Author: Gryphsis Academy Source: medium Translation: Shan Oppa, Golden Finance

< p style="text-align: left;">Since the birth of the Telegram Bot field, the transaction threshold has been greatly reduced, and on-chain transactions can be easily conducted on mobile phones. The existence of Telegram Bot as an "on-chain broker" has driven a strong increase in the token prices of many projects, thus leading a wave of Telegram Bot craze. This series of articles will provide an in-depth analysis of the Telegram Bot track and is divided into two articles. The first is a summary of the track overview, and the second is a summary of in-depth analysis of the project.

1. Track Overview

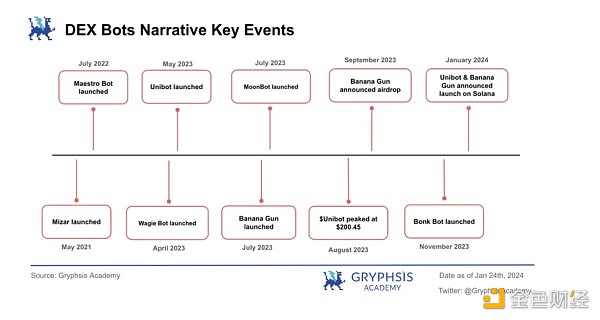

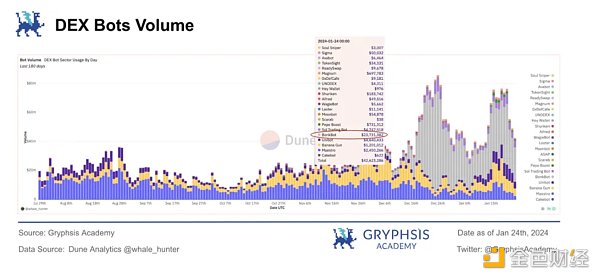

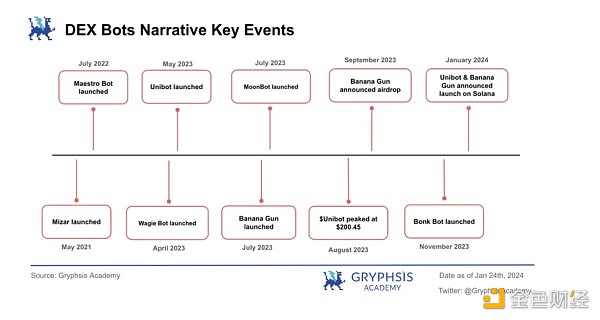

Since the birth of Telegram Bot space, we have witnessed many The project’s token prices rose strongly. Especially for Unibot, its price has been rising rapidly since July 2023. Unibot’s token price rose from a low of $3.13 in May to a high of $200.45 in August, according to CoinGecko data. That’s almost 100x growth, leading to the Telegram bot wave. However, as the popularity of the Unibot waned, the Banana Gun emerged. After the airdrop was announced in September, its token price climbed from about $9 to $18. Although its rising momentum is not as strong as Unibot, Banana Gun still maintains a certain degree of popularity for the Telegram Trading Bot ecosystem.

p>

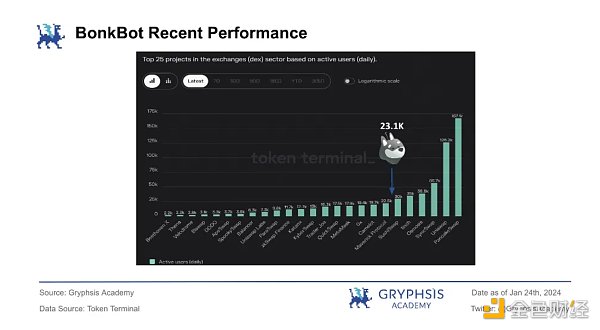

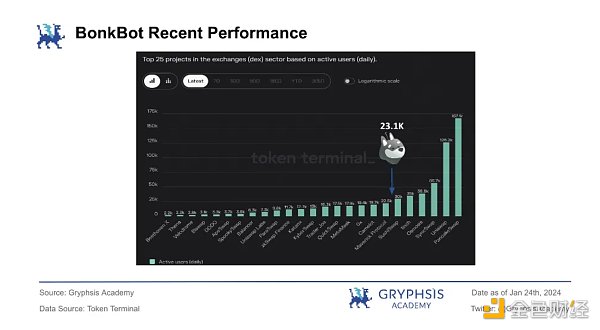

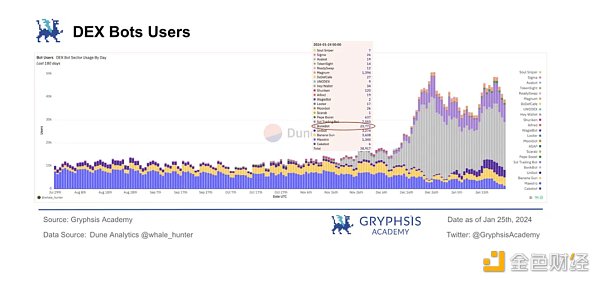

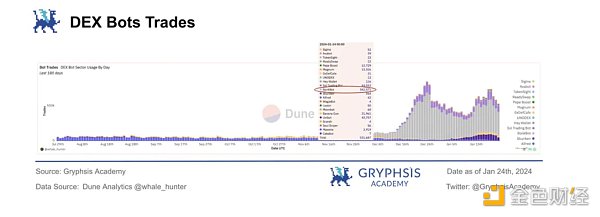

An emerging force worthy of attention is BonkBot based on the Solana chain. Its daily active users have reached approximately 35,700, not only surpassing mature projects such as Banana Gun and Maestro, but also performing particularly well compared to the decentralized exchange field. In the field of DEX competition, BonkBot’s seven-day average daily user volume is second only to sushiswap, and ahead of established projects such as Maverick Protocol and Trader Joe. This craze is undoubtedly due to the recent popularity of the Solana ecosystem, coupled with users' enthusiasm for memecoin transactions on Solana, which further promotes BonkBot's trading activity.

BTCBot.pro, as the Telegram Bot of the BTC ecosystem, has been online for nearly a month. Due to the particularity of the BTC ecosystem, BTCBot.pro also provides users with Telegram Bot functions that are different from those on the ETH and Solana chains, which is worth studying.

Looking at the world of Telegram trading bots, it is clear that this is not a flash in the pan phenomenon. However, the landscape in this field is constantly changing, and this article aims to sort out the current macro situation of Telegram trading bots and highlight some projects worthy of attention.

p>

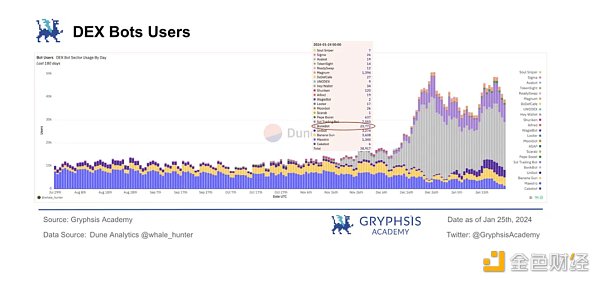

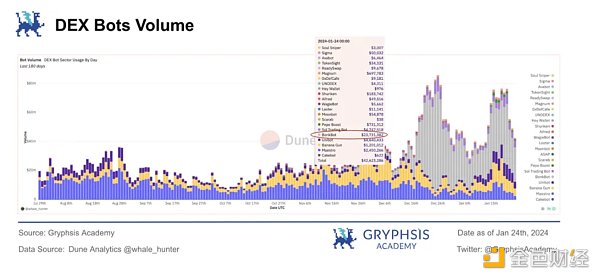

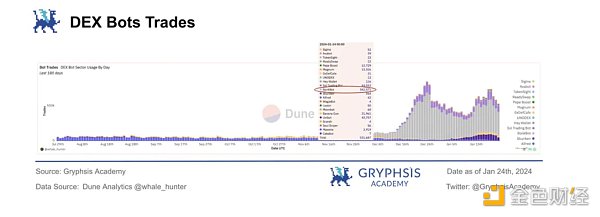

According to the above data analysis, since its launch, BonkBot has led other trading robots on the market in terms of transaction frequency and number of users. Especially in terms of transaction frequency, BonkBot's performance is significantly higher than Banana Gun and Maestro Bot, and its transaction frequency is approximately 10 times that of them. This outstanding result is due to BonkBot’s efficient design on the Solana chain, which is known for its high TPS and can support more frequent transaction processing. Meanwhile, with the recent rise of Memecoin in the Solana ecosystem, BonkBot has solidified its dominance in the Telegram trading bot market.

Learning from the success of BonkBot, a similar Sol-like trading robot was launched on Solana. It has caught up with projects like Banana Gun and Maestro Bot in transaction volume, and even surpassed them in transaction frequency and daily active users.

As for Unibot, existing data shows that its market advantage has weakened. Even so, it is worth noting that the project has begun to be deployed on the Solana chain, which has also slightly boosted its transaction volume trend. Apparently, projects using Solana as infrastructure could be the key to launching the next wave of Telegram trading bots.

Despite Solana Bot's performance, it shouldn't be overlooked that Banana Gun was performing well before the Solana craze, lagging behind BonkBot on several key metrics.

2. Historical evolution

With the booming development of the cryptocurrency industry, Telegram Bot as An intelligent trading tool that is gaining more and more attention from the cryptocurrency community. As early as 2017, Telegram Bot already had the ability to automatically reply to messages and execute user instructions. With the rise of the cryptocurrency industry, Telegram has become the most commonly used instant messaging tool among cryptocurrency enthusiasts. Against this background, trading robots based on Telegram are gradually emerging. It can realize automated operations such as token exchange, follow-up trading, data analysis, automated airdrop trading, and asset cross-chain.

p>

3. Market structure

Telegram trading bot is an automated system within Telegram that helps users go Centralized exchanges execute trades. Users interact with these bots through the app’s messaging interface.

Different Telegram trading bots offer unique features, but most come with common trading features, including stop-loss and take-profit orders, copy trading, and multi-wallets support.

These bots replace the user interface (UI) and user experience (UX) of Web3 wallets and DEXs, simplifying the complexities of buying and selling decentralized cryptocurrencies. process.

These bots utilize advanced algorithms and infrastructure to conduct fast transactions and are often referred to as "Uniswap snipers." They meet users' needs for transaction efficiency and convenience. Although what all these robots have in common is fast trading speed, they all differ in their segmented functionality. For example, UniBot offers features such as limit orders and mirror sniping, SwipeBot focuses on ease of use, and OxSniper has features such as anti-MEV protection. The following are the main uses of the trading bot:

Buying and selling tokens: The trading bot is integrated with the Telegram platform, and users only need to copy and paste the contract address into the message box. Get tokens easily. Some bots provide real-time updates of trading profits and losses and accelerate token sales by enabling pre-approved trades.

Set stop-loss orders: Users can use these Telegram trading bots to set stop-loss and take-profit orders, allowing trades to be automatically executed based on preset parameters. This feature is particularly suitable for trading new tokens that have not yet been listed on CEX, but trading such tokens is risky.

Anti-escape monitoring: Some Telegram trading robots have anti-escape and anti-MEV functions. If a token developer plans to run away, the anti-runaway feature identifies upcoming mempool transactions and quickly executes the sale to prevent runaway scams. Anti-MEV functionality directs purchase transactions through private relays, ensuring purchases are not broadcast in the mempool, preventing MEV or sandwich attacks.

In addition, the trading bot is able to detect upcoming malicious transactions by developers. If such transactions result in the token becoming unsaleable, the token will be considered a scam. The robot will quickly close your positions to avoid falling into a scam.

Following transactions: Users can automatically track transactions at a specific wallet address through a specific Telegram Bot. This type of robot acts as a bridge between the user's account and the chosen trader, executing trades based on the signals of the copy trader. However, it should be noted that copy trading involves liquidity risks. Lack of market liquidity may make it difficult to execute trades, thereby increasing transaction costs.

