If that happens, “new highs will be reached soon.” If it doesn’t, a retest of the “2024/summer consolidation” between $73,000 and $74,000 is on the cards, which should provide at least some support. “Right now, prices are pretty much in the middle.” BTC/USD daily chart. Source: Daan Crypto Trades

Analyst Jelle echoed the same sentiment, saying that Bitcoin’s current consolidation cycle could continue until the price breaks through $90,000.

“Break that and things will start to get really, really good again.”

For analyst Rekt Capital, Bitcoin’s weekly close above $88,000 would have to confirm a higher breakout.

In a March 24 article, the analyst stated:

Bitcoin is about to retest the resistance provided by the 21-week exponential moving average (EMA) (green), which is the top of the triangle market structure created by the 21-week EMA and the 50-week EMA.

BTC needs to close above the green EMA at $88,400 on a weekly basis and then retest to confirm a breakout above $93,500.

A similar price action was seen in 2021, when Bitcoin had a weekly close above $40,000, the following weekly candlestick retested that level, and then moved higher.

“If history repeats itself, this kind of volatility around the 21-week EMA would not be surprising.”

BTC/USD weekly chart. Source: Rekt Capital

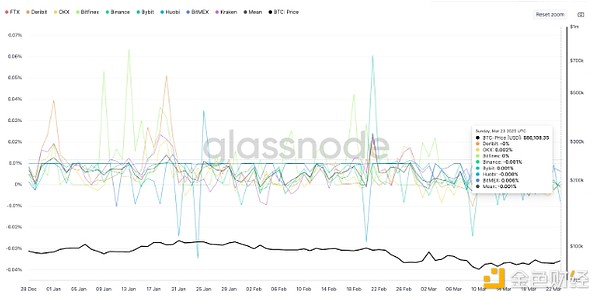

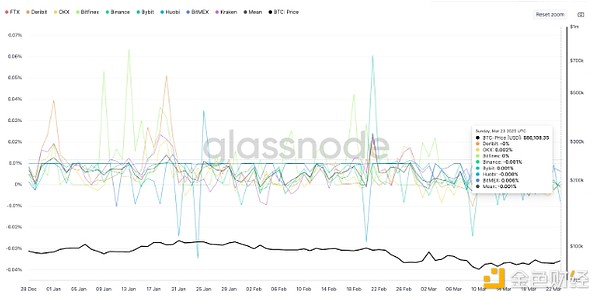

BTC funding rates remain subdued

One of the clearest signs that Bitcoin’s future price action will be more volatile is the negative funding rate and reduced open interest (OI) in its futures market.

Key Points:

The funding rate is a regular payment between long and short traders in a perpetual futures contract to keep the price in line with the spot market.

When the indicator turns negative, shorts pay longs, indicating bearish sentiment.

The BTC funding rate is around 0%, indicating indecision in the market.

BTC perpetual futures funding rates across all exchanges. Source: Glassnode

When the funding rate is zero, the cost of holding a position is extremely low, reducing the pressure on traders to exit long or short positions.

This can stabilize the price of Bitcoin in the short term as neither side pays a premium, thereby suppressing volatility and leading to continued consolidation.

This could also signal accumulation ahead of a potential rally, or distribution ahead of another leg lower.

Trading firm QCP Capital said in a Telegram note to investors that despite Bitcoin’s “modest rally” over the weekend, breaking above $85,000, “funding rates remain flat,” adding:

“We remain cautious on the prospect of a sustained breakout higher.”

Bitcoin Price Consolidation Coming to an End – Bollinger Bands

Bitcoin volatility indicators show that expectations for a BTC price breakout are building.

Key Points:

The tightening Bollinger Bands conditions suggest a breakout could be very close.

The weekly Bollinger Band is at an extremely oversold level, touching its lower green line.

The width of the Bollinger Band is as tight as it was between July and October 2024, when it consolidated between $63,000 and $69,000, setting a new all-time high in 2021.

Since then, the BTC/USD pair has risen 60% from $67,500 in October 2026 to the 2024 high of $106,000 reached in December 2024.

The indicator was also this tight between June and September 2023, following a 176% increase in BTC price from $24,400 to $73,800 on March 14, 2024.

BTC/USD daily chart with Bollinger Bands. Source: Cointelegraph/TradingView

If history repeats itself, Bitcoin could soon break out of its current range in the coming weeks.

Anais

Anais