From a technical position at a Hong Kong investment bank, to his entrepreneurial venture into P2P lending, and now to the helm of Astar, one of the most highly anticipated perpetual contract DEXs, Leonard's career is a journey through the evolution of traditional finance and the Web3 revolution. In this exclusive interview, he engages in a panoramic conversation with Mable, co-founder of the social protocol Trends. Leonard systematically outlines Astar's ambitions for the first time: how it began with perpetual contracts on the BNB chain and gradually grew into a comprehensive multi-chain trading platform, aiming to surpass centralized exchanges in user experience and functionality. He not only deeply analyzes the logic behind Astar's controversial "dark pool" design, but also candidly reveals the team's difficult trade-offs between efficiency and fairness in token distribution, the Genesis Points program, and the buyback strategy.

The following is the transcript of the conversation:

Leonard: Hello everyone. Thank you for having me. I'm Leonard, CEO of Aster. It's a pleasure to be here to talk about the perpetual contract DEX, our team, and our product.

Mable:Great. I thought maybe we could start by talking about your background. How did you get into crypto? How did you get to where you are today?

Aster's Development Path and Outlook for the DEX Industry

Leonard: It's a long story. I started my career in banking technology, working as a technician at an investment bank in Hong Kong. I later became a programmer in the stock market. I stayed there for about five years, and then I got into the startup world. I was working in fintech, peer-to-peer lending, in Asia. That startup attempt failed, and it was my first. It was in 2016. At the time, China was embracing the "Internet Plus" concept. But then there was a lot of regulatory pressure, and there were some scams throughout the industry, so it declined. But one thing I learned during that process was that we had to think: Is there a better way to do this? That's when blockchain emerged, around 2016. There was only Bitcoin, and Ethereum was just beginning to take off. My first exposure to it was through ICOs. I invested in them. I made money the first time and thought I was a genius, but I lost it all in the next three ICOs. But that sparked my interest in the technology. At the time, IBM had a project called Hyperledger. I was very interested in it and got involved. I tried to use it to build a lending platform. Clearly, I chose the wrong direction. Then I went to work at Bybit. That was in 2019. I worked there for a few years, overseeing various products. When dYdX emerged, we tried to build our own on-chain project. That was the first version of Aster—sorry, ApolloX. ApolloX has evolved over time, going through various phases like dYdX and GMX, constantly adjusting our direction to build something the market truly needs. Mable: That's fantastic. So how would you define Aster today? And what do you think Aster will look like in one or even three years? Leonard: A year is a long time. Aster is now known as a multi-chain trading platform and a trading DEX. In my opinion, it's more than just a perpetual swap DEX. Everyone thinks of Aster as a perpetual swap DEX on BNB Chain, and we're backed by BNB Chain. But we're more than just BNB Chain. In fact, we support at least four chains, including Arbitrum, Ethereum, and BNB Chain. We initially started with perpetual swaps, but it's clear that a significant number of new users have joined us over the past two weeks for spot trading. I believe we initially started as a perpetual swap product, but we're gradually expanding into a more comprehensive general-purpose trading platform, allowing people to access liquidity across multiple chains. Within a year, we will have 80% of the experience across all CEX product suites, not copied, but redesigned on our platform. In five years, we hope the entire DEX industry will be larger than CEX, and if we can achieve that, we'll dominate the space. Mable: There's been a narrative in the market about how Binance sees Aster as a strength of its product. If you were to sell your company as a multi-chain DEX, trying to surpass all CEXs, what is your unique value proposition? Leonard: I think the core point is that the entire infrastructure is built on the blockchain, and that way we provide self-custody and transparency. I think that's ultimately the biggest differentiator from CEXs. Additionally, as a DEX, it gives us greater flexibility in our governance model. I think DEXs will be much bigger than CEXs. CEXs have more resources and traffic, but for Aster and the entire DEX industry, it develops faster and is closer to your community. Therefore, we may have an advantage in terms of asset listing and incubating new product features.

Mable: So are you hinting that new market openings, or spot listings, will soon be voted on through the governance process?