Sniping: Some trading robots can perform liquidity sniping, method sniping and multi-wallet sniping. Liquidity sniping is a buying operation that is automatically executed when the bot detects an increase in liquidity. Method Sniping automatically executes purchases based on the "Method ID" of the developer's pending transaction. Users can also use multiple wallets to snipe through Telegram trading bots.

Traders can create automated tasks through robots to achieve airdrop goals. Bots targeting airdrop mining often operate across multiple chains to identify promising airdrop opportunities. However, you should be cautious when participating in unverified airdrops to prevent scams.

4. Technical implementation path

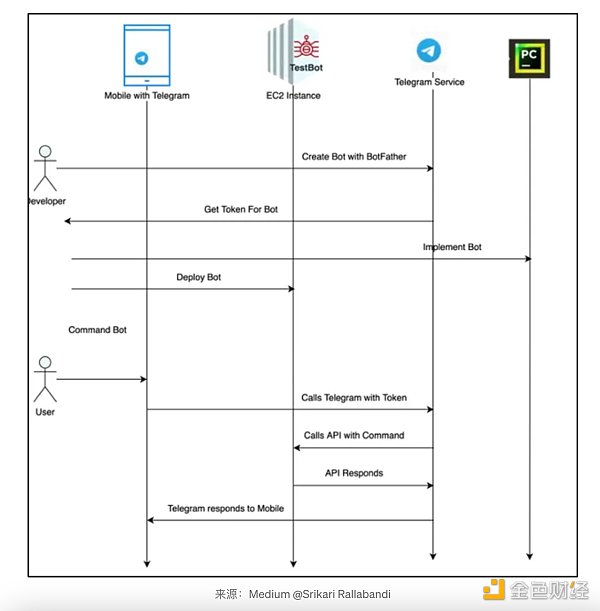

Telegram Bot function has existed for several years, but recently There is a lot of interest in integrating Telegram bots with Web3 technologies such as blockchain and smart contracts. Unibot is one of the leading platforms for bot development on Web3 Telegram, providing a set of tools and services to help developers create, manage, and organize bots that can interact with decentralized applications and blockchain networks.

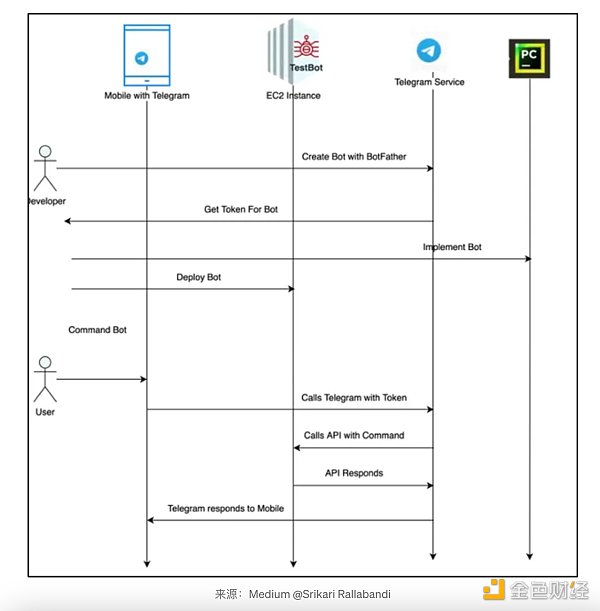

p>

Telegram bot is essentially a program that uses the Telegram bot API to interact with the Telegram system. Bots can be programmed to respond to messages, commands, and inline requests. To create a bot, you need to register in the Telegram system, which will provide you with a unique token. This token is used to authenticate the identity of the Bot in the system and send requests to the Bot API.

In terms of infrastructure, Bots run on servers, not on the user's device. This means they are always online and can respond to user messages instantly. The server can be a cloud server or a local machine, depending on the developer's preference.

5. Growth drivers

5.1 Popularity of cryptocurrency trading

Cryptocurrency trading is generally considered to have a common problem: the threshold for trading knowledge is high and trading is difficult to popularize. Compared with stock trading, cryptocurrency trading requires more basic settings, such as creating a wallet and completing KYC and other procedures, which brings certain obstacles to the public's investment in cryptocurrency. Secondly, even with a centralized exchange, the user interface is relatively complex and not simple enough compared to Telegram Bot.

Since the emergence of Unibot, the project has aimed to simplify the transaction process and focused on simplifying transaction operations to the greatest extent. All interactions are completed only by talking to the Bot, and fast Uniswap sniping is provided to achieve fast transactions and precise sniping. The convenience of Unibot is that users can trade through Telegram anytime and anywhere without relying on other trading platforms. This will go a long way in popularizing cryptocurrency trading.

Recently, the transaction volume of Telegram robots has surged, which just proves the market demand for this type of trading method. Especially for tokens that lack liquidity or are not yet listed on an exchange, Telegram bots can significantly increase their exposure. At the same time, this also adds more investment options for traders, forming a win-win situation.

5.2 Telegram carrier

As one of the most popular social software in the world, Telegram Day There are more than 55 million active users, which provides extremely fertile soil for the development of Telegram Bot. Due to its wide popularity and user base, Telegram is planning to transform into a super app similar to WeChat, supporting various mini programs running on its platform. This move not only enhances its functional diversity but also opens up new avenues for decentralized payments.

To realize this ambitious blueprint, Telegram is partnering with leading technology and cryptocurrency companies, including the TON Foundation and Tencent Cloud, aiming to expand Its global influence and accelerate the process of decentralization. This series of strategic moves highlights Telegram’s potential as a key super app for web3 in the future.

Telegram Bot built on such a powerful platform will undoubtedly be a beneficiary and is expected to transform Telegram's huge user base into a loyal user base of Bot, further strengthening Its influence in digital trading and cryptocurrency integration.

6. Risks

6.1 Asset security risks

When using Telegram Bots for cryptocurrency transactions, users need to bear the risk of asset security. These bots often require the creation of a dedicated wallet or connecting to an existing wallet. In both cases, the bot has access to private keys, leading to a security breach.

Private key access risk: These robots can access private keys, causing security issues. A private key is similar to a master key to a user’s digital wealth, and its exposure can lead to serious consequences, including theft and unauthorized transactions. Bot access to these keys significantly increases the risk of security breaches.

Challenges of self-custody: Delegating wallet creation and private key management to bots undermines the fundamental principle of self-custody in the cryptocurrency space to a certain extent. Moving from personal control to reliance on automated systems can lead to a false sense of security, leaving users vulnerable to mismanagement or even malicious activity.

Risk of asset mismanagement and unauthorized access: Telegram bots are often designed to manage assets without direct user supervision, thereby creating a risk for potential Poor management opens the door. Additionally, the lack of strong security protocols can lead to unauthorized access, whether through security flaws in the bot itself or through external threats.

To mitigate these risks, users are advised to conduct due diligence when using Telegram Bot for cryptocurrency transactions. This includes thoroughly researching the bot’s security features, avoiding storing large amounts of assets in wallets accessed by these bots, and regularly monitoring trading activity for any signs of unauthorized behavior. Although Telegram bots provide convenience and efficiency to transactions, they also pose significant risks to asset security. Users must remain vigilant and take proactive steps to protect their digital assets in this evolving field.

6.2 Risks of lack of code auditing:

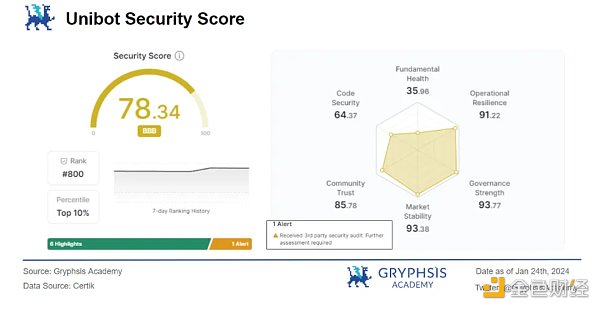

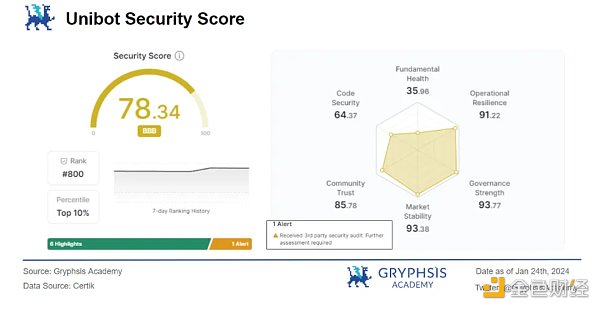

For Telegram bots, failure to conduct Comprehensive, regular security code reviews may increase the risk of vulnerabilities being exploited. The lack of auditing results in a lack of transparency and oversight, putting users’ assets at risk. Take Unibot and Banana Gun as examples. According to Certik's data, these two projects have not undergone Certik's code audit, so users need to bear the risks related to smart contracts.

p>

Because the project failed Certik's code review and KYC review, it scored low in "code security" and "basic health".

There has been a case of banana gun before. Less than 3 hours after the token went online, the currency price fluctuated violently. The price plummeted from a peak of $8.7 to just $0.02, almost close to zero.

In response to this abnormal market performance, the Banana Gun team explained through an official announcement that there was a serious error in the token contract and the team was unable to fix it. They added that although the contract had been audited twice, no errors had been found. This incident also confirms the risks caused by failing to pass code review.

p>

Unibot chose a less recognized third party to conduct code review and did not conduct KYC review. This situation may affect the credibility and security of the project, as less well-known audit firms may not be able to provide the same level of audit quality as more prestigious institutions. At the same time, the lack of KYC audits also increases the risk of transactions with anonymous or opaque entities.

6.3 Fierce competition

In the fiercely competitive Telegram Bot ecosystem, the market entry threshold is relatively high It is low and easy to be imitated and copied, leading to serious homogeneity among projects. In such a competitive landscape, a single Bot may face the challenge of user loss, so establishing strong competitive barriers becomes a key element. This means that projects need to have unique advantages to prevent competitors from encroaching on the market.

Take Bonkbot as an example. Its popular position in the Solana memecoin field is mainly due to its market pioneer status. However, user loyalty in this area is generally low and they are more likely to choose services based on product performance and potential benefits rather than brand loyalty. This means that users will quickly switch to other platforms once better trading conditions or more attractive opportunities arise. This is a key reason why platforms like Unibot or Maestro Bot fail to stay ahead of the curve.

In summary, although the Telegram Bot field as a whole shows good growth potential, this does not mean that every project can stand out from the competition. Therefore, investors need to be aware of the potential investment risks of each project when getting involved in this field, and be aware of the unpredictability of this market.

7. Summary and Outlook

7.1 Solana ecosystem Telegram Bot competition intensifies

Market saturation and leader formation: As competition among Telegram Bots in the Solana ecosystem becomes increasingly fierce, the participation of well-known projects such as Unibot and Banana Gun has made the market more saturated. Only a few projects can survive in such an environment, which requires each project to develop a unique roadmap and value proposition.

Personalization and innovation: Projects must stand out through personalized services, technological innovation, or better user experience to attract and retain users.

7.2 The cryptocurrency market enters a bull market

Influence of policy and market sentiment: Benefit from favorable policies News, the cryptocurrency market is gradually entering a bull market. This will attract more retail investors to the market and help popularize tools like Telegram Bot.

Market Positioning and Popularity: Given that Telegram Bot’s goal is to simplify the cryptocurrency trading process, as retail investors enter the market, their impact on the average Web 2 user attractiveness will increase.

7.3 Ordinals Inscription Market and Bitcoin Telegram Bot Development

Positive trends in the Bitcoin market : The Ordinals market is benefiting from positive Bitcoin trends and news and is expected to grow further.

Initial Market and Opportunities: As the Bitcoin Telegram bot market is still in its early stages, we remain optimistic about future development. This offers huge opportunities, especially for projects that can quickly adapt to market needs and innovate their services.

Overall, although the market competition is fierce, it also means that there are a lot of opportunities. It is important for the Telegram Bot project to identify and capitalize on these trends while continuing to innovate and improve to remain competitive and attractive in the market.

JinseFinance

JinseFinance