Recently, Atom Asset (AAX), a defunct Hong Kong exchange, began to transfer funds from its wallet to various decentralized exchanges and centralized platforms. According to Allegedly to evade anti-money laundering (AML) controls.

Prior to their discovery, the last known transactions involving AAX exchange wallets occurred in October 2023 and November 2022. Before its collapse, AAX was one of the largest cryptocurrency exchanges in Hong Kong, with more than 2 million users.

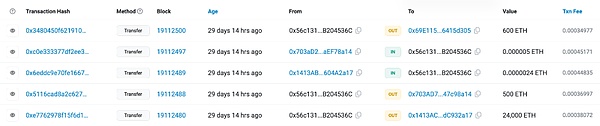

According to the analysis of the Beosin team, it was found that starting from January 29, 2024, the AAX exchange began to transfer 25,100 ETH from its exchange wallet to External transfer, the transferred funds were divided into three tranches, namely one tranche of 500ETH, one tranche of 600ETH, and one tranche of 24,000ETH. The transferred funds amounted to over $74 million based on current prices. What exactly is going on? What other strange on-chain data does this exchange have that cannot be disclosed? Please continue reading with us.

The whole story of the AAX exchange incident

On November 13, 2022, just two days after the cryptocurrency exchange FTX filed for bankruptcy, AAX also stopped withdrawals and cleared all social channels due to counterparty risk exposure. Initially, AAX attributed the freeze to security measures against an alleged malicious attack.

On November 15, 2022, the AAX exchange issued a statement stating that its platform required maintenance. In addition to suspending withdrawals, derivatives would be automatically liquidated. Since then, AAX has stopped platform operations and social media updates.

The strange thing is:After 426 days of silence, the AAX exchange wallet began to become active, and large amounts of funds began to be transferred out to other addresses, trying to avoid the identification and detection of AML tools. monitor!

link: https://etherscan.io/address/0x56c1319b31a5316a327bd889d58c8633b204536c

AAX exchange event chain fund analysis strong>

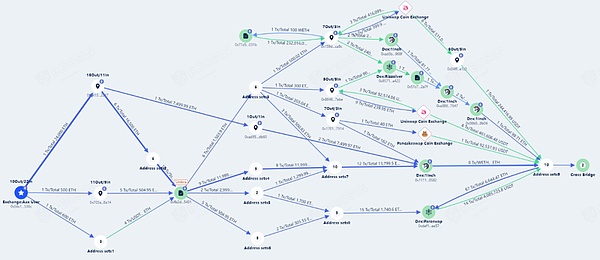

Beosin KYT anti-money laundering analysis platform conducted an in-depth study of the recent on-chain activities of the AAX exchange wallet and discovered a series of risky activities. First, all 25,100 ETH have been transferred. The operators took various means to convert some of the ETH into USDT, and then transferred the funds to different blockchains through the Cross Bridge to clean the funds.

Beosin KYT anti-money laundering platform

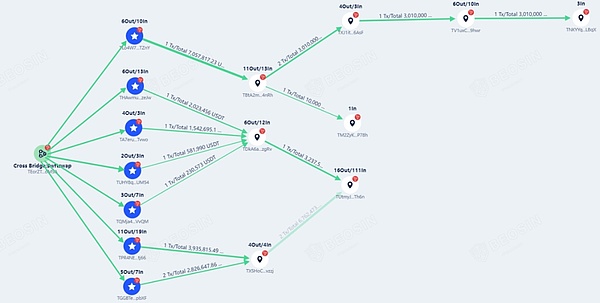

Among them, most of the funds were transferred to On the Tron blockchain, it is transferred through some addresses, and then settled in some addresses without ever being transferred. This behavior demonstrates a clear attempt to evade AML and conceal the true origin and destination of the funds.

Beosin KYT anti-money laundering platform

Hong Kong police take prompt action against fraud activities , arrested two people associated with AAX and are currently working to map the path of the transferred funds and recover the assets of affected users.

AAX Exchange uses technical means such as decentralized exchanges, cryptocurrency exchanges, and cross-chain bridges to try to obscure the paths and sources of capital flows. This creates significant challenges for regulators and AML analytics platforms.

How to solve the problem of cryptocurrency money laundering?

Due to the anonymity, convenience and decentralized nature of crypto-assets, criminals will choose to use crypto-assets to transfer their illegally profited funds. ,Regulators and virtual asset service providers (such as cryptocurrency exchanges, crypto wallet providers, crypto asset payment processors, etc.) face challenges such as anti-money laundering and counter-terrorist financing.

For regulatory agencies, relevant departments should improve and implement regulatory policies to ensure that virtual asset service providers comply with AML and KYC regulations, while strengthening cooperation with various countries and Cooperation between regional regulatory agencies to jointly combat cross-border money laundering activities.

For virtual asset service providers, the following are effective measures to prevent illegal funds:

1. Enforce strict KYC and AML regulations

Exchanges should require users to undergo comprehensive identity verification and ensure They comply with KYC and AML regulations. This includes collecting user identification information, address verification and other necessary information.

2. Monitor trading activities

Virtual assets Service providers should implement real-time monitoring systems to detect and analyze suspicious transaction activity. This includes monitoring information such as transaction amount, frequency, source and destination. Exchanges can use Beosin KYT to locate each transaction, profile users, rate transactions, and identify criminal behavior on the chain, thereby reducing the risk of criminals using virtual assets to launder money.

3. Establish a reporting mechanism

Virtual asset service providers should establish a reporting mechanism to report any suspicious transactions or activities through the risk control system. Virtual asset service providers should promptly address these reports and cooperate with regulators in their investigations. Beosin KYT can issue suspicious transaction reports (STR) for virtual asset service providers to help regulators and law enforcement agencies conduct forensic investigations.

4. Strengthen cooperation and exchanges

Virtual asset service providers should actively cooperate with security companies, regulatory agencies and law enforcement agencies to jointly combat money laundering activities. It is foreseeable that criminals will continue to adjust and improve their money laundering strategies to adapt to changes in regulatory measures and AML tools. They may decentralize transactions, use covert transaction routes, or exploit technological vulnerabilities to hide illicit financial flows. Virtual asset service providers should regularly cooperate and communicate with security companies to identify and respond to these changes in a timely manner.

Beosin focuses on the continuous updating and optimization of KYT anti-money laundering tools. We constantly monitor industry trends and new security threats, and integrate the latest analysis results and data Applied to the improvement of Beosin KYT tool. This ongoing updating and optimization ensures that Beosin KYT maintains a high degree of sensitivity and accuracy in the face of ever-changing malicious money laundering practices.

Summary

The AAX exchange incident once again highlights the anti- Importance of money laundering. In order to better respond to similar incidents,regulators need to strengthen cooperation with virtual asset service providers and blockchain security compliance companies, share information and best practices, and introduce advanced anti-money laundering analysis tools and platforms, such as Beosin KYT anti-money laundering analysis platform to strengthen the monitoring and analysis capabilities of capital flows on the chain.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance cryptopotato

cryptopotato Beincrypto

Beincrypto Ledgerinsights

Ledgerinsights Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist