Source: Lawyer Jin Jianzhi

01 Basic concepts of crypto funds

Whether it is a traditional fund or a crypto fund, the complete life course of any fund is fund raising, fund investment, post-investment management and post-investment exit, which is referred to as "raising, investment, management and exit". In the field of traditional funds, funds are divided into securities funds and equity funds according to the different asset classes of the investment portfolio; similarly, crypto funds can also be understood and operated with reference to this classification.

If the assets in the portfolio are various currencies, for ease of understanding, we can call it a crypto "security" fund. Similarly, if the assets in the portfolio are "projects", we Call it a crypto “equity” fund.

Raising, investment, management and exit: Traditional funds vs crypto funds

The main differences between crypto “securities” funds and crypto “equity” funds can be distinguished by their key elements. Among them, since the investment targets of crypto “securities” funds are highly liquid coins, they will be continuously purchased and redeemed according to market conditions and investor needs. Therefore, the scale of crypto “securities” funds is not fixed, nor does it have a fixed duration. ; On the contrary, the investment targets of crypto "equity" funds are various other projects, and the size of the fund is determined during the fundraising stage of the fund. Its duration is usually 3 years and can be extended for 2 years.

Key elements of the fund

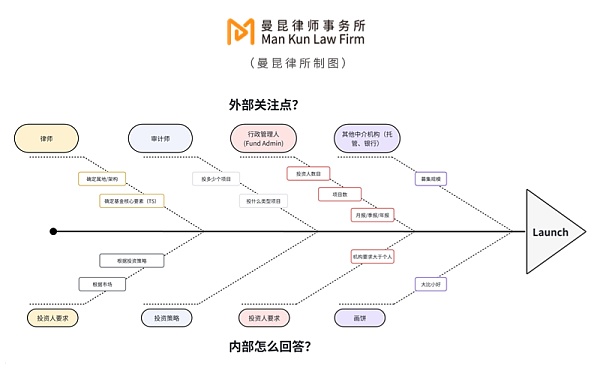

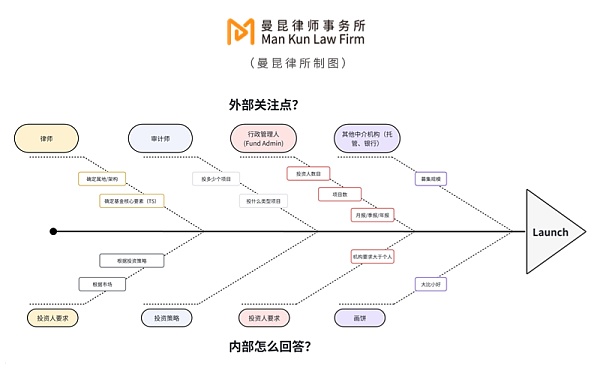

02 Steps to establish a crypto fund

Generally speaking, the steps to establish a crypto fund are: first determine the fund structure, and then select Suitable jurisdiction/fund form, then identifying the intermediary, and finally preparing documents to complete delivery. However, it should be pointed out that unless it is a very experienced large-scale investment institution or its internal risk control and compliance personnel can put the lawyers in the intermediaries behind, in most cases, as long as the decision is made to set up a fund, lawyers will appear in all Before taking any steps, we will accompany you throughout the journey of setting up a crypto fund.

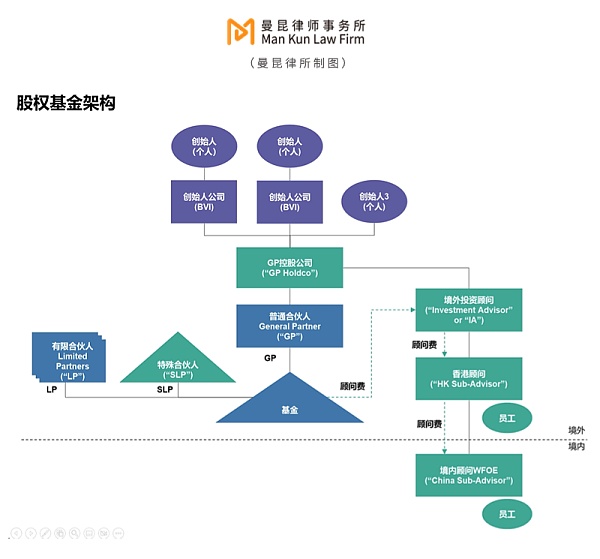

2.1 Determine the fund structure

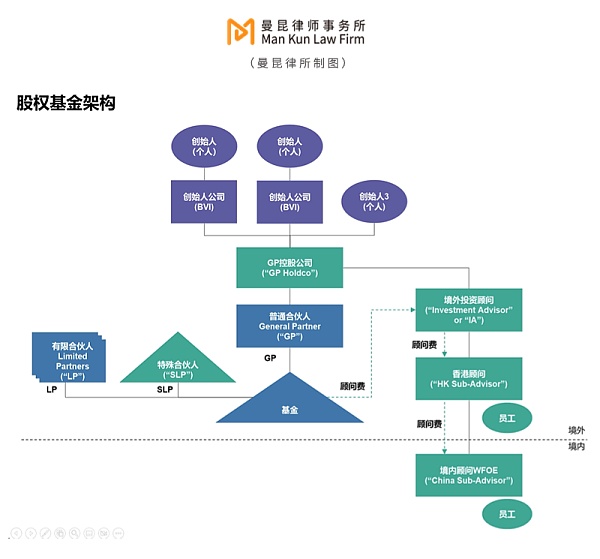

Classic structure of equity funds

Not much to say , the classic structure of equity funds is shown in the figure below.

Securities Fund Structure

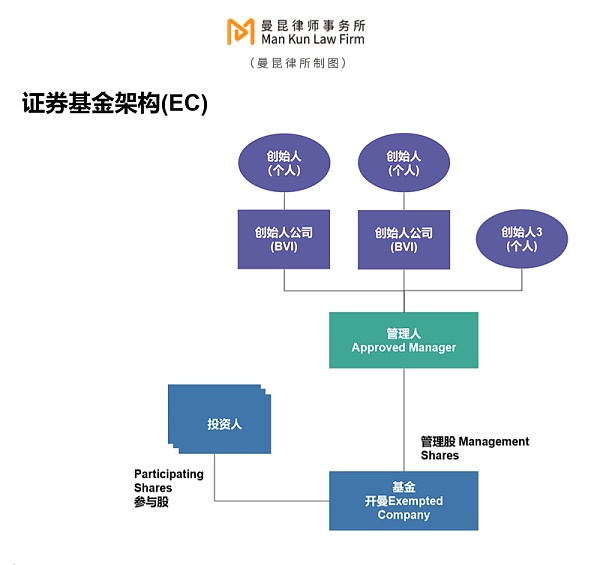

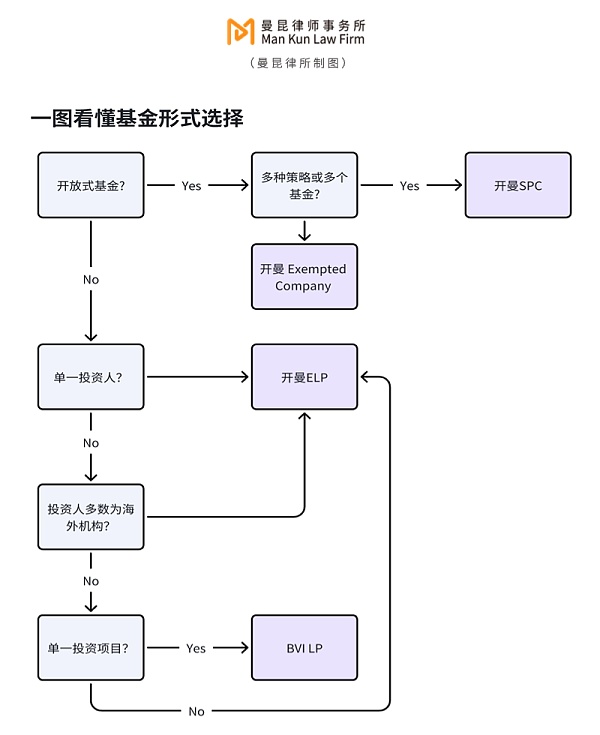

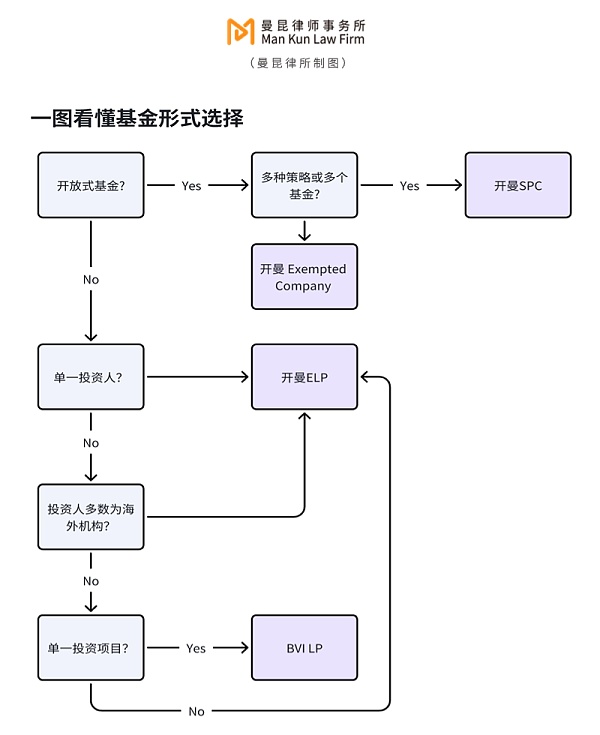

The securities fund structure is simpler than the equity fund structure, mainly including the single fund structure (Stand-Alone Fund Structure) and the diversified fund structure (Umbrella Fund Structure).

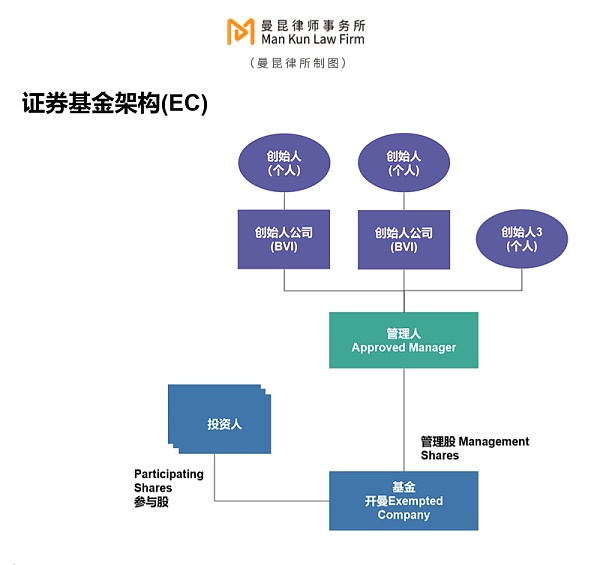

Stand-Alone Fund Structure: This is one of the simplest securities fund structures, referring to What is important is that each fund is an independent legal entity with its own investment portfolio and shares. Each fund has its own independent investment objectives and strategies, as well as independent unit holders. Single fund structures are generally easier to manage and regulate. The single fund structure built using Cayman Exempted Company is shown in the figure below.

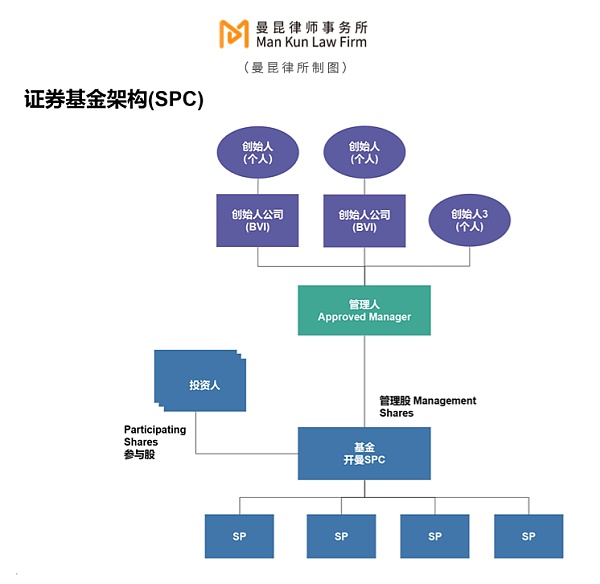

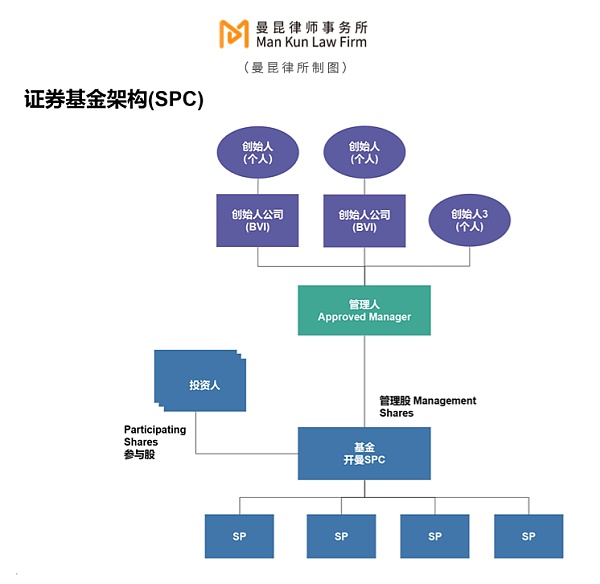

2. Diversified fund structure/umbrella type Umbrella Fund Structure: refers to an overall legal entity that contains multiple sub-funds. Each sub-fund is an independent investment pool with its own investment portfolio and shares. These sub-funds share the legal and management structure of the overall fund. However, each sub-fund has its own independent assets and liabilities and is isolated from other sub-funds. A multi-fund structure generally provides greater flexibility because it allows the manager to manage multiple funds with different strategies through a single legal entity. The multi-fund structure/umbrella fund structure established in the form of Cayman's Segregated Portfolio Companies ("SPC") is shown in the figure below.

2.2 Select the appropriate jurisdiction/fund form

Offshore places provide flexible regulations for the establishment of funds, and there is no need to obtain a specific financial license or the difficulty of applying for a license. In addition, the tax policy of offshore places is "tax neutral" ( tax neutral), for example, Cayman and the BVI do not levy income tax, capital gains tax, stamp duty and other taxes, nor do they tax transactions related to economic activities in other tax jurisdictions. Setting up crypto funds offshore is obviously a more cost-effective option.

2.3 Determine the intermediary agency

< p>The establishment of a fund requires multi-faceted support from external intermediaries.

2.4 Prepare necessary documents and compliance documents

The main files are as follows, there may be other files depending on the project structure and business needs:

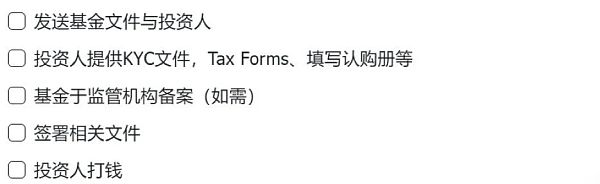

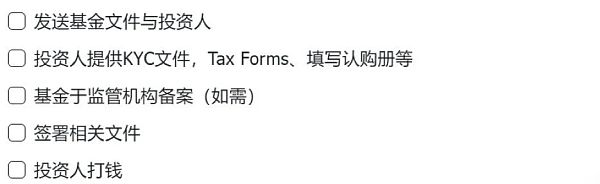

2.5 Closing Delivery

03 Compliance Framework Overview

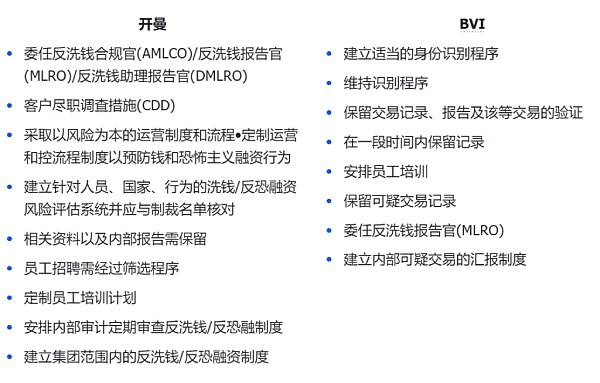

3.1 Relevant Cayman and BVI Laws ;

3.2 International Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) Regulations

International Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) Regulations are a series of regulations and regulations developed by the global financial system to combat money laundering and prevent terrorist financing. measure. As financial institutions, crypto funds involve a large amount of capital flows and transactions. In order to prevent money laundering and terrorist financing activities, investors need to do KYC, collect proof of identity, address, and understand the source of wealth and the source of funds.

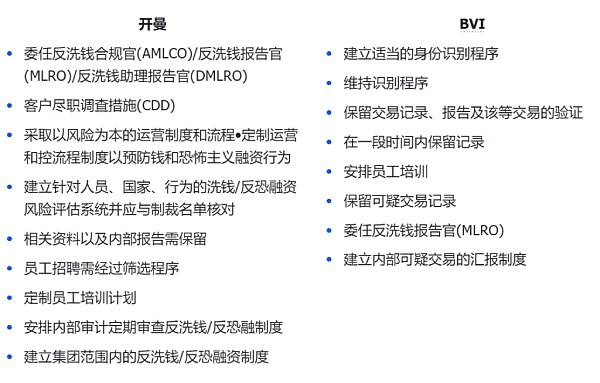

The following are the detailed requirements:

3.3 International tax compliance AEOI(CRS)/FATCA

To enable countries to share financial account information to ensure that individuals’ financial assets in different countries are properly accounted for There are a series of arrangements for tax processing and international tax compliance. Among them, AEOI/CRS (Automatic Exchange of Financial Account Information) and FATCA (U.S. Foreign Account Tax Compliance Act) are important components of international tax compliance:

1.AEOI(CRS): A framework for international tax cooperation aimed at automatically exchanging account information to combat cross-border tax evasion. It requires financial institutions to identify and report cross-border accounts to their home country tax authorities, who exchange the information with the tax authorities of the account holder's country of residence.

2.FATCA: A U.S. law that requires global financial institutions to identify and report the account information of their U.S. customers to the Internal Revenue Service (IRS). This is to prevent U.S. taxpayers from using overseas accounts to evade tax obligations.

Therefore,Investors subscribing to the fund need to fill in the W-8 form and self-certification form.

04 < strong>Tax considerations

Fund level exemption:The tax regimes of the Cayman Islands and the British Virgin Islands (BVI) have significantly lower taxes or no-tax features. In both jurisdictions, businesses and individuals generally do not have to pay income tax, capital gains tax, estate tax or gift tax.

Investors file tax returns based on their own circumstances.

CARF: So far, cryptocurrency is not the focus of AEOI/CRS (Automatic Exchange of Financial Account Information), which also prevents tax administration agencies in various countries from grasping this issue. This decentralized new transaction model creates taxation loopholes, but the OECD has drafted the Crypto-Asset Reporting Framework (CRS for virtual assets) and plans to implement it in 2027.

JinseFinance

JinseFinance