The competition in the stablecoin arena is becoming increasingly fierce.

On the other hand, amid complaints of "getting up early and arriving late", the actual demand and application scenarios of Hong Kong's stablecoins are also being questioned.

01 Hong Kong passed the Stablecoin Bill to fill the regulatory gap

2024March, the Hong Kong Monetary Authority announced the launch of the stablecoin issuer"Sandbox", in the same year

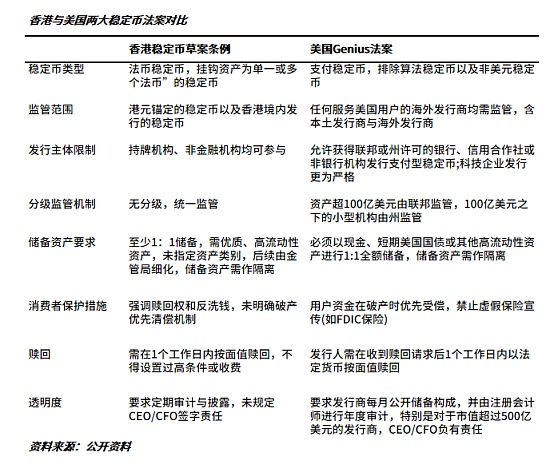

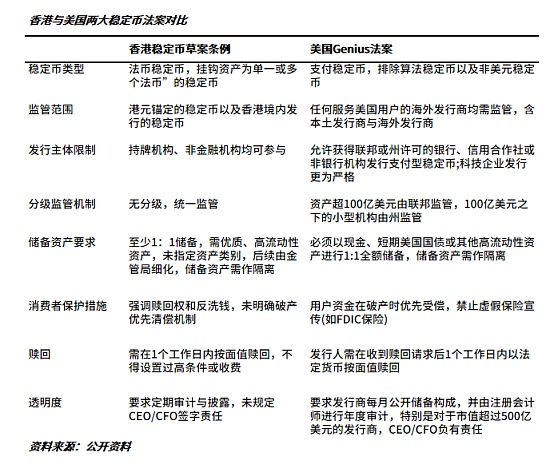

Hong Kong has entity requirements for stablecoin licensees, requiring that institutions applying for licenses must have physical companies in Hong Kong or authorized institutions established as corporations outside Hong Kong; licensees must have at leastThe minimum paid-up share capital of HK$25 million, and the regulations on reserves and redemption also stipulate that the licensee must ensure that the market value of the reserve assets is at least equal to its circulating face value at any time, and the fractional reserve model is prohibited, that is, at least 1:1 full asset reserves, and the reserve assets must be isolated from other funds, and the details of the reserve assets must be disclosed to the public regularly; redemption is free, and the licensee must pay the face value of the designated stablecoin to the holder who makes a valid redemption request, and no cumbersome conditions and unreasonable fees shall be attached. There are also restrictions on the sales entities of stablecoins. The stablecoin issuing licensees and virtual asset trading platforms licensed by the Securities and Futures Commission are the main sales entities.

Despite many differences, the legislation of stablecoins is still of far-reaching significance to Hong Kong itself. On the one hand, this legislation formally incorporates the fiat currency stablecoin into the regulatory framework, further improving Hong Kong's local virtual asset regulatory mechanism. The compliance of the deposit and withdrawal of fiat currency and stablecoin is opened, which can effectively promote the bridging of traditional financial institutions and Web3, attract traditional institutions and users to participate, which is not only a beneficial attempt to link the government and the market, but also provides a driving force for the vigorous development of the virtual asset industry; on the other hand, the strong entry of the Hong Kong dollar stablecoin also fills the market gap. At present, more than 99% of the stablecoins in the market are mainly US dollar stablecoins. The addition of the Hong Kong dollar occupies a new ecological niche, which not only reduces the dependence on the US dollar stablecoin, but also improves the security and autonomy of payment. It is also conducive to risk diversification and serves as a currency bridge between China and the United States. In fact, under the background of the continuous strengthening of the radiation power of the US dollar in the encryption field, integrating into the stablecoin ecosystem is also a necessary way to maintain Hong Kong's position as an international financial center. In addition, the promotion of the Hong Kong dollar stablecoin has also opened up space for the tokenization of Hong Kong assets, and more examples are expected to emerge in this field in the future.

