Author: [email protected], compiler: [email protected], data source: USDC Token Dashboard (only includes Ethereum data)< /p>

In the world of cryptocurrencies and digital assets, token analysis plays a vital role. Token analysis refers to the process of delving into data and market behavior related to a token. This is a detailed process that involves a thorough examination of the price and liquidity associated with these assets.

Through token analysis, we can obtain investment decisions on market trends, risk factors, trading activities and capital flows.

USDC is a stablecoin backed by U.S. dollar credit. It was launched in 2018 by ConsenSys, a company founded by fintech companies Circle and Coinbase. USDC is quickly making a name for itself in the digital currency world due to its stability and security in the volatile world of cryptocurrencies.

USDC tokens are fully backed by U.S. dollars and holdings of U.S. dollar-denominated assets. This ensures a 1:1 peg to the US dollar. USDC is one of the most transparent and trustworthy stablecoins, as every USDC token in circulation has a corresponding amount of U.S. dollars in reserves.

How to analyze USDC?

Token analysis is crucial. Generally speaking, what are the key indicators to consider?

Token Price Analysis: Understanding Market Cap and Price Fluctuations

USDC’s goal is to maintain a stable value pegged 1:1 to the U.S. dollar. This is accomplished through a reserve system, where every USDC token in circulation has a corresponding amount of U.S. dollars in reserve. This ensures that the price of USDC remains stable, making it an attractive option for those looking to avoid the price fluctuations associated with cryptocurrencies such as Bitcoin or Ethereum.

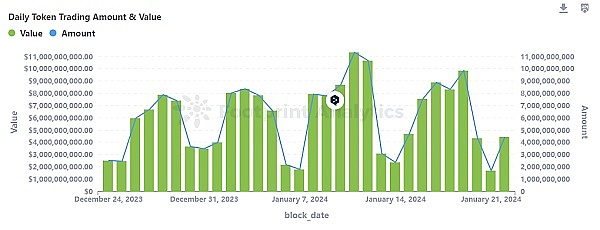

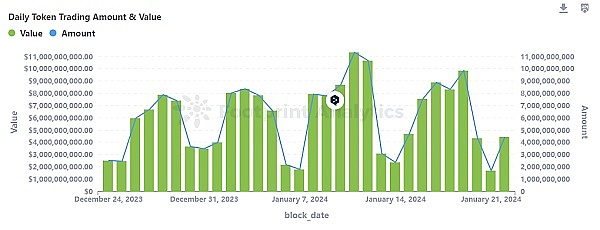

USDC Daily Token Transaction Amount and Value

Transaction Value Insights: Crypto Analysis Diagnostic Tools in

Token trading volume is a key indicator of market activity. Currently, the coin’s trading volume stands at $2.3 billion.

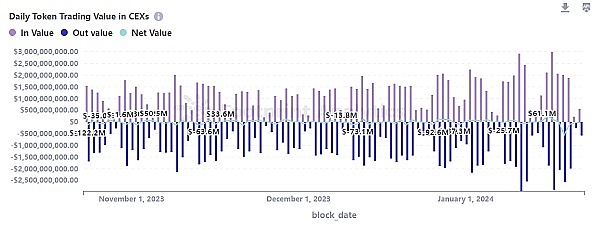

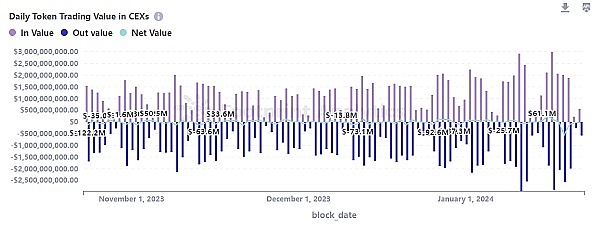

USDC’s daily token trading value on centralized exchanges

CEX Net Flow Analysis: Identifying Investor Behavior Trends

In order to gain a deeper understanding of investor behavior, it is crucial to analyze the net flow of tokens between centralized exchanges (CEXs). Trading activity and investor interest declined as more USDC left exchanges rather than entering them. This suggests investors are keeping the tokens in personal wallets, which could hint at selling intentions. This could signal cautious or pessimistic market sentiment, with investors waiting for better conditions or feeling uncertain about the market's immediate future.

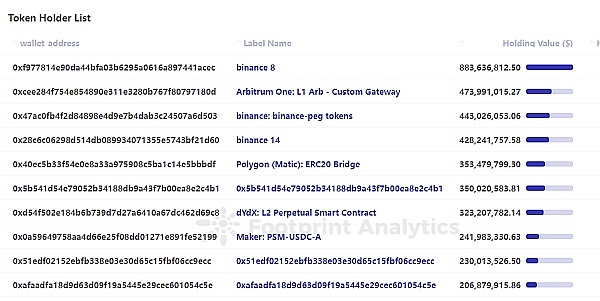

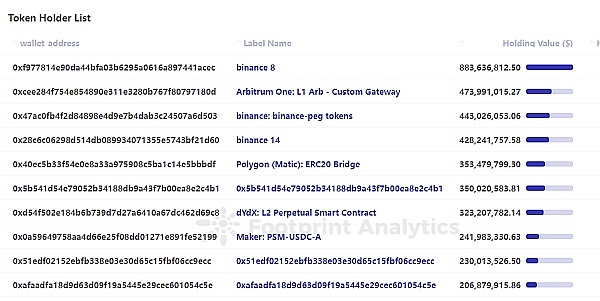

USDC token holders list

Token concentration: descriptive analysis Methodology

Analyzing token concentration is critical as it reveals key insights into market integrity and vulnerability to manipulation. By analyzing a token’s distribution among its top holders, we can gain insight into the influence of whale investors and the overall health of the token market.

JinseFinance

JinseFinance