Introduction

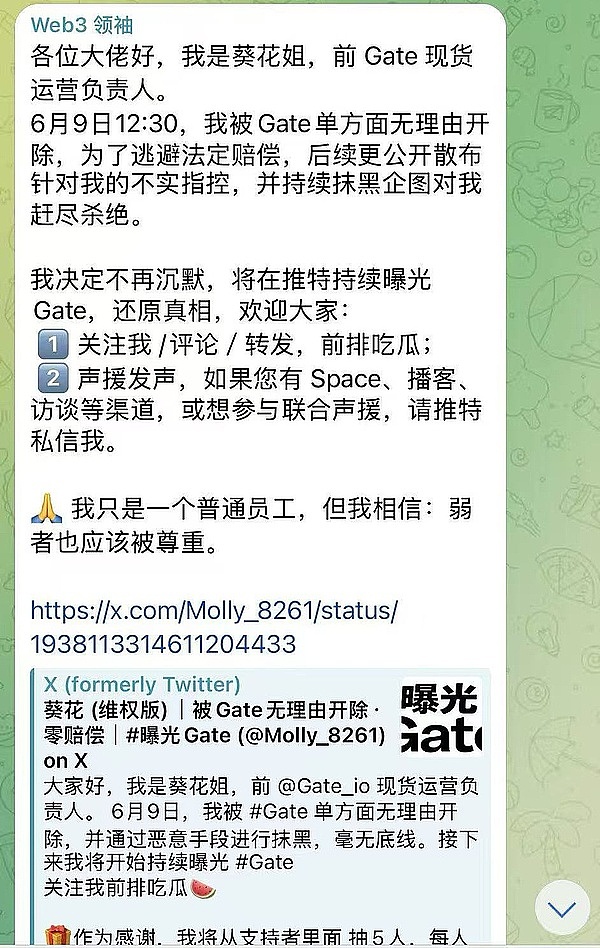

Recently, there was a small melon in the cryptocurrency circle. After being fired, an employee of a virtual currency exchange stated on social media that he was unilaterally fired by the exchange without reason in order to evade statutory compensation.

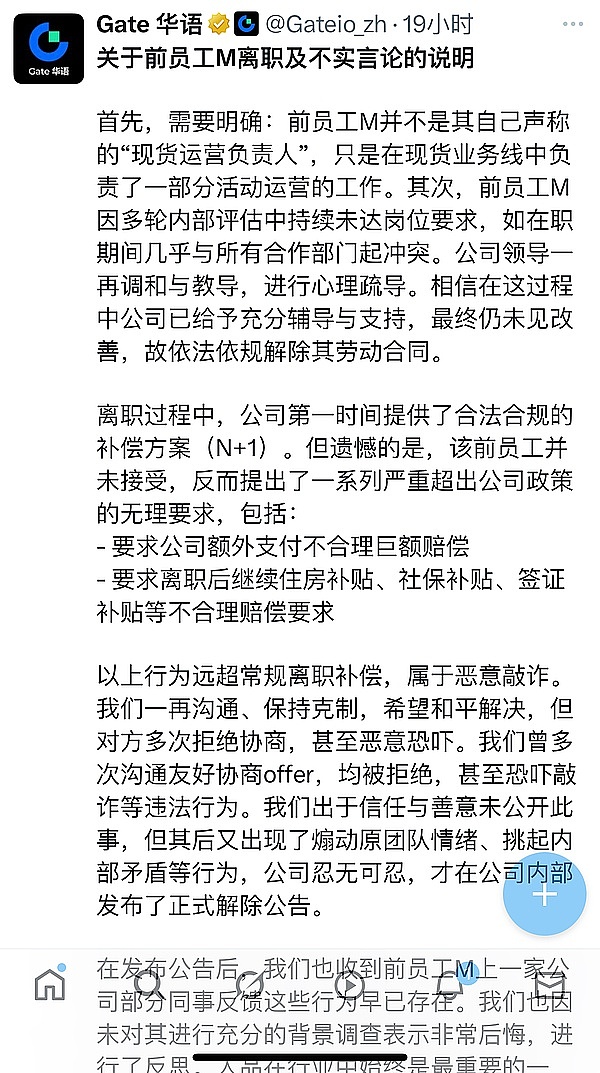

The exchange also responded on the official account of the social platform. In addition to not recognizing the statement of the former employee, it also stated that the company terminated his labor contract in accordance with the law and regulations, and during the employee's resignation process, the company immediately provided an N+1 compensation plan, but the employee did not accept it.

