Original: Liu Jiaolian

On the 24th, three departments (the People's Bank of China, the State Financial Supervision and Administration Bureau, and the China Securities Regulatory Commission) jointly released a major financial policy, which attracted global attention. Jiaolian will focus on thinking and judging what impact this set of policies will have on the future of A-shares, Chinese bonds, and BTC.

First, let's refine the key points of this set of policies, that is, the clauses with real money. Distinguishing between the weapons of criticism (verbal guidance) and the criticism of weapons (real money) is the first step. There are mainly three aspects:

The first aspect is to reduce the reserve requirement ratio and interest rates.

Among them, the reserve requirement ratio reduction is to reduce the bank deposit reserve ratio by 50bp, which can immediately release liquidity of about 1 trillion RMB. It may continue to reduce by 25-50bp this year.

The interest rate cut is through the 7-day reverse repurchase tool, and the operating interest rate is reduced by 20bp-compared to the usual 10bp reduction rhythm-from 1.7% to 1.5%. This will directly affect the deposit and loan market, guiding the LPR (loan market benchmark rate) and deposit rates to decline simultaneously. This will help maintain the net interest margin and not compress the profits of commercial banks. At the same time, it lowers the ceiling of treasury bond yields, which helps guide funds in the treasury bond market.

What we usually call the market interest rate (interest rate) refers to the LPR. The central bank did not follow the Fed's pace of interest rate cuts, which means that the LPR remains unchanged for the time being. At present, the 1-year LPR is 3.35%, and the LPR for more than 5 years is 3.85%.

What is the current deposit interest rate? According to the adjusted data of ICBC on July 25, 2024, the current account is 0.15%, the 3-month fixed deposit is 1.05%, the 6-month deposit is 1.25%, the 1-year deposit is 1.35%, the 2-year deposit is 1.45%, the 3-year deposit is 1.75%, and the 5-year deposit is 1.8%.

What about treasury bonds? Data on September 20: 1.4% for 3 months, 1.43% for 6 months, 1.39% for 1 year, 1.38% for 2 years, 1.5% for 3 years, 1.73% for 5 years, 1.91% for 7 years, 2.04% for 10 years, and 2.15% for 30 years.

I wonder what you think of the above data? First of all, the long-term and short-term yields of Chinese bonds are relatively normal, unlike the serious inversion of US bonds - that is, the yield of long-term bonds is lower than that of short-term bonds - which shows that China's economic situation is relatively normal, because common sense should be that the longer the repayment time is, the longer the funds are occupied, and the higher the interest paid.

The second is the abnormal part: the yield of this treasury bond is too low, right? For example, 1.73% for 5 years is actually lower than the 1.8% interest rate for 5-year fixed deposits? Isn't this far away from the spectrum?

Jiaolian has said before that the bond yield is inversely proportional to its price. The low yield of government bonds indicates that some funds are desperately buying government bonds, which has reached an almost irrational level!

This has caused a phenomenon, that is, the yield of Chinese bonds has been bought to an extremely abnormal low point.

The central bank has long publicly warned institutions not to rush into government bonds, but the weapon of criticism seems to be ineffective, so this time it directly brought out a heavy-weight move to criticize the market with weapons.

This big move is the first new tool launched: swap facility.

Secondly, a new monetary policy tool was introduced: swap facility, and special re-loan for stock repurchase and increase.

Why is this swap facility a heavy-weight move? Because the emergence of this tool has unprecedentedly allowed the central bank to target the A-share market.

Some people said with tears in their eyes that every time monetary regulation was carried out in the past, a sentence was added prohibiting entry into the stock market. This time it was actually specified that entry into the stock market was required. It was really "the bleak autumn wind is here again, and the world has changed"!

So how does this so-called swap facility work? Simply put, it is the first time that the central bank allows non-bank institutions (such as securities, funds, insurance and other institutions) to pledge assets with general liquidity (such as bonds, stock ETFs, CSI 300 constituent stocks, etc.) to the central bank, and exchange them for highly liquid assets (such as government bonds, central bank bills, etc.) from the central bank.

Please note that what the institutions get in return are government bonds and bills, not RMB. They need to sell them in the secondary market first, such as selling government bonds, before they can get RMB. My goodness, didn’t the teaching chain just say that government bonds are now being bought at a very high price by some institutions that don’t listen to advice? Now it’s good, it’s hard to persuade the damn ghost with good words, and the central bank directly released a bunch of government bond shorts to smash the market at a high level.

Do the government bond bulls want to continue to resist stubbornly and try to defeat the central bank, or listen to advice and quickly withdraw from the government bond market? From the bottoming out and rebound of government bond yields, we can see their thoughts and trends.

The last and most important step is that institutions that sell treasury bonds and get RMB are required to reinvest the money in the A-share market. That is, the purpose of the funds is specified: the funds obtained through the swap facility can only be used to invest in the stock market, aiming to improve the liquidity and stability of the capital market.

In other words, these participating institutions can only be short treasury bonds and long A-shares at the same time.

Another point is that the central bank emphasizes that the swap facility is not to give money directly, and will not expand the scale of base money, but to be carried out through the method of "bond-for-bond", aiming to improve the financing capacity of non-bank institutions, while not injecting base money.

