Author: Ciaran Lyons, CoinTelegraph; Compiler: Deng Tong, Golden Finance

A cryptocurrency trader said that if three long-term indicators continue to perform well, Ethereum could soar and retest the $5,000 price mark that it broke in 2021.

Anonymous cryptocurrency trader Blockchain Mane pointed out: "The dominant chart shows that we are entering the 'Ethereum season' and Ethereum may outperform other cryptocurrencies."

Previously, the U.S. Securities and Exchange Commission (SEC) preliminarily approved eight spot Ethereum exchange-traded funds (ETFs) on May 23.

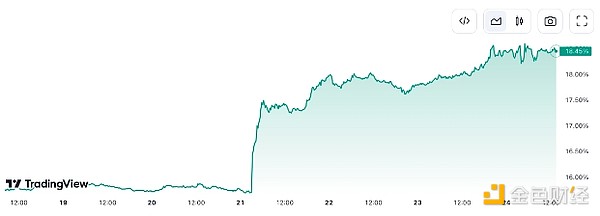

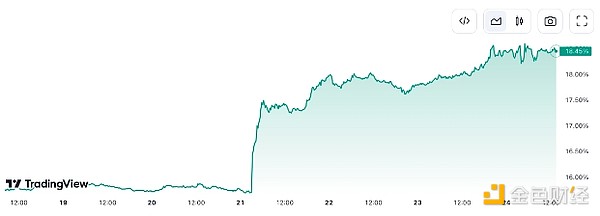

TradingView data shows that ETH's dominance, or its share of the cryptocurrency market, has jumped 19.56% in the past seven days following reports that the SEC is changing its hardline stance on ETF approval.

Ethereum's dominance has risen 18.45% in the past seven days. Source: TradingView

Blockchain Mane noted that another key long-term indicator, the Fibonacci retracement, is showing “strong support.” The indicator predicts price levels that Ethereum could bounce to based on mathematical patterns calculated based on the Fibonacci sequence.

Blockchain Mane said ETH shows “resistance targets at $5080.60 and $6231.83.” The price has not come close to that high since hitting an all-time high of $4,878 in November 2021, according to CoinMarketCap.

As of the time of publishing, Ethereum is trading at $3,802.

Parabolic and Fibonacci retracement indicators. Source: Blockchain Mane

The third indicator pointed out by Blockchain Mane is the parabola, which finds potential trend changes by crossing above or below Ethereum's price changes.

Mane said that ETH follows a "bullish trend" along the curve with three distinct stages: base one, base two and base three.

“The parabola suggests continued upward movement, especially after a falling wedge breakout,” they said.

Other crypto traders have been keeping an eye on the short-term price action of spot Ethereum ETFs.

Crypto commentator Benjamin Cowen said in a May 23 post: “ETH is up more this week than the S&P 500 has been in a year.”

Crypto trader Matthew Hyland believes it’s now critical for Ethereum to “hold support” around $3,800 “to stay afloat.”

Source: Matthew Hyland

Ethereum’s price barely budged after the ETF was approved, likely because it’s already been priced in and ETF trading hasn’t started yet.

JinseFinance

JinseFinance