Author: 0xLouisT, L1D Investment Partner; Translator: Jinse Finance xiaozou

In Greek mythology, Icarus and his father Daedalus made wings out of feathers and beeswax to escape King Minos's labyrinth. Daedalus warned his son: "Fly too low, and the sea will soak your wings; fly too high, and the scorching sun will melt them mercilessly."

But Icarus was intoxicated by the thrill of flying and flew higher and higher, forgetting his father's advice. The scorching sun melted the beeswax on his wings, and Icarus fell into the sea. The moral of the story is: Excessive arrogance often leads to a person's downfall.

In the current economic cycle, I have seen many things that are strikingly similar to the story of Icarus. Just as Icarus reveled in the thrill of flight, many crypto projects have been seduced by sky-high valuations. In both cases, the protagonists directed their own downfall, fueled by unsustainable promises and inflated valuations.

1Why is there aFDVmania?

What is behind this low circulation and high FDV mania? There are several factors at play:

*Anchoring bias:This cognitive bias influences decisions based on an initial reference point. If the founders believe their project is worth $1 billion, they may launch with a $10 billion FDV, firmly occupying the market's mind share. Even if the token falls 90%, it will return to what the founders believe is fair value.

* VCValuations:This is a different topic, but the oversupply of VC funding in 2021/2022 has led to inflated private valuations. VCs consistently overfund every round, and the public market has no appetite for such high valuations. Since no project is willing to conduct a TGE (token distribution event) at a valuation lower than the last private round, they have to find ways to launch at higher valuations.

* Incentives and Funding:The $10 billion FDV on the books increases the funding for projects, allowing them to attract top talent, make ecosystem donations, and build partnerships by distributing tokens to drive growth at a significant book value.

* Supply Allocation:After the ICO and SEC crackdown, distributing tokens to the community has become more challenging. Airdrops and community incentives often fail to allocate meaningful supply at launch. This remains a major hurdle for the industry.

* OTC(Over the Counter Sales) and Hedging:High launch prices facilitate cashing out through discounted OTC sales or hedging positions using perpetual contracts (although this is difficult to scale).

*Perception of Success:This is how we think. High valuations create an illusion of success. People are attracted to seemingly successful ventures and everyone wants a piece of it.

2How is it possible?

If you create Token A with a supply of 1 billion and pair it with 1 USDC in the Uniswap pool, then technically Token A is worth $1 and the FDV is $1 billion. This valuation is completely artificial, and the actual value of the token remains negligible.

For high FDV tokens, the same principle applies, the actual circulating supply is only a small fraction of the total supply. After the initial airdrop selling pressure subsides, most of the supply is held by market makers and whales, who have the ability to influence token prices. Therefore, a billion dollar FDV can be achieved with only tens of millions of dollars.

3The problem of high FDV frenzy

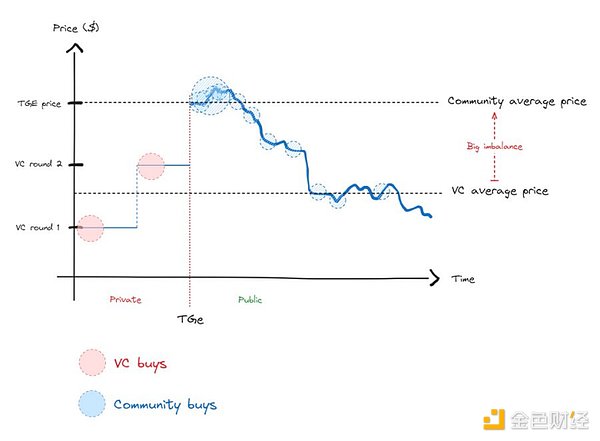

This high FDV frenzy has created a serious imbalance in the cost basis and supply distribution between TGE liquidity buyers and private placement investors (see figure below). This excessive imbalance has exacerbated the ongoing tension between these groups until

mean reversion occurs.

TGE buyers will immediately experience underwater and price crashes after buying, while VCs will also quickly sell after investing. Once community buyers understand this pattern, they will stop buying, which also explains the recent complete lack of interest in new altcoins.

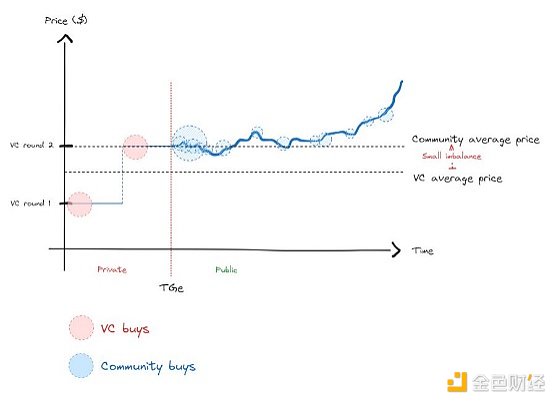

The healthier situation should be that the imbalance between community and VC prices narrows, allowing true price discovery (as shown below).

In an efficient market, price discovery is inevitable. While you can artificially influence the price in the short term, you are only delaying the inevitable return to the true price. However, markets are path-dependent, so a long downtrend before reaching the true price is much more painful than a downtrend that starts directly from equilibrium.

4Corollary

An important detail in the Icarus myth is the warning against flying too low. Just as Icarus was warned by his father that flying too low might get his wings wet, issuing tokens at too low a valuation can stifle growth potential. This can scare off partners and make it difficult to retain talent, thus affecting overall success. Waiting until the project is mature enough before issuing tokens is just as important as avoiding high FDV situations.

5Conclusion

* FDVisnotame:Avoid issuing tokens at high FDVs. Just like Icarus, trying to play the game with inflated valuations can backfire in the long run. High FDV tokens are a red flag for liquidity investors — who typically avoid or even short inflationary assets.

* Raise smartly:Raise only when necessary and in alignment with your growth strategy. Choose VCs you want to work with, not just the highest valuations. Avoid pressure to accept unsustainable valuations.

* Don’t launch too early:Avoid launching tokens based solely on high FDVs in private markets. Make sure you have clear traction and product-market fit before launching a token. .

* Token distribution:This is another topic, but for efficient price discovery, maximize the circulating supply when launching a token. The goal is to have at least 20% to 50% of the total supply, not just 5%. However, the current regulatory environment may make this difficult to achieve.

* Work with Liquidity:Liquidity is sophisticated participants who will take the risk for your project after the TGE, so they play a crucial role in price discovery, not VCs.

Coinlive

Coinlive

Coinlive

Coinlive  nftnow

nftnow decrypt

decrypt Others

Others Others

Others Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph