Author: Route 2 FI; Compiler: Deng Tong, Golden Finance

How do you become a venture capitalist? How do you create a venture capitalist?

How do you become a successful venture capitalist?

How can you have the opportunity to invest in protocols and be at the forefront of the market?

That's the question I'm trying to answer today.

Foreword

One day, you look at the market and find that you are not satisfied with the returns you have received so far. The market is falling and your investment has also suffered losses.

Another day, you look at the market and see that everyone is making a profit, but you are still not doing well as an individual compared to the big teams. But who are these big teams?

There are multiple entities, such as market makers, hedge funds, liquidity funds, and venture capital funds (VCs). The first three entities operate in somewhat similar ways: they buy and sell tokens that are already on the market. However, VCs are the ones who buy tokens before they are live.

VCs support the teams behind your favorite projects from the very beginning, even when the team is still developing an MVP (minimum viable product). These people are so convinced that a certain team will succeed that they are ready to invest a lot of money even before the product is live.

Their investment can grow significantly if the project succeeds, but they can also suffer significant losses if the project fails.

The risk/reward ratio here is high, but venture capital is more than just investing; it also involves backing teams and working directly with them to ensure the long-term success of the project.

So, how do you become a venture capitalist? How do you create a venture capitalist? How do you become a successful venture capitalist? How can you get a chance to invest in protocols and be ahead of the curve?

To create a VC, you must understand the basic VC structure and, most importantly, the key players in that structure

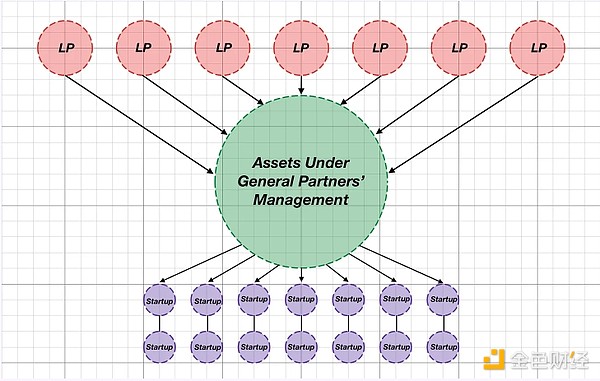

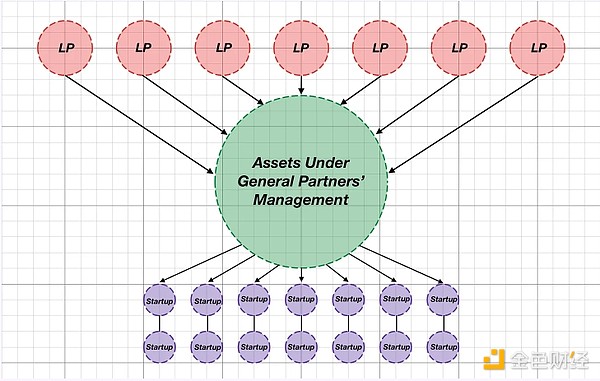

Every venture capital fund has 3 main players: Limited Partners (LPs), General Partners (GPs), and Founders:

LPs are people with a lot of money who want to increase their capital; one of the options they have is through venture capital.

GPs are people with a lot of knowledge who want to increase the investment of LPs and earn fees on successful deals.

Founders are people who build an innovative, single product or service and aim to bring it to market. They need investment to get started.

If I were to describe the VC structure in a diagram, I would probably use this one:

LPs have a very clear mandate to GPs; they just entrust the funds and wait for returns. The main task of LPs is to invest in the right people to manage the funds. The goal of LPs is to target major targets.

LPs are usually not involved in the process of investing in startups, as all due diligence is handled by GPs. However, LPs can bring deals from their network for GPs to review and judge whether they are worth investing in.

GPs usually make monthly/quarterly/yearly reports to let LPs know the current status of the VC fund. This includes providing investment strategy, market sentiment, overall completed investments, and any changes in unrealized (or realized) returns.

GPs aim to be as transparent as possible, because everyone understands that VC is a risky business; only 1 in 100 startups will become a unicorn (a company that reaches a valuation of $1 billion).

Typical VC funds operate on a model called 2/20. This means that the GP takes 2% of the total LP investment per year for operational purposes (mostly salaries, partnerships, agreements, legal, etc.).

In addition, the GP takes a 20% fee for each successful investment they make, which is also called "carry". This means that if the total return on investment (ROI) equals $1 million, the LP will receive $800,000 and the GP will receive $200,000 as a success fee for their work.

It is worth mentioning that most VCs are not very good and they will not bring in that many returns. But why do LPs continue to invest in them?

The venture capital business is mostly about illiquid assets that are not correlated with other assets, so this can hedge risk with a small portion of its total AUM (assets under management). Large institutions and high net worth individuals usually allocate 5-10%.

However, the right GP can bring significant returns. In 3-5 years, LPs can get 3-10x returns, which is usually not possible in other asset classes.

But how to stand out and make LPs choose you instead of other fund managers?

