Author: DWF Labs Research Translation: Shan Oppa, Golden Finance

In our previous article, we introduced perpetual contracts – including the evolution of existing perpetual DEXs and potential developments in the field.

In this article, we will explore the current token economics landscape of sustainable DEXs, analyze the different mechanisms used by the protocol, and discuss potential future developments.

Why are token economics important?

Token economics are crucial to the development and stability of the protocol. With the experience of the "DeFi Summer", liquidity mining successfully guided the yield protocol in the early stage, but was ultimately unsustainable in the long term. This mechanism attracts profit-seeking capital, thus forming a vicious cycle of "planting and dumping". Farmers are constantly looking for the next agreement to provide higher yields, while the planting agreement has suffered a devastating blow.

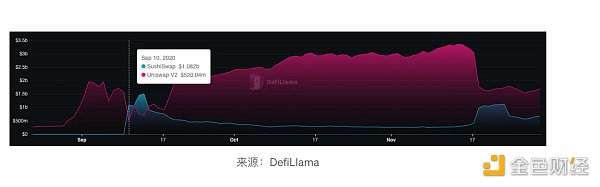

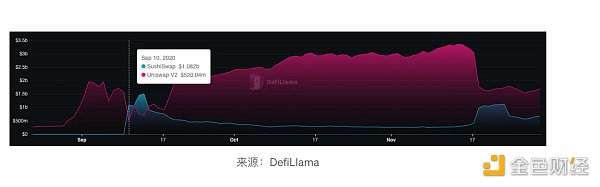

One example is Sushiswap’s vampire attack on Uniswap, which successfully attracted a large amount of TVL at first, but was ultimately unsustainable. At the same time, protocols like Aave and Uniswap’s product-first focus successfully attracted and retained users, while sustainable token economics helped solidify their position as market leaders, a position they still maintain today. With.

p>

While product-led growth is important, token economics are a notable factor in a sustainable DEX in a highly competitive market. Tokens represent how users value the protocol based on their activity, similar to how stocks reflect a company’s forecasted performance. Unlike traditional markets, token prices often precede widespread awareness and growth of crypto projects.

Therefore, it is important to have token economics that accumulate value from the growth of the protocol. It is also important to ensure there is a sustainable token economy that provides adequate incentives for new users to join. Overall, good token economics are key to achieving long-term growth and preserving protocol value.

Review: The Sustainable DEX Landscape

In our previous series of articles on hindsight , we extensively covered the evolution and mechanics of sustainable DEX. A closer look at the tokenomics of these protocols – dYdX was one of the first to introduce perpetual contracts on-chain in 2020, launching its token in September 2021. The token is rewarded for staking, LP, and trading as it doesn’t offer much utility to holders other than trading fee discounts.

Targeting the unsustainability of emissions is GMX, which entered the market in September 2021. GMX was one of the first companies to introduce a peer-to-pool model and a user fee sharing mechanism that generates revenue from transaction fees, paid by profession and payment form. Native token. Its success has also led to the creation of more Peer-to-Pool model systems, such as Gains Network. Its staking model and revenue sharing parameters are different, which poses lower risks to users but also lower yields.

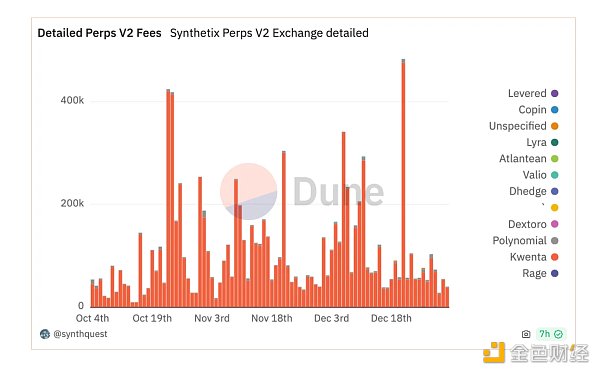

Synthetix is another OG DeFi protocol in this space, supporting multiple front-ends for perpetual and options exchanges such as Kwenta, Polynomial, Lyra, dHEDGE, etc. . It uses a synthetic model where users must put up their SNX tokens as collateral to borrow sUSD for them to trade. Stakers receive sUSD fees generated by all front-end transactions.

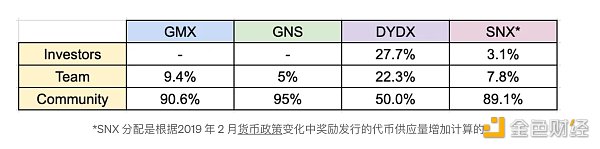

Tokenomics of Perpetual DEX: Comparison

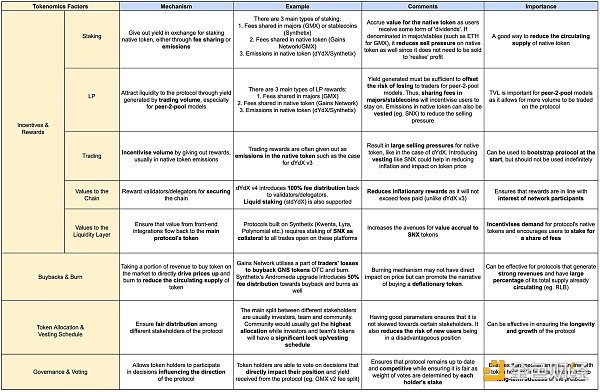

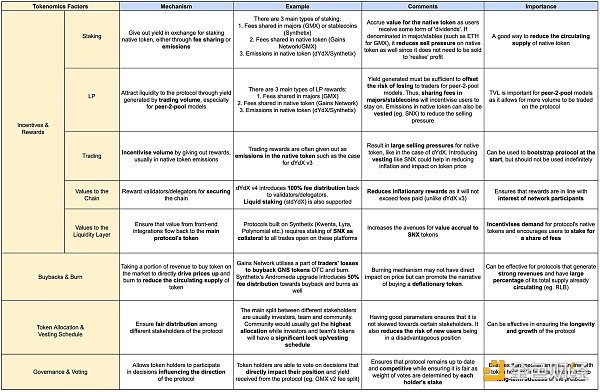

The table below shows the different protocols Comparison in terms of token economics:

Creating good tokenomics: factors to consider

Well-designed token economics require careful consideration of various factors to create a system that aligns participant incentives and ensures the long-term sustainability of the token. We discuss various factors below based on the current landscape of the perpetual DEX token economy.

1. Incentives and rewards

Incentives and rewards play an important role in encouraging desirable behaviors effect. This includes staking, trading, or other mechanisms that encourage users to contribute to the protocol.

1a. Staking

Staking is a method of depositing native tokens into the protocol mechanism in exchange for benefits. Users receive revenue either through revenue sharing from fees (which can be larger capped tokens/stablecoins) or from native token emissions. Judging from the protocols we analyzed, there are three main types of pledges:

Main or stable Token fee sharing

Native token fee sharing

Emissions shared in native token

As can be seen from the table, cost sharing can effectively motivate users stake their tokens. For dYdX and Synthetix, the table reflects recent changes made to token economics - including the introduction of 100% fee sharing for dYdX v4 and the elimination of inflationary SNX emissions.

Previously, dYdX v3 had a security and liquidity staking pool that generated inflationary DYDX rewards because the pool did not draw directly from the platform. Benefit from trading volume. After a community vote, both pools were deprecated in September/November 2022 as it did not truly serve its purpose and was not efficient for the DYDX token. In v4, fees generated by transaction volume will be returned to stakers, thus incentivizing users to earn revenue through staking.

GMX uses a mix of two types of staking to earn rewards, primarily split fees (ETH/AVAX) and its native token. GMX, Gains Network, and Synthetix have very high token staking rates, indicating that rewards are sufficient to incentivize users to provide upfront capital and maintain their stake within the protocol. It's hard to pinpoint what the ideal mechanism would be, but paying a portion of the fees in professional/stable and introducing vesting of native token emissions has worked so far.

In general, staking has the following benefits:

Reduce the circulating supply of tokens (and selling pressure)

Only valid if the output produced is not pure emissions, to ensure sustainability

Earnings generated by owning a major currency or stablecoin will reduce selling pressure because users can "realize" their gains without selling

2. The value accumulation of pledged tokens

As As the protocol develops and the fees generated by each token increase, the value of the token can grow indirectly

Having a stable token Yields can also attract non-traders to enter just to earn a yield

Nonetheless, how to achieve the goals of the protocol There are still several factors to consider when implementing staking:

Lifespan and reward type< /p>

Considering that risk-averse users do not need to sell tokens To "realize" benefits, it is very important to have stable returns

The emission rate is also important to ensure that the benefits received by users are not Will be too volatile and can be sustained over a period of time

2. Reward the right users

Lower barriers to entry and ease of earning rewards (no upfront funds, no need to cash out, etc.) may attract mercenary users, thereby Dilute rewards for active users (active traders, long-term stakeholders, etc.)

Our thinking: In most protocols , staking is common in order to reduce the circulating supply of tokens. This is a great way to align with user interests, especially where collateral is required (such as SNX), and it reduces the volatility of user positions through yield returns. The impact of staking would be more positive and long-term if rewards were issued in the form of partial fees and professional/stable, which would suit most perpetual DEXs with decent trading volumes.

1b. Liquidity Provider (LP)

Liquidity Provider (LP) LP) is crucial for sustainable DEXs, especially for peer-to-peer models, as it will enable them to support larger trading volumes on the platform. For the peer-to-pool model, limited partners become counterparties to traders on the platform. Therefore, the revenue shared from fees must be sufficient to offset the trader's risk of loss.

For order book models like dYdX, LP is a way for users to earn rewards. However, the majority of TVL still comes from market makers, and the rewards issued in DYDX are pure inflation. As a result, the LP module will be deprecated in October 2022. Synthetix is an exception, technically stakers are LPs on the platform it is integrated with (Kwenta, Polynomial, dHEDGE, etc.) and earn fees from trading volume.

Both GMX and Gains Network employ a peer-to-peer pool model that requires limited partners to serve as counterparties to transactions conducted on the platform. Comparing the two protocols:

The TVL of GLP is significantly higher than gDAI - probably because Higher yield

gDAI users have lower risk of loss, traders' profits are backed by GNS minting, and GMX through GLP Pay user funds

Users with higher risk aversion will be attracted by GLPs with higher yields, while users with higher risk aversion will be attracted by GLPs with higher yields. Users with low income can deposit gDAI with low income

