Author: Veronika Rinecker; Compiler: TaxDAO

The SEC has approved several spot Bitcoin ETFs in the United States; however, these ETFs are not allowed in the European Union due to strict regulations. But there are other alternative ways to invest in cryptocurrencies safely.

After years of anticipation and more than 20 rejections, the SEC has finally approved a wave of spot Bitcoin exchange-traded funds (ETFs) to trade on U.S. stock exchanges. These ETFs track the price of the world's major cryptocurrencies one-to-one by directly purchasing and holding Bitcoin. Previously, only Bitcoin futures ETFs were available in the United States. These funds track the performance of Bitcoin futures contracts, not the actual price of the cryptocurrency, and do not hold any real Bitcoin.

The newly approved spot ETFs provide institutional and retail investors with a regulated and convenient way to get access to Bitcoin without having to buy and store Bitcoin directly. As regulated products, these ETFs are supervised by the SEC and subject to the same rules as investment funds and the Code of Conduct for fund providers and managers.

But what does this approval mean for the possibility of a Bitcoin ETF in Europe? Are financial regulators in the EU ready to follow suit, or will EU investors have to wait longer?

1 ETNs offer a familiar route, but challenges remain

The trading landscape for Bitcoin and other cryptocurrencies in Europe remains relatively complex for investors. Retail trading and investment platforms such as Bison, Bitpanda and eToro offer convenient entry points, but their suitability for larger investors or those seeking a traditional structure is limited.

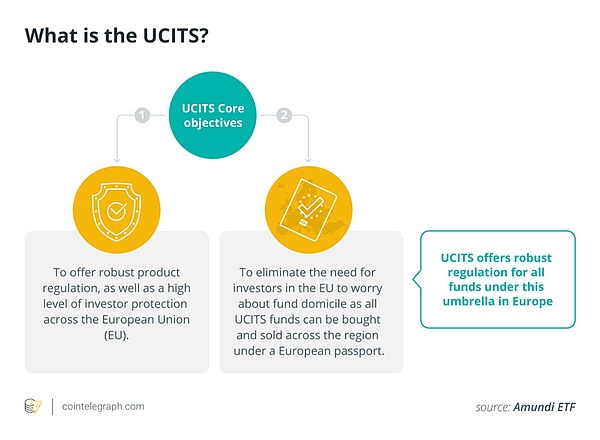

If an ETF invests exclusively in Bitcoin, it will not be approved in Europe due to the EU’s UCITS regulations. One of the goals of the scheme is to protect investors from total financial loss. These safeguards also require European funds to diversify their offerings and not invest too much in a single asset class or product.

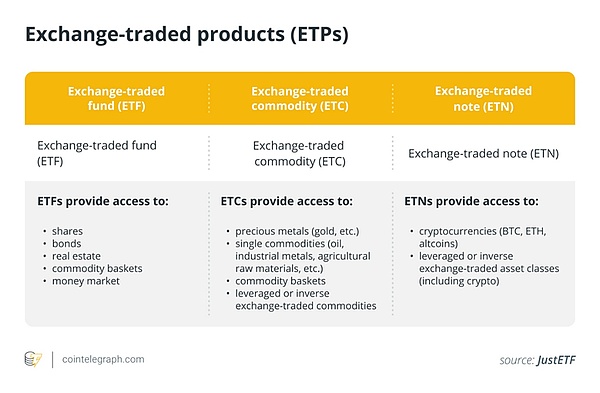

Therefore, investors must rely on alternative products if they want to participate in the cryptocurrency market in EU countries. For example, in Europe, these include Bitcoin exchange-traded notes (ETNs), which belong to the same category as ETFs, namely exchange-traded products (ETPs), and are usually also backed by "physical" Bitcoin. Several European investment companies such as 21Shares, VanEck, ETC Group and Deutsche Digital Assets (DDA) offer such Bitcoin alternative investments in the form of ETNs.

Dominik Poiger, chief product officer at Deutsche Digital Assets GmbH, told Cointelegraph that a clear advantage of ETNs is that they can be easily traded on exchanges such as Deutsche Börse’s Xetra electronic trading platform, the Amsterdam Stock Exchange or the Swiss Stock Exchange, and that investors are already familiar with the concept of ETNs.