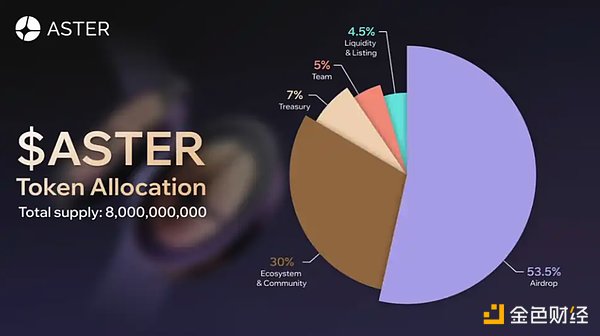

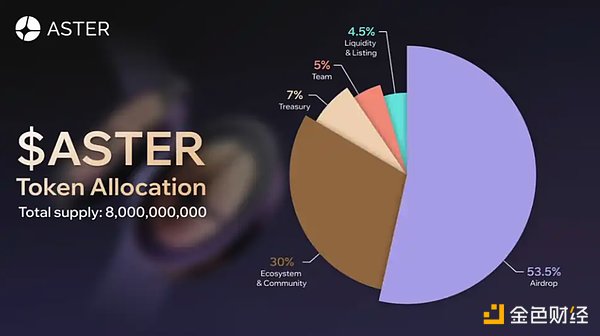

Leonard:I think this is something we are considering. I believe there's a trade-off between full decentralization and retaining some control, especially for an early-stage startup where you need to focus on execution efficiency and balancing vested interests. We'll gradually improve Aster's decentralization and governance. Ultimately, we hope that as the system matures and Aster has a clearer business model, we'll gradually release power and improve decentralized governance. Mable: Yes, we'll talk about your dark pool design in a moment. Just a personal question: Besides Aster, what's your favorite DEX product? Leonard: That's such a simple question. The answer is always Hyperliquid. Hyperliquid inspired a whole new era of order-book DEXs. And GMX, like OG, is a representative of automated market makers, inspiring the entire DEX space's LP (liquidity provider) model based on market makers. I think there are some interesting projects out there that are less well-known. I find their products very interesting. They have very high leverage. For example, we have a product called 1001X, and they have one too, but they have a different profit-sharing model, like only paying when you make money? That's interesting. Also, I like Zhou's project on the Base chain; I love its user interface. I think products are becoming increasingly homogenous. When you see something others have built that attracts a lot of users, you tend to emulate it in your own product. I think in Web3, everything is public, so you can easily copy it. But what's more important is what you excel at. Some products focus on extremely high leverage, while others focus on an oracle-based LP model. These are some of the products I've tried and liked. But I think we're just good at different things, and it's hard to say which one is better. Aster's Product Features, Dark Pool Design, and Token Supply Mable: Yes, of course. Let's delve deeper into the dark pool design. To give the audience some context, Aster has invisible, hidden orders; their size and direction are not revealed. I'm wondering, after the orders are matched, is there a verifiable record that people can use to confirm that they matched fairly? Leonard: We do have the ability to do that. For example, we can conduct a third-party independent audit. We can replay all the transactions and verify them, just like we have snapshots of the matching engine. Currently, there's no way to publicly verify it because it's hidden. If you could figure it out afterward, it defeats the whole point of having a hidden signal. So, at this point, yes, I don't think there's any way to publicly verify it. But if anyone has any good solutions, I think we're constantly improving this product. If anyone wants to work with us on building a privacy-preserving blockchain or related features, feel free to reach out. We have some ideas, but we haven't fully thought them through yet. Mable: But you guys definitely had a strong conviction to launch this dark pool design on day one. I'd love to hear the story behind that. Leonard: I think it stems from the fact that we've been thinking about dark pools for a while now, because in traditional finance, dark pools are much larger, and OTC is much larger. So, multiple people have discussed this idea with us: What would it look like on-chain? Is there a similar need? Because it's a bit of a strange, conflicting idea: everything on the blockchain is public. But there seems to be a huge demand for privacy protection in financial transactions, at least in traditional markets. Then there was the famous conversation between CZ and James. James claimed he was being liquidated by people on Hyperliquid because his trades were exposed. Then CZ said, "I've always had this idea of doing perfect transactions on-chain." I think because of this public conversation, we felt now was the perfect time to launch something to test market demand. So we launched the feature very quickly. We got press coverage. But the demand wasn't as big as we expected. I think at this point, if people really cared that much about privacy, they would just go directly to a CEX. So, we didn't give up. We'd still like to try different forms of experimentation to see if we can actually meet the demand for this kind of private transactions on-chain. We're researching it, but right now, there doesn't seem to be much demand from retail users. Mable: I think even in traditional dark pools, they're not designed for organic liquidity. They're primarily used for so-called "toxic liquidity." So I imagine that with more institutional participation, things would be different. Leonard: Yes. Once you get involved with institutions, you have to deal with the whole world of regulation and compliance requirements. Self-custody and some degree of anonymity are obstacles for most of them. I think this is an interesting area, and if someone wants to start a new Web3 Wall Street firm, they should consider it. This goes back to the concept of permissioned vs. permissionless. Adding some kind of permissioned protocol on top of the blockchain seems like a viable solution. It's not something we're currently exploring, but I think it has potential in the future. Mable: Yes, I know. I think a lot of proprietary trading funds and high-frequency trading firms will likely explore these things over the next few years. Next, I wanted to ask about Aster's token supply, as I imagine you get asked about it quite often. We see on-chain that about 96% of the supply is held in a handful of wallets. What are these wallets? Leonard: I did see some tweets about this on Twitter, but I don't think the 96% figure is accurate. It might be, but we don't control all of those wallets. I think about 80% of the supply is locked on-chain based on the token economics. About 40% of the airdropped tokens are in on-chain wallets, which accounts for 40% of the total supply. I think the second largest portion is in the asset contracts, which is where everyone trades perpetual contracts and spot on our platform. After we enabled withdrawals, several wallets withdrew. I should clarify that I believe at least 80% is traceable on-chain, and the usage of all addresses is verifiable. I believe the circulating supply is currently around 10%, including all the conversions we do for APX. The contract is a bit confusing because the majority of asset transactions occur on our contract. So it may seem like we control the majority of the tokens, but in reality, it's our holders who own and control the majority of the tokens.

Mable: So is Sky9 Labs the only private investor at the moment?

Leonard: They are the only private investor, but they only hold a minority stake, but they do provide a lot of support.

Mable: Is there any transparency information such as lock-up periods or cliff periods for their token investments? Leonard: We can't reveal too many details about our dealings with them because of a non-disclosure agreement. But it's clear they're not in a rush to sell any tokens, and they don't need the money, that's for sure. And I think after our successful TGE and the traction it gained, it became clear we added significant value to the BNB ecosystem. I think it's in their best interest to not release selling pressure into the market, even without any legally binding lock-up period. So I don't think people should be overly concerned about them. However, if you look at the token economics, investors only receive a 5% share of the team allocation. Investors are investing in equity. As far as the tokens are concerned, everything is transparent, and on-chain, they only receive a 5% share of the team allocation, which is proportional to their investment. Therefore, the value they received before the TGE was very small. But after this successful TGE, even a fraction of 5% would mean a significant amount in fiat terms. I don't think people need to worry too much about it; they have little incentive to sell at this point. But I can't reveal too many details about our deal with them because of the NDA. I wouldn't worry too much about Sky9 Labs. Phase 2 Points Program Mable: Okay. Since we're already talking about tokens, I want to talk about the Genesis Phase 2 Points Program. You're currently running this program. Can you share a bit about how it's going and the thinking behind designing the rules? Leonard: First, it ran for 32 weeks before the TGE, and then it's going to run for another two weeks. We just finished the third part, so there's one week left. We're allocating 4% of our tokens to this. We're trying to be fair and distribute it equally to everyone. We want to reward traders who actually trade. In a program like this, it's inevitable that some will try to inflate their points. We've worked hard to adjust the rules to ensure that genuine traders, those who actually hold positions for the long term, are rewarded. Obviously, one aspect we look at is open interest, and while there are ways to circumvent this, those who hold positions for the long term tend to be genuine traders. We also look at other behavioral patterns to filter out studios attempting to inflate their points, allowing us to reward as many genuine users as possible. In terms of trading volume, the program has been quite successful. After we announced the end date and the total allocation, trading volume skyrocketed. We surpassed other projects and became the number one perpetual contract trading volume, with daily trading volume exceeding 3 billion. It's the final week now, but we'll be launching Phase 3 very soon, which includes spot trading. We want to include spot trading because it's become a significant part of our business. The user profile we want to encourage is one that will shift the majority of their trading activity to our platform. Our ultimate goal is to become a multi-chain platform with a user experience that's on par with, or even better than, CEX. We want to reward actual traders. We'll do our best to identify you and airdrop you. That's the goal of Phase 2. After Phase 2 concludes, we'll continue calculating points and will release more information about the distribution and end date of Phase 3 shortly. Mable: Phase 3 will begin shortly thereafter. Is Aster the main player in spot trading right now? Leonard: Aster is the majority, about 80-90% of it. It's our largest product in the spot space right now. I want people to try everything on our platform, and spot trading will be a part of that. We certainly hope people will also move their spot trading activity to us and tell us what they really want, because we're getting a lot of feedback right now. For Phase 3, please try our spot products and tell us what assets and features you'd like to see. Mable: There probably won't be many liquid trading pairs for other spot trading. What other assets can actually be traded on Aster? Leonard: We currently only have a few major ones, like A-BTC, A-ETH, and Aster. We actually launched a token with Citadel, which is one of the projects we're trying out. We'd like to partner with more startup platforms to provide liquidity for early-stage projects. For example, I think Citadel raised around $200 million in their presale, and they immediately transferred some of that money to Aster to provide liquidity for initial trading. We'd like to experiment more with asset issuance and early-stage asset liquidity. Mable: Will the actual rewards for Phase 2 be airdropped together after Phase 3? Or what's the plan? Leonard: How much you'll receive in Phase 2 will be clear to everyone. I think the distribution mechanism is still something we're designing. Some people are concerned that immediately releasing 4% of tokens into the market will create a lot of selling pressure. We're considering how to balance the interests of existing holders with the new holders who will receive the airdrop. Mable: So is there a possibility of a lockup period or something like that? Leonard: I think we reserve the right to do that. It'll be announced soon. I think in the next two or three days, you can expect us to make a final decision and release information about it. Mable: Okay, that's helpful. So, what's the current distribution of volume between perpetual swaps and spot? Leonard: Perpetual swaps make up the vast majority, over 90% of the volume. Within perpetual swaps, the majority is BTC, followed by ETH. Mable: Interestingly, BNB isn't there. I thought BNB might be on par with Ethereum. Leonard: I think it's because people used to trade BNB on Binance because they have a really good product. For those who couldn't trade BNB on Binance, they would often go to some of the BNB markets, which weren't as popular. So, I guess, if I had to guess, that's the reason. Mable: Of course, that makes sense. I've asked enough about tokens. Let's talk about the XTL incident. I know there are some details you might not be comfortable sharing, but to the extent you can, can you walk us through what happened? For example, there was an error in the pricing configuration of the XPL perpetual index, which caused the price to spike to $4, causing losses for some users. Can you walk us through the subsequent recovery process? Leonard: I think this was actually something that someone very cleverly discovered and pointed out on Twitter. I think the biggest mistake was that it happened in pre-market mode. So, even if it were a normal perpetual contract, it should have been getting the correct index, so the price wouldn't have jumped or deviated from the market price. I think this is a common risk with pre-market perpetual contracts. It happened because in pre-market, we get prices internally, and there's no other source of prices. We have to get prices from the order book. When we adjusted the configuration, it got incorrect prices from the internal order book. We quickly realized the error and switched it back to normal contract mode. We made a mistake. I think we made a very quick decision: we would compensate everyone and we would cover the losses. This highlights that pre-market contracts are a riskier product. I think there are a few things we can do going forward. First, even in pre-market, we can get pre-market prices from other pre-market trading platforms in the market. We can't just rely on the internal order book. But as long as it's a pre-market and there's no other external price source or oracle to rely on, there's always the risk of this kind of price deviation if there's insufficient liquidity. I think it's a balance between whether we have enough ability to manage risk and how much market demand there is. Mable: Regarding oracles, I have a related question. I believe you'll also be offering tokenized stocks. Where will the oracles or data sources for these prices come from? Do you plan to offer 24/7 trading?