The "resignation storm" has caused a certain amount of public opinion on social media, especially on overseas platforms where friends in the cryptocurrency circle gather.

As a web3 lawyer, Lawyer Liu does not talk about the emotional right and wrong and moral right and wrong in this incident. We analyze the legal issues in it, especially the labor and employment legal issues in the cryptocurrency circle.

1. Labor and employment disputes in exchanges, are Chinese laws useful?

Lawyer Liu noticed that both the aforementioned former employees of the Gate Exchange and the Gate Exchange itself mentioned legal terms such as "statutory compensation", "labor contract", "in accordance with laws and regulations", and "N+1". In the context of the Chinese meaning, we will naturally understand that this is most likely a statement made by all parties in accordance with relevant Chinese laws.

Then the problem arises. As we all know, since the mainland’s "9.4 Announcement" in 2017 ("Announcement on Preventing the Risks of Token Issuance and Financing"), mainland exchanges have successively gone overseas. After the "9.24 Notice" in 2021 ("Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation"), virtual currency exchanges have almost no foothold in the mainland, and most of them have been cracked down on by criminal law.

Regarding the labor employment of virtual currency exchanges, the “9.24 Notice” also mentioned:

“Overseas virtual currency exchanges that provide services to residents in my country through the Internet also constitute illegal financial activities. Domestic staff of relevant overseas virtual currency exchanges, as well as legal persons, non-legal organizations and natural persons who know or should know that they are engaged in virtual currency-related businesses and still provide them with marketing, payment settlement, technical support and other services, shall be held accountable in accordance with the law.”

There is a distinction here that domestic staff of overseas exchanges will be held legally responsible; as for overseas staff of overseas exchanges, our country’s regulatory documents actually do not care.

Therefore, we also discuss two situations:

(I) Domestic staff of the exchange

This situation belongs to the prohibited behavior in the "9.24 Notice". For domestic staff of the exchange, because it violates the mandatory provisions of the "9.24 Notice", even if a "labor contract" or "labor service contract" or other similar contracts are signed, it is an invalid agreement under Chinese law and it is difficult to take effect under Chinese law. However, if the signed contract stipulates extraterritorial jurisdiction, then it depends on which country or jurisdiction's law is specifically agreed to apply, and then analyze it.

(II) Foreign staff of the exchange

For foreign staff of the exchange, in fact, the laws of mainland China have even less control. Even if the nationality of the foreign staff is a Chinese mainland household registration, the worker is on a foreign work visa and is definitely subject to regulations other than the laws of mainland China.

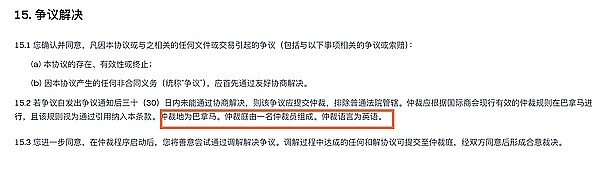

Take the "Service Agreement" on Gate's official website as an example. It agrees with users (players) that the way to resolve disputes is arbitration (in practice, you can choose to sue in court or choose arbitration. Generally, the platform decides which model to adopt, and users have almost no choice). The arbitration place is Panama and the arbitration language is English.

Of course, this does not mean that the labor contract between Gate and its employees is also of this kind. The specific details should still be based on the actual contract text.

Another situation is that the exchange may consider the regulatory policies of mainland China and use a mainland shell company or affiliated company to sign labor contracts for employees in the mainland and pay mainland social security, but the actual work content is still to provide labor for overseas exchanges. If this situation is viewed through, it is still essentially that domestic employees provide labor for overseas virtual currency exchanges, which is still a violation of the "9.24 Notice". However, if the actual work content of the affiliated company is not directly related to the exchange, I personally think that this can be appliedtothe labor laws of mainland China.

II. Employment suggestions for exchanges

For domestic affiliates of overseas virtual currency exchanges that are not engaged in virtual currency trading-related businesses, Lawyer Liu's analysis and suggestions are as follows:

(I) Regulate employment relations in accordance with the law and avoid "quasi-outsourcing" and "pseudo-freelancer" models

In order to reduce employment costs, many exchanges often adopt methods such as signing labor contracts, freelance agreements or affiliating with outsourcing companies to circumvent formal labor contracts. If the mandatory regulations of the "9.24 Notice" are not taken into account, especially for domestic affiliates of overseas exchanges, once a dispute occurs, the above practices are likely to be recognized as "de facto labor relations" by labor arbitration or the court, and not only will they need to make up for social security payments, but they may also face compensation liability.

