Author: route2fi Source: The Black Swan Translation: Shan Ouba, Golden Finance

Introduction

Centralized stablecoin issuers, such as Tether and Circle, account for about 90% of the stablecoin market and have become heavyweights in the cryptocurrency field, with valuations and profits far exceeding traditional financial giants such as JPMorgan Chase and BlackRock. Their business model is simple: use the liquidity behind stablecoins to support a variety of risky assets.

As currency interest rates rise, these entities have transformed into lucrative "cash machines". Tether and Circle generated more than $10 billion in revenue in 2023 and are valued at more than $200 billion. This wealth created will not be shared with users who contribute to its success. Usual's goal is to make users owners of protocol infrastructure, funds, and governance. By redistributing 100% of the value and control through its governance token, Usual ensures that its community is in the driver's seat.

The Usual protocol distributes its governance tokens to users and third parties who contribute value, realigning financial incentives and returning power to participants within the ecosystem.

Usual is revolutionizing the world of stablecoins by introducing the functionality of a decentralized RWA stablecoin. By depositing yield-generating assets (initially USYC), users can earn speculative returns pegged to the success of the protocol through the Usual Governance token ($USUAL). This yield is designed to exceed the risk-free return of the underlying asset. Its mission is to transform stablecoin holders into profit owners.

Turning Users into Owners

TLDR:

While traditional stablecoins like Tether prevent users from participating in both yield and growth, and yield-producing assets only deliver yield, not growth, Usual offers the best of both worlds. With Usual, you get both yield and growth potential.

The shared ownership mechanism makes it possible for Usual to capture a significant market share by creating a positive feedback loop, ensuring a tight alignment between early contributors and the protocol. By distributing ownership widely, the protocol rewards early participants and aligns the interests of all stakeholders.

Stablecoins like Tether collect users’ cash, earning interest, while users receive neither yield nor growth from the issuer. In exchange, users receive a token to use in DeFi, but receive nothing from the profits.

What if users could benefit from all three, interest, growth, and utility, without compromise?

That’s where Usual steps in: a decentralized stablecoin issuer where users are owners.

There are three categories of stablecoin issuers on the market today:

Tether retains all revenue and distributes it all to Tether’s shareholders. Users own DeFi-compatible stablecoins but miss out on yield and protocol growth.

Yield stablecoins issued by tokenizers like Ondo or Mountain mark a significant shift in the stablecoin space, redistributing underlying yield to users through permissioned stablecoins. Users receive yield but are not subject to protocol growth: whether USDM’s TVL is $100M or $100B, users still “only” receive 5%.

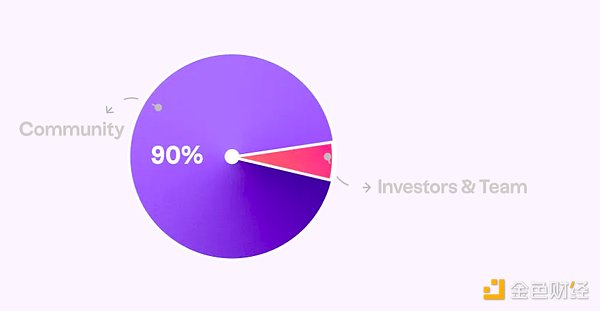

Usual goes a step further by redistributing value through $USUAL tokens, giving users ownership of the protocol. Unlike a revenue sharing model, Usual concentrates all created value into its treasury, 90% of which is distributed to the community through governance tokens. Users get both: utility, yield, and growth.

This is how Usual transforms users into direct owners, giving them control over the protocol’s infrastructure, finances, and future cash flows.

