Author: Steven Ehrlich Source: unchainedcrypto Translation: Shan Ouba, Golden Finance

As a reporter who has followed Bitcoin miners for many years, I have witnessed their ups and downs. For a long time, their stocks were the only way for investors to get exposure to Bitcoin without directly holding Bitcoin assets. In recent years, however, they have faced new competitors for investor funds and a tougher operating environment.

Now, they may face an unprecedented challenge - tariffs of up to 36% on new mining machines, which may completely destroy their ability to make sustained profits.

Can they get relief from the Trump administration?

Bitcoin miners, the unsung heroes of the industry, have become collateral damage in Trump's trade war. During his 2024 campaign, President Donald Trump said he wanted all remaining Bitcoins, about 1.15 million of the 21 million supply, mined in the United States. While that promise was both unrealistic and antithetical to Bitcoin’s decentralized ethos, the message was clear: America was going all-in on Bitcoin mining.

Fast forward to April 2025, and that promise seems downright ridiculous. The beleaguered industry has been hit hard by the Trump administration’s unprecedented policy of so-called “reciprocal tariffs” on nearly all of America’s trading partners.

Now, these miners, who import hundreds of millions of dollars’ worth of mining hardware from countries like Vietnam, Thailand, and Malaysia, face tariffs of 24-46%.

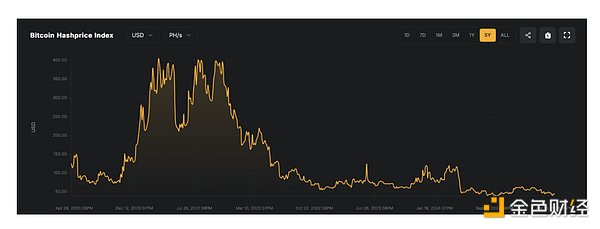

And the news couldn’t come at a worse time. The “hash price” (a term used to assess mining profitability, i.e. the number of bitcoins earned per unit of energy) continues to hit record lows as competition intensifies and earnings from new bitcoins stagnate as global macroeconomic recessions and bitcoin prices slump. As of this writing, the bitcoin price is $84,536, down 22% from its all-time high of more than $108,786 in January 2025.

These conditions have left U.S. miners with a tough decision. (They account for about 40% of the world’s total computing power, or mining capacity, on the Bitcoin network, according to multiple sources.) Should they import the machines and pay steep tariffs to maintain their share of the Bitcoin network’s computing power, or let the machines sit idle in warehouses in Asia?

“I see a lot of confusion from everyone, even the top people. No one really knows what’s going on,” said Taras Kulyk, CEO of Synteq Digital, the official distributor of Bitmain, the world’s largest manufacturer of Bitcoin mining machines. “No one really understands what the ‘strategy’ is, for lack of a better word, that’s being implemented. It seems to be chaos, and it’s not even controlled or organized chaos. It’s not 5D chess anymore. It just seems to be complete, ridiculous chaos.”

Miners’ recent scars

If there is a silver lining for Bitcoin miners, it is that the many challenges they have overcome in recent years have strengthened them. Bitcoin miners are facing a host of challenges after the Chinese government expelled all miners from the country in May 2021, causing a 42% drop in hashrate.

First is a host of Bitcoin proxy alternatives that have suddenly become competitors for investor money. Strategy (formerly MicroStrategy) pioneered the Bitcoin accumulation strategy as a corporate credo in 2020 and became the spiritual symbol of the Bitcoin industry. The company now owns 528,185 Bitcoins, worth $44.8 billion, with paper gains of $9 billion. Its stock more than quadrupled in 2024.

A range of companies, including Semler Scientific, Metaplanet, and Genius Group, followed suit. They were able to finance these purchases through "stock issuance at market price" or "zero coupon convertible bonds," meaning investors lent billions of dollars to these companies at zero interest so that they could buy Bitcoin now. This strategy is in stark contrast to Bitcoin miners who must pay huge upfront costs to purchase mining machines, power generation, facilities, and bear various administrative expenses. All in order to get a return in the next 12-24 months.

To make matters worse, many miners had to sell newly mined Bitcoin and Bitcoin on their balance sheets during the bear market in 2022 and early 2023 to maintain operations. This meant that they could not benefit from Bitcoin's rise above $100,000.

The second blow came from the launch of spot Bitcoin ETFs in January 2024, led by companies such as BlackRock and Fidelity, who accumulated more than $100 billion in Bitcoin. All of this meant that listed Bitcoin mining stocks, which had been operating in an oligopolistic manner for many years, suddenly faced competition from investors who wanted exposure to Bitcoin and leveraged or high-beta exposure.

Miners’ Crossroads

Then came the AI or High Performance Computing (HPC) boom of the past two years. Miners suddenly faced another critical decision – should they focus on mining or switch to this hot industry? The choice is not as simple as it sounds, as the servers needed to mine Bitcoin are very different from those needed to run a large language model (LLM) such as ChatGPT. However, hosting sites can have dual purposes. Many companies have made olive branches to the HPC industry, but at least for now, many of them are just marketing gimmicks. The only Bitcoin miner that generates significant revenue from serving HPC customers is Core Scientific.

The switch to HPC may boost stock prices in the short term, but it also means miners miss out on future gains from mining Bitcoin. It also exposes them to the dramatic reversal of fortune that occurred when Chinese competitor DeepSeek shocked the market with a low-cost LLM competitor.

All this uncertainty, combined with the recent market plunge, has led to Bitcoin miners being punished by investors this year. Many top miners have lost more than 50% of their market value in 2025.

Hold your breath

In speaking with multiple miners, many of them are focused on improving operational efficiency and delaying major decisions until there is more clarity on tariffs. Their mantra is to control what they can control. The good news is that most major miners can afford to ride out the coming months and see what happens when Trump’s 90-day moratorium on reciprocal tariffs expires on July 9, even if that sometimes means taking on extra costs to maintain hash rate growth expectations.

Lauren Lim, head of hardware at ASIC broker Luxor Technologies, said in an interview that most miners are happy to pay the 10% flat tariff on import orders from Southeast Asia. “We’re seeing miners just take on 10% of the cost. Initially, they were already paying about 3% tariffs in Malaysia (for example), so paying 7% more is still relatively affordable.”

But the costs aren’t limited to tariffs. Any goods imported into the U.S. faced a rush to buy ahead of the July 9 deadline, so shipping costs soared. “I know some of our largest partners have suffered huge losses trying to import hardware before the April 9 deadline, when the reciprocal tariffs were supposed to go into effect,” Kulyk said. “They spent tens of millions of dollars on this, only to see Trump grant an extension and then offer exemptions for all goods.”

For most tier-one miners such as Riot, CleanSpark and Iris Energy, the impact appears limited. These companies have either paused their hash rate expansion or received major shipments ahead of schedule,” mining analyst Wolfie Zhao said in an interview. Not everyone will be so lucky, he said. “However, other companies such as Cipher Mining and Hut 8 may be more exposed. Cipher has a pending second-quarter shipment of Bitmain S21 XP series, while Hut 8 has disclosed multiple Bitmain purchase agreements since late 2024 that may still be fulfilled.”

Zhao also noted that at today’s prices (still up 37% over the past 12 months), miners are still producing bitcoin profitably and they are in no danger of being forced to liquidate more assets to pay down debt or massively subsidize operations. "Overall, we don't see signs of major distress. Bitcoin's current price remains well above levels that would force widespread balance sheet strain, and most miners have learned from the 2021 cycle and are no longer overleveraged."

But miners are already adjusting their strategies regardless so as not to be completely subject to the whims of Trump's tariffs. Miners with spare capacity around the world are already planning to relocate machines to other locations to avoid U.S. tariffs. "In the third and fourth quarter of last year, we moved machines from a number of our U.S. sites to Ethiopia because the cost difference was so significant," said Charley Brady, vice president of investor relations at publicly traded bitcoin miner Bitfufu. Going forward, Brady said the company will prioritize overseas expansion, such as further into Ethiopia to take over existing sites or build new ones, while exploring opportunities in the U.S.

Bitdeer’s head of capital markets and strategic initiatives Jeff LeBerge was more explicit in an interview with Unchained: “We have capacity in Texas that we’re looking to fill, but we also have capacity in Norway and Bhutan, which is where most of our new capacity has come online this year. So we were able to move some of the miners out of Texas. Now we’re going to prioritize Norway and Bhutan until we have more clarity on the tariff situation.”

Uncle Sam may not deliver on his promises

But it’s clear that any expectation that American bitcoin miners will reduce their reliance on foreign manufacturing, such as the two exceptions mentioned above, is likely misplaced. MicroBT, another of the two major Chinese miner oligopolies, has been making miners in the United States for about three years. But it can only produce about 5,000 units per month in the United States. Bitmain has three factories in the United States, and publicly listed Canaan Creative also makes some miners in the United States. Luxor’s Lim estimates that the three companies can produce up to 15,000 units per month in the U.S. together. There are also smaller but growing domestic manufacturers, such as BitDeer and Auradine, that are increasing production.

But Lim said all of these together account for less than 10% of global monthly production. And the situation is further complicated because rapidly increasing production may be more difficult than it sounds.

“I don’t actually expect domestic production to increase significantly because the production costs here are very high. And the production speed is not as fast as non-U.S. factories,” she said. Lim also noted that these companies may have a hard time selling the equipment they have already produced in the United States because the types of equipment those factories are able to produce do not necessarily match what miners want to order.

“Chilling effect” or escape clause?

All of this means that by sometime this summer, especially if reciprocal tariffs are not further delayed, these companies are going to have to make some key decisions.

More simply, they’ll need to decide whether the U.S. is a safe place to make a nine-figure investment, given this regulatory uncertainty. And the trend may not be immediately apparent. “The committed capital for existing projects that have already broken ground [in the U.S.] is not going to stop,” Kulyk said. “Those projects will get developed, and you’ll probably see growth over the next six to nine months, 12 months, 18 months. The ones that are really going to have a significant chilling effect are the new projects that are breaking ground, the projects that are allocating new development and capacity.”

One potential mitigating factor may be that the Trump family is now directly involved in the bitcoin mining business, through a new company called American Bitcoin, in partnership with Hut8. Even with its close ties to the government, the company can’t avoid the economic costs of these tariffs, so perhaps that could lead to special carve-outs for the industry.

Clement

Clement

Clement

Clement Catherine

Catherine Hui Xin

Hui Xin Kikyo

Kikyo Joy

Joy Davin

Davin Joy

Joy Catherine

Catherine Hui Xin

Hui Xin Hui Xin

Hui Xin