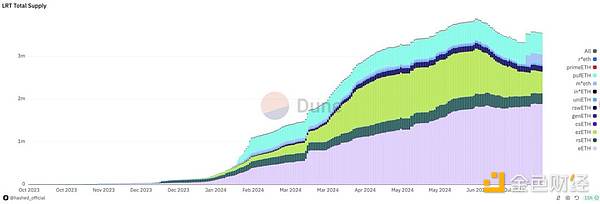

Since June, the TVL of the LRT track has experienced negative growth, from the ATH of 3.8843 million ETH to the current 3.5508 million ETH. The number of deposit addresses, daily deposit scale, social media discussion heat and other indicators of the LRT track have also declined synchronously.

The reasons for this phenomenon are as follows:

As we all know, the LRT income of "one fish, three meals" consists of three parts: ETH Staking income, Eigenlayer points airdrop income, and LRT project points airdrop income.

With the full pricing of Ether fi and Renzo's tokens on CEX, and the pricing of Eigenlayer in the pre-trading market, the market's previous overly optimistic expectations of LRT's return rate have changed, and it has gradually recognized the coin-based fixed-income attributes of LRT staking.

The pricing range of LRT WrapETH assets in the Pendle YT market has dropped to 6% to 7%. At present, Renzo's rsETH has the highest YT, but it is only 7.1%. This coin-based yield level is already difficult to attract ETH holders and airdrop farmers to stake and re-stake ETH at the risk of losing their principal.

Faced with this situation, how can LRT break through and start the second round of growth? There are currently three directions:

Continue to accumulate FI, such as Ether fi and Renzo launched S3 points activities, but due to the measurable low APY, the market feedback is not positive, and the TVL data has not shown a significant increase.

Use the new narrative lever to expand the market's expected returns. Puffer recently launched an infrastructure project related to the new narrative Based Rollup, which increased the market's expectations for its potential airdrop returns and achieved a wave of reverse growth in its TVL during the downturn in the track.

Actively and deeply participate in AVS, and get an extra "fish" (AVS project airdrop reward). KelpDAO and Renzo are the most active. This strategy is long-term, betting on the asset issuance wave of the super bull market next year and the year after. At present, there are 16 AVS in the Eigenlayer ecosystem, distributed in the fields of ZK coprocessor, AI+DePin, chain abstraction, Web3 games and social networking.

In addition, KelpDAO is also cooperating with emerging projects to jointly increase the income through points farming, and provide more multi-chain support and better liquidity for its re-pledged assets rsETH.

In general, LRT is in a Pre-Bull dormant period. It is normal for a certain data decline to occur at this stage. We should take a long-term view, adhere to long-termism, and wait for the new paradigm of AVS to be verified by the market.

Kikyo

Kikyo

Kikyo

Kikyo Coinlive

Coinlive  Others

Others Tristan

Tristan Coinlive

Coinlive  Beincrypto

Beincrypto Cointelegraph

Cointelegraph Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph