Author: Nancy Lubale, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Since breaking through the $90,000 mark for the first time on November 19, the price of Bitcoin has been consolidating between $91,500 and $106,500.

But according to several technical and on-chain indicators, Bitcoin's consolidation may be nearing its end. The key question that remains is when Bitcoin will break out of the consolidation.

BTC/USD daily chart. Source: Cointelegraph/TradingView

Bitcoin Price Action: Currently Trading Sideways

Bitcoin may continue to consolidate in its current range for a while, according to a cryptocurrency analyst, especially after U.S. President Donald Trump’s tariff threats triggered large-scale cryptocurrency liquidations and raised concerns about a trade war.

In a Feb. 5 analysis for X, Rekt Capital said that despite Bitcoin’s retest of $101,000 on Feb. 3, BTC failed to convert the daily close “into new support.” He added: BTC/USD daily candlestick chart. Source: Rekt Capital

For independent analyst Arjantit, Bitcoin’s current consolidation cycle could last until the end of February.

Arjantit said:

Bitcoin price is consolidating after a 15-week rally (+105%).

As long as BTC/USD remains above $90,000, its daily structure remains strong.

However, a break below $90,000 could be a “buying opportunity”.

The consolidation cycle could end by the end of February, after which BTC will rebound to $120,000.

BTC/USD weekly chart. Source: Artjantit

BTC demand has not peaked yet

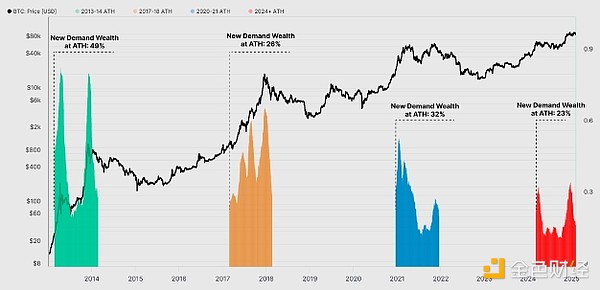

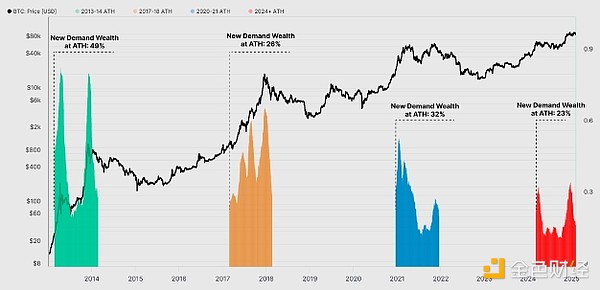

With BTC prices breaking through the $100,000 mark, many market participants expect investors' exposure to Bitcoin to increase. However, data shows that new demand is still "significantly lower" than demand at the peak of previous cycles.

Glassnode describes the current BTC price trend as an “atypical market cycle,” with its latest Week On Chain report noting:

At the all-time high in 2017, new demand for Bitcoin was 26%, and at the peak of the bull cycle in 2021, it was 32%.

At the current all-time high of $109,000, new demand is 23%.

Glassnode added:

[T]he new demand for BTC is primarily coming from large entities, not small retail entities.

The HODL ratio achieved by Bitcoin. Source: Glassnode

Therefore, it may be necessary for small players to continue to provide new demand to end the current consolidation period.

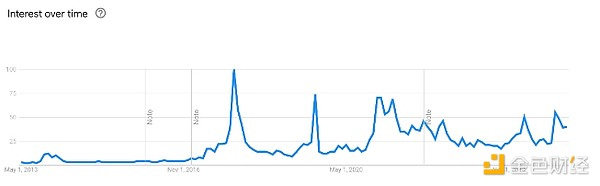

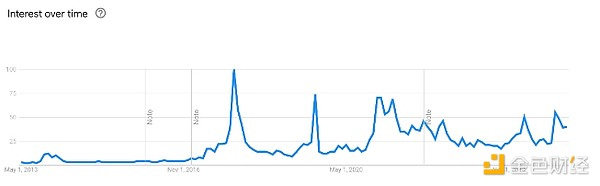

Meanwhile, Google Trends also shows that social interest has declined compared to previous cycles:

Search volume for Bitcoin has not yet reached the levels seen during the 2021 bull run.

Bitcoin interest over time. Source: Google Trends

Bitcoin could break out of its consolidation phase once investor interest picks up again.

Bitcoin price breakout is coming – Bollinger Bands

The Bitcoin volatility indicator suggests that consolidation in Bitcoin price is a precursor to a major breakout.

Key Points:

The tightening conditions of the Bollinger Bands suggest that a breakout could be very close.

The daily Bollinger Band width is extremely oversold, touching the lower green line.

The width of the Bollinger Bands is currently narrower than it was in November 2024 when the Bitcoin price was $68,000.

BTC/USD subsequently rallied 46% from $67,300 on November 5 to $99,317 on November 22.

The indicator was also this tight in June 2024 and January 2024, following BTC price increases of 31% and 19%, respectively.

BTC/USD daily chart. Source: Cointelegraph/TradingView

Weatherly

Weatherly