Original: Liu Jiaolian

Overnight, BTC continued to hold the 60,000-dollar line, breaking upwards for days against the pressure of the bears. BTC is about to enter the Q4 start-up season.

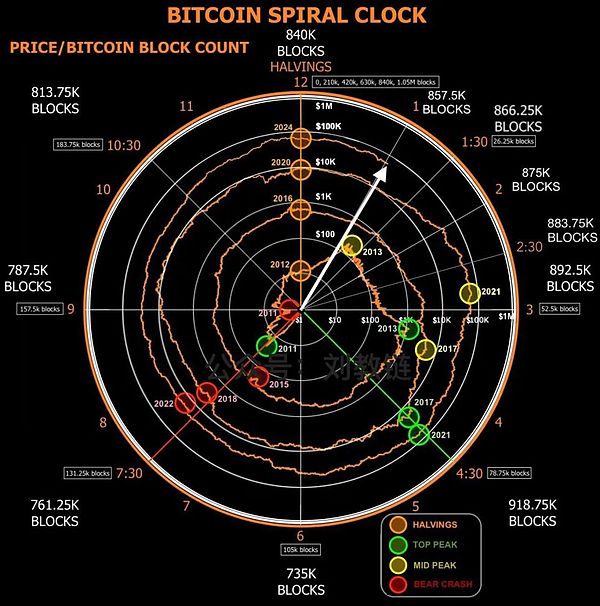

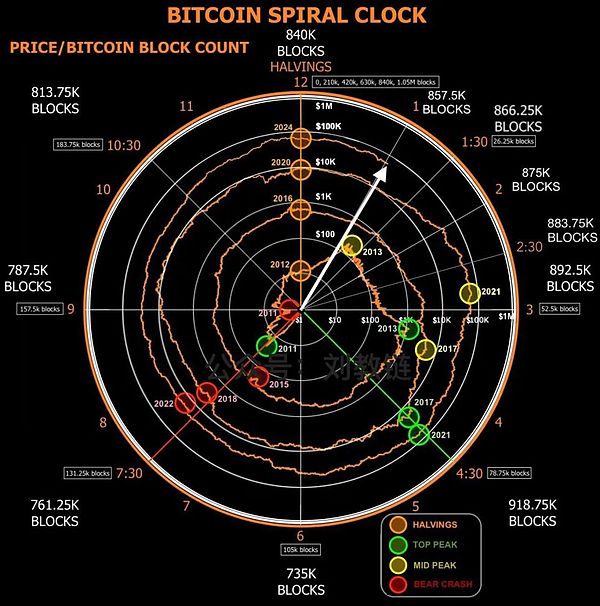

From the BTC clock, we have just passed 1 o'clock (see the picture below). Do you think the market will start after 1:30 (October), 2 o'clock (December), 2:30 (February next year) or 3 o'clock (April next year)?

Yesterday, a reader left a message saying that the US GDP has been developing in recent decades. Although it encounters an economic crisis every 10-20 years, it is still rising overall, and gold has failed to retaliate.

This reader may have forgotten that the growth of nominal GDP does not mean the increase of real wealth.

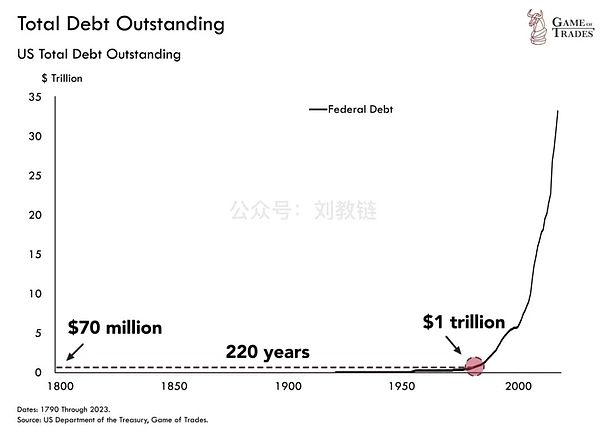

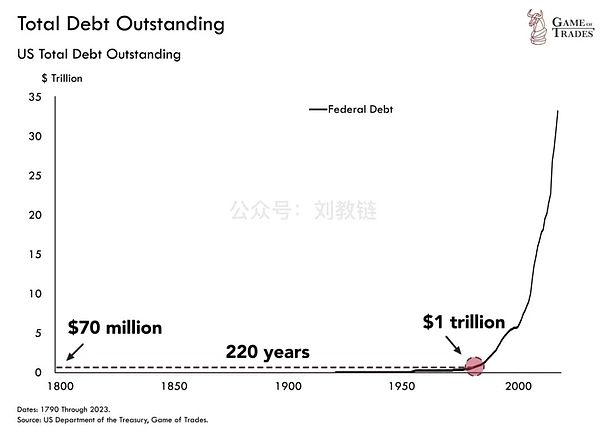

Since Nixon suddenly defaulted on the world in 1971, canceled the link between the dollar and gold, and tore up the Bretton Woods system, the dollar has been free and the US debt has completely lost control.

Previously, it took more than 200 years for the US debt to accumulate to 1 trillion US dollars.

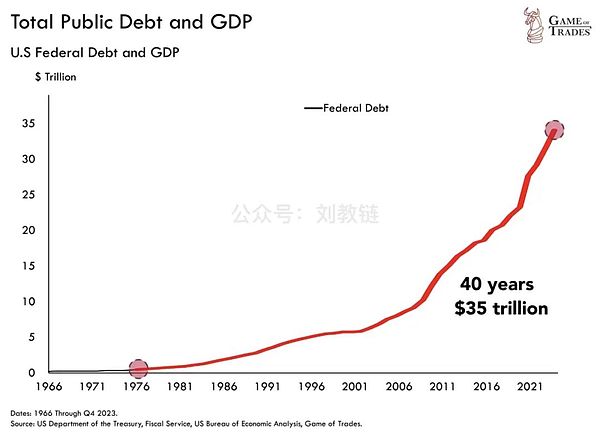

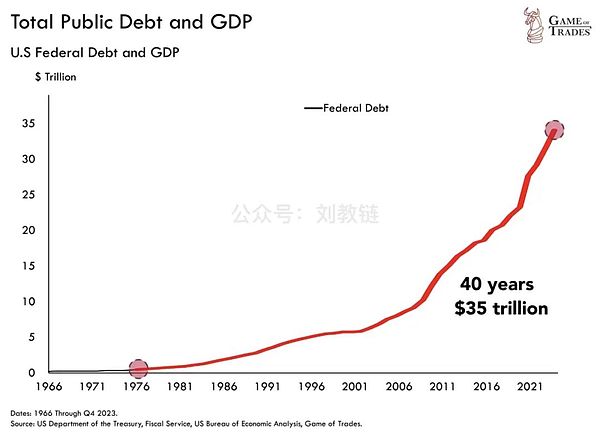

However, it took only 40 years to rapidly expand from 1 trillion US dollars to 35 trillion US dollars!

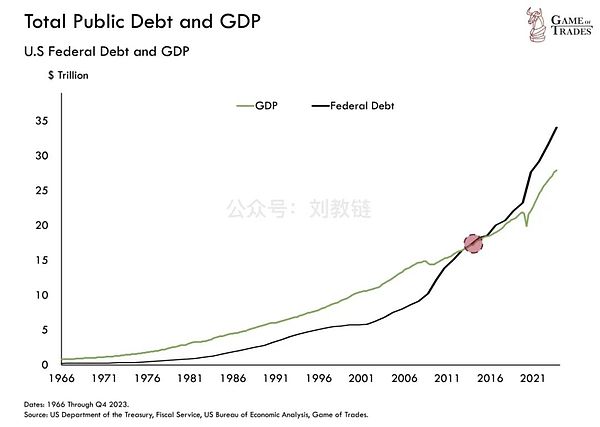

The US GDP, and the comprehensive national strength and even national destiny behind it, have already peaked and have been trading sideways at a high level for many years. It's just that under the rapid depreciation of the US dollar driven by macro debt, it has maintained a still considerable nominal growth rate. If it is priced in gold, all nominal growth will reveal its true colors.

Some even say that the starting point of the peak and decline of the US national fortune was September 11, 2001.

