In the world, El Salvador may be just an unknown small border country, leaving people with a vague impression of hot volcanic landforms and diverse ecosystems. But in the crypto world, El Salvador is also a well-known existence.

Back in 2021, the global monetary environment at that time could be described as treacherous. The pandemic caused a sharp increase in monetary debt, and the scale of global debt soared to US$27.5 billion. A new round of digital currency experiments emerged around the world, and Bitcoin became mainstream with great momentum, reaching US$69,000.

In this environment, Nayib Bukele, the newly elected president of El Salvador, made a rather bold decision to create a new financial system with a new currency and make Bitcoin the country's sovereign currency. Congress unexpectedly supported it and eventually voted to pass the bill with an absolute majority, officially making Bitcoin the country's legal tender, making El Salvador the first country in the world to grant legal status to cryptocurrency. Bukele also said that land will be allocated to build basic facilities such as food, clothing, housing and transportation, and Bitcoin will be used as the settlement currency to build a complete Bitcoin city. The government even developed an e-wallet called Chivo to promote public adoption.

This decision caused a sensation around the world. The International Monetary Fund, global central bank institutions, and crypto industry practitioners all focused their attention on the small American country with a population of less than 7 million. The voices of opposition, ridicule, and applause were intertwined. The world hopes to see the results they want from El Salvador's social experiment and witness its vision of a "Bitcoin city" that may be declining or glorious.

Under the hype and publicity, tourists flocked to El Salvador, bringing the first batch of fresh traffic. But problems also followed one after another. The high volatility of cryptocurrencies, the security of e-wallets, and the slowness and slowness of transfers quickly made people dissatisfied with cryptocurrencies. A year later, only 20% of locals continued to use Chivo. In November 2022, the crypto world suffered a heavy blow, with Bitcoin quickly falling to $16,000, while the El Salvador National Bitcoin Office (ONBTC) was officially established in the same month. The untimely dislocation cast a shadow on El Salvador's Bitcoin plan again. Since then, the Bitcoin City has gradually faded away, and El Salvador has gradually ended from the crypto stage.

A typical example is that in order to raise money to build a city, the Salvadoran government was ambitious to launch the world's first sovereign blockchain bond "Volcano Bond", but the issuance time has been continuously postponed, from 2022 to 2023 and then to 2024. The bonds that were originally expected to raise $1 billion are still far away.

However, as the market has recovered and regulation has been relaxed, Bitcoin is only one step away from $100,000, and the global attitude has also changed significantly. The national reserve competition for Bitcoin has officially begun, and many countries around the world have begun to show interest in including Bitcoin in their national reserves. In addition to the United States, which has made bold statements, Switzerland has also passed a bill to include Bitcoin in the national bank's reserve assets. Bhutan's Bitcoin holdings even exceed 30% of the total GDP. Members of parliament in Venezuela, Poland, Argentina, and Germany have all proposed relevant proposals.

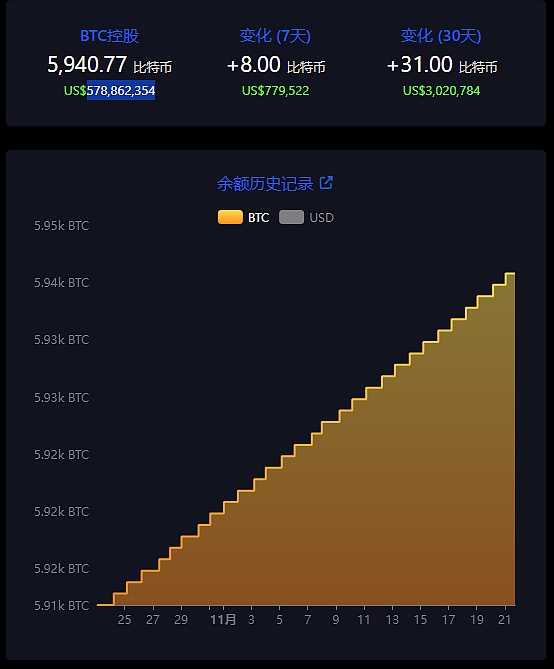

El Salvador also seems to have changed from a wishful extremist to an innovator who takes a different approach, becoming the first person to try something new. According to The Bitcoin Office, since March 16 this year, El Salvador has adhered to the principle of purchasing one coin per day. As of press time, the Bitcoin holdings have reached 5940.77 BTC, and its holdings have a market value of US$578,862,354. The gimmick of the Bitcoin City has finally shown its investment value, and the city has taken shape. In August this year, Turkish holding company Yilport will invest $1.62 billion in two seaports in El Salvador, one of which is located in the "Bitcoin City". In terms of public education, El Salvador has also spared no effort to promote Bitcoin wages among civil servants nationwide, shifting the salary structure from traditional currencies to Bitcoin, and even launching a Bitcoin certification program to provide Bitcoin-related training and certification for 80,000 civil servants.

But the public's conservative attitude is also better than before. According to a new survey by the Francisco Gavidia University of San Salvador, in El Salvador, only 7.5% of respondents said they used cryptocurrencies for transactions, while 92% admitted that they did not use cryptocurrencies, and only 1.3% believed that Bitcoin was the country's main future development direction.

From the data alone, El Salvador's Bitcoin vision is still far away. Even with the president's strong support, El Salvador holds only 1.5% of its GDP in Bitcoin, and since 2022, El Salvador's cryptocurrency remittances have continued to decline, from $84.8 million to $57.4 million. According to data from the Central Bank of El Salvador, from January to August 2024, only 1.1% of all remittances sent to the country involved cryptocurrencies. The first tokenized debt project launched by Bitfinex Securities in April this year to support the construction of the Hilton Hotel in El Salvador was aborted due to failure to attract the minimum $500,000 required to continue operations, reflecting the failure of the Bitcoin effect in El Salvador. In this regard, the president can only reluctantly admit that "Bitcoin has not yet been widely adopted as we hoped."

But in any case, since the announcement of Bitcoin as a sovereign currency, El Salvador's fate has been closely linked to Bitcoin. The brand of "Bitcoin Capital" has been launched, and El Salvador's Bitcoin journey is still continuing. At present, El Salvador is planning to build a new capital market around Bitcoin and is preparing to introduce more regulatory support policies. The results are already evident. Just recently, Bitfinex Securities once again issued tokenized U.S. Treasury bonds for the first time under the legal framework of El Salvador.

In response to the above, Juan Carlos Reyes, chairman of the National Digital Asset Commission, El Salvador’s top cryptocurrency regulator, accepted an exclusive interview with Coindesk to discuss the current status and future of digital assets in El Salvador.

The following is the full text of the interview with the original author Tom Carreras, compiled by Gyro Finance, with slight changes and adjustments:

El Salvador is ahead of most other countries in regulating cryptocurrencies. As the first country to adopt Bitcoin as legal tender, it has become a gathering place for many crypto companies.

"From a macro perspective, most people will not understand what we are doing in El Salvador. They can only see a corner of the whole picture," Juan Carlos Reyes, chairman of the National Digital Asset Commission (CNAD) of El Salvador, said in an interview.

“Even for foreign companies that are regulated locally but don’t have a full local office, they don’t understand how advanced the regulation is in El Salvador and how fast the industry is evolving.” Reyes said the president’s initiative forced state institutions to grapple with the impact of new technologies and their close ties to digital currencies.

As a result, El Salvador avoided delegating crypto regulation and oversight to traditional financial regulators, such as the Superintendency of the Financial System (SFS), and instead created the CNAD from scratch, with the goal of creating a tailor-made regulatory framework for cryptocurrencies rather than trying to extend existing rules to digital assets.

“There is a way of inductive reasoning: when I see a bird, it walks like a duck, it swims like a duck, it quacks like a duck, I call it a duck.” But in the context of assets, digital assets are completely different from traditional financial instruments.

That’s why CNAD took a technical approach to regulating cryptocurrencies as soon as computer science heavyweight Reyes became its leader in September 2023. Feedback from crypto companies that have received El Salvador’s Digital Asset Service Provider (DASP) license has been very promising.

“We were totally surprised at how knowledgeable and meticulous CNAD was, and how technically savvy they were,” Nick Cowan, group CEO of tokenization solutions firm VLRM, said in an interview.

Victor Solomon, partner at El Salvador-based tokenization consultancy Tokenization Expert, agrees. “We don’t want to overly praise El Salvador, but it was amazing how quickly they got to the heart of the matter to review our application. We didn’t have to spend time explaining the technical foundations of our operations — they already understood the intricacies of tokenization and the compliance measures that would be taken, and Reyes understood the practical challenges that businesses face, from fundraising to navigating regulations, making him not just a regulator but an advocate for businesses that have a positive impact on the Salvadoran economy,” added Solomon.

Reyes was born in El Salvador and moved to Canada as a child to escape the war that was raging in the country at the time. A self-described “high achiever,” he holds bachelor’s degrees in computer science, mathematics, and physics, as well as a master’s degree in management from Harvard University. He then pursued a doctorate in philosophy at the Peoples’ Friendship University of Russia, but did not complete it due to the pandemic and the war in Ukraine.

His professional background is highly complex and his career experience is quite extensive. He developed business opportunities for the Missanabie Cree First Nation after leading a consulting firm for 15 years and once opened a bar on the second floor of his beach house. A believer in Bitcoin since 2013, he decided to move back to El Salvador in 2021 to participate in the cryptocurrency nationalization process.

CNAD has a completely independent staff of 35 people, and Reyes provides a sample standard for employees: everyone knows the underlying technology of cryptocurrencies. In fact, 20 employees are currently taking postgraduate crypto courses at Argentina's CEMA University to improve their expertise.

"We have the best-educated and most complete team in the world when it comes to crypto asset regulation," Reyes said. "If someone doesn't know how to trade on Bitcoin, including my driver, they probably can't work here."

This elite team has undoubtedly impressed companies seeking to obtain a license to operate in El Salvador.

"Reyes is a technical expert," Cowan, whose company has worked with dozens of other regulators around the world, told CoinDesk. “In other jurisdictions, the regulators understand regulation and investor protection, which is critical, but they don’t necessarily understand the technology, which can make your job quite onerous at times.”

“It was a very detailed and complex process. We submitted a 700-page application, but once we submitted it, the decision process was much quicker than in other countries… The process was consistent with any other regulatory process we’ve had to go through before, it wasn’t a different path, it was just faster,” Cowan said.

For Reyes, the agency’s crypto knowledge means it can adhere to one of the most important philosophical tenets of the space — don’t trust, verify — and check the blockchain every time it interacts with a new company applying for a license. The team doesn’t rely on documents provided by compliance officers, which are often found to provide regulators with false information.

Reyes likes to use an analogy to explain why cryptocurrencies need their own regulator. "If you buy an electric car and it breaks down, you give it to a mechanic with 20 years of experience, but when he opens the hood, he won't find an engine, just a battery, and he doesn't know what to do with it."

This is also the difference between cryptocurrencies and traditional financial assets that Reyes feels. They look similar on the surface, but dig deeper and the two are very different. This is also one of the reasons why jurisdictions around the world have been slow to implement regulatory frameworks for digital assets.

However, El Salvador is a small country. With a GDP of only $35 billion, ranking 17th among Latin American countries and 103rd in the world, the country has no currency of its own, no strong financial institutions, and even no existing developer ecosystem. But it is precisely here that all these things proved to be positives when it comes to regulating cryptocurrencies because El Salvador "started with a blank sheet of paper."

Going back to the electric car analogy, El Salvador was able to focus immediately on repairing batteries and motors without having to transform its existing infrastructure into a garage that can repair Teslas.

"In other countries, a lot of new technology is created by rational people who are trying to move the crypto ecosystem forward, but they don't think about how the technology can be abused and become a tool for money laundering," Reyes said. "It's hard for regulators to know how much regulation to relax."

"We are able to make CNAD the single entry point for all digital assets in this country, and any entity that is not licensed by the commission is illegal."

There is also the fact that financial institutions in Western countries are the ones who make the existing rules, so overturning the original regulations will have a wider and more serious impact than in Latin American countries. "Traditional finance has lobbying institutions that have been fighting against crypto, such as implementing Operation Chokepoint 2.0 (referring to the behavior of US regulators to restrict cryptocurrency companies from obtaining banking services). They will do everything they can to ensure that this industry does not flourish," said Reyes, who once had a Canadian bank account frozen for engaging in cryptocurrency activities. “But countries like El Salvador have a lot to gain if they move fast and seize the opportunities that cryptocurrencies present.”

But what kind of regulatory environment does El Salvador want to create?

In terms of financial instruments, Bitcoin is “more than enough,” Reyes said, but beyond that, the CNAD is technology agnostic. Most of the companies the agency regulates run on Ethereum. The size of the regulated companies varies greatly: there are global heavyweights like Tether and Bitfinex Securities, but also small local El Salvadoran businesses, which, according to Reyes, “start with $2,000.”

Consumer safety and financial security are top priorities. This means, for example, requiring exchanges to use multi-signature wallets to ensure that another FTX incident doesn’t happen, or requiring companies’ private blockchains to follow certain security standards. The identification of every customer is also mandatory.

"It is important to emphasize that our country has been intimidated by gangs for many years. Therefore, we attach great importance to financial transparency, money laundering and financial terrorism, which have been effectively incorporated into regulation." He believes that if a crypto company is regulated in El Salvador, it can obtain a license anywhere in the world.

Reyes is particularly enthusiastic about one area: real world assets (RWA). In his view, attempts like VLRM and Tokenization Expert will expand the range of investment opportunities for retail investors. “Before Robinhood, it was impossible for most young people in the U.S. to buy Tesla or Nvidia. Robinhood democratized all these different stocks that only the super elite could buy. That’s where tokenization comes in. In the coming years, Salvadorans will hopefully have access to regulated products that are not available in other jurisdictions.”

Reyes stressed, “This is the first time in modern history that a developing country can lead a financial revolution instead of being left behind and picking up the scraps.We’re trying to encourage other countries to look to El Salvador and learn how to apply our model to other countries.”

Hui Xin

Hui Xin

Hui Xin

Hui Xin Hui Xin

Hui Xin Brian

Brian Brian

Brian Hui Xin

Hui Xin Brian

Brian Hui Xin

Hui Xin Joy

Joy Joy

Joy Joy

Joy