The meaning of not injecting base money is to clearly tell the market that this is a zero-sum game and a process of wealth redistribution, forcing the wealth of the bond market out and transferring it to the stock market in a targeted manner.

Some time ago, some treasury bond bulls tried their best to withdraw liquidity from the A-share market and move it to the bond market. The national team has been quietly buying the bottom below 3,000 points for more than half a year. Many big Vs are laughing at them for not being able to hold the bottom. They are desperately trying to fool retail investors to sell at the bottom and exchange dollars to buy U.S. stocks at high prices. After the Fed cut interest rates, they fooled retail investors to buy bonds, saying that interest rate cuts are good for bonds to go bullish, and so on. But their suggestions are almost never right.

Now the national team has almost finished buying the bottom. The Fed has also cut interest rates, and the exchange rate pressure has been relieved. The market has also been waiting for policies for a long time. The right time, the right place, and the right people.

Institutions that have accumulated a large number of low-priced high-quality chips can exchange stocks for bonds with the central bank, smash the bond market for money, use the money to boost the stock market, and then find the central bank to exchange the purchased stocks for bonds... Cyclic operations, smash the longs in the bond market and blow up the shorts in the stock market.

This swap facility is a long-term tool, not a short-term emergency. The first phase of 500 billion yuan will be used to test the waters, and there will be a steady stream of hundreds of billions and trillions of yuan waiting to be used.

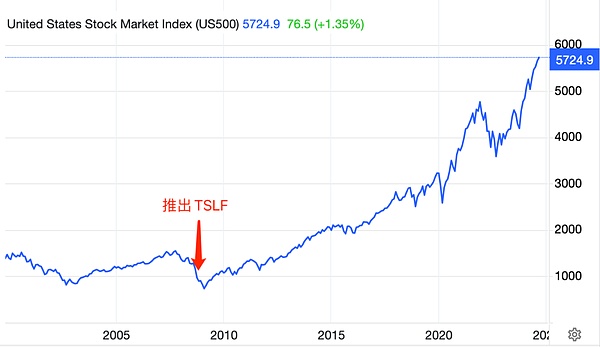

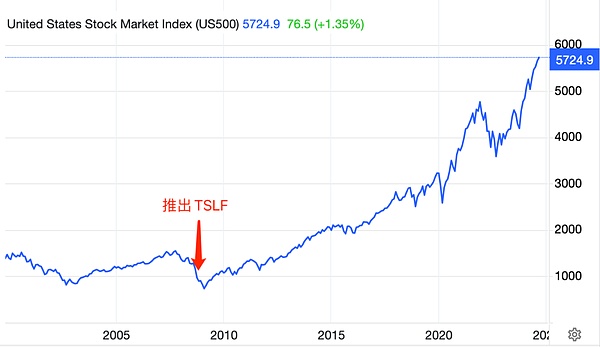

In fact, the Federal Reserve has already had similar tools. The Federal Reserve's swap facility is called the Term Securities Lending Facility (TSLF). This tool allows primary dealers to use less liquid securities as collateral to borrow more liquid Treasury bonds from the Federal Reserve, making it easier to raise funds in the market and boosting the market. It was launched during the 2008 financial crisis and was reactivated during the 2020 epidemic.

Let's enjoy the grand scene of the 15-year bull market in the U.S. stock market after the Federal Reserve applied TSLF: (see the figure below)

As for another tool, the special re-loan for stock repurchase and increase in holdings, it is to guide banks to provide loans to listed companies and major shareholders to support the repurchase and increase of stock holdings. If the major shareholders are confident that they can run the company well, as long as the profit dividend, that is, the dividend rate, exceeds the special loan interest rate, they can carry trade (carry trade), which will help motivate the company's shareholders to repurchase and increase the stock price, and run the company well and give dividends back to shareholders. Of course, as a kind of leverage, it is definitely risky. I will not go into details.

The third aspect is the support for the housing market. Continuing to reduce the stock of mortgage loans is not so much to support the housing market as to release the money in the hands of the people to stimulate the consumer market. The only thing that is really related to the housing market is to unify the down payment ratio of the second house and the first house to 15%. Compared with the above big support for the stock market, it seems a bit bland and tasteless.

It is obvious that the east of the river is ten years, and the west of the river is ten years. From the focus of the policy, it can be seen that the country has made up its mind to change the development model, get rid of the dependence on real estate, and guide capital to the stock market and to high-quality enterprises that match the development direction of advanced productivity.

Jiaolian has said, "As for the A-share market, it will also usher in its 20-year wedge breakthrough."

If you complain too much, you will break your heart. It is better to look at the long-term situation.

Jiaolian has carefully analyzed that the central bank's launch of the heavyweight long-term tool swap facility will hit the bond market in the short term, push up the yield of government bonds, and push up the stock market.

We can also judge that when the long-term bond yield rebounds and rises in a short period of time, it will often be accompanied by a wave of bull market in BTC.

This month, China and the United States have successively made major turning points in monetary policy, which coincides with the end of the year when BTC will be reduced by half a year and the prelude to the bull market next year. When the market is turning from disagreement to finding the direction of the bull market, it is hard not to sigh that there is a will of heaven in the dark.

I am happy to see the waves of rice and beans, and heroes everywhere in the evening smoke.

JinseFinance

JinseFinance