Solana Development Series 1 — Understanding Solana

Solana is a high-performance blockchain platform that achieves high throughput and low latency through a unique consensus mechanism and account model.

JinseFinance

JinseFinance

On Solana, MEV operates differently than other blockchain networks, primarily due to its unique architecture and the absence of a global memory pool. Extra-protocol memory pools must be developed independently and require adoption by a majority of the network’s stake holders to operate effectively, which poses high technical and social barriers.

Jito ceased its public memory pool service in March 2024, resulting in a significant drop in revenue. This move reduced harmful MEV behavior, but also led to the rise of alternative memory pools that lack transparency and primarily benefit specific groups.

Memecoin traders are particularly vulnerable to sandwich attacks because they set high slippage tolerance when trading illiquid and highly volatile assets. Such users prefer to use Telegram trading robots for faster transaction execution and instant notification services, and are relatively insensitive to transactions being preempted.

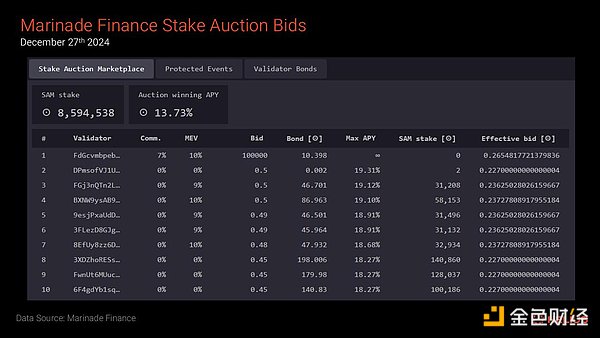

Marinade Finance's Staking Auction Market (SAM) uses a competitive auction mechanism where validators bid directly against each other for stake allocations through a "pay-for-stake" system. However, the mechanism has been controversial because it allows validators who conduct sandwich transactions to obtain more stakes through high-price bidding, thereby enhancing their influence in the network.

Most sandwich transactions on Solana originate from a private memory pool operated by a single entity, DeezNode. A key validator operated by DeezNode (address beginning with HM5 H6) currently holds a delegated stake of 811,604.73 SOL, worth approximately $168.5 million, and the delegated stake has experienced significant growth in the past few months.

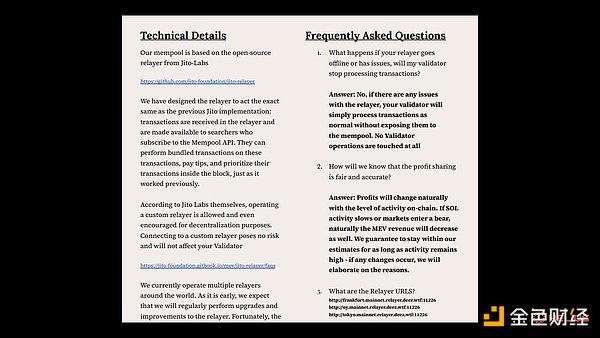

Multiple Solana validator operators report receiving lucrative offers to participate in private mempools, including detailed documents outlining profit sharing and expected returns.

Jito bundles are the primary method for seekers to ensure profitable transaction ordering. However, Jito data does not cover the full scope of MEV activity; in particular, it does not capture seeker profits or activity through alternative mempools. In addition, many applications use Jito for non-MEV purposes, such as bypassing priority fees to ensure timely inclusion of transactions.

Over the past year, Jito has processed over 3 billion transaction bundles, generating a total of 3.75 million SOL in tips. This activity has shown a clear upward trend, from a low of 781 SOL on January 11, 2024, to 60,801 SOL on November 19.

Jito's arbitrage detection algorithm analyzes all Solana transactions, including those outside of the Jito bundle, and has identified more than 90.44 million successful arbitrage trades in the past year. The average profit per arbitrage was $1.58, while the single most profitable arbitrage trade generated $3.7 million in gains, and these arbitrage trades generated a total of $142.8 million in profits.

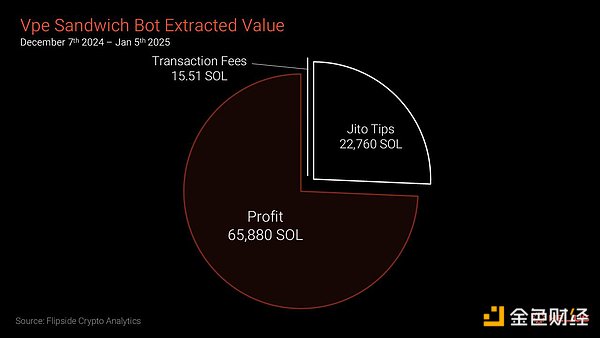

DeezNode runs a sandwich trading bot on an address starting with vpeNAL. Jito's internal analysis shows that almost half of the sandwich attacks against Solana can be attributed to this program. During a 30-day period (December 7 to January 5), the program executed 1.55 million sandwich transactions, making a profit of 65,880 SOL (about $13.43 million), with an average profit of 0.0425 SOL (US$8.67) per sandwich transaction. On an annualized basis, the program will generate a profit of more than 801,500 SOL per year.

Whitelisting is widely seen as a last resort to combat bad actors, but it may create a semi-permissioned and censored environment, which is in direct conflict with the decentralized philosophy of the blockchain industry. In some cases, this approach may also delay transaction processing, affecting user experience.

The Multiple Concurrent Leader (MCL) system provides a promising long-term solution to the harmful MEV problem by allowing users to choose between leaders without incurring delays. If leader A acts maliciously, users can redirect their transactions to honest leader B. However, it is expected that implementing MCL will take several years of development.

Maximum Extractable Value (MEV) is the value that can be extracted by manipulating transaction ordering, which includes adding, removing, or reordering transactions within a block. MEV manifests in different forms, but they all have one thing in common: they rely on transaction ordering. Seekers (traders who monitor on-chain activity) attempt to strategically place their own transactions before or after other transactions to extract value.

On Solana, MEV operates differently and uniquely from other blockchain networks, largely due to its unique architecture and the absence of a global memory pool. Features such as Turbine (for propagating state updates) and Stake Weighted Quality of Service (SWQoS) for transaction forwarding together shape Solana’s approach to MEV. Its fast streaming block production, without the need to rely on external plugins or off-protocol auction mechanisms, somewhat limits the scope of traditional approaches to certain types of MEV (such as front-running). To gain a competitive advantage, searchers run their own nodes or work with high-stake validators to access the latest state of the blockchain in real time.

