 5%, stocks fell as yields rose, and rallied sharply when yields fell. This is part of a financial system focused on inflation rather than growth.

Let's put this together. The dollar, yuan, and yen are interchangeable in global financial markets. They all have their way into U.S. big tech stocks in some form or another. You may not like it, but it's true. I've just laid out step-by-step why, at least in the short term, the U.S., China, and Japan are not speeding up fiat money creation and, in some cases, raising the price of money. Inflation remains high and is likely to rise further in the near future as the world economies decouple. That is why I expect the 10-year yield to rise. What will happen to the stock market if it rises because of inflation fears and a rapidly increasing US debt with no marginal buyers in sight? The stock market will plummet.

In the long term, Bitcoin is not correlated with stock prices, but in the short term the correlation can be high. This is the 30-day correlation of Bitcoin with the Nasdaq 100. The correlation is high and rising. If stocks fall because the 10-year yield rises, this is not good for short-term price predictions.

Another belief of mine is that Bitcoin is the only truly global free market that exists. It is extremely sensitive to global fiat liquidity conditions; therefore, if a fiat liquidity crunch is imminent, its price will fall before stocks and will be a leading indicator of financial stress. If it is a leading indicator, then Bitcoin will bottom before stocks, predicting that the fiat money printing spigot will reopen.

If financial stress is due to a bond market crash, then the answer from the authorities will be to print money. First, the Fed will stand with Team Trump and do their patriotic duty…press the dat USD Brrr button. Then, China can reflate with the Fed without suffering currency weakness. Remember, everything is relative, and if the Fed creates more dollars, the People's Bank of China can create more yuan and the USD/CNY exchange rate will remain the same. The largest holdings of Japanese companies are in US dollar financial assets. Therefore, if the prices of the above assets fall, the Bank of Japan will pause its rate hike plans and ease financial conditions for the yen.

In short, a small financial crisis in the United States will provide the monetary mana that cryptocurrencies crave. It will also be politically expedient for Trump. Overall, this gives me a 60% confidence interval for the above scenario in Q1 or early Q2.

As mentioned in the introduction, the increased risk of avalanches prevents us from continuing to ski. The key is not to fool around and not to find out. Extending this metaphor to cryptocurrencies, Maelstrom will hedge himself by underinvesting in the market. It's all about expected value, not whether I'm right.

How do I know I'm wrong? You never know, but in my opinion, if Bitcoin trades strongly with volume above $110,000 (a level reached during the peak of the $TRUMP memecoin mania) and the open interest continues to expand, then I would throw in the towel and buy back in with higher risk. More precisely, it's crazy that $TRUMP memecoin rose to a fully diluted value of nearly $100 billion in 24 hours. I bought it a few hours after its launch and sold it halfway through a weekend spa vacation. My travel expenses were paid for many times with just a few clicks on a smartphone. Trading shouldn’t be that easy, but it is during the manic phase. In my opinion, $TRUMP is a top signal, just like FTX buying the rights to the MLB umpire logo in the 2021 bull run.

Trading is not about being right or wrong, it’s about trading perceived probabilities and maximizing expected value. Let me explain my thought process. Obviously, these are perceived probabilities that can never be objectively known, but the game of investing involves making decisions with incomplete information.

Why do I believe Bitcoin will have a 30% correction? I have been trading this market for over a decade and through three bull cycles. Given Bitcoin’s volatility, this type of pullback has occurred frequently throughout the bull run. What’s more, the market surpassed its all-time high in March 2024, right after Trump won reelection in early November 2024. Many people, myself included, have written extensively about how Trumpism portends an acceleration in money printing in the US and how other countries will boost their domestic economies with money printing programs. I think we will fall back to our previous all-time highs and give back all of the gains from Trump. 60% chance of a 30% correction in Bitcoin 40% chance of a continued bull run and a 10% increase in Bitcoin buybacks (60% * -30%) + (40% * 10%) = -14% expected value The math tells me that my approach to reducing risk is correct. I reduce risk by selling Bitcoin for the long term and holding more of my funds as collateral in USDe, which currently yields about 10% to 20% annually. If Bitcoin plummets, it will be Armageddon in the altcoin space, which is where I really want to play. As mentioned at the outset, Maelstrom has many liquid altcoin positions due to various early stage investments and advisory placements. We sold most of them. If Bitcoin drops 30%, the best quality stuff will sell for over 50%. The last super liquidation candle in Bitcoin will tell me when to reverse and buy crypto alts.

Let me repeat; if I am wrong, my downside is that we took profits early and sold some of the Bitcoin we purchased with our previous altcoin investment profits. But if I am right, then we have cash to quickly double or triple our money on the quality altcoins that took advantage of the general crypto market sell-off.

As a final note, when this article was delivered to my editor on the trading day of Monday, January 27, 2025, the market was in full panic mode as investors reassessed their bullish case for NVIDIA and American tech exceptionalism due to the launch of DeepSeek. Nasdaq futures were falling and cryptocurrencies were falling with them. DeepSeek is an AI model developed by a Chinese team that reportedly costs 95% less to train, yet outperforms the latest and greatest models from OpenAI and Anthropic. The problem with bubbles is that when investors start questioning one core tenet of their bullishness, they start questioning them all. And my concern is that they believe interest rates don’t matter. The panic among Western investors over DeepSeek may be the catalyst for their own panic about the current poor fiat liquidity situation and the secular rise in 10-year Treasury yields. Isn’t it interesting that China is embracing the open source movement while capitalist America clings to its walled garden? Competition is a beautiful thing.

据《华尔街日报》消息,美国检察官正在调查Tether是否违反制裁及反洗钱法律,指控USDT可能被非法组织滥用。对此,Tether及其首席执行官断然否认调查存在,称公司一直与执法机构密切合作,斥责报导毫无证据。

Alex

AlexMeta Platforms is creating an AI search engine to lessen its reliance on Google and Microsoft’s Bing, aiming to deliver real-time conversational responses via Meta AI. This move reflects a strategic shift as the company seeks to manage its search operations in-house.

Catherine

CatherineFetch.ai’s key network upgrade with CUDOS mainnet integration has boosted its AI and DeFi capabilities, driving a 93.89% increase in trading volume and a 6% rise in FET token value.

Kikyo

KikyoThe US DOJ has charged Maximiliano Pilipis, the operator of crypto exchange AurumXchange, with money laundering and tax offenses. Alongside laundering allegations, Pilipis faces charges for failing to file tax returns on income earned in 2019 and 2020.

Catherine

Catherine玻利维亚加速采用稳定币技术,Bisa Bank成为该国首家提供USDT交易服务的银行。客户可通过其平台进行USDT的购买、出售、持有及跨境汇款,进一步推动稳定币在玻利维亚的普及和金融现代化。

Alex

Alex在以太坊和其基金会遭遇广泛批评之际,以太坊共同创始人Vitalik Buterin(V神)上周在社交平台X上引发大量关注。他发布了关于以太坊路线图的文章,并明确回应了对以太坊基金会频繁出售ETH的质疑。

Alex

Alex美国总统大选临近,特斯拉CEO兼X平台负责人马斯克(Elon Musk)近期高调力挺共和党候选人川普。今日,马斯克分享了一张柴犬的狗狗币(DOGE)梗图,推动DOGE币在一小时内上涨约3%。

Miyuki

MiyukiA DWF Labs partner was dismissed after being accused of drugging a woman he invited to discuss a job opportunity in Hong Kong. The incident, reportedly caught on CCTV, is now under police investigation.

Joy

Joy最新消息指出,輝達的GB200 AI伺服器即将出货,微軟、Google、Meta、亚马逊AWS等科技巨头正争相购入高性能的GB200 NVL72机柜。鴻海作为主要代工厂,订单已爆满,股价随之攀升至三个月来的新高。

Weiliang

WeiliangAlameda Research is suing KuCoin to recover over $50 million in frozen assets linked to the FTX collapse, claiming KuCoin has unjustly refused to release the funds. KuCoin has stated the assets were frozen due to suspicious activities and is following legal orders regarding the situation.

Weatherly

Weatherly