Author: [email protected]

Data source: BNB Coin Dashboard (includes Ethereum data only)

In the world of cryptocurrencies and digital assets, token analysis plays a vital role. Token analysis refers to the process of delving into data and market behavior related to a token. This is a detailed process that involves a thorough examination of the price and liquidity associated with these assets.

Through token analysis, we can obtain investment decisions on market trends, risk factors, trading activities and capital flows.

BNB, or Binance Coin, is the native cryptocurrency of the Binance exchange, the world’s largest exchange by trading volume. It is vital to the Binance ecosystem, making transactions more efficient and providing benefits to users. As an ERC-20 token running on the Ethereum blockchain, BNB is versatile and supports token creation, trading, and investing on the BNB chain.

How to analyze Binance Coin?

Token analysis is crucial. Generally speaking, what are the key indicators to consider?

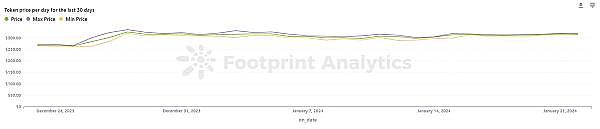

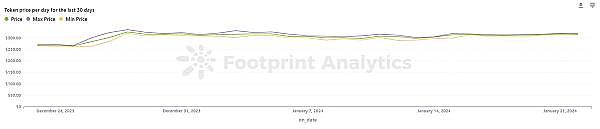

BNB Token price per day for the last 30 days

Token prices, measured in both fiat and cryptocurrency forms, are a key metric for assessing the health and potential of the token market. As of January 22, the price of BNB coin was $317.24, up approximately 17.68% from the previous month. Analyzing this price trend through diagnostic analytics can provide insights into the coin’s performance and potential predicted trends.

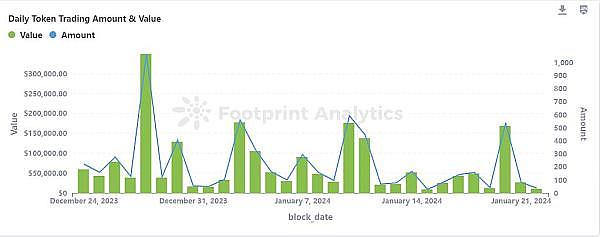

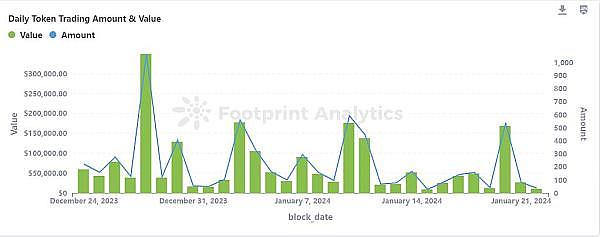

BNB Daily Token Trading Amount & Value

Token trading volume is a key indicator of market activity. Currently, the coin’s trading volume is around 45.22. The analysis uses a variety of data analytics to show a trend of declining activity, reflecting current market sentiment and potential changes in market capitalization.

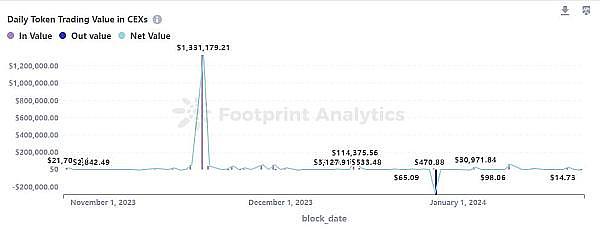

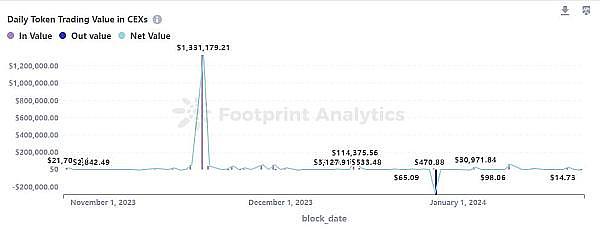

Daily token transaction value in CEX

Analyzing the net flow of tokens to and from centralized exchanges (CEX) can provide insights into investor behavior. The significant net inflow of tokens into centralized exchanges challenges the prevailing view of the move to decentralized platforms. This highlights the solid investor confidence in centralized exchanges, which is exactly the opposite of what might be expected in an increasingly decentralized digital asset environment.

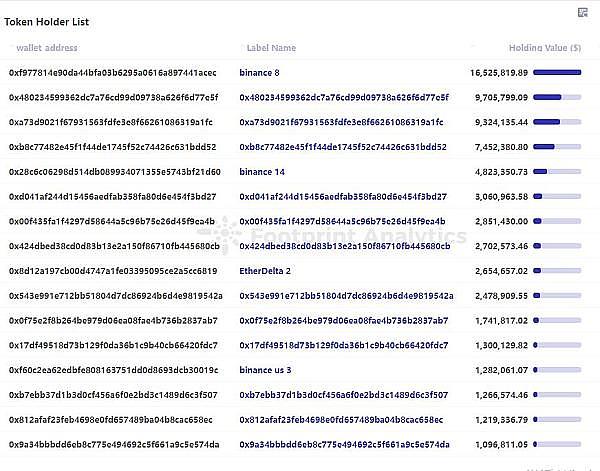

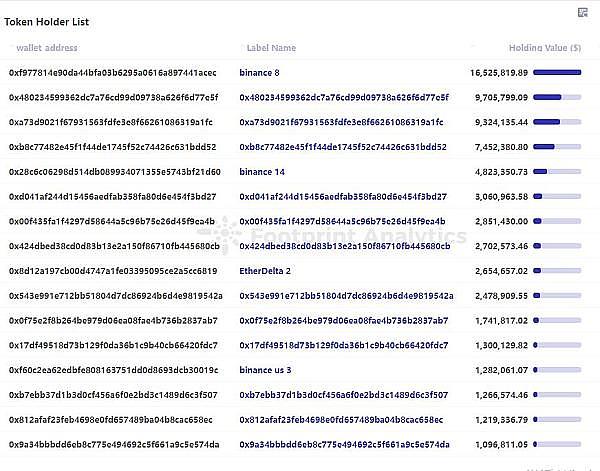

Figure: List of token holders

Token concentration

< /li>

Analyzing token concentration is critical as it reveals key insights into market integrity and vulnerability to manipulation. By analyzing a token’s distribution among its top holders, we can gain insight into the influence of whale investors and the overall health of the token market.

Sanya

Sanya