Author: Sirius & Joe

Social products have always been a controversial field. Whether in the traditional Internet or on the chain, there are endless debates about social applications. As Marx's famous saying said, "Man is the sum of all social relations." By abstracting the underlying logic of social products, we can get the following logic: the core of a social product is to help users establish certain social relationships, generate interactions, transmit information, and expand their own social networks on this application. This is considered a successful social product.

Therefore, based on different forms of social networks, countless familiar products have appeared in the traditional Internet, such as Facebook, WeChat, Soul, etc. They build social networks for various social scenarios such as acquaintances/strangers/campus, which are social products in the traditional Internet.

For Web3 social products, due to the characteristics of financialized asset issuance, the social network has added the characteristics of "Fi". How to issue assets based on social networks, or how to build social networks through assets, is the core point of the web3 SocialFi project, and the decentralized anti-censorship liberal ideology has put forward higher requirements for the project party in terms of content control. Therefore, the SocialFi track is also the most difficult product to build among all Web3 products.

In this article, we will analyze several SocialFi products that have developed well on the market, Farcaster, FriendTech, UXLINK and CyberConnect as examples, and explore the growth path of SocialFi products.

From the number of user addresses to the value of assets, how to determine the real growth of SocialFi?

In the previous article, we mentioned that the core of SociaFi lies in the combination of social networks and assets. Whether it is issuing assets based on social networks or building social networks based on assets, it is the fundamental logic of SocialFi products. Next, we will analyze the above-mentioned products from the two levels of social networks and asset issuance, and then select indicators from various dimensions of these products for comparison.

Social Network Form

The social network topology in Farcaster is the same as that in Twitter, both of which are attention-based social networks with a relatively open network; FriendTech is a refined and enhanced version of Twitter's social network, and its form is a closed network with a single node as the core; compared to Farcaster and FriendTech, which inherit Twitter's online social network with attention as the core, UXLINK's network form focuses on real-world social networks and brings acquaintance social interaction onto the chain; as for CyberConnect, it forms a social network through on-chain activities.

Asset issuance layer

Farcaster positions itself as the basic layer of social networking. Relatively speaking, it does not have a strong "Fi" attribute, but has a stronger community cultural attribute. On this basis, the core asset $degen is generated; FriendTech v1 takes the attribute of asset issuance to the extreme, creating the Ponzi flywheel through the design of Bonding Curve. Each KOL's social network is endowed with asset bubbles. The value of Twitter's social network is fully reflected by the liquidity of the room key. UXLINK is more balanced than the previous two. The design of the dual-token model is more stable and healthy for the entire system, and can more continuously motivate users to create value in social networks. CyberConnect is governed only through its own native tokens, and relatively lacks incentives for social network expansion.

After the qualitative analysis, we need to start quantitative analysis. We first select basic indicators at the social level and asset level to make judgments. First, at the social attribute level, we select the number of active users of the protocol as an indicator; and at the asset level, we select the market value of the core assets of the protocol as an indicator.

Social attributes

Number of active addresses of the protocol

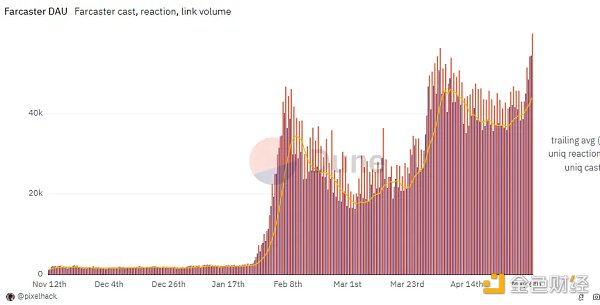

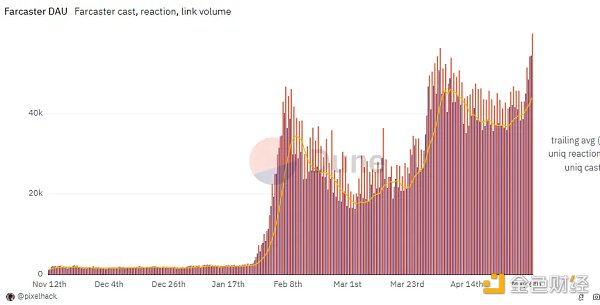

Farcaster's DAU began to grow rapidly in February of this year, and after a decline in March, more new users poured in

