Author: Xie Zefeng Editor: Yang Xuran

It took only one year for Hong Kong stocks to go from a "financial ruin" to a core hub for global capital investment in China.

In 2024, 70% of new Hong Kong IPOs fell on the first day, and some investors threatened: "Whoever dares to go public will have his legs broken"; one year later, retail investors went crazy buying new stocks and shouted: "Don't ask if you can get on the train, just ask if you understand the policy?"

In the first half of this year, the Hong Kong IPO frenzy continued. A-share giants such as CATL, Haitian Flavoring, and Hengrui Medicine have gathered in the Hong Kong stock market. In six months, 240 companies have flocked in, and there are 220 more waiting in line (as of June 30).

In just half a year, 43 new IPOs were listed on the Hong Kong stock market. Some people joked that "the Hong Kong Stock Exchange's golden gongs are not enough." The number increased by 43.3% over the same period in 2024; new shares raised HK$106.71 billion, topping the global IPO fundraising list, surpassing Nasdaq (HK$71.3 billion) on the other side of the ocean.

Back to 2019, Hong Kong was still the world's largest IPO company. But in the following years, the epidemic, turmoil, global economic and trade turmoil, low valuations, and liquidity depletion have caused the world's "one of the three major financial centers" to decline, and it has even been called a "financial ruin."

However, unlike overseas financial cities such as Singapore, Hong Kong's real backing is the entire Chinese mainland. From the earliest state-owned enterprise red chips, to Internet companies, the return of Chinese concept stocks, and now more industrial companies are listed, Hong Kong has actually become an outpost for Chinese companies to participate in international competition.

The existence and prosperity of the Hong Kong Stock Exchange has strengthened Hong Kong's role as a "super connector" and "super value-added person." In the future, the connection between the mainland and Hong Kong will become increasingly close, and the historical status of the Hong Kong Stock Exchange will continue to rise.

IPO boom

The current Hong Kong stock IPO boom can't help but remind people of the wave of Chinese concept return that began in 2020, and the steps taken by state-owned enterprises to go public in Hong Kong in the 1990s, represented by Tsingtao Brewery.

History will not repeat itself, and this time, the significance will be even greater.

The scorching summer, the sound of gongs in the Hong Kong Financial Center Hall is dense.

On May 20, the lithium battery giant CATL was listed on the main board of the Hong Kong Stock Exchange. The exchange hall was crowded with investment bank elites holding mobile phones for live broadcast. This time, Ning Wang went to Hong Kong to raise about 35.7 billion Hong Kong dollars, setting a record for the world's largest IPO this year. Its Hong Kong stock market value even surpassed the A-share market by nearly 300 billion yuan.

A month later, the "soy sauce giant" Haitian Flavor Industry was listed on the H-share market, raising 10.1 billion Hong Kong dollars in one fell swoop, with oversubscription of more than 930 times, which shows how crazy the new listing of Hong Kong stocks is.

In addition, companies with core businesses in mainland China, such as Hengrui Medicine, the A-share pharmaceutical leader, and Mixue Group, the tea beverage giant, also chose to attract global investors in Hong Kong stocks. Among them, Hengrui Medicine's Hong Kong stock financing amount is three times that of A shares; and with the help of the Hong Kong capital market, Mixue Ice City founder Zhang Hongchao's net worth exceeded HK$200 billion, surpassing Qin Yinglin to become the new richest man in Henan. Listed companies including Laopu Gold, Pop Mart, and Weilong Food have set off a wave of new consumption.

With the support of a number of convenient measures, companies from mainland China are accelerating their influx into the Hong Kong Stock Exchange.

On June 26 and June 30, three companies went public at the same time every day. On July 9, it was a rare sight that five companies were listed collectively in a single day.