Pitching is an art, and the art gets better with each iteration

Yes, you want to invest in other startups, but at first you also have to raise money; otherwise, what are you going to invest in?

Raising money for your fund is a unique process because you can understand what it feels like to pitch to others because, at the end of the day, there will be others pitching to you.

The process is almost no different from traditional fundraising. However, there are some differences. First, if you are a crypto-native fund, you will only invest in crypto companies (otherwise, what's the point of a fund).

But LPs can be very diverse people. If you are raising money for a crypto fund, it doesn't necessarily mean you have to find LPs that are also crypto-native.

What you have to do is prove that you have the ability to bring them decent returns. For example, I have a friend who is a GP of a crypto fund, and his LPs include people from e-commerce, real estate, oil production, etc.

The plan is called a "fund thesis". This is really just some optimized parameters that make your investments more targeted and more efficient.

Some of these parameters include:

Investment stage. There are 6 investment stages: Pre-seed, Seed, Series A, Series B, Series C, Series D. Also, sometimes startups do "private placements", which is basically a fancy way of hiding what stage you are in. Focus on pre-seed, seed and private placements; they bring the best returns but also carry higher risk. It will definitely show if you are successful or not.

Value Added. This is probably the most important parameter. Most of the time, investors prefer smart money over “invest and forget”. So you have to bring something to the table. For example, a16z offers almost everything. They will help you with research, marketing, product development, hiring, etc. Decide what you (and your team) can bring to the table besides money, and focus on that.

Not surprisingly, most VCs don’t offer any value besides money, and this is often what separates the good VCs from the average ones. This is especially evident in bear and bull markets.

In a bull market, there are a lot of projects and a lot of capital. Everyone is going crazy (especially retail investors), and even the worst tokens can get you around 10x. VC funds have to fight for allocations for bad projects because the demand for tokens is quite high. This creates a situation where you can’t properly manage the risk/reward ratio because everything will grow anyway.

However, in a bear market, there are a lot of builders (because bear markets are great for building, it’s such a peaceful space), but not a lot of capital because almost nothing will grow.

That’s when a good VC firm is defined, because you really have to rely on a lot of metrics, the team behind the project, a sustainable token model, the technical solution, and the overall vision and go-to-market strategy. This sometimes requires more skills, experience, and even intuition!

So if you’re starting a business from scratch, it’s best to do it in a bear market or at the end of a bull market, so you’ll have less competition and more options.

People Matter — Who Should You Hire?

Yes, the team matters, just like anywhere. Human capital is the most important capital, so how do you hire a great team and who exactly should you hire? The answer to this question is simple and a bit “cliche”, but — hire people smarter than you to build a team that can outperform the market.

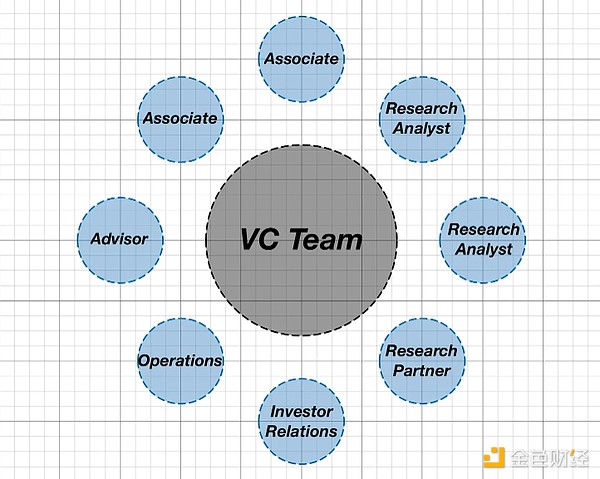

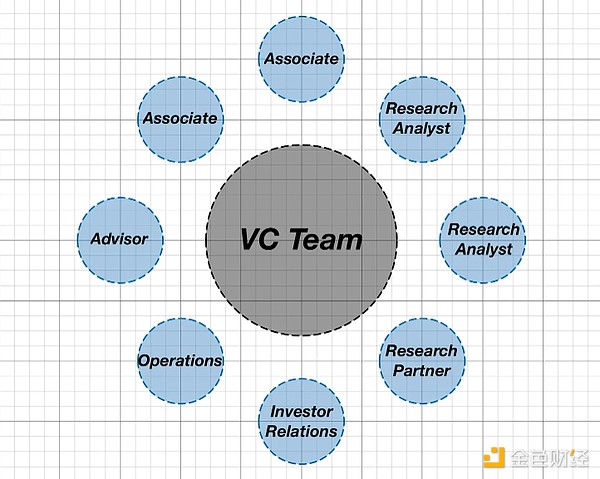

In most cases, venture capital teams are actually quite small; you don’t need more than 10 people to manage $50 million or more. Because the process is actually quite simple: find (or be found) startups → identify the best startups → invest → help the startups grow → sell your shares (tokens) → get returns.

But in reality, it takes a lot of experience and knowledge to perform each task in the best way. You obviously can’t do this alone, so your dream team looks like this:

Partners are responsible for almost all communication between VC funds and startups. These people usually do the initial screening of startups and provide feedback. They communicate before, during, and after the investment.

They also scout projects from any possible source: Twitter, alpha groups, local meetups, conferences, demo days, hackathons, etc. Partners also create deal flow partnerships between different VC funds, where entities share deals received from their network. This drives collaboration between funds.

Researchers typically do everything related to research: token economics, business models, technical solutions, markets, etc.

Researchers are also typically responsible for looking at the bigger picture and predicting trends and narratives. For example, you might research a project that could become one of your portfolio companies.

That's great, but for example, you can predict what the market will look like 6-12 months from now, and which companies could drive value there. So it gives you a better lens to look at the overall market situation, rather than a specific protocol.

Advisors provide expertise and strategic guidance to VCs and their portfolio companies. They typically work as part-time advisors.

Their responsibilities include sourcing potential investments, conducting due diligence, and providing strategic advice to portfolio companies. Advisors share networks and connect startups to key resources and potential partners.

IR (Investor Relations) specialists at venture capital funds typically attract and maintain investor relationships. They work closely with the firm's partners to develop and execute fundraising strategies, create investor materials, manage communications, and other tasks. They often handle media inquiries, prepare for investor meetings, and track investor sentiment.

Every component of the team is important, and a key task for the GP is to ensure the team is working together and achieving its goals (in addition to overseeing fund strategy and overall performance).

Organize Deal Flow and Strategy

Investing is hard, so we just let it flow? Well, it could have been that way... but, letting it flow is too easy. It's better to leave a legacy to get better performance so that you can improve over time.

What do I need to do to properly evolve over time?

1. Put each startup into a legacy table. Make a list of competitors, their performance, and valuations. A quick summary of each project will help a lot in the future when you have a database of 300+ startups to extract as many insights as possible.

2. Collaborate more with colleagues to explore the best strategy for finding projects. When you are well-known enough, you usually don't need to do anything - startups will find you on their own. However, when you are growing, you have to be everywhere. Sniper hackathons, demo days, early groups, etc.

3. Not only snipe, but also be flexible. If you see a startup that is not worth your attention, you can find it out in the first conversation, don't waste your precious time. If you find a startup that is too good, and you know they will close the round of financing soon - be as flexible as possible to get the best deal.

4. Increase your exposure online. For online content, publish articles that focus specifically on topics that your fund is interested in. For example, Paradigm did a lot of research on MEV and eventually invested in Flashbots (a research and development organization established to mitigate the negative externalities caused by MEV).

What to pay attention to when investing?

There are countless indicators you can rely on when investing or choosing the right project to invest in, but when you have a protocol in hand and the only question is whether to invest or not, there are a few parameters you should probably look for.

Token Economics. Study inflation rates, emissions, payments to stakers (if that’s the case). The point is to avoid selling pressure and understand some strong mechanisms of the token to incentivize people to keep buying.

Technical/Fundamentals. This is probably the hardest subject to research. If you have a very complex project — you should find someone with expertise to outline what you should look for. It’s easy to analyze a collection of NFTs, but it’s much harder to understand the mechanics of a separate L1 blockchain or a developer SDK.

Competitors. Look for competitors of the protocol you might want to invest in. How are they performing? How much market share do they have? How are they different? Are they better or worse? In what respect? By comparing them, you can learn more about the project you’re researching.

Ecosystem. Usually, most protocols are based on only 1 ecosystem: Ethereum, Solana, some Layer 2, Cosmos, etc. The goal here is to see if a particular protocol fits into the ecosystem. For example, someone might build some farming protocol on Optimism. But there is no reason to do so, because Optimism is not focused on DeFi. You have to look for such moments to make sure that the protocol can find its PMF (Product Market Fit).

Investor research. If a project is doing its second or third round of financing, then they already have backers before. You can research the backers, and they are usually divided into tiers, the smaller the tier, the better. For example, Multicoin is considered tier 1, and it is one of the best VCs in the crypto space, while Outlier Ventures is about tier 4. You can check out some funds in this table.

Team. Make sure all team members have relevant experience and vision to build a successful project. Do they know what they are talking about? Are they smart? Do they fully understand the proposition? Would you feel comfortable if you were on the same team with them?

There are many more parameters like sentiment analysis, on-chain analysis, partner analysis, differences between pre-IPO and secondary markets. The tip here is to try investing unless there is evidence that the investment looks bad.

So find the parameters and indicators that prove that this could be a good investment. If you can't find any parameters and indicators, then it really could be a bad investment.

Summary

Starting your own venture capital fund can be painful at first because setting up operations and processes is always stressful. If you have moved from one city to another, you will understand what I am talking about. But it will get better in the end.

The goal here is to return the fund, for example, if the total capital you want to invest is $100 million and your average check is $1 million for 10% of the protocol, then it only takes one unicorn for your share to be worth $100 million so that you can return the fund to the investors.

Remember, investing is an art, pitching is an art, communication is an art, and research is also an art. Keep practicing until you and your fund become one of the most famous artists.

JinseFinance

JinseFinance