Leonard: We currently use some oracles, such as Pyth. Currently, we can't offer 24/7 trading due to oracle limitations. If the oracle doesn't have data, we can't do it. We can do it in a way that relies on the order book for prices, just like a pre-market, but that comes with risks. I think for some indices, if we can find better oracles with longer-term support, for example, we're looking at indices with 23-hour oracle feeds, as opposed to individual stocks, whose futures trade on multiple venues. For these indices, I think we could potentially open up 24-hour trading, but individual stocks are still limited by the fact that oracles can't always provide data. Token Buybacks and Product Features Mable: Got it. Okay, let's shift gears a little bit and talk about token buybacks. I think I mentioned this token buyback program in another interview. So what's the typical frequency of these initiatives? Leonard: I don't think we want to commit to a fixed timeline at this point. I think we prefer that the project owner or operator should have more control over how the revenue is invested. I do think we will do buybacks, and we will use a significant portion of our revenue for buybacks, the specific amount and frequency will be announced. But I don't think we'll make it permanent, and I can say it won't be as predictable as other programs because we want to maintain some flexibility in how we invest that revenue. Mable: Right? Actually, a lot of different founders have very different opinions on this topic. For example, I think some think buyback programs are a bad use of funds, but they're doing it because others ask them to. On the other hand, I think some think 100% of protocol revenue should be returned to token holders. What are your thoughts on these execution philosophies? Leonard: I think I'm a pragmatic person, and I think the real, best solution is always in the middle. Sometimes I think allocating 100% is best, and sometimes reserving a larger percentage for investment in the project is better. I think the key is flexibility. Over time, I think people will develop enough trust in the project after we do a buyback. I understand why some people think a buyback might not be the best option, as it's a bit like a dividend. If it were a dividend, it would mean there's no better way to use the funds. For a project like ours, we believe there are many opportunities to invest in talent and partnerships to grow the project. Furthermore, the token price will greatly influence the efficiency of a buyback. If you use an automated algorithm to conduct a buyback and announce it publicly, the price will likely be inflated. I have two key points: First, I believe the percentage of revenue we should allocate to buybacks should be adjusted based on the different stages of the project. Second, I don't think 100% transparency in execution is the most efficient approach. But I do think that after the buyback, all relevant information should be shared, transparent, and locked somewhere for everyone to monitor. I think there should be some flexibility in the proportions and execution, but we should be public about what we did after the fact. Mable: So you'll also disclose, for example, that you decided to only buy back 30% of the tokens this quarter, and then provide a rationale for why the remaining funds should be used for other things. I think that makes sense. Leonard: Exactly. And I think we can always adjust, right? For example, if you announced it, if the community has a good reason to disagree, we can always adjust. I think that's the benefit of not fixing it upfront; we can adjust and get better over time. Mable: Yes, when you have such a large market capitalization, it's impossible to please everyone. There's always a balance to strike. I'm sure you've experienced this. Leonard: We're scaling rapidly, and we're learning as well. Mable: I see. Actually, I'd like to talk more about the product itself. You already have grid trading. Why did you prioritize launching this feature? Leonard: Actually, we've had this feature for a long time, all the way back to the ApolloX days. We've had this feature. Obviously, it's a great feature for many professional traders who employ certain strategies. It's a very convenient tool. It's also great for exchanges. It increases liquidity. Because most retail users, if you don't give them this tool, will just place market orders directly like the listers. But if you give them this tool, they'll engage in grid trading, essentially placing limit orders, and become liquidity providers. So it's a win-win situation: retail investors can run strategies and provide liquidity. That's why we had this feature early on, and it's always been with us. Mable: Absolutely. What's your current trading user base like? I'm guessing you also look at things like IP distribution. Leonard: Before TGE, most of our IP came from Asia. But after TGE, we've been getting more attention from the Western world. You can see this on Twitter too, where more people speaking English and European languages are talking about us. That's changing. Mable: Also, some external parties are using your API and data. I've heard some complaints about data formats and so on. Are there any planned improvements in this area? Leonard: We've received a lot of feedback, and we're working around the clock to address these issues. Please keep us informed, as we're