Source: Beosin

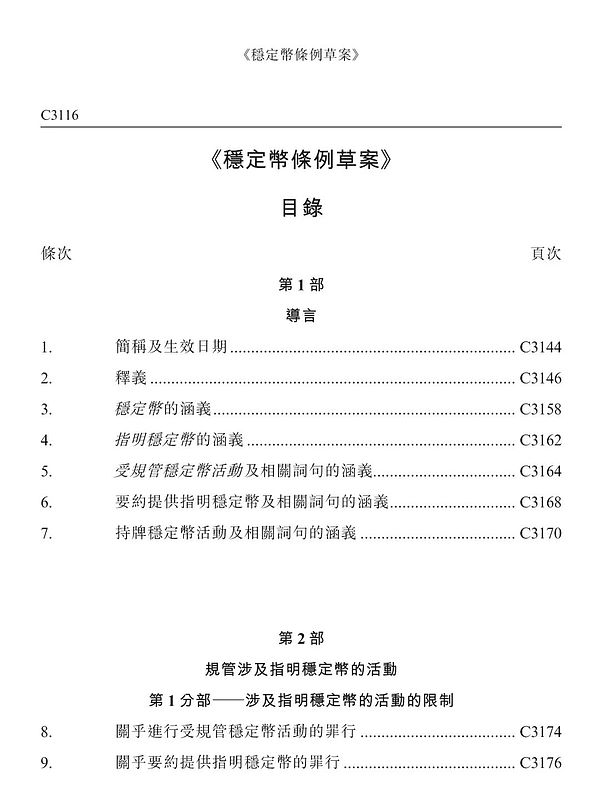

On December 6, the Hong Kong government announced the highly anticipated Stablecoin Bill. This legislation provides a detailed regulatory framework for issuers of Fiat-Referenced Stablecoins (FRS) and aims to make Hong Kong a global leader in the virtual asset sector.

This landmark move directly addresses core issues such as financial stability risks associated with FRS, user protection needs, and regulatory clarity. By implementing these measures, Hong Kong not only hopes to enhance public trust in the stablecoin ecosystem, but also seeks to unleash the full potential of virtual assets and their underlying blockchain technology in financial innovation and economic growth.

The Stablecoin Bill sets out the main regulatory requirements for the issuance and operation of stablecoins:

1. Capital requirements

• A registered capital of at least HK$25 million, or an equivalent in an approved foreign currency, must be held. Licensed institutions should have sufficient financial resources to meet their financial obligations and meet other financial resource standards.

2. Regulation of reserve assets

• For each stablecoin, an independent reserve asset portfolio must be established to ensure that its market value is at least equal to the face value of the unredeemed stablecoin.

• The reserve asset portfolio should be managed separately from other assets of the institution.

• Reserve assets should be selected as high-quality, highly liquid, and low-risk investments.

• Implement strict risk management and audit processes.

• Make the management, risk control and audit results of reserve assets public.

3. Stablecoin redemption mechanism

• Licensees must provide unconditional stablecoin redemption rights and shall not impose unreasonable restrictions.

• Redemption requests must be processed promptly and paid in the form of agreed assets after deducting reasonable expenses.

• In the event that the licensee is insolvent, the holder has the right to redeem the stablecoins they hold in proportion.

4. Personnel qualification requirements

• Licensees must ensure that all controlling shareholders are clearly identified and have the corresponding qualifications.

• Key positions such as CEO, directors, stablecoin managers, etc. must be held by suitable candidates.

• Senior management should have the necessary expertise and experience to perform their duties.

5. Risk Management Policy

• Licensed institutions must formulate comprehensive risk management policies to ensure information security, prevent fraud, and have emergency response capabilities, and must comply with policies approved by the Monetary Authority.

6. Anti-Money Laundering and Countering Terrorist Financing

• Licensed institutions must establish measures to prevent money laundering and terrorist financing related to stablecoins, and ensure compliance with the Anti-Money Laundering and Countering the Financing of Terrorism Ordinance and related measures.

7. Purpose and robustness of stablecoin issuance

• The purpose, business model and operating arrangements of licensed institutions in issuing stablecoins must be robust to avoid potential risks.

8. Business scope restrictions

• Licensed institutions should focus on stablecoin business and obtain the approval of the Financial Authority before conducting other businesses, while ensuring that other business activities do not pose significant risks to the stablecoin business.

9. Information disclosure requirements

• Licensed institutions must publish a white paper to provide comprehensive and transparent information on stablecoins, and disclose information such as complaint handling and compensation mechanisms, stablecoin management and risk assessment.

10. Complaints handling mechanism

• Licensed institutions must establish and implement effective complaints handling and compensation mechanisms to ensure that holders can resolve their problems conveniently and efficiently.

11. Interest-free policy

• Licensed institutions shall not pay interest on stablecoins, nor allow any form of interest payments.

12. Orderly reduction and recovery plan

• An orderly reduction mechanism must be established to ensure that the exchange of stablecoins can be carried out in an orderly manner. Licensed institutions should formulate appropriate contingency plans.

In order to effectively implement the system, the "Bill" also proposes to give the Monetary Authority the necessary supervisory, investigative and enforcement powers.

The Secretary for Financial Services and the Treasury, Mr. Paul Chan, said that this legislative proposal is crucial to fulfilling Hong Kong's obligations as a member of the Financial Stability Board. Adhering to the principle of "same activities, same risks, same regulation", the legislative proposal focuses on risk-based approach and strives to create a robust regulatory environment, which is also consistent with Hong Kong's regulatory approach to virtual assets.

The Chief Executive of the Hong Kong Monetary Authority, Eddie Yue, said that the legislative proposal has been widely consulted and the opinions of the industry have been fully considered when determining the details of the regulatory system. He believes that a robust regulatory environment will help promote the sustainable and responsible development of Hong Kong's stablecoin ecosystem.

This comprehensive regulatory framework aims to ensure the stability, security and transparency of the stablecoin ecosystem while protecting the rights and interests of relevant stakeholders. The "Bill" is scheduled to be reviewed for the first time in the Legislative Council on December 18. Its future implementation will be an important step in promoting the further development of Hong Kong's virtual asset ecosystem.

Through this legislation, Hong Kong has demonstrated its firm determination to move towards compliance and innovation in the global virtual asset field.

Huang Bo

Huang Bo

Huang Bo

Huang Bo Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist