Author: Jack Inabinet, Bankless; Translator: Baishui, Golden Finance

Ethena has dominated DeFi in 2024, and although its synthetic dollar received a lot of criticism and attention when it was launched, the team's efforts have become one of DeFi's most notable success stories this year as traders have flocked to the protocol.

There are signals that the basis trading tokenization game has just begun as other DeFi players hope to seize Ethena's growth prospects.

In recent months, the market bubble has significantly increased Ethena's revenue and transformed ENA into a top-performing cryptocurrency company.

Today, we explore Ethena's success story in 2024.

Explosive Growth

Ethena accepted its first public fundraising on February 19, and within a month of the mainnet launch, USDe's circulating supply has exceeded all but five stablecoin competitors.

Thanks to its sizable airdrop incentives and timely entry into the hottest funding rate environment of the year, USDe supply expanded unrestricted to $2.39 billion by mid-April, then stagnated as excitement about the ENA airdrop waned and the crypto market cooled.

Although Ethena's subsequent decision to reduce insurance funding occupancy on May 16 temporarily revived USDe and led to a 50% one-month supply expansion, continued funding rate compression throughout the third quarter took its toll. By September, the rise in USDe supply had fully reversed, with ENA prices down 86% from their post-launch highs.

While the funding rate arbitrage strategy employed by Ethena has long been possible for any trader familiar with futures, the problem is that the funds collateralizing these trades must be locked up on an exchange (whether in CeFi or DeFi), which makes them impossible to lock up.

With Ethena’s approach, this underlying trading position itself becomes “tokenized” and represented in USDe, allowing traders to earn additional yield in DeFi or borrow against their holdings.

Despite some initial hesitation from third-party applications to quickly incorporate USDe collateral, Ethena’s synthetic dollars now dominate the crypto credit market due to simple yield economics.

Yield providers who cannot compete with Ethena’s market-leading returns risk seeing a reduction in deposits or excessive borrowing demand. This dangerous dynamic could algorithmically set borrowing rates well above market value and force numerous DeFi lending markets to frantically buy up billions of dollars in USD derivatives collateral when funding rates spiked again in November.

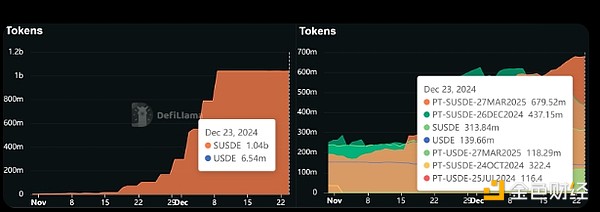

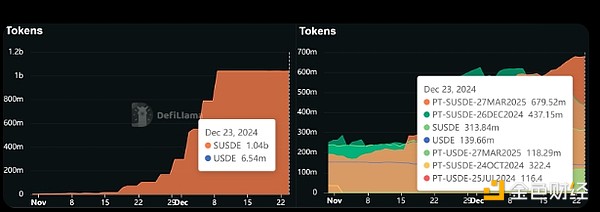

In just a few weeks, Aave sUSDe’s deposit cap soared to $1 billion (in early November, its lending market held a paltry $20 million in Ethena collateral). Meanwhile, other lenders on MakerDAO and Morpho were absorbing $1.2 billion in extremely illiquid Pendle sUSDe primary token (PT) exposure at an extremely high 91.5% maximum leverage ratio.

An unparalleled asset?

Ethena’s assets are now intertwined with blue-chip DeFi, and ENA is intrigued by this, rebounding more than 500% from its September lows, an impressive rebound, finally stabilizing not far from its post-launch highs.

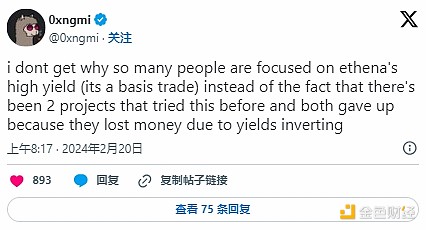

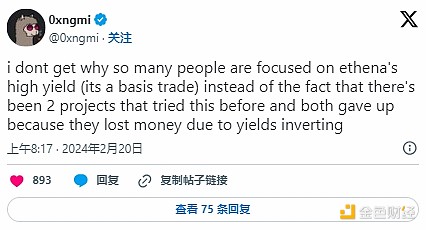

While a negative funding rate environment is a known risk that could result in losses for USDe, many cryptocurrency observers are optimistic that Ethena’s recently deployed U.S. Treasury product (USDtb) could be a suitable basis trading alternative to establish a yield floor for Ethena depositors.

That being said, funding rates are inherently volatile, and there is great uncertainty as to how Ethena will appropriately respond to a prolonged period of negative funding rates.If losses must be realized to convert existing synthetic USD exposure into Treasury collateral, USDe investors may begin preemptively selling tokens to avoid additional losses, leading to further redemptions, which could result in forced liquidation of USDe or a crisis of confidence in the entire market. Liquidations occur in thin markets (i.e., in market downturns) when hedging demand is high.

At its core, Ethena is an unregulated tokenized hedge fund. While its basis trades have been wildly successful in the fourth quarter of 2024, investors should still consider the various unknowns of the protocol that could create problems when funding rates change.

Alex

Alex