“These products then appear as a configuration in the securities account and can therefore be easily used for portfolio diversification,” he said. “Fully secured debt securities are also well known to commodity investors – such as Xetra Gold – so people are moving forward in familiar territory,”

From a legal perspective, however, ETNs do not enjoy the same legal protection as ETFs. Poiger said that if the issuer goes bankrupt, customer funds may not be separated from the bankruptcy estate. Some providers have implemented a variety of safety measures to address this, including the use of regulated cryptocurrency custodians, independent security trustees and internal governance mechanisms.

21Shares co-founder and president Ophelia Snyder said that if the product structure (spot price, physical collateral) is appropriate, the differences between ETFs and ETNs are almost irrelevant. For example, the issuer of the 21Shares ETP reduces the risk of potential default by depositing the collateral assets with an independent custodian. Snyder explained that in this way, this investment vehicle also makes up for the claimed advantage of ETFs, which treat investor capital as a special fund, thereby protecting it from creditors in the event of the issuer's bankruptcy.

As a financial instrument listed on a regulated stock exchange, European investors can easily buy and sell crypto asset ETNs on the secondary market at the current market price on the exchange or over-the-counter, which is similar to the experience of trading stocks or ETFs.

For institutional investors, some financial institutions can also offer special alternative investment funds (AIFs). Such funds are not regulated under the UCITS Directive at EU level. They include hedge funds, private equity funds, real estate funds and various other institutional funds. AIFs can invest directly in cryptocurrencies, such as the HAIC Crypto Native Advanced Select from German private bank Hauck Aufhäuser Lampe Privatbank AG. However, the product is actively managed and only available to institutional investors, not an alternative for retail clients.

2 Will Bitcoin ETFs be approved in the EU in the future?

Poiger does not think that a Bitcoin ETF will come to Europe as a single asset as it has in the United States. EU law states that crypto assets, like gold or other commodities, are assets that are not eligible for UCITS, and "even if the EU changes the rules and allows crypto assets to be purchased directly in UCITS funds, they must still comply with UCITS diversification rules." "Therefore, it is unlikely that a pure Bitcoin UCITS ETF will appear in Europe, but it is conceivable that a basket of cryptocurrencies will be approved as a UCITS fund, although the possibility is small." Simon Seiter, head of digital assets at Aufhäuser Lampe, told Cointelegraph that a crypto index ETF based on a variety of cryptocurrencies is possible. However, this requires the establishment of a recognized cryptocurrency index that meets UCITS requirements. These can then serve as the basis for ETFs, similar to the way certain stock indices are selected as the basis for stock ETFs today.

"In this case, I don't think there is a need for regulatory changes. In my opinion, whether UCITS funds should be opened to single-asset ETFs is beyond the scope of the cryptocurrency sector. If a crypto ETF that meets UCITS requirements could be issued, I can definitely see a market for such a product. This would enable retail clients to retain their existing custody structures and still invest in cryptocurrencies in a diversified manner."

3 Europe leads in diversified cryptocurrency investment options

Poiger believes that cryptocurrencies, especially Bitcoin, are becoming an important asset class, as evidenced by the recent launch of a Bitcoin ETF in the United States.

"Crypto assets will become increasingly inevitable for investors seeking diversification. We regularly analyze the impact of adding Bitcoin to traditional portfolios and find that this allocation has a positive impact on the risk-return profile, including volatility, Sharpe ratio and maximum drawdown, while also improving performance."

Snyder said that there are already many ways to invest in Bitcoin and cryptocurrencies in Europe, so EU investors don't have to despair about the lack of a Bitcoin ETF.

21Shares alone offers about 40 products in eight EU countries, including indexes, single asset products, liquidity pledge products and short products, all of which are fully backed by physical spot crypto assets.

These products are also listed on exchanges such as Deutsche Börse's Xetra electronic trading platform and the Swiss Stock Exchange. “Europe is well ahead of the U.S. in providing regulated access to cryptocurrencies for both retail and institutional investors via ETN/ETF wrappers,” Snyder said, adding that demand for cryptocurrencies in Europe will be high as investors continue to see value and opportunity in cryptocurrencies.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Huang Bo

Huang Bo Edmund

Edmund Hui Xin

Hui Xin Clement

Clement Beincrypto

Beincrypto Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph