By Stella L ([email protected])

In 2024, blockchain gaming mass adoption has an unexpected catalyst: Telegram. As major public chains scramble to build on this instant messaging platform with a massive user base, a core question emerges: Does this user acquisition strategy lead to real sustainable growth, or does it simply create a short-lived data bubble?

The Rise of Telegram Gaming

The Telegram gaming revolution began with Notcoin’s simple tap-to-earn mechanism, which quickly proved the platform’s potential as an entry point to Web3. This success set off a chain reaction throughout the blockchain ecosystem.

What started as a simple gaming experiment on TON has evolved into a full-blown competition. Aptos took the lead, and its Telegram game Tapos pushed the on-chain daily transaction volume to over 50 million in August. This breakthrough achievement triggered a chain reaction, and public chains such as Sui, Core, Starknet and Matchain joined the battle and launched their own Telegram game-related projects.

This wave quickly attracted the attention of mainstream cryptocurrency exchanges. Binance was the first to list multiple Telegram-based game tokens, including Hamster Kombat and Catizen. Other exchanges followed closely, vying to get a share of this emerging track.

Since the second half of 2024, institutional capital has also begun to enter the market in a big way. It is worth noting that Binance Labs has strategically invested in Pluto Studio, the publisher of the Catizen game. Animoca Brands' mobile gaming subsidiary GAMEE (developer of WatBird) completed two rounds of financing in August, highlighting the growing confidence of institutional investors in Telegram game-related projects.

Layout and effectiveness of major public chains

In 2024, multiple blockchain networks launched Telegram games one after another, achieving varying degrees of success in user acquisition and retention. By analyzing the specific data of Core, Sui and Matchain, we can understand the immediate effect and long-term sustainability of this strategy.

Core: A new attempt in the Bitcoin ecosystem

The Core blockchain is an EVM-compatible Layer 1 public chain driven by Bitcoin. At the end of September 2024, the social game TomTalk was launched on Core, allowing users to earn points through chat behavior within their Telegram applets.

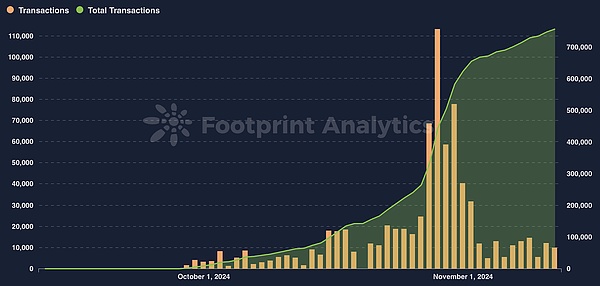

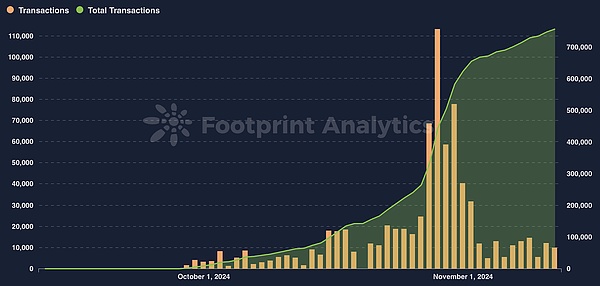

According to Footprint Analytics, TomTalk has had a significant impact on Core. As of November 12, the platform has accumulated 729,000 users (unique wallet addresses) and generated 757,000 on-chain transactions. During the peak period from October 28 to 31, DAU (daily active users) reached 80,000, accounting for 14.3% of Core's total DAU, and the average daily transactions during the same period accounted for 7.6% of the total transactions.