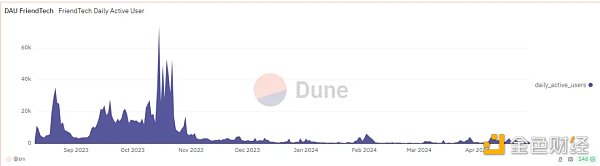

FriendTech

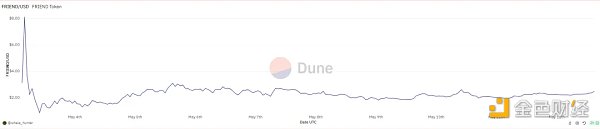

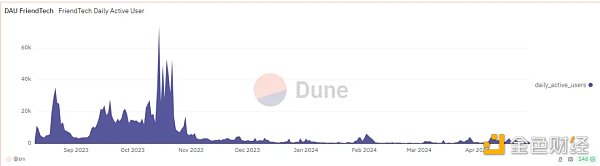

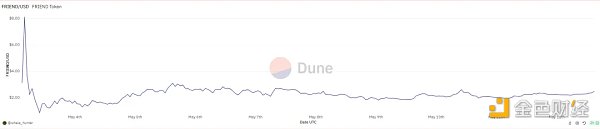

In the v1 version of FriendTech, users actively obtained points in order to win airdrops. From the end of last year to April this year, due to the delay in issuing coins by FriendTech, user confidence declined and users lost. After the v2 version issued coins, most users chose to give up.

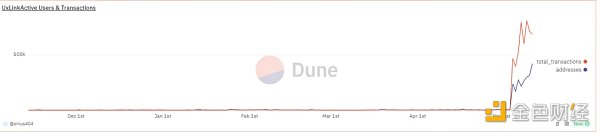

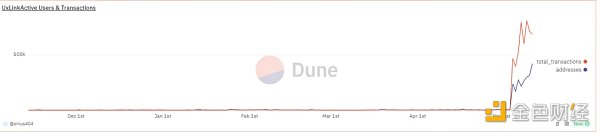

UXLINK's growth rate this year was extremely amazing. In May, the number of addresses reached nearly 500K, quietly reaching a user volume several times that of other protocols.

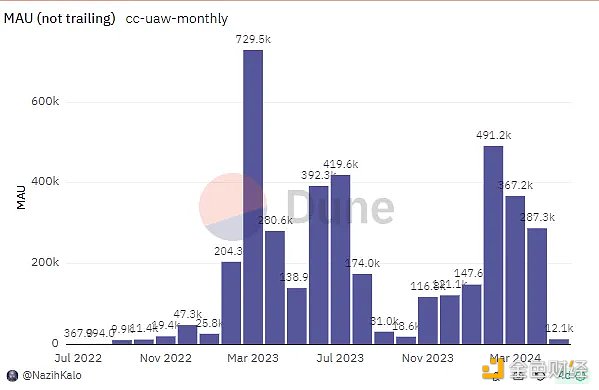

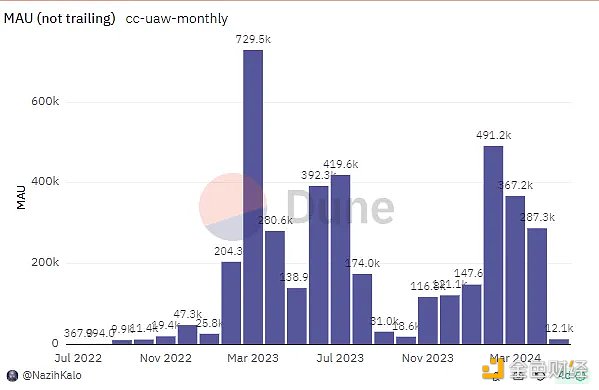

The number of CyberConnect users has seen a rebound in the first half of this year, but the momentum is relatively insufficient.

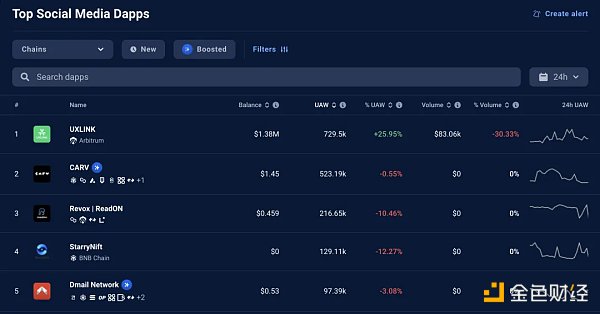

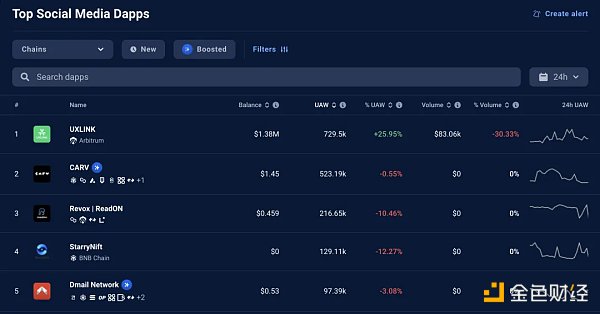

On the whole, UXLINK is undoubtedly the most popular blockchain social infrastructure at the moment, and its on-chain activity far exceeds that of the other three major competitors in the SocialFi field. According to UAW (Unique Active Wallets), UXLINK has 729.5k active wallets, ranking first among all Social Media Dapps.

In comparison, the UAW of the other three mainstream SocialFi products in the same period is much lower than that of UXLINK. Although this indicator mainly reflects the on-chain activity of each product in the short term, it also proves that the current Web3 social players' attention has been greatly attracted to UXLINK.

Asset attributes

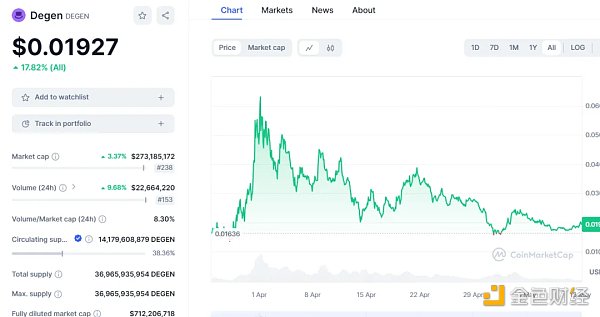

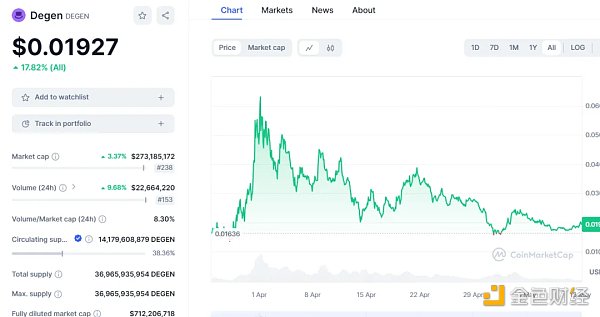

Farcaster's own asset attributes are relatively weak. Here, we select the community-fermented asset degen as the representative asset. In April, as the base ecosystem became popular, its price soared. Recently, as the ecosystem stalled, it fell.