According to statistics, in the first half of this year, there were 43 new IPOs in Hong Kong stocks, while there were only 30 in the same period last year. The total amount of funds raised by new stock IPOs was HK$106.71 billion, surpassing Nasdaq (HK$71.3 billion) and returning to the world's first throne. Just two years ago, the amount of financing raised by the Hong Kong Stock Exchange rarely fell out of the world's top five.

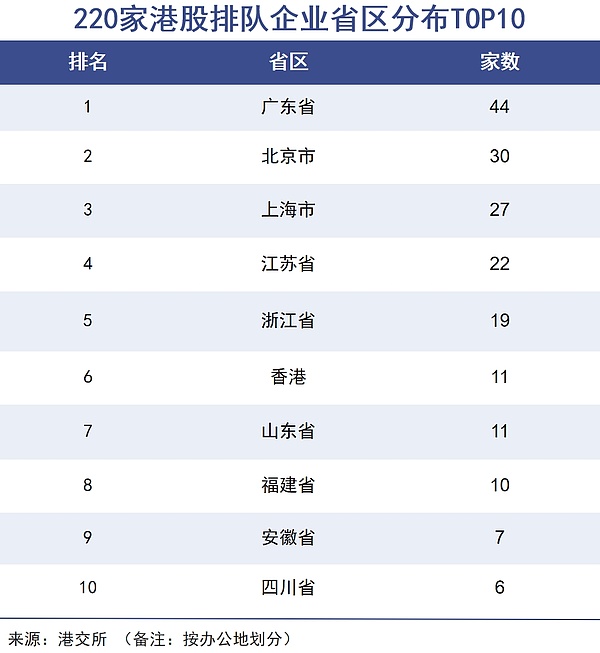

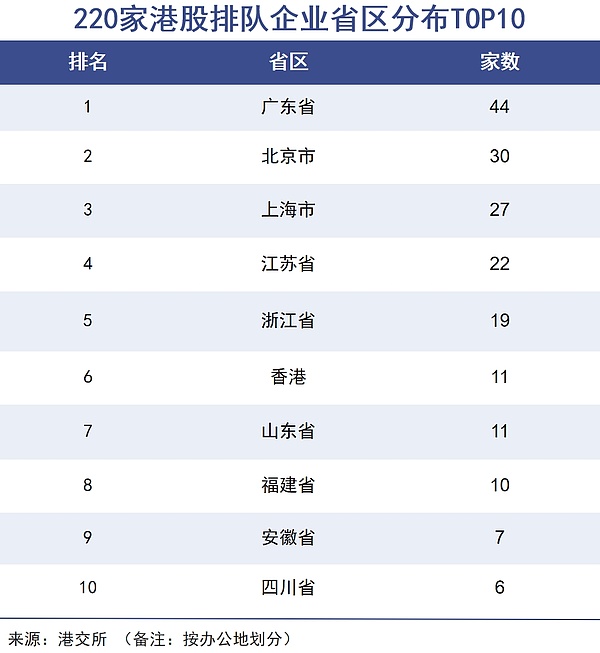

Data shows that in the past May alone, more than 40 companies submitted their applications. By the end of the first half of the year, a total of 240 companies had collectively entered the market, and the number of companies queuing up behind them increased to 220, of which 219 had submitted their applications this year.

Deloitte China predicts that there will be 80 new stocks listed in Hong Kong this year, raising HK$200 billion, and is expected to take the top spot in the world. Among them, it is expected that 25 will be "A+H" new stocks, which shows the ability of Hong Kong's capital market to undertake mainland enterprises.

Sweeping away the haze of the past two years, judging from the number and scale of listings, this round of Hong Kong stock IPO wave has already established Hong Kong's status as an international financial center.

In the early 1990s, the Hong Kong stock market was dominated by real estate companies such as Cheung Kong Holdings and Sun Hung Kai Properties, and local public utility companies such as Hong Kong Electric and China Gas, with a relatively simple structure.

