Source: Liu Jiaolian

As BTC failed to rebound and fell to 75k again, rumors about whether the positions of MicroStrategy (now renamed Strategy), a large-scale hoarder who "overcharged" to increase positions at the high of $100,000 a few months ago, would be blown up and cause a large-scale flood-like sell-off of BTC began to spread quietly in the market. Some people pointed out that according to the 8-K form disclosed by it to the US SEC, MicroStrategy is not "never selling" as its boss Michael Saylor said, but "may" sell its BTC positions when financial problems arise.

Jiaolian looked at the original text in the 8-K form and it reads: "If we are unable to generate sufficient cash flow to service our debt and make necessary capital expenditures, we may be required to sell bitcoin."

This only points out a theoretical possibility. Let's take a look at the specific context:

"We may be unable to repay our debts, which will result in our inability to fulfill our debt repayment obligations and even be forced to enter bankruptcy liquidation procedures.

Our ability to repay the principal and interest of our debts on time and to refinance our debts depends on and is limited by the company's financial and operating conditions. These conditions are partly affected by uncontrollable factors such as the macroeconomic environment, financial market fluctuations, industry competition, changes in laws and regulations, and counterparty operating risks, including the availability of financing channels in the U.S. banking system and capital markets. If cash flow and capital reserves are insufficient to pay the principal and interest of our debts, we may be forced to take the following measures: reduce or postpone capital expenditures, sell assets, seek additional financing, or restructure or refinance existing debts. Financing. We cannot guarantee that we will be able to obtain sufficient financing in the future to repay debts, refinance debts or meet other liquidity needs. Even if refinancing is obtained, the new debt may face higher interest rates and more stringent restrictive terms, further restricting the company's operating autonomy. In addition, in accordance with the Bitcoin investment strategy, we may increase our holdings of Bitcoin by borrowing, but if we cannot generate sufficient cash flow to repay debts and maintain necessary capital expenditures, we may need to sell our Bitcoin holdings. These emergency measures may not work, resulting in our inability to fulfill our debt repayment obligations or meet financial constraints, thereby triggering debt defaults. Any failure to pay principal and interest on time may result in a downgrade in credit ratings, which in turn will impair the company's ability to obtain additional financing.

Once a debt default occurs, the relevant creditors have the right to declare that all outstanding loan principal and interest are immediately due and payable. Such events may trigger cross-defaults on other debts. We may lack sufficient funds to repay defaulted debts due to factors such as the shrinking market value of our Bitcoin holdings, and may not be able to raise funds in a timely manner on acceptable terms (or at all). Financing conducted in this situation will significantly dilute the equity of existing shareholders, and failure to raise funds may lead to the company's bankruptcy and liquidation. "

「」

"With respect to any conversion of the convertible notes, we must pay cash for the convertible notes unless we elect (or have irrevocably elected) to settle only in the Company's Class A common stock (other than fractional shares of cash). However, future additional debt may contain restrictive terms that: (i) prohibit the use of cash to settle the conversion or redemption of convertible notes, which would force us to settle only in stock (other than fractional shares of cash); or (ii) restrict our right to obtain repayment funds by selling bitcoin.

According to the definition of "material change" in the convertible note indenture, when this clause is triggered, the noteholders have the right to require us to repurchase all outstanding notes at a price of 100% of the face value (plus accrued and unpaid interest as of the day before the repurchase date). It is worth noting that even if a change in control or a material change does not constitute a default in itself, the exercise of the repurchase right by the holder may trigger the default clauses under other debt agreements due to the impact on the company's financial condition. In order to raise funds for the repurchase, we expect to need to refinance the convertible notes or obtain a waiver from the holders, but we may not be able to obtain refinancing on reasonable terms. If we fail to obtain a waiver from the relevant holders, our failure to make a qualified repurchase offer as agreed or to repay the validly tendered notes will directly constitute an event of default under the convertible note indenture. 」

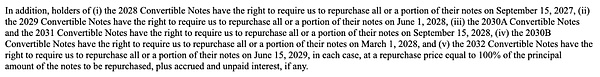

“In addition, the holders of each tranche of Convertible Notes will have the right to require the Company to repurchase all or part of their Notes on specific dates, as follows:

(i) the holders of the 2028 Convertible Notes will have the right to require repurchase on September 15, 2027;

(ii) the holders of the 2029 Convertible Notes will have the right to require repurchase on June 1, 2028;

(iii) the holders of the 2030A and 2031 Convertible Notes will have the right to require repurchase on September 15, 2028;

(iv) the holders of the 2030B Convertible Notes will have the right to require repurchase on March 1, 2028;

(v) Holders of the 2032 Convertible Notes have the right to request a repurchase on June 15, 2029.

The above repurchase prices are 100% of the principal amount of the repurchased notes, plus accrued and unpaid interest (if any) up to (excluding) the repurchase date. "

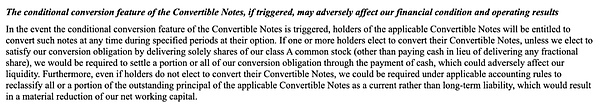

"Once the contingent conversion clause of the convertible notes is triggered, it may have an adverse effect on our financial condition and operating results

If the contingent conversion clause of the convertible notes is triggered, the relevant note holders have the right to choose to convert their notes at any time during a specific period. If the holder exercises the conversion right, unless the Company chooses to fulfill the conversion obligation only with Class A common stock (except for payment in cash for fractional shares), we must pay part or all of the conversion amount in cash, which may have an adverse impact on our liquidity. In addition, even if the holder does not choose to convert, in accordance with relevant accounting standards, we may need to reclassify all or part of the outstanding principal of the relevant notes as current liabilities rather than long-term liabilities, which will result in a significant reduction in our net working capital."

According to the data, MicroStrategy's current BTC holdings are roughly like this: "Strategy Currently holding 528,185 BTC, with an average cost price of $67,458, worth $40.119 billion." So, if BTC continues to fall, for example, if it falls below the cost price of 67k held by MicroStrategy, will it cause it to sell its BTC position? And, is there such a possibility in the future, that is, because BTC falls into a deep bear market, MicroStrategy is forced to sell? Teaching Chain asks deepseek to help analyze the above issues. The following is deepseek's analysis:

According to the financial information disclosed by MicroStrategy (now Strategy) and market analysis, the risk of its BTC holdings bursting needs to be comprehensively evaluated in combination with the debt structure, market environment and response strategy:

1. Short-term risks: Liquidity pressure is controllable, but there is a risk of chain reaction

1. Distribution of debt maturity

The main convertible note repurchases are concentrated in 2027-2029, and there is no rigid redemption pressure at present. However, if the BTC price continues to be below the $67k cost line, the following risks may be triggered:

• Reclassification of liabilities under accounting standards: The principal of outstanding notes may need to be included in current liabilities, resulting in a sharp drop in net working capital (net working capital was already negative in 2024)

• Credit rating downgrade: Asset shrinkage may trigger a downgrade by rating agencies and increase refinancing costs

2. Cash flow fragility

The company's software business has annual revenue of only US$500 million, which cannot cover potential debt interest. If BTC is depressed for a long time, it may be forced to:

• Start ATM stock issuance: However, the decline in stock prices will reduce financing efficiency (MSTR stock price fell 45% from its peak in March 2025)

• Pledged BTC loans: This method is not used yet, but it may become an option in extreme cases

2. Medium- and long-term critical points: the game between BTC price and debt cost

1. Safety margin calculation

The current holding cost is $67,458, with a total value of $40.1 billion. If BTC falls to:

• 50k USD: the market value of holdings shrinks to $26.4 billion, close to 3.5 times the total liabilities ($7.61 billion)

• 30k USD: the market value drops to $15.8 billion, and the debt coverage ratio drops to 2.1 times, which may trigger the creditors' early redemption clause

2. Debt snowball effect

If the notes due in 2027-2029 cannot be refinanced:

• Concentrated repayment pressure: More than US$5 billion in principal needs to be repaid in March 2028 (2030B notes) and June 2028 (2029 notes)

• Cross-default risk: One default may trigger the accelerated maturity of other debts

III. Risk Mitigation Mechanism: Saylor Control and Market Narrative

1. Corporate governance firewall

Michael Saylor holds 46.8% of the voting rights and can block the liquidation proposal. Its "missionary-style" marketing of Bitcoin is still the key to maintaining market confidence

2. Market expectation management

• Davis double kill risk: BTC's decline will compress both earnings expectations and valuation premiums (current price-to-book ratio is 3.4 times)

• ETF substitution effect: Products such as Grayscale BTC Trust weaken the uniqueness of MSTR as a "leveraged Bitcoin option"

Fourth, thunderstorm scenario deduction (see the table below)

Trigger conditions | Possible consequences | Probability of occurrence |

|---|

BTC falls below 50k and lasts for 6 months | ATM issuance fails, BTC pledge loan or small sale (<50,000) is initiated | Medium |

BTC fell below 30k and liquidity dried up | Creditors demanded early repayment and were forced to sell more than 100,000 BTC, triggering a downward spiral | Low |

US stocks continued bear market + BTC sideways | Equity financing costs soared, and debt-to-equity swaps were chosen to dilute Saylor's control | Medium-high |

Regulatory restrictions on institutions holding BTC | Forced to liquidate positions, becoming the largest source of selling pressure in the market (accounting for 2.5% of the circulation) | Low |

V. Conclusion

The current risk of MicroStrategy’s explosion is generally controllable, but there is a non-linear risk exposure:

• Short term (2025-2026): Unless BTC falls below $50,000 and lasts for more than half a year, the possibility of large-scale sell-offs is less than 20%

• Long term (2027-2029): The peak of debt maturity and the trough of the BTC cycle may form a "perfect storm", and attention should be paid to the pressure of the first batch of bill repurchases in Q3 2027

Investors should focus on: ① Whether BTC can maintain more than $60,000 in 2025-2026; ② Whether the liquidity environment of US stocks supports continuous equity financing; ③ How much Michael Saylor maintains control over the company.

It can be seen that, basically as Jiaolian said in the internal reference, there is no big problem in the short term. As for the long term, it depends on the market situation and the variables in Micro Strategy's financial management strategy.

Catherine

Catherine