“The current development path of RWA in Hong Kong, China, is to ‘lean as far as possible on the chain’ within the regulatory boundaries, but it will never easily cross the control line of identity, custody, and circulation. In short, the technical level strives for standardization and modularization. The legal and market levels are steady and progressive, with controllable priority.”

On June 27, the launch of an interest-bearing tokenized security in the Hong Kong Special Administrative Region of China attracted widespread attention from the local financial market.

Just the day before, the "Digital Asset Development Policy Declaration 2.0" announced by the Hong Kong Special Administrative Region Government of China has clearly proposed to promote the development of digital assets by expanding the types of tokenized products.

As the latest case of the on-chain RWA (real world asset) product from concept to implementation, according to the information announced by HashKey Chain on the same day, GF Securities (Hong Kong) has fully connected to HashKey Chain as the core on-chain issuance network and issued Hong Kong, China's first daily redeemable tokenized security, namely "GF Token".

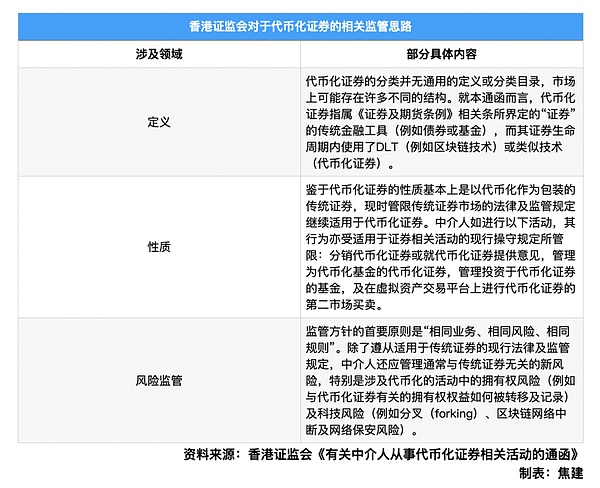

The so-called "tokenization", according to the definition of the document previously released by the Hong Kong Securities and Futures Commission, generally involves the process of recording the asset rights recorded in the traditional ledger on a programmable platform by using distributed ledger technology. The nature of "tokenized securities" is basically traditional securities packaged in tokenization.

The existing local laws and regulations for the traditional securities market continue to apply to tokenized securities. The Hong Kong Securities and Futures Commission has also pointed out many times that tokenization can bring some potential benefits to the financial market, but it is also aware that the use of this new technology may bring new risks.

As a tokenized security issued by GF Securities (Hong Kong) based on its credit support, this issuance simultaneously launched three currencies to investors: US dollars, Hong Kong dollars and offshore RMB. Among them, the yield of the US dollar tokenized securities is anchored to the US overnight secured financing rate (SOFR), providing users with US dollar-denominated cash management tools.

The subscription and trading of GF Token are limited to institutional professional investors and high-net-worth individual professional investors. The relevant parties claim to support daily interest calculation. In addition, GF Token also has the characteristics of multi-point distribution and token custody. The meaning of this approach is that investors can subscribe through GF Securities (Hong Kong) or HashKey Exchange, or use the traditional securities custody model to hold the tokenized securities. From the perspective of HashKey Chain, while it is the core issuance network of the product, multiple business organizations under HashKey Group are deeply involved in this on-chain issuance. HashKey Chain said that it will continue to expand cooperation with traditional financial institutions including securities companies and banks, and further expand the on-chain issuance and circulation mechanism of compliant assets. According to its official website, HashKey Group is a digital asset financial services group. Its Web3 ecological map includes HashKey Exchange, a licensed virtual asset exchange in Hong Kong, China, and HashKey Global, a global virtual asset exchange. It also includes on-chain ecology and the developed Ethereum L2 HashKey Chain.

From the perspective of GF Securities (Hong Kong), in January 2024, it took the lead in issuing the first tokenized securities applicable to Hong Kong law in Hong Kong, China, becoming the first Chinese securities firm in the local area to complete the minting, issuance and distribution of independently created financial assets on the public chain.

After the Hong Kong Securities and Futures Commission issued the "Tokenization Circular" and other regulatory guidelines in November 2023, this project was also considered to be the first local tokenized securities issuance. Since then, GF Securities (Hong Kong) has successively launched tokenized securities linked to financial assets such as stocks. In January 2025, it cooperated with relevant parties to land the first fund underlying tokenized securities distribution and trading.

As of the morning of June 28, when the reporter of Caijing published the article, neither GF Securities (Hong Kong) nor HashKey Chain responded to Caijing's interview questions such as the hope to learn more about the details of GF Token.

Lawyer Liu Honglin, founder of Shanghai Mankiw Law Firm, which focuses on serving the new economy of Web 3.0, explained to Caijing that based on existing public news materials, GF Token has gone a step further than several previous tokenized products in Hong Kong, China. It is not just "on-chain issuance + brokerage account custody", but has introduced multi-channel subscription, on-chain custody and multi-currency participation, which are closer to the structure of real financial transaction scenarios.

"Investors can complete subscription through brokerage channels or through HashKey Exchange. The tokens held can be placed in traditional accounts or managed directly on the chain. It sounds very open, but there are at least two core directions worth discussing." Liu Honglin said.

The first is whether holding on the chain means free transfer and anonymous circulation. Liu Honglin believes that "GF Token is most likely to control the circulation rights based on the whitelist mechanism. After all, this is a tokenized security issued in Hong Kong, China, not a DeFi (decentralized finance) project. Tokenized securities must be issued, traded and managed on qualified platforms, and the platform itself means entry barriers and compliance reviews. Even if investors hold tokens on the chain, this address is likely to be bound to their identity, and assets cannot be transferred to other wallets at will, let alone allowed to enter the open market for free trading."

The second is whether the daily interest calculation is settled on the chain. Liu Honglin pointed out, "GF Token's interest calculation mechanism is more likely to remain within the account system. The on-chain part is more like a 'registration book' for asset structures and transactions rather than a settlement channel. That is, a combination of 'on-chain accounting + offline redemption' is adopted. In the future, when the stablecoin regulations of Hong Kong, China are implemented and support is given to the use of Hong Kong dollar or US dollar stablecoins as payment tools, this structure will have the opportunity to further evolve to on-chain dividends. The possibility of direct on-chain settlement is not high at present." Ronghui Gu, a member of the web3 development task force of the Hong Kong Special Administrative Region of China and CEO of CertiK, further explained to Caixin that "tokenization does not mean free transfer or anonymous circulation. From the structure of GF Token, it can be seen that identity binding and restricted transfer are necessary for a regulated environment." As a leading global Web3 security service provider, CertiK was founded by professors from Columbia University and Yale University.

Ronghui Gu also pointed out that "interest calculation involves relatively complex mathematical calculations. These calculations are very time-consuming to implement on the chain, and may also introduce some security issues, such as loss of precision. At present, some on-chain settlement (daily interest calculation) projects can be realized because the off-chain calculation results are updated on the chain in a centralized manner. The core logic of many projects is actually still carried out off-chain."

"The launch of GF Token may also reflect a reality, that is, the current development path of RWA in Hong Kong, China is to "try to get on the chain" within the regulatory boundaries, but will never easily cross the control line of identity, custody, and circulation. Things on the chain can be done, but they must find an anchor within the legal system. In short, the technical level strives for standardization and modularization. The legal and market levels seek stability and controllability first." Liu Honglin said.

Alex

Alex

Alex

Alex Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Catherine

Catherine Kikyo

Kikyo Alex

Alex Alex

Alex Alex

Alex Catherine

Catherine