In 1984, Chinese companies acquired Hong Kong listed companies (CITIC Group invested in Ka Wah Bank) and started the "red chip model", and Hong Kong stocks began to add a touch of Chinese capital; in 1993, Tsingtao Brewery became the first mainland company to be listed in Hong Kong, igniting the fire of state-owned enterprises to go public in Hong Kong. Since then, the three major operators, large energy companies, and large financial companies have come one after another.

Around 2010, the Internet economy began to prosper, but because the Hong Kong Stock Exchange did not allow companies with "different rights for the same shares" to be listed at that time, Alibaba was unable to enter the Hong Kong Stock Exchange.

The then CEO of the Hong Kong Stock Exchange, Charles Li, had a clear understanding of this: "New technology and new economy have become the new wave driving the development of the world economy... Although we have missed one or two big IPOs, we have begun to seriously think about how Hong Kong should keep pace with the times and how to consolidate its unique advantages as an international financial center."

Four years later, the reform measures were implemented, and Alibaba finally got its listing on the Hong Kong Stock Exchange. Baidu, JD.com, and NetEase also returned to the Hong Kong stock market.

Today, leading companies in new consumption, new technology, and innovative medicine are telling new "China stories" in the Hong Kong stock market. The Hong Kong capital market, like a blood bond, connects the relationship between international capital of mainland companies.

The most typical example is that CATL chose to invest 90% of its Hong Kong stock funds in its Hungarian factory. It is said that investment bankers were still revising the prospectus at 2 a.m.: "European customers only recognize supply chains listed on the Hong Kong stock market." Midea has hundreds of billions of cash in its account and is not short of money at all. The reason for its insistence on going south is also coveting the global market.

Pricing power

The boiling of Hong Kong stock IPOs also hides the secret battle between Chinese finance, Chinese capital and Wall Street financial capital.

Hong Kong stock financing has returned to its peak, and it is also the acceleration of the internationalization of Chinese financial institutions. Among the companies that have gone public this year, CICC helped 13 companies to go public, taking the top spot, while CITIC and Huatai tied for second place with 9 companies. The 220 companies in the queue were almost all sponsored by Chinese-funded institutions, while Morgan Stanley, Goldman Sachs, UBS, and Citigroup pale in comparison.

When Mixue Ice City leveraged global capital with 4 yuan lemonade, the ultimate Chinese supply chain + industrial Cthulhu + digital empowerment, plus the "surrounding the city from the countryside" play, the international capital veterans said they couldn't understand it;

Laopu Gold uses ancient techniques to create modern luxury goods, telling a dual story about culture and precious metals. Nowadays, snapping up Laopu's products is like having afternoon tea with a girlfriend, and the stock's PE has been pushed up to 120 times. Fund managers who hold a large position in Laopu Gold believe that the company has taken the high-end product value formula "product value = functional value + emotional value + asset value" to the extreme, and this valuation system is obviously difficult to match the investment logic of international investment banks.

When Labubu swept the wallets of young people around the world, this grinning doll made Pop Mart's stock price soar 21 times from its lowest point, and investors around the world who adhere to the value investment concept could only be stunned.

It is said that China Merchants Securities International has formed a 30-person team specializing in special technology fields, using the "pipeline valuation method" to evaluate innovative pharmaceutical companies, and even using the "user asset model" to calculate the value of milk tea shops.

Due to the hot issuance, in recent years, there have even been signs of foreign investment bank talents flowing to Hong Kong's Chinese financial institutions. These job-hopping bankers joined the battle with client lists from Goldman Sachs and Morgan Stanley.

Chinese investment banks use "Chinese-style valuation" to compete for pricing power, while Chinese funds from the mainland directly stir up the trading logic of Hong Kong stocks.

Since the beginning of this year, southbound funds have swept up 730 billion Hong Kong dollars, and the transaction share has jumped from 34.6% last year to 43.9%, which means that mainland funds have mastered nearly half of the trading rights of Hong Kong stocks.

The interconnection targets continue to expand, the scope of the Shanghai-Shenzhen-Hong Kong Stock Connect ETF targets is expanded, and the tax preferential policies are continued. The three arrows are fired simultaneously, and the institutional dividends of the Hong Kong stock market continue to attract fresh water from the source. Since the beginning of this year, the Hang Seng Index has crushed the major global stock indexes with a 22% increase.

When southbound funds contribute more than HK$700 billion in incremental funds each year, insurance funds allocation exceeds 51%, and large-scale Internet + AI + new consumption + innovative drug listed companies constitute the forefront of Hong Kong stocks, a historic transformation has begun. In an ideal state, the Hong Kong financial market will break away from the European and American pricing system and become the main battlefield for global pricing of RMB assets.

Chinese assets + Chinese stories + Chinese pricing + Chinese capital, a financial war targeting Hong Kong, the balance has begun to tilt.

Revitalization

In 1866, the earliest securities trading activities in Hong Kong began to sprout. It was not until many years later that British businessman Paul Charter established the Hong Kong Stockbrokers Association in 1891, marking the birth of Hong Kong's first stock exchange.

In the following century, the Hong Kong financial market became a vassal of foreign-funded enterprise financing and the British colonial economy. The Gold and Silver Stock Exchange, Kowloon Stock Exchange, "Hong Kong Club" and "Far East Club" were four associations. In 1986, the Hong Kong Stock Exchange officially opened, and the four associations completed the merger.

By March 2000, the Hong Kong Stock Exchange, the Futures Exchange and the Central Clearing Company merged into the Hong Kong Exchanges and Clearing Limited (HKEX), which was later listed on the Stock Exchange, becoming one of the first listed exchanges in the world.

After 25 years of development, the market value of mainland Chinese companies currently accounts for 81% of the total market value of Hong Kong stocks. Hong Kong stocks have become a must-visit "shelf" for international investors to buy Chinese assets.

After a century of ups and downs, Hong Kong's status as a financial center has encountered many challenges. Epidemics, political turmoil, international economic and trade turmoil, and its own institutional defects have all made the outside world doubt Hong Kong's future, but every time, Hong Kong can reach new heights.

With multiple advantages, the Hong Kong financial market will obviously not evolve into a useless and embarrassing situation like Singapore. At present, the financing capacity and trading volume of Singapore's financial market are shrinking rapidly. Whether it is stock, bond or commodity trading, Singapore cannot compare with Hong Kong.

In 2025, the Singapore stock market saw a capital flight, and 11 companies collectively delisted within 4 months. HSBC and Standard Chartered moved their Asia-Pacific headquarters back to Victoria Harbour, and the so-called "financial safe haven" myth that Singapore has long operated is rapidly fading.

Backed by the motherland, facing the world. The Hong Kong stock market has been reforming itself: breaking the listing restrictions of "same shares, different voting rights" and embracing Chinese stocks; adding Chapter 18A to allow non-profit biotech companies to go public; launching Chapter 18C in 2023 to support financing for "special technology" companies; introducing the SPAC (special purpose acquisition company) listing mechanism in 2024 to form a diversified listing channel, making the Hong Kong stock market a hot spot for new economy financing and investment; in terms of mechanism, opening the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, and continuously optimizing the Bond Connect and Swap Connect, injecting continuous impetus into the Hong Kong stock market.

According to the latest reform measures, companies in the Guangdong-Hong Kong-Macao Greater Bay Area that are listed in Hong Kong will be allowed to list in Shenzhen in accordance with policy regulations, which means that there is hope for a new "H+A" type of listed companies in the future.

With opportunities in international turmoil, irreplaceable bridge role, siphon effect of elite talents, favorable time, favorable location and favorable people, Hong Kong is shattering the fallacy of "financial ruins" and breaking the financial myth of Singapore. It is foreseeable that this Oriental Pearl will inevitably release its brilliant light again in the future, but this time, it will not be the same as the prosperity decades ago.

Kikyo

Kikyo