18px;">FriendTech issued tokens in v2, and the token price was relatively stable after digesting the airdrop pressure.

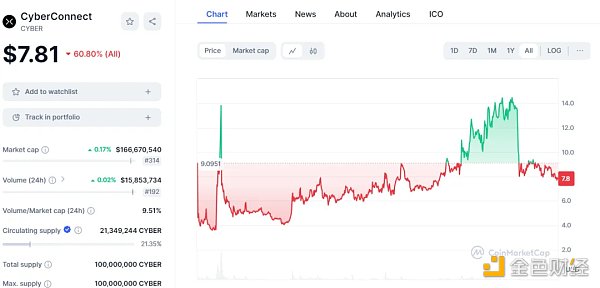

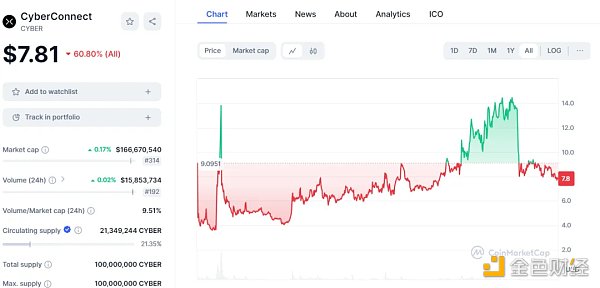

Cyberconnect tokens were issued for more than two years. In the first half of the year, the price increased with the hype of the track, and then fell back to a low point.

UXLINK has not issued assets yet, so it is not compared here.

On the whole, UXLINK ranks first among the current Web3 SocialFi products in terms of the number of users with its amazing social network expansion rate, while FriendTech uses its innovative asset issuance mechanism to attract players eager to make money.

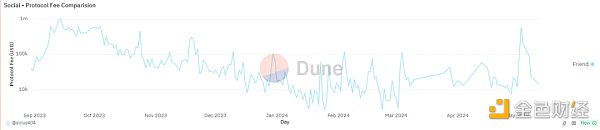

Deep factors behind the appearance: Positioning and focusing on the North Star indicator

If we abstract the behavior of users in social products, we can describe it in the following mode: "Users expand their social networks in the product and interact to complete information transmission." After adding asset attributes, the behavior can be expanded to complete asset transactions in addition to information transmission. In SocialFi products, the exchange of information is often accompanied by asset transactions, which brings the ecological activity of the entire economy. The product itself can also obtain benefits from the economic behavior in the ecosystem. Therefore, in this article, protocol income is selected as the North Star indicator to measure a social product.

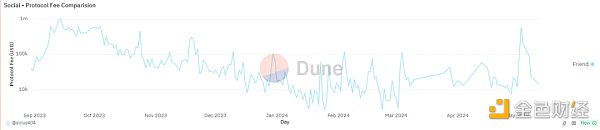

FriendTech peaked at launch due to its innovative asset issuance mechanism. As the popularity declined, the activity in the economy continued to decline. However, after the release of v2, the token airdrop and innovative club design raised the popularity again.

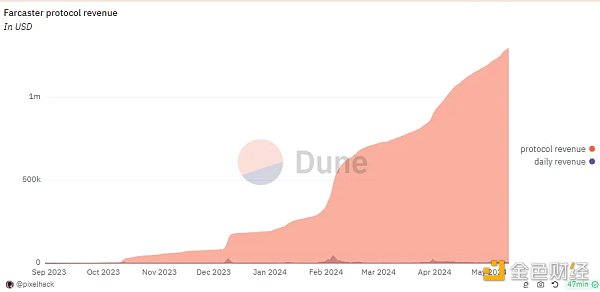

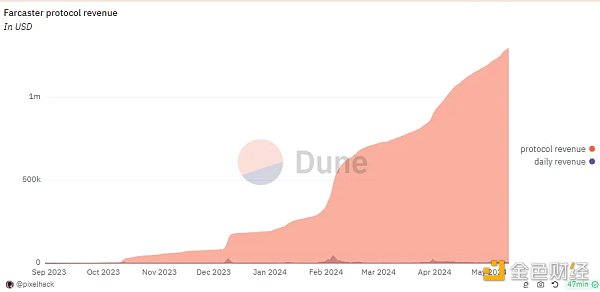

Farcaster has ushered in a wave of strong growth this year with the outbreak of the base ecosystem, and the influx of new users has brought an increase in protocol revenue.

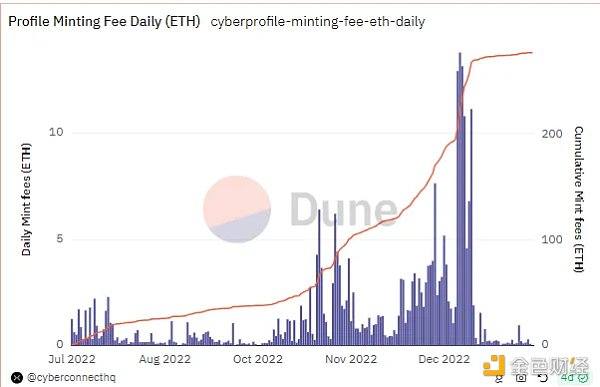

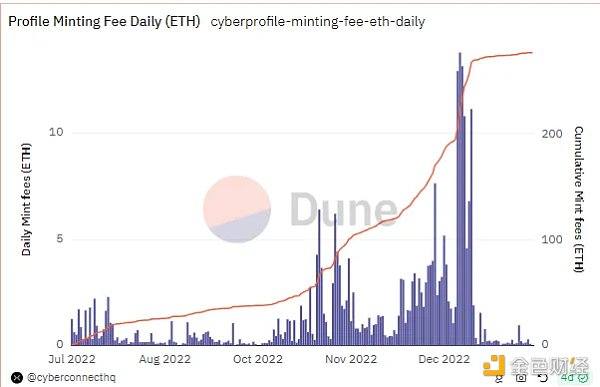

CyberConnect's revenue was close to zero after the airdrop, which shows that users do not have a strong real social demand for this product.

The UXLINK economy is relatively early, there is no data, and it is not listed here.

In SocialFi, if you have to choose between the "Social" and "Fi" attributes, then products with "Fi" as the core will win in the competition. After all, in Web3, transactions are the underlying needs of all users.

From the mapping of indicators to products, how should product design be optimized?

We can see that the rise of the above representative socialfi products is strongly related to the activeness of the economy and the issuance of assets. This also reflects that for web3 products, asset issuance is the first principle, and transactions are the underlying needs of users. All SocialFi products should think about how to embed users' transaction behaviors into the social network of their own products.

For CyberConnect, users did not have any trading scenarios in the product. The early users were active to meet the airdrop rules, not real social needs. This also explains why the economic activity of CyberConnect fell sharply after the airdrop.

For Farcaster, during the Ice Age, through the decentralized front end, many liberal users who disliked Twitter's censorship of speech retained the fire of rising again. At the same time, it was the base camp of the base ecology. With the rise of the base ecology, it was active as a high-quality alpha gathering place for the base chain.

For FriendTech, airdrops were used to attract users to engage in social activities in the early stage. In v2, it helped big Vs to create clubs and issue coins through influence to realize monetization, and brought tradable assets to ordinary users to maintain the activity of the economy. However, the trading behavior is relatively not obvious, and the Farcaster team itself seems to be downplaying the "Fi" attribute.

From the perspective of coin issuance, FriendTech and UXLINK are the most user-friendly and are most likely to have a wealth effect to attract users; from the perspective of social network form, Farcaster and UXLINK have relatively stronger social attributes, which can keep the entire economy resilient enough. Therefore, we can look forward to the performance of the two after they go online, and pay attention to the issuance of assets based on acquaintance social networks.

Catherine

Catherine