Today, the term MEV has been overused, and people have different opinions on its exact definition. In fact, not all MEVs have negative effects. Due to the distributed and transparent nature of blockchain, it is generally believed in the industry that it is almost impossible to completely eliminate MEV. Those networks that claim to have eradicated MEV either lack sufficient user activity to attract searchers or use technologies such as random block packaging, which, while seemingly mitigating the impact of MEV, may also trigger a surge in spam.

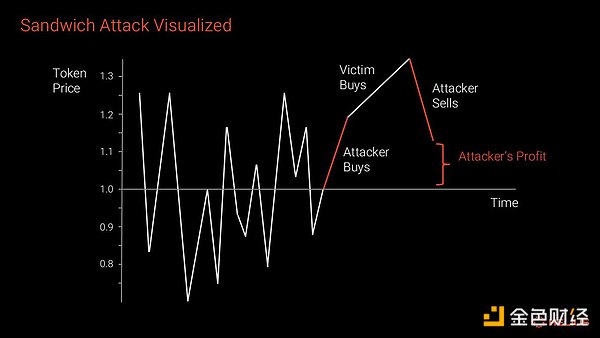

Among them, "Sandwiching" is one of the most concerned types of MEV, which is extremely disadvantageous to users. In this strategy, the searcher inserts a transaction before and after the target transaction to profit from it. Sandwiching transactions are naturally profitable for searchers, but it increases transaction costs and reduces the transaction execution price for ordinary users. A detailed discussion of this MEV type will be discussed in the following content.

Above: Visualization of a typical sandwich attack. The attacker conducts front-running and trailing transactions before and after the victim's buy transaction to make a profit.

In this report, we analyze the current MEV landscape on Solana, divided into four sections:

Solana MEV Timeline: Outlines a chronological series of key events, providing valuable context for readers who are less familiar with the rapid development of MEV on Solana;

Types of MEV: Explores the various types of MEV currently observed on Solana through specific and detailed examples;

Solana MEV Data: Provides relevant, quantifiable, and contextualized data to illustrate the current scope and impact of MEV on Solana;

MEV Mitigation Mechanisms: Examines the strategies and mechanisms being considered to reduce or eliminate harmful forms of MEV.

Below is a timeline of important events related to Solana MEV.

NFTs were the first area to gain significant traction on Solana. MEV in the NFT space primarily occurred during public events, where participants competed to acquire rare or valuable assets. These events undoubtedly created sudden profit opportunities for seekers, with no MEV potential in blocks minted before and huge MEV potential in blocks minted later. The NFT minting mechanism was one of the earliest causes of the massive congestion surge on Solana caused by spam transactions sent by bots, which overwhelmed the network and caused block production to temporarily stop.

Solana implements an optional Priority Fee that users can specify in their computational budget directives to prioritize their transactions. This mechanism strengthens the network’s economic model by allowing users to pay for accelerated processing during peak activity to relieve network congestion and establish a more efficient framework for the fee market.

In addition, priority fees help curb spam by changing the playing field. Bots that previously relied on brute force transaction volume to gain an advantage are no longer able to dominate through spam alone. Instead, priority is also determined by the fees that users are willing to pay.

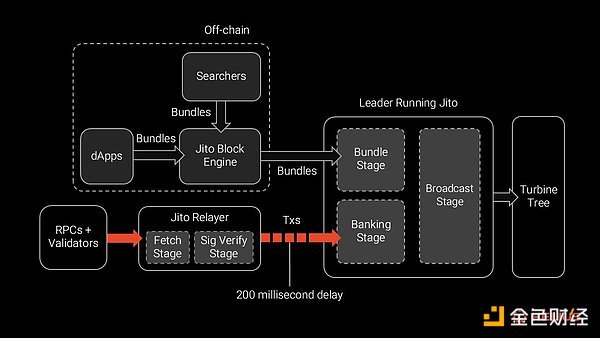

Jito has become the default Solana MEV infrastructure. The client aims to democratize MEV capture, ensuring a more equitable distribution of rewards across the network. When leaders use the Jito client validator, their transactions are initially directed to a Jito relayer, which acts as a transaction proxy router. The relayer retains the transaction for 200 milliseconds before forwarding it to the leader. This speed buffer delays incoming transaction messages, providing a window for off-chain auctions through the Jito block engine. Seekers and applications submit atomically executed transaction bundles with SOL-based tips. Jito charges a 5% fee on all tips, with a minimum tip of 10,000 lamports. (Bundles can be inspected via the Jito Bundle Explorer.)

Above: The current Jito architecture consists of a block engine that accepts bundles submitted by searchers and a relayer that delays sending incoming transactions to leaders

This approach reduces spam and improves the efficiency of Solana’s computational resources by conducting auctions off-chain and only publishing a single winner into a block. This is particularly important given that unsuccessful transactions can consume a large portion of the network’s computational resources.

In its first nine months, adoption of the Jito-Solana client remained below 10% as network activity remained low and MEV rewards were small. Starting in late 2023, adoption accelerates significantly, reaching 50% by January 2024. Today, over 92% of Solana validators (weighted by stake) use the Jito-Solana client.

Early 2024 saw a surge in network activity. Memecoins such as Bonk and DogWifHat gained popularity, sparking high interest from searchers and leading to a significant increase in MEV activity. This period marked a notable shift in user behavior: Memecoin traders preferred Telegram trading bots such as BonkBot, Trojan, and Photon over traditional decentralized exchanges or aggregators. These bots offered faster transaction speeds, real-time notifications, and an intuitive user interface that appealed to retail speculators. Notably, these traders are often willing to set higher slippage rates to ensure that time-sensitive transactions are processed first, and are relatively indifferent to their own transactions being preempted.

Jito's Mempool provides a 200 millisecond window for searchers to preview all incoming leaders' transactions. During its operation, the system was often used for Sandwich Attacks, which severely degraded the user experience. In order to prioritize the long-term growth and stability of the network, Jito made the controversial decision to suspend its Mempool, sacrificing significant revenue in the process. While the move received widespread support, it was also criticized by several prominent figures, including Mert Mumtaz and Jon Charbonneau.

The main risk of this decision is that alternative memory pools that replicate Jito’s functionality could emerge, allowing for more harmful forms of MEV. Because unlike public memory pools that promote a fairer distribution of MEV opportunities and mitigate power imbalances within the network, private permissioned memory pools lack transparency and only benefit a few who have access.

Above: Portion of the DeezNode MEV proposal for “DeezMempool.” Shortly after the Jito Mempool was suspended, multiple validators reported receiving the DeezNode MEV proposal.

Multiple Solana validator operators reported receiving lucrative offers to participate in private Mempools.

As part of the Agave-Solana 1.18 update, the new Scheduler significantly improves Solana’s ability to order transactions in a deterministic manner. The improved scheduler better prioritizes transactions with higher fees to increase their likelihood of being included in a block. The central scheduler builds a dependency graph called a “prio-graph” to optimize the handling and prioritization of conflicting transactions across multiple threads.

Previously, bots engaged in arbitrage and other MEV activities were incentivized to improve their chances of successful execution by spamming leaders. The randomness of the old scheduler led to variability in the placement of transactions within blocks. However, the new deterministic approach reduces this randomness, disincentivizing spam and improving the overall efficiency of the network.

Marinade Finance’s Staking Auction Market (SAM) uses a bidding auction mechanism in which validators bid directly against each other for stake allocations through a “pay-for-stake” system. This structure incentivizes validators to bid to the highest rate they deem profitable. However, the mechanism has been controversial because it allows validators who do sandwich transactions to obtain more stakes through high-price bidding, thereby increasing their influence in the network. Marinade Labs recently proposed the establishment of a public committee to oversee delegation behavior. After Jito, Marinade Finance’s mSOL has become the second largest liquid staking token and staking pool on Solana.

Above: Staking auction in the Marinade Finance staking auction market (December 27, 2024)

As of epoch 717, validators with 0% staking commissions and 0% MEV commissions typically offer stakers an APY (annualized rate of return) of about 9.4%. Validators that use extra-protocol methods to redistribute block rewards typically offer an APY of 10% or less. In contrast, Marinade's SAM auction showed a winning APY of 13.73%, while the top ten validators bid as high as 18.27% APY.

This discrepancy suggests that these validators are either bidding poorly and losing money as a result (they may be subsidizing their bids through stake delegations from the Solana Foundation) or supplementing their income through other sources, such as MEV extracted from user sandwich transactions.

Solana MEV became a hotly debated topic after Solana research firm Temporal publicly expressed concerns about the potential centralization of network stake, sparking widespread discussion and once again prompting the ecosystem team to address the challenges posed by Solana MEV.

Validators that engage in harmful MEV extraction capture value disproportionate to their contributions, causing their stake to grow much faster than other validators. This allows validators to accumulate greater network influence over time, introducing centralization risks to Solana's validator economics. These higher-yielding validators can also offer higher returns to stakers, thereby attracting more stakes and further expanding their dominant position.

It is important to note that the majority of Solana’s sandwich trading activity originates from private memory pools operated by a single entity, DeezNode. A key validator operated by DeezNode (address beginning with HM5H6) currently holds 811,604.73 SOLs in delegated stake, worth approximately $168.5 million. The delegated stake of this validator has experienced a significant increase, from 307,900 SOLs on November 13 (epoch 697) to 802,500 SOLs on December 9 (epoch 709), after which growth has stabilized. It is worth mentioning that 19.89% of the stakes come from Marinade’s mSOL liquid stake pool and Marinade’s native delegation. The validator currently holds 0.2% of the total stake (currently 392.5M SOL), ranking 93rd by stake within the wider set of validators.

Jito’s internal analysis shows that an increasing number of sandwich attacks are occurring outside of Jito’s auction mechanism, suggesting the presence of additional block engines or modified validator clients conducting such transactions.

Next, let’s look at the various types of MEVs on Solana and illustrate each with specific examples of actual transactions. Below are the most common types of MEV transactions currently observed on Solana.

When a borrower on a lending protocol fails to maintain the required collateralization ratio for their loan, their position becomes eligible for liquidation. Seekers monitor these undercollateralized positions on the blockchain and perform liquidations by paying off some or all of the debt in exchange for a portion of the collateral as a reward. Liquidations are considered a benign type of MEV. They are critical to maintaining protocol solvency and promoting stability in the broader DeFi ecosystem.

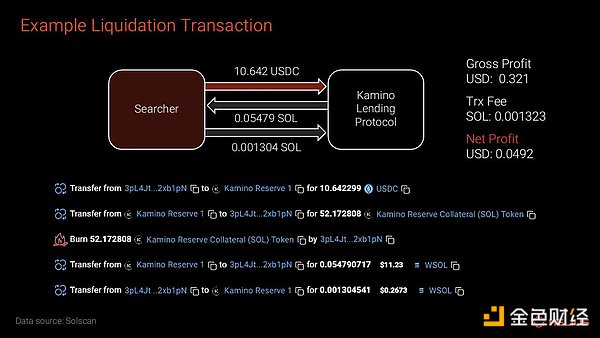

Liquidation Transaction Example

This liquidation event occurred on December 10th and involved Kamino, the largest lending protocol on Solana by liquidity and user base. The transaction consisted of three steps:

The Seeker initiated the liquidation by transferring 10.642 USDC to the Kamino reserve to cover the user's debt position.

In exchange, the Kamino reserve transferred the user's 0.05479 SOL collateral to the Seeker.

The searcher paid a protocol fee of 0.0013 SOL.

In addition, the searcher paid a priority fee of 0.001317 SOL for this transaction, resulting in a net profit of $0.0492.

Above: Example of a clearing transaction on Solana’s Kamino currency market

Arbitrage improves market efficiency and profits by adjusting prices on different trading venues and taking advantage of price differences for the same asset. These opportunities may occur within a chain, across chains, or between centralized and decentralized exchanges (CEX/DEX arbitrage). Among them, intra-chain arbitrage guarantees atomicity because the two parts of the transaction can be executed together in a single Solana transaction. In contrast, cross-chain and cross-platform arbitrage introduces additional trust assumptions.

Atomic arbitrage is the main form of MEV on Solana. The simplest example of atomic arbitrage occurs when two DEXs list different prices for the same trading pair. This typically involves leveraging outdated price information on a constant product model (xy=k) automated market maker (AMM) and hedging transactions on the chain limit order book, at which point the market maker has adjusted the quote based on the off-chain price changes.

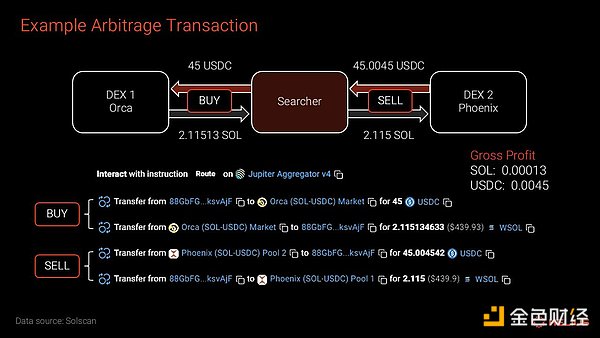

Arbitrage Trading Example

Above: Example of arbitrage trading between two decentralized exchanges

In this case, the price of the SOL/USDC trading pair has changed off-chain, prompting Phoenix market makers to update their quotes accordingly. At the same time, Orca AMM is still quoting based on outdated prices, creating an arbitrage opportunity for the seeker. The seeker bought 2.11513 SOL for 45 USDC on Orca, and then sold 2.115 SOL for 45.0045 USDC on Phoenix, making a profit of 0.00013 SOL (about $0.026). Arbitrage trades are executed atomically, without the seeker holding inventory. The only risk is that if the trade is reversed, there may be associated fees.

Front Running is when a MEV seeker identifies a buy or sell order from another trader in the memory pool and places the same order before that trader, profiting from the price impact of the victim's trade.

Front Running occurs when an observer notices that an unconfirmed transaction may affect the token price and acts on this information before the original transaction is processed. This strategy is simple and straightforward, and does not involve the complexity of other methods such as sandwich attacks.

The searcher realizes that there is a pending buy trade that will have a positive impact on the target token price, so it bundles its buy trade with the target trade. Their order will be processed at a price lower than the target, and once the target trade is completed, they will make a profit. In the process, the target trader will suffer losses due to the influence of the MEV searcher's buy trade and buy at a higher price.

Back Running is the counterpart of Front Running. It is a specific MEV strategy that takes advantage of a temporary price imbalance caused by another transaction, which is usually caused by improper routing. Once the user's trade is executed, the trailing trade searcher will balance the prices of various pools by trading the same asset and ensure a profit. In theory, the user could have captured this part of the profit through more efficient trade execution.

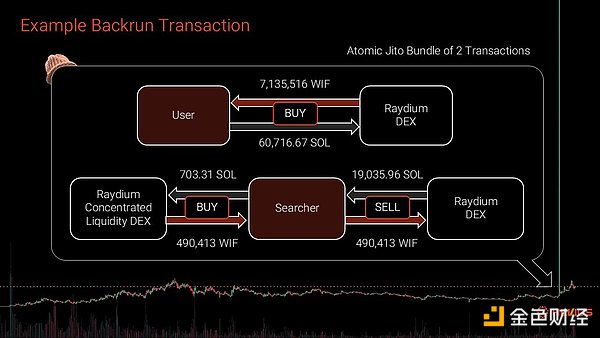

Tail Trade Example

This famous tail trade took place on January 10, 2024, when a user purchased $8.9 million worth of DogWifHat tokens, WIF, in a single transaction. At the time, WIF tokens were trading at $0.20, and liquidity across all on-chain venues combined was only a few million dollars. The Jupiter aggregator executed the trade through three pools with limited liquidity, causing the price to surge to $3.

The seeker executed the tail trade using the Jito Bundle and provided a generous Jito tip of up to 890.42 SOL ($91,621). They first exchanged 703.31 SOL ($72,368) for 490,143.90 WIF tokens through a Raydium centralized liquidity pool. They then exchanged these WIF tokens for 19035.97 SOL ($1,958,733) through the Raydium V4 liquidity pool. This series of operations netted a net profit of 17442.24 SOL ($1,794,746) in a single transaction. All USD values reflect the price at the time of the transaction.

Above: Trailing transactions after a large purchase of WIF tokens in January 2024

Sandwich Attacks are one of the most destructive types in MEV, specifically targeting traders who set high slippage tolerance on automated market makers (AMMs) or bonding curves. These traders increase their slippage tolerance not to accept worse prices, but to ensure that orders can be executed quickly. Memecoin traders are particularly vulnerable to sandwich attacks because they tend to set high slippage tolerances when trading illiquid, volatile assets, which ultimately leads to them trading at extremely unfavorable prices.

A typical sandwich attack involves three atomically bundled trades. First, the attacker executes an unprofitable front-running trade, buying the asset to push its price up to the worst execution level allowed by the victim's slippage settings. Next, the victim's trade occurs, and because it is executed at an unfavorable price level, the price rises further. Finally, the attacker completes a profitable trailing trade, selling the asset at an inflated price, thereby offsetting his initial losses and making a net profit.

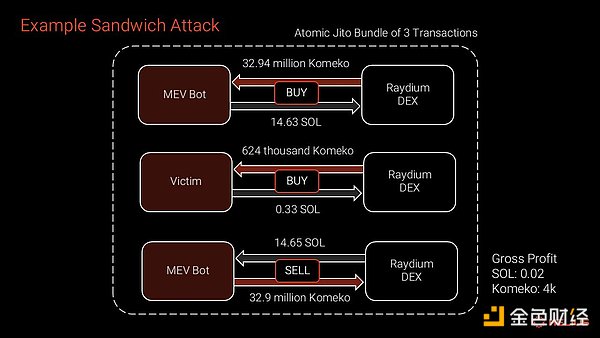

Sandwich Attack Trade Example

The attack took place on December 16, 2024, and was carried out using a well-known sandwich attack program (vpeNALD… Noax38b). The Seeker submitted these transactions as atomic Jito bundles and paid a tip of 0.000148 SOL (about $0.03).

Front Transaction: Seeker paid 14.63 SOL to buy 32.9 million Komeko tokens, a newly launched Memecoin on the Pump Fun platform;

Victim Transaction: 624,000 Komeko tokens were purchased for 0.33 SOL;

Trail Transaction: Seeker sold 32.9 million Komeko tokens for 14.65 SOL.

Above: An example of a sandwich attack that bundles three transactions together

Features that indicate this is a sandwich attack:

The signer of the middle transaction is different from the signer of the first and last transaction.

The tokens purchased in the first two transactions are the same as the tokens sold in the third transaction.

The token traded was a newly minted, illiquid, and highly volatile Pump Fun token.

The seeker made a net profit of 0.01678 SOL, which was approximately equivalent to $3.35 at the time of the trade.

This section evaluates the current Solana MEV landscape using existing public data. It begins by analyzing Jito’s performance metrics, then dives into the number of Reverted Transactions and the breakdown of arbitrage profitability. It ends with a case study detailing the behavior and profitability of a well-known sandwich trading bot.

Jito bundles are the primary method for seekers to ensure profitable trade ordering. Most Jito tips come from demand at the top of blocks from users looking to be among the first to buy tokens or to seize an opportunity. However, Jito data does not cover the full scope of MEV activity; in particular, it does not capture seeker profits or activity through alternative memory pools. In addition, many applications use Jito for non-MEV purposes, bypassing priority fees to ensure timely inclusion of transactions.

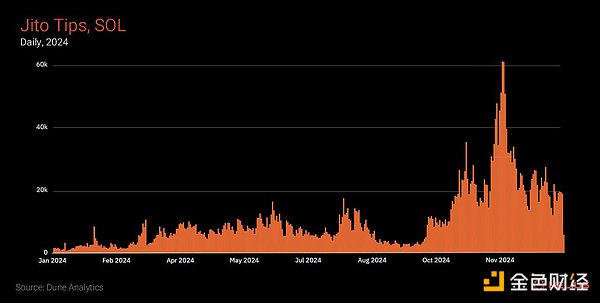

Data from transfers to eight designated Jito tipping accounts show that Jito has processed more than 3 billion transaction bundles over the past year, generating a total of 3.75 million SOL in tips. This activity shows a clear upward trend, from a low of 781 SOL on January 11, 2024, to highs of 60,801 SOL and 60,636 SOL on November 19 and 20, respectively. From the chart, there was a clear slowdown in the third quarter, with tips falling to a low of 1,661 SOL on September 7. In addition, the value of tips before December 2023 was negligible compared to the substantial growth throughout 2024.

Above: Daily amount of Jito tips in SOL (data source: Dune Analytics, 21co)

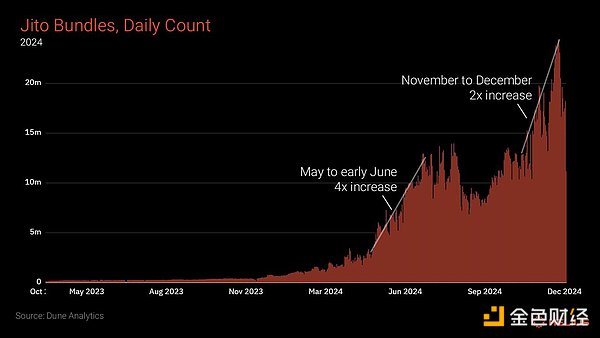

Throughout 2024, the number of bundles processed through Jito continued to grow, eventually peaking at 24.4 million bundles on December 21. This growth included two notable surges. The first surge occurred between May and early July, with the number of daily bundles increasing from about 3 million to 12 million, likely in response to network congestion issues. The second surge occurred between November and December, with the number of daily bundles doubling from about 12 million to a peak of 24 million.

Above: Daily number of Jito tips (bundles) throughout 2024 (data source: Dune Analytics, Andrew Hong)

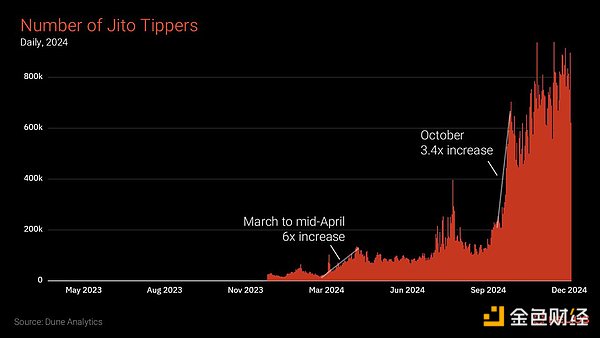

During this period, the number of accounts using Jito also showed a parallel upward trend, with about 20,000 daily tip payers at the beginning of the year and a peak of nearly 938,000 on December 10. Notable growth periods include the rise from 21,000 in early March to 135,000 in mid-April (a 6x increase), and the sharp increase from 208,000 in October to 703,000 by the end of the month (a 3.4x increase).

Above: Number of daily tip payers for Jito (data source: Dune Analytics, Andrew Hong)

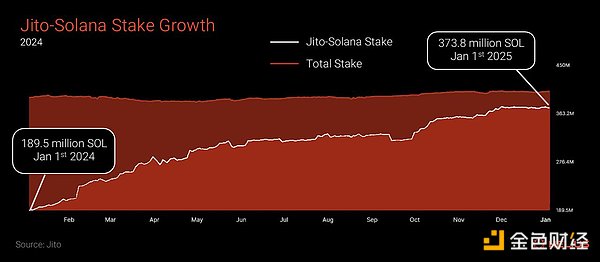

Throughout 2024, the proportion of validators adopting the Jito-Solana client has steadily increased, reinforcing the effectiveness of the Jito bundle for fast transaction inclusion. At the beginning of the year, validators using the Jito-Solana client staked 189.5 million SOL, accounting for 48% of the total stake on the network. By the beginning of 2025, this number had increased to 373.8 million SOL, accounting for 92% of the total stake.

Above: Jito-Solana validator adoption growth by stake in 2024 (data source: Jito)

A large portion of transactions on Solana are related to MEV withdrawal-related spam. By examining the ratio of reverted transactions to successful transactions, we can identify patterns that indicate MEV bots are racing to capture arbitrage opportunities.

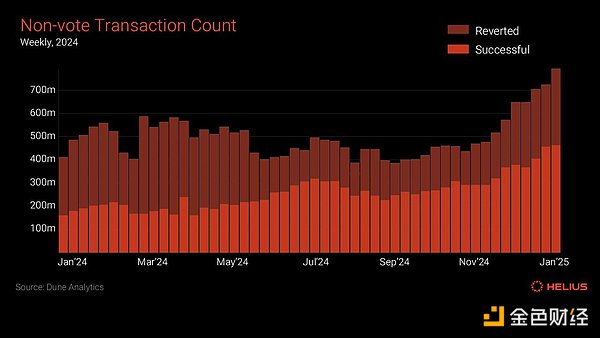

Above: Number of reverted and successful non-voting transactions per week in 2024 (data source: Blockworks Research)

Spam poses a huge challenge because it causes many transactions to be reverted. Under the winner-takes-all nature of MEV, only one transaction can take advantage of a given opportunity. However, even after this opportunity is captured, the leader will still process other transactions that attempt to take advantage of the same opportunity. These revoked transactions still consume valuable computing resources and network bandwidth. Competitive latency races between searchers further exacerbate this problem, causing the network to be flooded with duplicate transactions, which in extreme cases can also cause congestion and a degraded user experience. Due to Solana’s low transaction costs, revoked arbitrage spam still has a positive expected value. Over time, traders can realize profitability by executing these trades at scale (even though individual trades may fail).

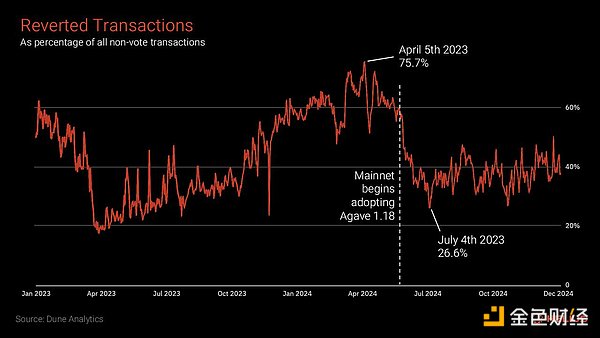

Revoked transactions peaked in April 2024 at 75.7% of all non-voting transactions. This percentage has dropped significantly after the rollout of key updates including the Agave 1.18 central scheduler. The new scheduler improves deterministic transaction ordering within the “Banking Stage”, thereby curbing the effectiveness of spam.

Above: Reversed transactions as a percentage of all non-voting transactions (data source: Dune Analytics, 21co)

Jito's arbitrage detection algorithm analyzes all Solana transactions, including those outside the Jito bundle, and identified 90,445,905 successful arbitrage transactions in the past year. The average profit per arbitrage was $1.58, and the single most profitable arbitrage transaction generated $3.7 million in gains. These arbitrage transactions generated a total of $142.8 million in profits, of which $126.7 million (88.7%) was denominated in SOL.

Above: Arbitrage trading profits by token in 2024 (data source: Jito)

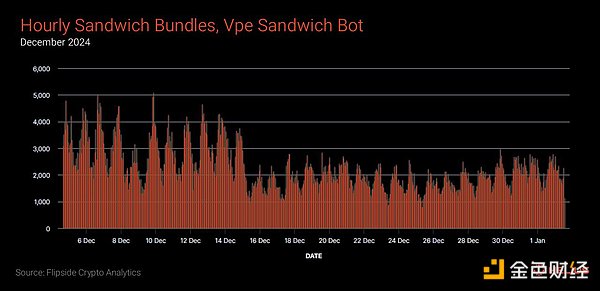

DeezNode runs a sandwich trading bot on an address starting with vpeNAL as part of its alternative memory pool operations. This highly active program has recently become notorious for executing large-scale user sandwich attacks.

Above: The number of sandwich transaction bundles initiated by the Vpe sandwich transaction program per hour (data source: Flipside crypto analytics, Marqu)

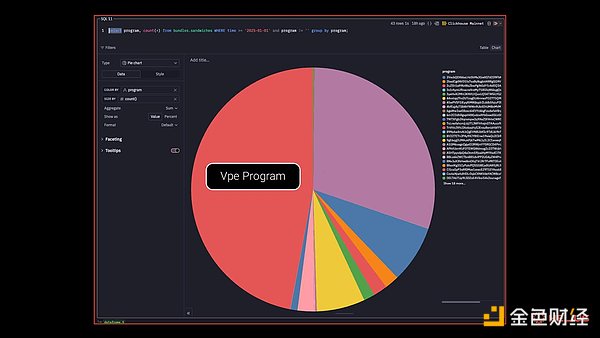

Jito's internal analysis shows that almost half of the sandwich attacks against Solana can be attributed to this program.

Above: Vpe program is the source of nearly half of Solana sandwich attacks (Source: Jito internal)

During a 30-day period (December 7 to January 5), the program executed 1.55 million sandwich transactions, an average of about 51,600 transactions per day, and a success rate of 88.9%. The program generated a profit of 65,880 SOL (US$13.43 million), equivalent to earning about 2,200 SOL per day. The program paid out Jito tips totaling 22,760 SOL ($4.63 million), an average of about 758 SOL per day, with an average profit of 0.0425 SOL ($8.67) per Sandwich trade.

Above: Value extracted by the Vpe Sandwich trading bot from December 7, 2024 to January 5, 2025

Most of the victim transactions involved exchanges made through Raydium. Of the first 20 Sandwich-attacked tokens, 16 were created on Pump Fun, which can be identified by the token minting addresses ending in "pump".

The Vpe Sandwich trading bot is one of many on-chain programs that have performed Sandwich attacks. Visit Sandwiched.me to see Sandwich attacks detected on Solana in real time.

Annualizing the December profit data, the program is expected to generate an annual profit of 801,540 SOL. In the worst-case scenario for network centralization, if all of these profits were reinvested in validators of the alternative memory pool, their share of the network stake would increase by 0.2%, assuming overall network stake remained constant.

However, this worst-case scenario is unlikely for several reasons. First, the network is currently experiencing near-all-time high activity levels, and second, it is reasonable to assume that memory pool searchers and operators would cash out some of their profits rather than reinvest all of their gains.

Substantial resources have been invested in researching and exploring various mechanisms to mitigate or redistribute MEV. Generic, out-of-protocol solutions are increasingly being integrated into applications and infrastructure to minimize the scope of on-chain MEV, and these mechanisms are detailed below.

One proposal is that stakers, RPC node providers, and other validators could exclude validators who are found to be conducting sandwich attacks by ignoring their leadership slots. However, whitelisting is widely viewed as a last resort. Assuming a leader is assigned four consecutive slots, this approach could delay transaction processing by several seconds, resulting in a poor user experience. More importantly, whitelisting has the potential to create a semi-permissioned and censored environment, which is in direct conflict with the decentralized philosophy of the blockchain industry. Additionally, such a system carries an inherent risk of falsely excluding honest validators, which could undermine trust and participation in the network.

It is worth noting that some independent developers and applications are free to build their own validator allow or deny lists, such as the sendTransaction method in the Helius Node.js SDK.

Traditionally, managing slippage has been a challenging and cumbersome process for users, who need to make manual adjustments based on the tokens they are trading. This approach is particularly cumbersome when dealing with volatile or less liquid tokens, as the slippage settings that apply to stable assets (such as liquid staking tokens or stablecoins) differ significantly from those that apply to Memecoins.

In August 2024, Jupiter Aggregator, the most popular retail trading platform on Solana, introduced Dynamic Slippage to address this complexity. This algorithmic mechanism uses a set of heuristic algorithms to optimize slippage settings in real time to calculate the ideal slippage threshold for each transaction. These heuristic algorithms consider factors such as:

Current market conditions

The type of token traded (such as a stablecoin pair vs. a volatile Memecoin)

The pool or order book the transaction passes through

The user's maximum slippage tolerance

These heuristic algorithms ensure that transactions are optimized with minimal slippage to succeed, thereby reducing the scope for MEV extraction.

MEV protection mode is becoming increasingly common among decentralized exchanges and Telegram trading bots. When enabled, user transactions will be routed only to the Jito block engine, significantly reducing the risk of sandwich attacks. However, this protection comes at the cost of slightly higher transaction fees, so many Telegram bots will not choose to enable it even if MEV protection is provided. Because they are more focused on the rapid inclusion of transactions, they prioritize speed over reducing the risk of sandwich attacks.

RFQ (Request for Quote) systems are gaining traction on Solana, and they allow professional market makers rather than on-chain automated market makers (AMMs) or order books to fill orders. These systems use a signature-based pricing approach that allows off-chain calculations, and the price discovery process also takes place off-chain, with only the final transaction being recorded on-chain. Here are some examples:

Kamino Swap: An intent-based trading platform designed to eliminate slippage and MEV. Kamino leverages the Pyth Express Relay to broadcast swap requests to a network of seekers, who compete in a bidding war to complete trades. The winning seeker offers the best execution price and pays a tip to the user. In the event of an arbitrage opportunity, a seeker may execute a trade at a better price than the request, generating a trade "surplus". Users benefit by retaining any surplus on their trades, increasing their overall execution value.

JupiterZ (Jupiter RFQ): Starting in December, all exchanges on Jupiter will have JupiterZ enabled by default. This feature allows exchanges to automatically select the best price between Jupiter's standard on-chain routing engine and the RFQ system. With RFQ, users benefit from no slippage or MEV because trades are executed directly with off-chain market makers. Additionally, market makers incur trade priority fees and eliminate the need for complex routing logic.

RFQ systems work well for tokens that are widely traded on CEXs. However, they work less well for newer, less liquid, and more volatile on-chain assets. Unfortunately, these are precisely the trades that are most vulnerable to MEV attacks. Another disadvantage is that liquidity is moved off-chain, reducing composability.

Sandwich-resistant AMM (sr-AMM) is an experimental design built on the traditional constant product model (xy=k) AMM. Its core is to automatically adjust the token price in the funding pool using a geometric formula.

sr-AMM uses slot windows to manage transactions. Trading within a slot window has an asymmetric impact on the bid and ask order pools:

When a buy order is executed, the ask price on the pool rises along the xy=k curve, while the bid price remains unchanged, effectively increasing the bid-side liquidity;

Conversely, sell orders consume this bid-side liquidity, lowering the quote determined by the xy=k curve.

At the start of each new slot window, the sr-AMM resets to an equivalent xy=k state, recalibrating bid and ask prices. By decoupling these resets from individual trades and maintaining consistent pricing within each slot window, the sr-AMM undermines the atomic execution required for a sandwich attack, rendering it ineffective.

However, sandwich attacks are still possible at the boundaries between slot windows. If the leader controls consecutive slot windows, they can perform front-running and target trades at the end of the first slot window, and then perform trailing runs at the beginning of the next slot window.

In November, Ellipsis Labs released Plasma, an audited reference implementation of a sandwich-resistant AMM design.

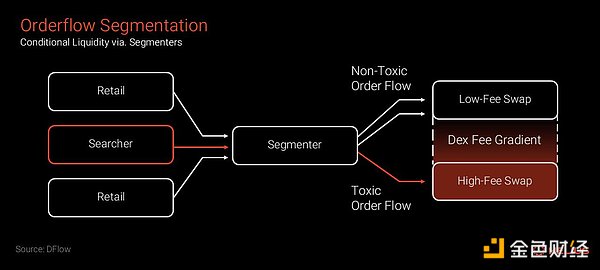

Decentralized exchanges (DEXs) currently lack a mechanism to apply variable pricing to different types of market participants. This limitation stems from the inability of DEXs to accurately identify the costs that order flow imposes on the DEX protocol. DEXs narrow spreads to attract order flow, but inadvertently increase their risk of adverse selection from sophisticated buyers.

Conditional liquidity introduces a new mechanism that enables DEXs to dynamically adjust spreads based on the "expected toxicity" (expected malicious behavior or potential harmful effects) of incoming order flow. This enables DEXs to express a wider range of on-chain immediate preferences. Rather than offering a single spread to all participants, conditional liquidity enables DEXs to present a gradient of spreads that is calibrated to the perceived likelihood of adverse selection by a particular taker.

This process relies on a new class of market participants, “Segmenters.” Segmenters specialize in assessing the “toxicity” of order flow and adjusting spreads accordingly. They take a portion of the adjusted spread as compensation while passing the remainder to wallets or traders. By managing the responsibility for setting spreads, segmenters enable DEXs to better compete for non-toxic order flow. Segmenters compete with each other to minimize the risk of adverse selection for liquidity providers. The tightest quotes are reserved for flows that are deemed least likely to harm liquidity providers. In the simplest form, a wallet or application can act as a segmenter for its own order flow. Alternatively, it can delegate the responsibility for flow segmentation to the market.

Users leverage this through “declarative swaps,” which enable them to declare their intention to swap and leverage sub-stakeholders for execution. These swaps interact with existing Solana liquidity sources and conditional liquidity-enabled DEXs. Declarative swaps built with the Jito bundle provide traders with guaranteed quotes at the time of signing, while recalculating the best route before the trade enters the network, ensuring that the initial quote is adhered to.

This approach significantly reduces the latency between route calculation and trade finalization, thereby mitigating slippage. Additionally, declarative swaps minimize the potential for sandwich attacks when routed through a conditional liquidity-enabled DEX. By providing tighter spreads for non-toxic flows, these DEXs improve trading conditions for Solana users. As a result, declarative swaps provide traders with reduced slippage, lower latency, and increased protection against sandwich attacks, providing a more efficient and secure trading experience.

Paladin-Solana is an improved version of the Jito-Solana validator client that includes Paladin Priority Port (P3) transactions in the bundle phase by introducing a minimal code patch (~2000 lines of code). Paladin Priority Port (P3) facilitates the processing of high-priority fee transactions. Validators act as leaders to open this fast lane, allowing them to process valuable transactions in a timely manner. Each P3 transaction meets the minimum fee threshold (10 lamports per computational unit) and is passed directly to the packaging phase to be processed in the order received.

Paladin prioritizes high-priority fee transactions and actively identifies and discards sandwich transaction bundles based on transaction patterns. While this may initially appear detrimental to validator rewards, Paladin validators can be compensated through a trust-based mechanism. Validators that avoid sandwich attacks can attract direct transactions, creating an ecosystem of trust and increasing returns.

Validators are incentivized by the prospect of additional rewards and by relying on the trust of P3 fast-track users. However, if they include sandwich transaction bundles in their blocks, they risk losing P3 transaction revenue. This trust is collateralized by PAL tokens.

The PAL token is designed to align the interests of validators, users, and the broader Solana community. It has a fixed supply of 1 billion tokens, 65% of which will be distributed to validators and stakers, and the remainder will be divided between Solana builders, the Paladin team, and a development fund. Validators can enable P3 transactions on their nodes by locking up PAL, creating a decentralized, permissionless, and token-controlled mechanism for MEV extraction and transaction prioritization.

The project is still in its early stages and has not yet reached critical mass for widespread adoption. Currently, there are 80 validators running Paladin, accounting for 6% of the network's stake. Paladin claims to increase block rewards by 12.5%.

Block producers maintain a monopoly on transaction inclusion within their assigned slots. Users are unwittingly submitting transactions and expecting them to be processed immediately, even if the current leader is known to be malicious and conduct a sandwich attack. Users cannot choose which node processes and orders transactions, making them vulnerable to manipulation.

The Multiple Concurrent Leaders (MCL) system introduces competition between block producers in the same slot. Users gain the ability to choose a leader without incurring delays. If leader A is malicious and known to conduct a sandwich attack, the user or application can choose to submit the transaction to leader B, who behaves honestly.

Long-term maximization of competition among leaders involves shortening the duration, limiting the number of consecutive slots a single leader is assigned, and increasing the number of concurrent leaders per slot. By scheduling more leaders per second, users gain greater flexibility, allowing them to choose the most favorable offer from the available leaders to trade with.

While MCL offers a compelling long-term solution to MEV, its implementation is complex and may require years of development.

Asynchronous execution (AE) is another potential way to reduce MEV. Under AE, the outcome of every transaction does not need to be executed or evaluated when a block is constructed. This speed poses a significant challenge to algorithms in calculating profitable opportunities and executing effective sandwich strategies in a timely manner.

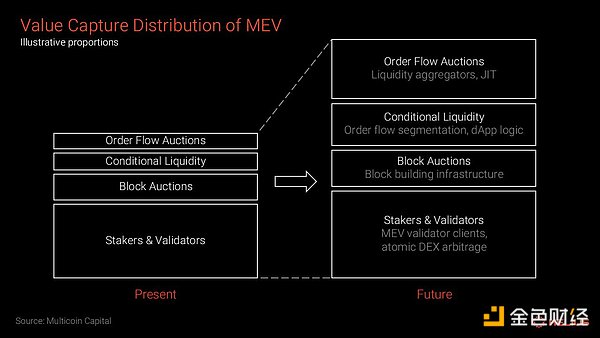

Solana's MEV landscape is rapidly evolving and is far from reaching a stable competitive equilibrium. As searchers continue to explore more complex strategies to capture value, the ecosystem deploys a diverse set of infrastructure and mechanisms to mitigate the impact of harmful MEV. Forward-looking ecosystem investors such as Multicoin Capital are actively deploying capital, believing that the value that ecosystem teams gain from Solana MEV will grow significantly and that the landscape of value distribution will change significantly in the coming years.

Above: MEV value capture distribution (Source: Multicoin Capital, Tushar Jain)

MEV is an inevitable challenge for any blockchain that hosts significant financial activity. Properly addressing and managing this "MEV demon" is critical to the long-term success of the network. Solana has undoubtedly emerged stronger from the difficulties of 2023 and is now a highly active blockchain with growing user adoption. However, new challenges lie ahead. To achieve wider adoption, the ecosystem must face these challenges head-on. Solana is currently at a critical juncture in its development, which is both a challenge and a valuable opportunity to define its future.

Solana is a high-performance blockchain platform that achieves high throughput and low latency through a unique consensus mechanism and account model.

JinseFinance

JinseFinanceFractal Bitcoin is neither Layer 2 nor an extension of Bitcoin. It is a completely independent blockchain that runs a fork of the Bitcoin Core codebase.

JinseFinance

JinseFinanceScammers have developed a new tactic to defraud Solana users by burning their tokens seconds after purchase, using a Solana token extension to secretly erase crypto holdings. While the motives vary, the result is consistent: users lose their assets.

Catherine

CatherineSOLANA,Restaking,Jito Network,Does Solana need Restaking? Golden Finance, a brief analysis of Jito’s latest product.

JinseFinance

JinseFinanceSolana will launch new features on June 25, 2024: Solana Actions and Blinks, these tools will greatly simplify the user's interaction experience with the Solana blockchain.

JinseFinance

JinseFinanceA story of lies, inflated metrics, and where we go from here.

CharlieXYZ

CharlieXYZCryptocurrency-powered financial systems boast a high throughput, with the capacity to handle thousands of transactions per second.

Bitcoinist

BitcoinistSet to develop on the Solana Chain, SolMad is an NFT collection in the Solana-verse where nomads travel in search ...

Bitcoinist

BitcoinistThe new shop entertained about 400 crypto-curious guests on opening day, and hopes to host even more as other stores are opened across the U.S. and the rest of the world.

Cointelegraph

CointelegraphCoinbase added wallet support for SOL and Solana-based tokens, and said it will also support NFTs and dApps on the blockchain in the future.

Cointelegraph

Cointelegraph