Data source: TomTalk daily and cumulative transaction counts

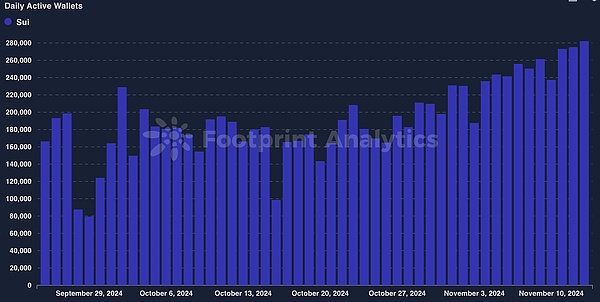

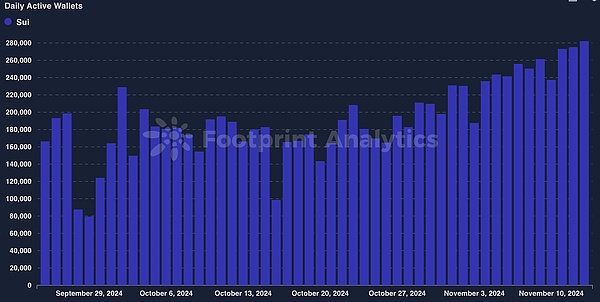

However, after the initial peak, TomTalk's data showed a significant cooling. By November 12, the game's daily active users stabilized at around 14,000, daily transaction volume remained at a similar level, and its Telegram mini program had 16,000 monthly active users. This cooling trend highlights the challenge of maintaining user activity. Sui: A rising dark horse Sui is a Move-based public chain known for its high-performance transaction processing. BIRDS launched Sui on September 25, ingeniously combining Memecoin elements with GameFi features in this game. BIRDS has impressive data performance. As of November 12, it has attracted 751,000 unique wallet users and generated 17.7 million transactions on the platform. Even more impressive is that BIRDS' influence in the Sui ecosystem continues to rise, with its daily active users increasing from 9.1% to 34.0% (November 12), and the number of transactions also increased from 4.3% to 13.5%.

Data source: BIRDS daily active users

The most striking thing is that, unlike the general downward trend of other Telegram games after they were launched, BIRDS has maintained a stable upward trajectory so far. Its Telegram applet has 6.2 million monthly active users, while its average daily active users on Sui Chain in November were 243,000. This gap shows huge user conversion potential and provides ample room for imagination for future growth.

Matchain: A Dramatic Rise

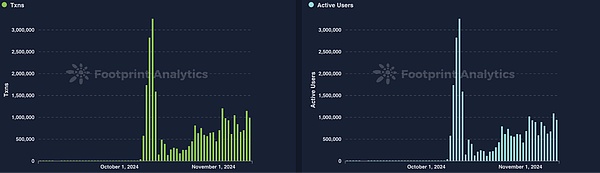

Matchain, a decentralized AI blockchain focused on data and identity sovereignty, has seen the most dramatic results with Telegram game integration since its mainnet launch in August 2024.

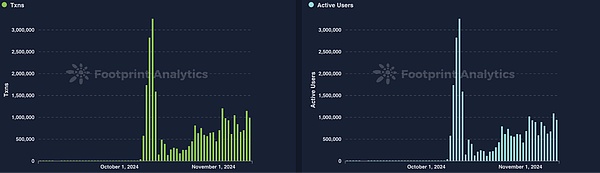

From a tiny starting point of only 78 daily active users in September, the Matchain gaming section surged to an average of 550,000 daily active users in October, driven by Telegram games such as LOL, Jumper, and Digiverse, and daily transactions also soared from 127 to 565,000.

From October 9 to 13, Matchain had its most glorious moment, with its game section’s daily active users exceeding 2 million, and hitting a record high of 3.3 million users on October 12. Although the data subsequently fell back, it remained stable at 615,000 users at the end of October, and regained its growth momentum in November, reaching 769,000 daily active users. This growth trajectory shows the huge potential of blockchain games based on Telegram in terms of user acquisition.

Data source: Matchain game section data

Matchain's development trajectory is perhaps the best example of the potential of Telegram games to drive blockchain adoption - jumping from negligible activity to maintaining hundreds of thousands of daily active users in just two months. However, its stabilization process after its sharp rise also highlights the challenges of projects maintaining growth momentum after completing initial user acquisition.

Telegram Game Advantages and Disadvantages

Telegram Games have shown amazing efficiency as a blockchain user acquisition channel. Compared with the customer acquisition cost of more than $10 in traditional Web3 channels, and even the customer acquisition expenditure of up to $40-50 in centralized exchanges, Telegram Games has reduced the customer acquisition cost to less than $0.1. More importantly, these users generally have a basic understanding of cryptocurrency, and the threshold for conversion into active Web3 participants is relatively low.

However, this seemingly perfect customer acquisition strategy still faces several key challenges. First, the current user composition is highly concentrated in Telegram's advantageous markets, such as emerging market regions such as Eastern Europe, Africa, and South Asia. Secondly, all projects generally face the problem of a sharp decline in user retention rate after the initial launch period. In addition, the large area of studio and robot activities also requires the project party to invest a lot of energy to ensure the healthy and sustainable development of the ecosystem.

Future Outlook

As the early dividend period comes to an end, blockchain networks need to layout the Telegram ecosystem more strategically. The key to success is to build a combination of viral marketing tools, design sustainable growth mechanisms, establish a sound user behavior analysis system, and continuously optimize customer acquisition funnels and retention strategies.

The Telegram gaming phenomenon is not just a short-term trend, but a paradigm shift in blockchain user acquisition models. Public chains or other types of Web3 projects that can effectively solve retention problems while maintaining efficient customer acquisition advantages will have an advantage in the next stage of Web3 mass adoption.

Weatherly

Weatherly