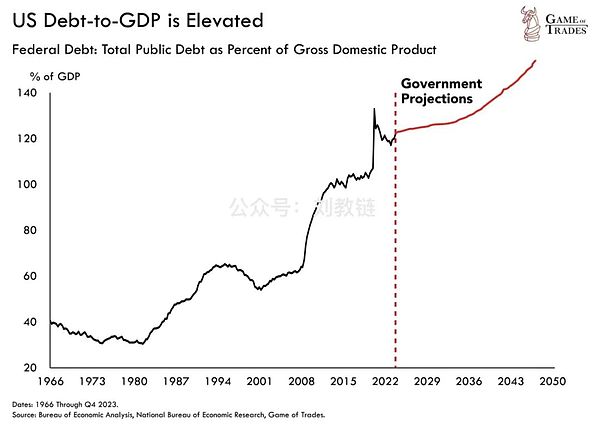

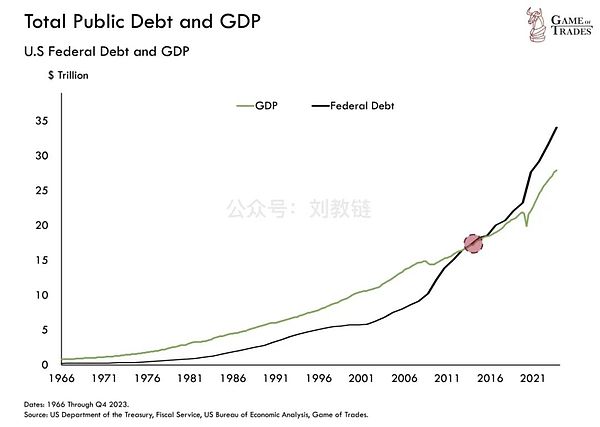

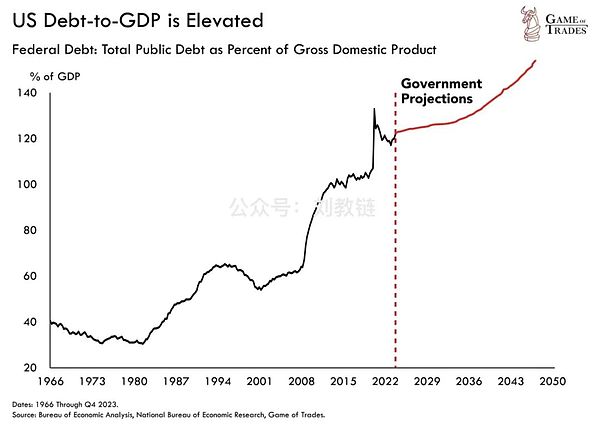

By 2015, the scale of US debt has permanently exceeded the total GDP.

The US debt-GDP ratio has exceeded 120%. It can only continue to rise in the future.

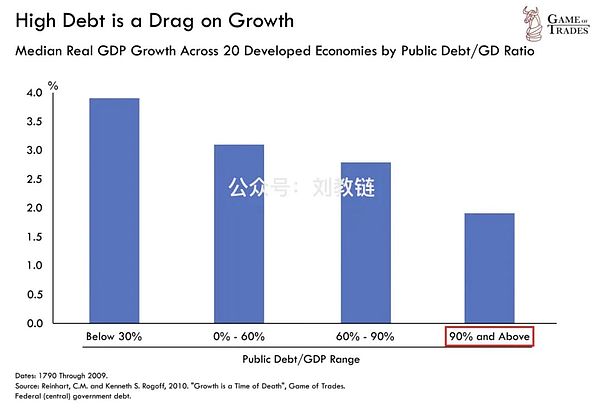

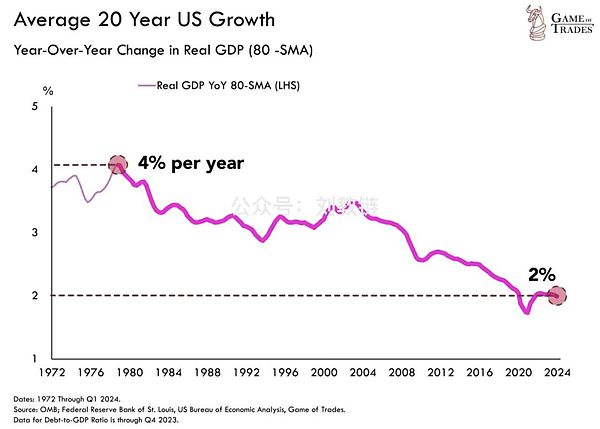

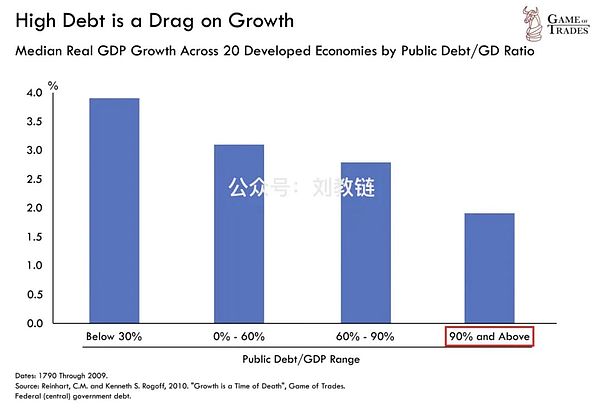

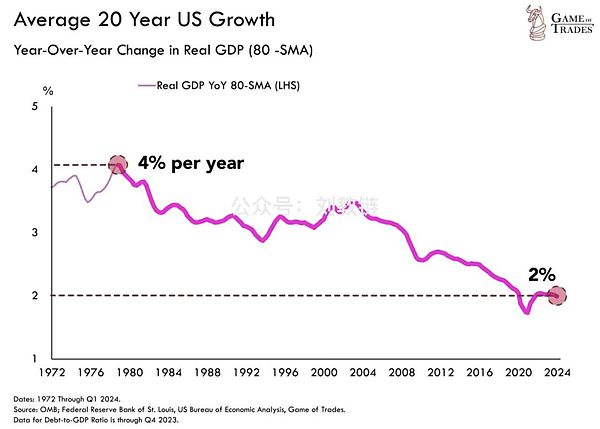

Obviously, with the rapid expansion of the debt scale, the driving force of debt on GDP growth is getting weaker and weaker. When the debt-GDP ratio is less than 30%, the US GDP can easily achieve a nominal growth rate of 4%. When the debt-GDP ratio is higher than 90%, even a nominal growth rate of 2% is difficult to maintain.

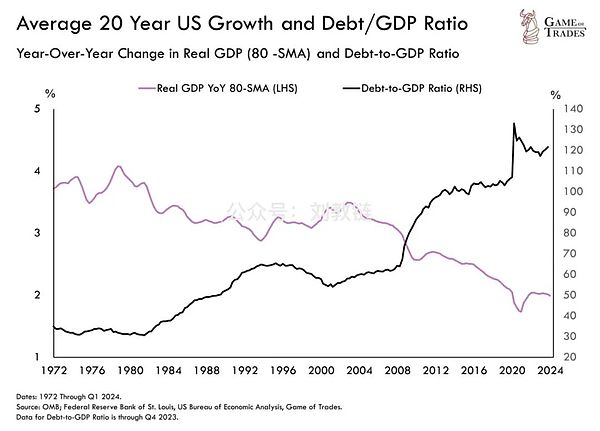

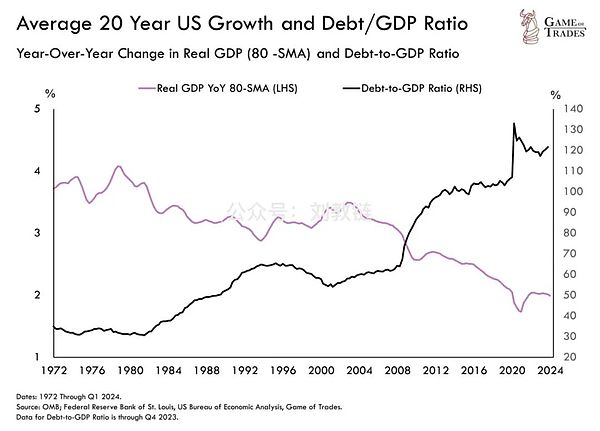

In fact, the root of all the troubles can be traced back to the 1970s, when the United States unilaterally defaulted on its contract with the world. Since the Bretton Woods system was torn up by the United States, the growth rate of US GDP has been declining.

Data shows that the debt-GDP ratio and GDP growth rate show an extremely obvious negative correlation.

And these are the insights of Satoshi Nakamoto in 2007, the motivation for proposing the idea of BTC in 2008, and the motivation for officially launching BTC in 2009.

In any case, when you invest or hold BTC, you are shorting the US dollar, shorting the United States, and betting on the inevitable collapse of US debt and the decline of the US national destiny. (In fact, the hedge is all the undisciplined debt fiat currencies and the willful power behind them, but the debt dollar is the "first bird" at this stage, and BTC is the "shotgun" in the hands of the people)

Of course, no one wants the United States to collapse suddenly. It is better for it to retreat gently, return to the state of being anchored to the US dollar before 1971, and successfully realize the exchange of US dollars for BTC.

If it is achieved, it will be a great soft landing. The beast dollar and the power behind it can be locked in the cage of BTC.

1971-20XX, from the gold dollar to the unanchored dollar, from the unanchored dollar to the BTC dollar, it's like a dream.

Anais

Anais