Author: YASHU GOLA Source: Cointelegraph Translation: Shan Ouba, Golden Finance

Former US President Donald Trump went all-in on Bitcoin in his latest keynote at the Bitcoin 2024 conference in Nashville, promising voters to make the United States the "cryptocurrency capital of the world."

He will do this by creating a national Bitcoin "reserve," making the cryptocurrency a "permanent national asset."

Naturally, Trump's campaign promise sparked a bullish reaction from top cryptocurrency analysts, with some predicting a tenfold increase in BTC's price in the future.

Analyst: Bitcoin Price Could Break $800,000

One of the boldest and most optimistic outlooks for Bitcoin after Trump's speech came from independent market analyst Daan de Rover.

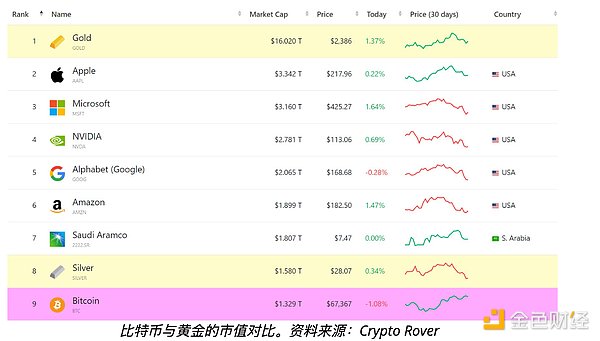

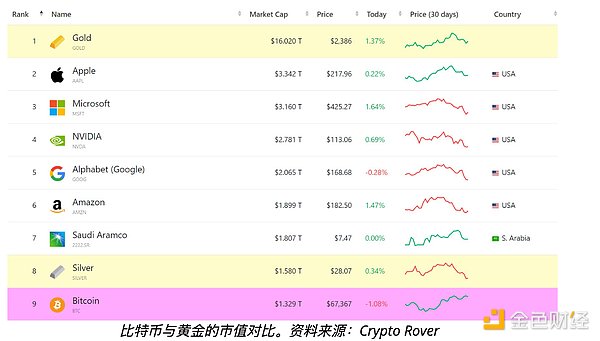

The chart analyst, who goes by the nickname "Crypto Rover" on X, expects the price of BTC to surpass $800,000 if the former US president is re-elected in November, especially considering that Trump also said that Bitcoin could surpass the market value of gold in the future.

Rover said in a July 28 tweet: "If this happens, BTC will be worth $813,054."

Wyoming Republican Senator Cynthia Lummis is also optimistic about Bitcoin. She has proposed legislation to establish an official U.S. strategic reserve of 1 million BTC over the next five years, equivalent to nearly 5% of the total supply of 21 million BTC. Loomis said: "BTC will be held for at least 20 years and can be used for one purpose: to reduce our debt." The U.S. government currently holds 210,000 BTC worth more than $14.26 billion. Trump promised to distribute these assets to the U.S. Treasury and said that if elected, his government would never sell them.

Analyst: Bitcoin Price Will Hit $100,000

Bitcoin sold off after Trump's speech and has since stabilized at around $67,500-68,000. But that hasn't stopped some analysts, such as Daan Crypto Traders and Tanaka, from predicting that Bitcoin will rise to $100,000.

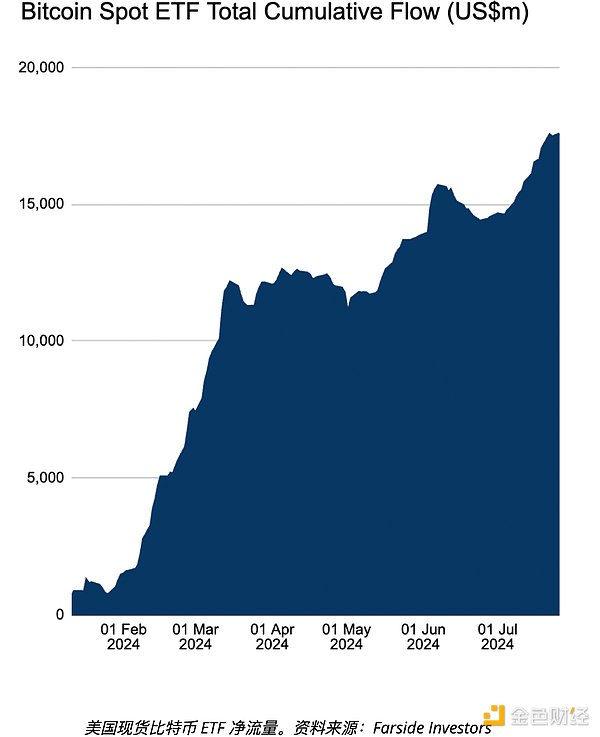

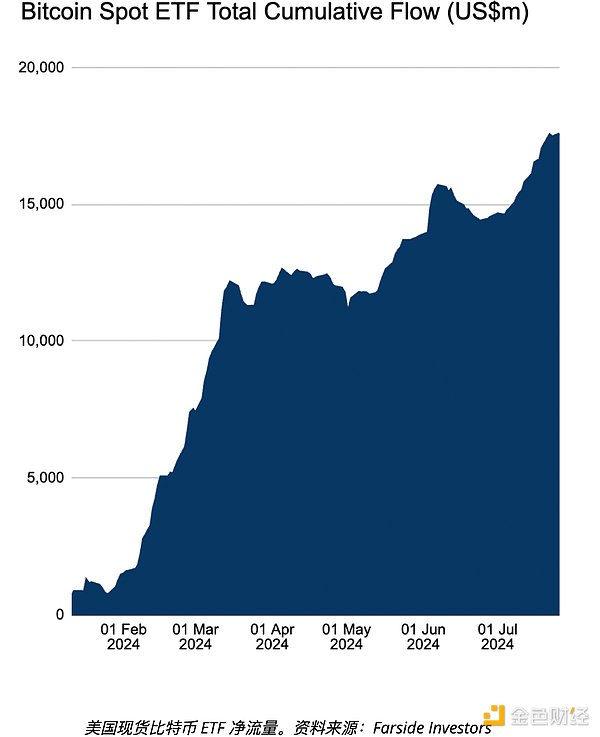

"In the long run, I am confident that BTC will reach $100,000 and ETH will reach $8-10,000," Kanaka said, noting that the U.S. spot Bitcoin exchange-traded fund (ETF) will gradually "attract more large institutional investors" into the Bitcoin market. As of July 26, the assets under management of U.S. Bitcoin ETFs reached $17.58 billion, the highest level to date. This figure is also higher than $14.65 billion in early July, reflecting a surge in interest in Bitcoin in the days before Trump's keynote speech.

Meanwhile, analyst Cryptomist expects BTC price to reach $100,000 based on the ascending channel pattern.

Rising Wedge: Bitcoin’s Next Target is $74,000

Bitcoin’s volatile price action is occurring within BTC’s current ascending wedge pattern, which suggests a rally to $74,000 by August. This level is 9.30% higher than the current price level and is where the two trendlines of the wedge meet.

On the contrary, if the lower trendline of the wedge is clearly broken (the specific point of the break depends on the breakout point), a drop to the $60,000-66,000 range is possible. This is mainly due to the way the rising wedge breakout is calculated: the maximum distance between the two trendlines is measured and then the result is subtracted from the breakout point.

JinseFinance

JinseFinance