Common Token Infrastructure

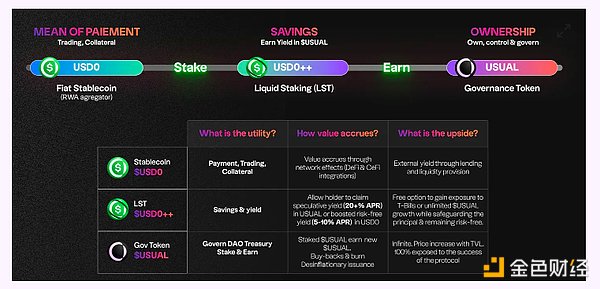

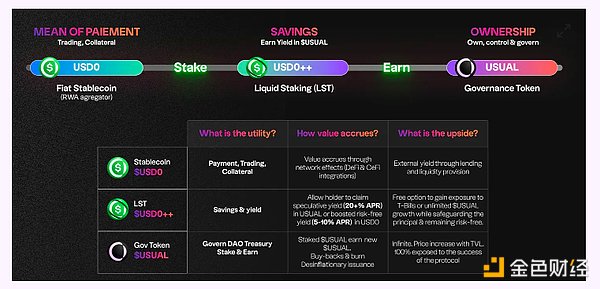

The protocol is built around three tokens:

USD0

USD0 is Usual's dollar-pegged stablecoin, designed to act as a payment method, counterparty, and collateral token within the protocol. It provides a better alternative to USDC and USDT while complying with US and EU regulations. This institutional-grade stablecoin is available to retail investors and DeFi users.

USD0 aggregates U.S. Treasury tokens to create a safe, bankruptcy-proof asset that has nothing to do with traditional bank deposits. It is fully transferable and permissionless, and can be seamlessly integrated into the DeFi ecosystem.

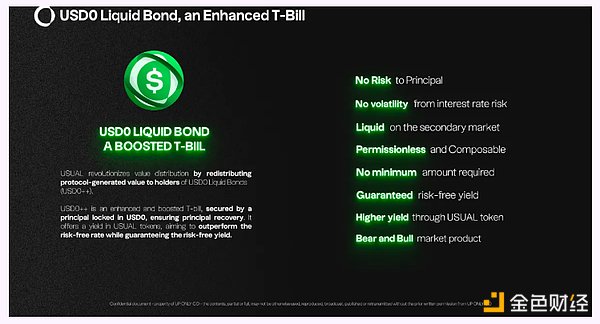

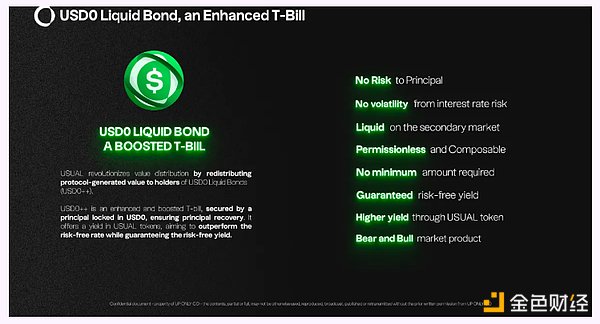

USD0 Liquid Bond (USD0++)

If USD0 holders want their stablecoins to generate benefits, they must stake the stablecoins to obtain RWA's efficient LST. USD0++ is a liquid representation of staked USD0. By locking up capital, users have the opportunity to claim $USUAL every day. If they have not claimed $USUAL yet, they can exercise their right to a risk-free return every six months. USD0++ is fully composable in DeFi, similar to USD0.

Therefore, USD0++ is an enhanced US Treasury bond that entitles you to:

Speculative yield in the form of the Usual governance token $USUAL. The yield fluctuates based on the price of $USUAL determined by the secondary market.

Based on the money rate of the underlying Treasury bond, at least the risk-free rate is increased. This yield is increased proportionally by the floating supply of unproductive USD0.

$USUAL - Governance Token - Benefits of USD0 Adoption

USUAL rewards USD0 growth, adoption, and usage in the ecosystem. The token represents the growing adoption of USD0, aligning incentives with users who contribute to the expansion and utilization of the protocol.

The $USUAL token is the governance token in the Usual ecosystem, representing the protocol's revenue and empowering users to participate in the decision-making process related to protocol operations and treasury management.

