Author: William M. Peaster, Bankless; Compiled by: Deng Tong, Golden Finance

Frax Finance has always been one of the most innovative protocols in the cryptocurrency field. This is a stablecoin protocol, so the project creates tokens that are pegged to the value of other assets for easy use throughout the crypto economy.

Things changed this month when they launched Frax Bonds (FXB) to complete the V3 upgrade of the FRAX token.

To put it simply,Frax Bonds are similar to traditional bonds but operate on the blockchain, providing returns comparable to short-term U.S. Treasury bonds in the traditional financial world. This dynamic allows cryptocurrency investors to earn returns similar to one of the most popular real-world assets (RWA), but entirely on-chain.

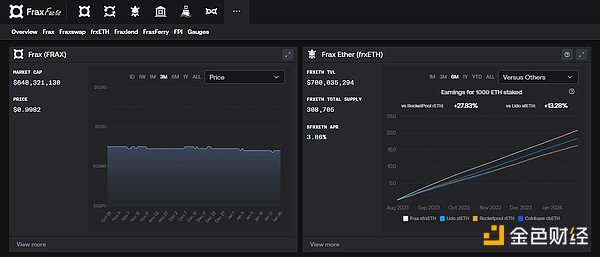

Track current and historical activity of the Frax stable and protocol on fac< /span>

How Frax Bonds work

When you purchase Frax Bonds, you are essentially purchasing a commitment to receive a certain amount of FRAX stablecoins at a future date .

The process is similar to lending money and getting it back with interest, but in this case, the "interest" is reflected in the discounted price relative to its future value when you invest. Therefore,FXB tokens do not directly track Treasury yields – they simply emulate them in a crypto-native way.

Frax Bonds’ main Features:

Expiration Date - Each FXB has a specific expiration date at which time it can be redeemed for FRAX stablecoins. Frax offers bonds with different maturity dates, allowing investors to choose based on their investment horizons.

Equivalent Interest Rate - While FXBs do not pay periodic interest like traditional bonds, they are sold at a discount. This means you buy them for less than they are worth at maturity, similar to earning interest.

On-chain operations - All aspects of FXB, from issuance to exchange, are conducted on the blockchain, ensuring the transparency and security inherent in decentralized finance .

Integration with DeFi - FXB can be used in different decentralized finance applications, such as providing liquidity on Curve Finance, adding another layer to bond holders. A level of practicality and potential benefits.

Overall, Frax Bonds are designed to meet the needs of all types of investors, whether you are a professional looking for stable, low-risk returns or a beginner looking to diversify your crypto portfolio. By combining the familiar mechanics of traditional bonds with blockchain innovation, FXB provides investors with a new and accessible entry into DeFi.

How to buy Frax Bonds

If you are interested in buying FXB tokens, you first need to get some FRAX, such as trading on Uniswap, because Frax is Frax Medium of exchange in an ecosystem. Once you have your FRAX ready, you can follow these steps:

Go to app .frax.finance/fxb/overview and connect your wallet.

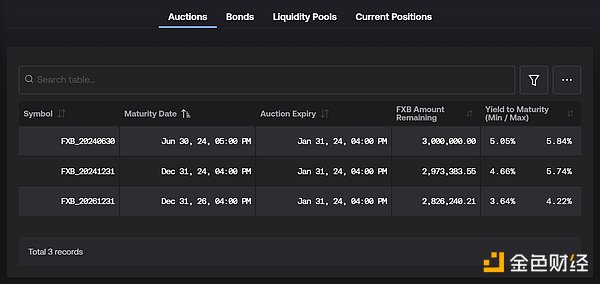

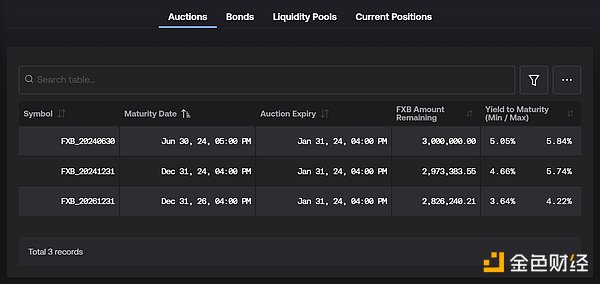

In the Auction tab, you will see FXB offerings with different expiry dates – click to select the token that matches your desired timeline. Please note that "Yield to Maturity" is the expected total return if held to FXB's maturity date.

In the subsequent "Buy Bonds" interface, enter the number of bonds you want to purchase.

Click "Buy".

Use your wallet to sign to approve transactions and subsequent purchases to complete the process.

That’s it! Once the FXB tokens expire, you can redeem them on Frax Finance’s page to receive discounted FRAX.

What else can I do with FXB tokens?

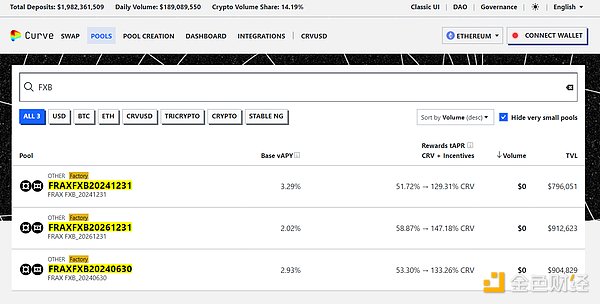

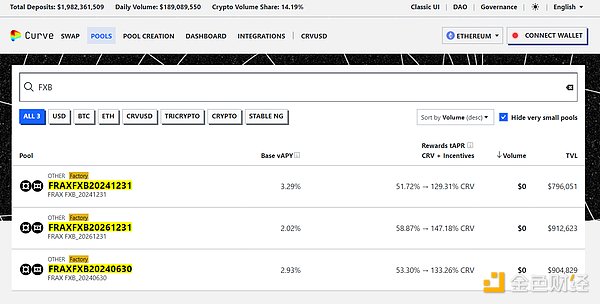

You can add your FXB is used in DeFi to earn extra yield on top of your bonds’ base yield-to-maturity. For example, Curve offers FRAX-FXB-20261231, FRAX-FXB-20240630, and FRAX-FXB-20261231 liquidity pools, which DeFiLlama currently estimates provide annualized returns of up to 60% through CRV token rewards.

What is this idea? Deposit FRAX and FXB tokens into Curve’s automated pool to earn trading fees and CRV rewards in return for your services in helping facilitate token swaps.

Future Picture

Frax Bonds are very important to Frax because they enable the creation of a yield curve, a dynamic that helps determine the cost of lending FRAX to the protocol Value changes over time. This curve essentially prices the time cost of conducting lending activities within the Frax ecosystem.

On the user side, the FXB token provides an opportunity for crypto investors looking for low-risk investments, similar to Treasuries, but with the added advantage of being entirely on-chain. This approach allows investors to experience returns comparable to traditional finance while enjoying on-chain accessibility, security and transparency.

JinseFinance

JinseFinance