working on clearing some backlogs. Feel free to join our Discord, message me directly, or contact us on our official Twitter account. We even had several technical developers come in as contractors before the TGE and suggest some technical improvements. Some of these were very helpful. For example, one of the biggest issues we encountered was that deposits to the Solana contract were slower than we'd like. Now someone is directly talking to our developers and suggesting ways to improve them. We're now releasing updates two or three times a day to improve our system. If there's anything you're still struggling with, please let us know. We'd love to hear what's bothering you the most and fix it as quickly as possible. Aster Chain's Future Vision Mable: Yes, regarding Solana, if there are any additional requests, we'll definitely address them. I imagine it'll probably be similar to Arbitrum or other chains; everyone will be happy to work with you. I want to change the subject a bit. You mentioned Aster Chain in another interview. I'd love to learn more about it. What role do you envision Aster Chain playing in the future? Leonard: I think we want to ensure that all transactions are transparent and verifiable on-chain while preserving some trader privacy. That's our goal. We don't want to invest a lot of effort in building an ecosystem around it like some competitors have. Instead, we want to integrate more with other chains and then aggregate liquidity onto our own chain, making it verifiable for everyone. We're going to focus on the trading experience and making sure we have good liquidity and a good trading user experience. That's our focus for at least the next 3 to 6 months. The role of a chain is to provide transparency and verifiability, but we don't intend for it to be another public chain. I think there are too many chains now, and we don't need more. But we need a better decentralized trading experience. Mable: Yes, I like Hyperliquid; they benefit from having their own chain because they get gas fees and protocol revenue. So I guess that's one of your starting points as well. Leonard: I think in the long term, we'll probably focus more on that than in the short term. In the short term, we want to focus on all of our trading functionality. Building an ecosystem requires a lot of effort, and we don't want to be distracted by that right now. What we're good at is building a trading platform with all the features of a CEX, and the ecosystem can be considered later. Mable: Yes. I mean, if a lot of transactions settle on Aster Chain, then you can get the protocol revenue instead of having it go to other EVM chains. I'm asking if that's the idea behind it. Leonard: We're actually trading on our own chain right now, but it's internal and gas-free. We want to make that information public so people can run nodes and verify it. That's the goal we want to get to. As for whether we'll eventually build a whole ecosystem around it, that's not a priority right now. Mable: Do you have an AMM or market maker program? Can people just apply to join? Please share. Leonard: We do. If you visit our website, there's a Market Maker Program page in the documentation with all the details, the volume requirements, and the fees you'll earn. Anyone interested can contact us directly via email; all the information is on that page. Mable: Would you mind sharing how many market makers you have currently? Or is that not convenient to share at this time? Leonard: I won't disclose the exact number. We've already onboarded quite a few, over a dozen, and they're active. Over the past two weeks, there's been tremendous demand for people willing to pay for liquidity, so we've been getting tons of inquiries daily about how to join the market maker program. Mable: My last question is about distribution. Right now, you only have a website or desktop version. Are you planning on developing a mobile app? Or are you looking to distribute through some other mobile front-end? Leonard: Oh my goodness, that just goes to show we're not doing well enough, we actually have a mobile app! We have an Android version, and it's already available on Google Play. We're still working on getting the iOS version on the App Store, but we do have a TestFlight version for people to test. We're working with other wallets, like Trust Wallet and SafePal, to build front-ends for us. We'll be launching a partnership with Trust Wallet soon. SafePal is already integrated. We welcome any wallet to collaborate with us. I encourage everyone to test our product. No matter which chain you're on or what device you're using, please test our product and give us feedback. We have a feedback page on our website. You can also message me directly on Twitter. We have a team that's checking it out. So please join our community and test our product. Mable: Yes, Leonard and I spoke before this livestream, and he specifically mentioned that he'd like to collaborate with not only the BSC project, but a number of other projects as well. I want to emphasize this so that if there's anyone who wants to work with Aster, please make sure you reach out to them as well. Leonard: Thank you so much. We're not just an exchange for the BNB chain. We actually support multiple chains. We're happy to work with everyone. Even if you're not on the BNB chain, we look forward to hearing from you.

JinseFinance

JinseFinance