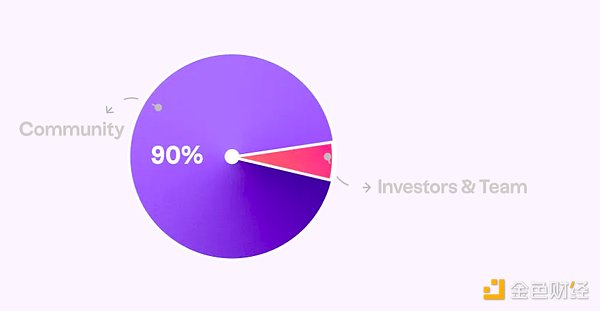

USUAL is designed for long-term value growth, with its issuance rate intentionally kept below protocol revenue growth to increase intrinsic value over time. In line with its community-first philosophy, 90% of tokens are allocated to the community, leaving only 10% for the team and investors.

Growth

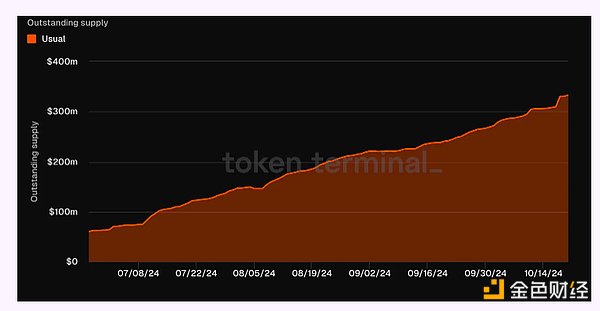

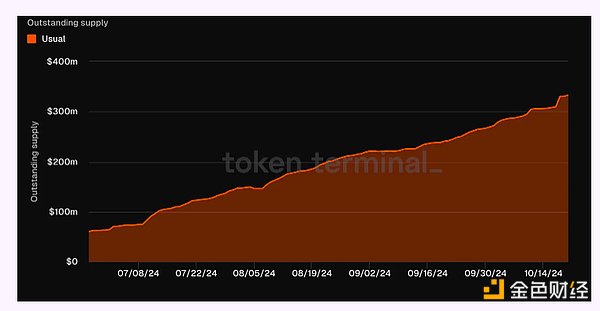

Usual showed the highest TVL growth rate among stablecoins in the summer of 2024, ranking among the top five fiat-backed stablecoins:

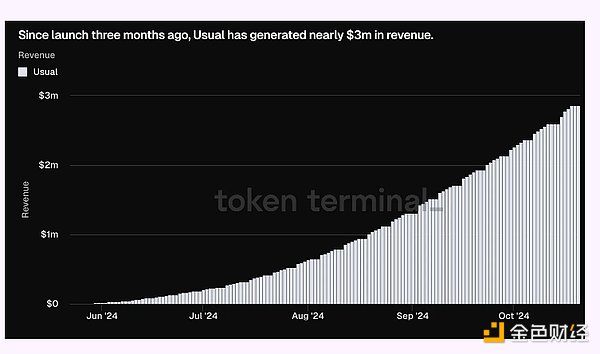

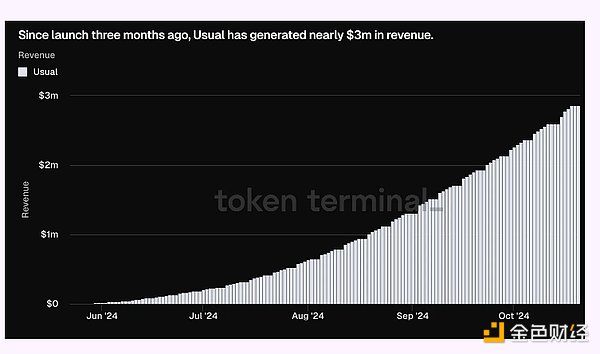

Usual has experienced rapid growth, reaching $330 million in total value locked (TVL) in just three months. This impressive expansion makes it one of the best performing projects on Ethereum in the summer of 2024.

With over 40,000 users across various integrated platforms, Usual has become a top player in the stablecoin space, ranking as the 13th largest stablecoin issuer. Additionally, it ranks among the top five mining pools on Curve and leads in TVL behind Morpho and Pendle.

The protocol expects to reach $15 million in annual revenue, further solidifying its position in the DeFi ecosystem.

Team

Pierre Person, CEO of Laywer, presidential advisor, former French parliamentarian, and vice chairman of the presidential party, set out two years ago to create a stablecoin protocol that encompasses cryptocurrency and decentralized true value. While serving as a member of parliament, he worked on the development of the French cryptocurrency regulatory framework.

Hugo Sallé de Chou, COO As a fintech entrepreneur, Hugo founded Pumpkin, a Venmo-like payments startup in 2014, challenging the traditional banking system and gaining 2 million active users at its peak.

Adli Takkal Bataille, DEO

A true crypto OG, entering block #271376 in 2013, he founded a French-language crypto organization called Le Cercle du Coin and has been advising on several projects since 2018.

In 2020, he founded Shift Capital, a crypto-native venture capital fund in Luxembourg, which currently only makes market-neutral investments. Twitter | LinkedIn

Pierre Cumenal, CFO

With a double Masters in Applied Mathematics and Quantitative Finance, Pete worked at Natixis and Amundi before moving to London to work as a Quantitative Analyst at BNP Paribas. Here he developed pricing models for exotic derivatives across different markets. Most recently he developed a fully decentralized options protocol.

Backers

Usual has raised $7M over three rounds and is currently backed by 170 investors: VCs, angels, protocols and DAOs. Investors include Dewhales, IOSG, Kraken Ventures, GSR, Psalion, Hypersphere, LBank Labs, Public Works (Gitcoin co-founder), Kima Ventures and Breed (former Circle executive).

These 120 angel investors include Sam from Frax, Charlie and Michael from Curve, Defi Dad, DCF God, Chud, Lux Temple, Amber Group, Ivan from Gearbox, Convex founders, Zoomer Oracle, and more.

USUAL Token Economics

Today, many governance tokens are flawed in their design. They often follow an unoptimized copy-paste model and struggle to balance short-term traders and long-term buyers, resulting in selling pressure without sustained demand or utility growth. Additionally, these tokens have poor correlation between value, governance, and revenue potential, focusing on speculative trading rather than long-term utility, leading to hype-driven price inflation. Interests are often misaligned, with founders and insiders holding large tokens while value-creating users are underserved and face inflation that devalues their token holdings.

Usual offers a stark contrast by aligning the interests of users, contributors, and investors to achieve long-term sustainable value growth and real utility.

The USUAL token is the primary governance tool within the Usual framework. At launch, the USUAL token provides economic benefits and governance capabilities to holders. Rewards are distributed to holders in the form of $USUAL tokens, which derive their value from their economic rights, as well as real yield generated by stablecoin collateral.

No VC Dominance: 90% of USUAL tokens are distributed to those who contribute value and revenue to the protocol, primarily via USD0 TVL. Contributors such as investors, team, and advisors collectively hold no more than 10% of the total supply, protecting users from excessive dilution.

Cashflow-Linked Issuance: USUAL issuance is directly tied to future cash flows generated by stablecoin collateral. USUAL is minted every time $0 is staked, and as protocol revenue grows, so will token supply.

Controlled Dilution: Usual’s issuance model is designed to be deflationary, much like Bitcoin. The inflation rate is calibrated to stay below protocol revenue growth, ensuring that the rate of token issuance does not exceed the rate of economic expansion of the protocol.

Treasury Management: USUAL holders will also have the ability to decide how treasury and protocol revenue are managed, through future mechanisms such as token burns or revenue splits.

Measured Voting: USUAL holders guide protocol liquidity and influence key decisions, ensuring they play an active role in the protocol's growth and success.

Staking Rewards: Token holders can earn income by staking their USUAL tokens. When USUAL tokens are staked, they become USUAL+ - holding $USUAL+ entitles holders to receive up to 10% of newly minted $USUAL tokens, calculated as per the specified emission rules.