Lawyer Liu suggested: For employees who are actually subordinate to management, attendance, instructions, etc., the mainland affiliated companies (not engaged in virtual currency exchange-related businesses) should sign a formal "Labor Contract" and pay the "five insurances and one housing fund" on time.

(II) Avoid disputes caused by illegal termination and vague performance mechanism

During the layoff process, some affiliated companies did not follow the economic layoff procedures in accordance with the law or vaguely agreed on performance appraisal indicators, resulting in employees claiming "illegal termination" and receiving double compensation.

Lawyer Liu suggested: Strictly follow the provisions of Articles 40 and 41 of the "Labor Contract Law" of mainland China to implement the termination process, and pay special attention to the fact that performance appraisal must have clear standards, quantifiable processes, and signed confirmation of appraisal results.

(III) Optimize the company structure in accordance with the law and clarify the application of local labor laws

Virtual currency exchanges often "remotely" employ domestic employees through entities located overseas, creating a legal gap of "overseas labor contracts + actual domestic office".

Lawyer Liu suggested: If the actual office is located in China, the domestic entity should bear the employer's responsibilities and do not confuse the employer. (The application premise of this article is still: the business conducted in the Mainland has nothing to do with virtual currency transactions. If it actually directly provides technical, marketing and other services for overseas virtual currency transactions, it is still a violation of the mandatory provisions of the "9.24 Notice")

III. Suggestions for workers in the cryptocurrency circle

The application premise of the suggestions in this section is the same as the previous article. If workers in the cryptocurrency circle directly provide services for overseas virtual currency exchanges, it is difficult to protect their rights and interests through China's Labor Contract Law.

(i) Make sure that the contract signing entity is consistent with the actual manager

Many employees sign English contracts with overseas companies, but their salaries and work arrangements are made by domestic teams. If a dispute occurs, the rights protection may fail due to difficulties in providing evidence.

Lawyer Liu suggests: Keep work communication records, clock-in records, salary payment accounts and other evidence to ensure that in the event of a dispute, you can claim a "de facto labor relationship."

(ii) Be wary of disguised dismissals "for performance reasons"

We have encountered some cryptocurrency workers who reported that before leaving, the company suddenly downgraded their positions or salaries on the grounds of "unsatisfactory performance" or forced them to resign automatically by using "position adjustments."

Lawyer Liu suggested: Employees have the right to ask the company to disclose performance evaluation standards and data. If the company has malicious dismissal, they can claim compensation for illegal termination (Article 48 and Article 87 of the Labor Contract Law).

(III) Apply for arbitration in time after leaving the company to prevent the statute of limitations from exceeding the statute of limitations

According to Article 27 of the Labor Dispute Mediation and Arbitration Law, the statute of limitations for labor arbitration is 1 year, calculated from the date on which the rights are known or should be known to be infringed.

Lawyer Liu suggested: After being dismissed or discovering the company's illegal behavior, you should protect your rights in writing and submit a labor arbitration application as soon as possible to avoid missing the statute of limitations.

IV. Conclusion

From the legal perspective of various countries, virtual currency exchanges are indeed a very new industry. Especially under the premise that virtual currency business activities are defined as "illegal financial activities" in mainland China, domestic currency circle workers are definitely in an absolutely weak position. Web3 practitioners who work directly for exchanges cannot rely on the laws of mainland China. This requires you to be familiar with the legal provisions of the exchange's place of registration, actual place of operation, and place of employment, especially the relevant provisions of labor laws (labor laws).

Singapore also made stricter supervision on web3 practitioners a few days ago, which requires all web3 workers to not only be familiar with the knowledge of the industry, but also to understand some legal knowledge. Or you can get legal advice from professional web3 lawyers.

In the future, the virtual currency industry will face the pressure of stricter global supervision and business contraction, and labor disputes will occur more frequently. Exchanges should employ workers in compliance with regulations, and employees need to enhance their awareness of rights protection. In the future, there may be more judicial disputes over "cross-border labor relations". It is recommended that employers and employees clarify the applicable laws and dispute resolution methods when signing contracts. Strive to resolve disputes in the bud.

Kikyo

Kikyo

Kikyo

Kikyo Catherine

Catherine Catherine

Catherine Kikyo

Kikyo Catherine

Catherine Kikyo

Kikyo Catherine

Catherine Catherine

Catherine Kikyo

Kikyo Catherine

Catherine