02 Hong Kong once again overtook the United States, but it triggered doubts

The number of listed coins is also evident. Taking HashkeyExchange, the largest licensed and compliant exchange in Hong Kong, as an example, the total number of listed coins is only 19, of which only 4 can be purchased by retail investors, namely BTC, ETH, LINK and AVAX. Compared with the same type of compliant exchange in the United States, Coinbase, the number of tradable assets has reached 294, far exceeding Hashkey.

In this situation, the market often reveals some regrets about Hong Kong's crypto industry, "getting up early and catching up late". Judging from this bill alone, despite constant media coverage, the market's attention is very limited, and some people even question whether it is another license transaction. A typical example is that after Bitcoin broke through a new high of $110,000, Bloomberg's article directly pointed out that the reason was the US Stablecoin Act, but it did not mention the Hong Kong Stablecoin Ordinance at the same time.

On the other hand, the introduction of this stablecoin has opened a new wave of asset tokenization, but it is a huge challenge for the localCBDC. In fact, as early as the US authorities explicitly refused to issue digital dollars, some countries in the world had doubts about CBDC. The core is the legal currency of most countries, which is strongly related to the US dollar. Without the digital dollar, CBDC settlement is very likely to become rootless. The US stablecoin bill has once again declared the end of the fantasy of the digital dollar.

The mainland and Hong Kong are closely connected, and the market has also heatedly discussed whether the Hong Kong dollar stablecoin can promote the internationalization of the RMB.

Xiao Geng, Chairman of the Hong Kong International Finance Association and member of the Expert Group of the Chief Executive's Policy Unit of the Hong Kong Special Administrative Region Government, said in an interview that the legal issuance of stablecoins in Hong Kong, China also means that there will be stablecoin asset management platforms linked to the RMB and supervised by Hong Kong, China in the future, which will promote the internationalization of the RMB and RMB assets. Member of Parliament Qiu Dagen also said during the bill review that Hong Kong is considering including the RMB in the legal stablecoin. On the other hand, when it comes to the internationalization of the RMB, the digital RMB is also an unavoidable topic. Although since 2025, Beijing, Guangzhou, Shanghai, Zhejiang and many other places have issued digital RMB pilot work development plans, and the application work deployment has also shown the characteristics of detailed and strong implementability from the overall planning, and the scene application has entered the stage of refined integration, but from the top level, the digital RMB seems to have cooled down.

Citing the data from the mobile payment network, looking at the main time nodes of the development of the digital RMB, the last time the central bank issued a white paper on the digital RMB was in 2021, and the last batch of pilot cities was announced in December 2022. Even for the disclosure of application data, the latest disclosed data is only up to September 2024, and the stage time nodes are continuing to lengthen. The policy terms have also changed, from the initial "actively and steadily advancing" and "unswervingly advancing" to the current "steady and orderly advancement" and "solid advancement", which is enough to show that the pace of the promotion of the digital RMB by the central bank, the competent authority, is actually slowing down step by step, and its attitude is also shrinking from being active and active, emphasizing "stability" as the top priority. As for the reasons, it is nothing more than the difficulty of changing user habits, the relationship of functional coordination, ecological promotion, governance mechanism and other issues. Even the fall of Yao Qian, the first director of the Digital Currency Research Institute of the People's Bank of China, has more or less made the top leaders more cautious about the digital RMB. The situation shown is that the digital RMB, which is positioned in retail, has made faster progress in government and enterprise services, peer institutions and cross-border. At present, compared with the stable currency that may appear later, the interaction between the digital RMB and the digital Hong Kong dollar is obviously closer.

Back to the topic, whether it is a stable currency or a digital RMB, no matter what currency it relies on or what path it takes, the battle horn for the right to mint coins in the digital age has already sounded. If you don't occupy the ecological niche early, you will eventually become passive in the financial field. This move by Hong Kong is not only a realistic requirement under the rampant illegal stablecoin transactions, but also an inevitable measure to maintain payment sovereignty in the development of digital currency. In the long run, this may also be one of the strategies for Hong Kong to continue to play the role of window and bridge.

In innovation and risk control, Hong Kong has taken another trembling step. Although it is still not optimistic at the moment, looking back on the long line, I believe this is still an important moment in history.

Catherine

Catherine