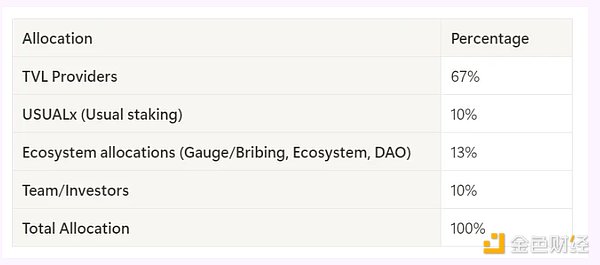

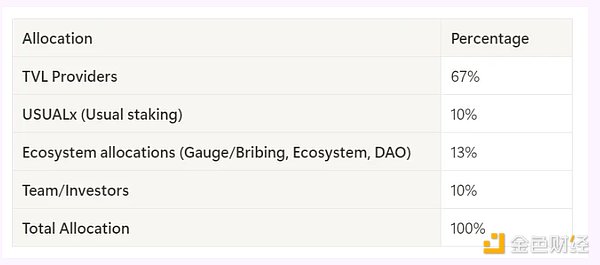

USUAL Token Distribution

The majority of $USUAL tokens are distributed to users who actively contribute to protocol growth and value creation. This model is designed to protect the community from any dilution caused by the team or investors, ensuring incentives are aligned with those who drive the protocol's success.

Detailed distribution

Emissions are divided into various allocation channels, which can be modified through governance votes, each of which has a different purpose:

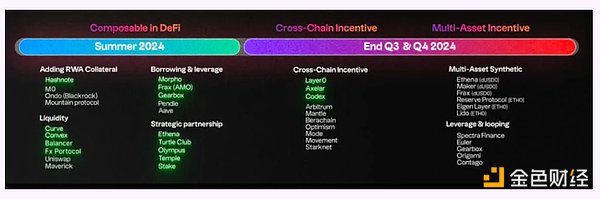

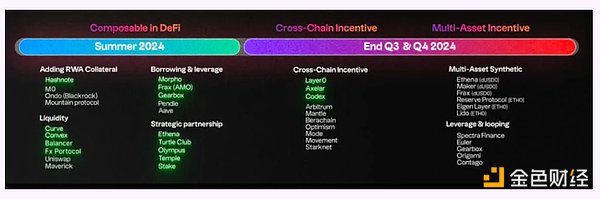

Partnerships

Integration is a key factor for Usual to expand its total locked value (TVL), increase user stickiness and build a moat. To give you a better understanding of Usual’s partner ecosystem, the following is a list of partners that have been integrated or are in negotiation, and they are categorized:

Lending: Morpho, Euler, Term Finance, Sturdy, Arkis, PWD, Llamalend

Cross-chain: Chainlink, LayerZero, Axelar, Socket (under discussion)

Yield: Etherfi, Pendle, Origami, Spectra, Equilibria, Penpie, StakeDAO

Re-staking: Karak

L2 Network: Arbitrum, Base, BNB, Mantle, Starknet, Mode, Berachain, Monad, Movement, Sui

Decentralized Exchanges/Liquidity: Curve, PancakeSwap, Balancer/Gyro, Maverick, Uniswap

Fiat Deposits and Withdrawals: Banxa, Holyheld

Upcoming Integrations:

Morpho, EtherFi, Pendle, Symbiotic, EigenLayer, GainsTrade, Reserve, dTrinity, Polynomial, Bubbly, Hourglass, Superform, Brahma, Abracadabra, TimeSwap, Gearbox, Contango, DYAD, Idle, Notional, Exponential.fi, Curvance, Fluid, Thetanuts, Mach, GMX, Vertex, Bunni, vDEX.

Participate in the Pre-Launch

The Pre-Launch is Usual’s airdrop program that runs from July 10th to mid-November.

7.5% of the USUAL supply will be airdropped and distributed based on points earned during the pre-launch. The system rewards daily points based on the Usual products held by users. Additionally, minting USD0++ earns instant points.

The points system works like this:

Daily Points:

USD0++ holders earn 3 points per token per day.

USD0/USD0++ Curve LP holders receive 3 points per USDO deposited per day.

USD0/USDC Curve LP holders receive 1 point per USDO or USDC deposited per day.

Many other opportunities exist, such as Pendle, Morpho, and more.

Visit popular dApps to learn about various ways to participate, especially through Pendle, Etherfi, Morpho, Curve, Equilibria, Karak, and more.

Edmund

Edmund