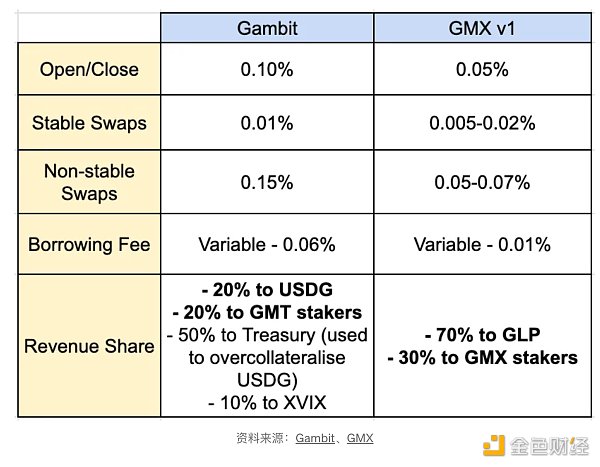

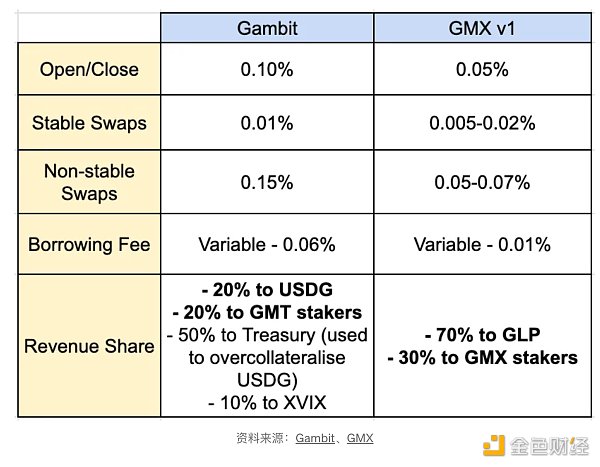

The mechanism of Gains Network is similar to the predecessor of GMX. Also known as Gambit Financial on BNB. Gambit generated considerable volume and TVL upon launch. While Gambit and GMX share similar features in their peer-to-peer model and revenue sharing mechanism, their parameters differ.

p>

While Gambit has gained decent traction, GMX on Arbitrum has suffered in terms of trading volume and users after making changes to its token economics and structure. Explosive growth. Based on the example, we noticed the following key changes:

To stakeholders/LPs Providing the majority of the revenue share

Gambit will only give 40% of the revenue share (20% to USDG + 20% to Gambit stakers) Allocated to holders/stakers, while GMX v1 allocated 100% (70% to GLP + 30% to GMX stakers)

Increasing benefits for stakers/LPs creates a good narrative, attracting a wider audience beyond pure traders

Transfer risk to limited partners who serve as direct counterparties

Gambit only takes 20% of revenue share Allocated to USDG, while GMX allocates 70% of its revenue share to GLP

USDG and GLP both deposit whitelisted assets To mint and provide liquidity for platform transactions. The reason why Gambit provides lower yields to LPs is that USDG is a stable currency, and the platform uses 50% of the revenue share as collateral to ensure the redemption of LP funds. In contrast, GMX transfers risk to limited partners, who bear the brunt of traders' profits or losses

From Case studies from Gains Network, Gambit and GMX show that increased LP yields can incentivize greater liquidity compared to protocols that absorb some risk. In GMX v2, there are subtle changes to the token economics that reduce stakers and GLP holders’ share of fees by 10%. Adjustment details:

GMX V1: 30% allocated to GMX stakers, 70% allocated to GLP Provider.

GMX V2: 27% allocated to GMX stakers, 63% allocated to GLP providers, 8.2% allocated to protocol vaults, 1.2% is allocated to Chainlink, a protocol approved by a community vote.

Community members largely support the vote, GMX v2’s continued TVL growth suggests the change is positive for the protocol .

There are benefits to significantly rewarding limited partners, especially for peer-to-peer models where they are one of the key stakeholders:

Enhance stickiness to the protocol through stable output

Reduces the risk of limited partners losing initial capital

Coupled with a stable yield, it reduces the inertia of changing positions since they don't need to liquidate tokens to "realize" the yield

Given the volatility of yields emitted in the native token, this mechanism does not apply to dYdX v3

< p style="text-align: left;">2. Increase in the value of native tokens

For GMX, the growth in GLP and platform trading volume indirectly increases the value of GMX (in terms of fees generated per token), which is a huge driver of demand for the token

Factors to consider:

Adjust LP's risk to the agreement

If parameters are not changed based on risk and market conditions, limited partners may be exposed to risks in peer-to-peer pools and order patterns

SNX stakers recently lost $2 million due to TRB's market manipulation incident because the OI cap was set to the number of TRB tokens, not the dollar amount

GLP holders have largely benefited from traders' losses in the past, but there are questions about the sustainability of the mechanism. As token economics change, any significant trader winmightbe backed by protocol vaults

Our thinking: This mechanism is crucial to the peer-to-pool model, as growth requires incentivizing user liquidity. GMX has done this effectively over time, holding a high percentage of revenue share and increasing traders' losses. While LPs face risk when traders win, we believe the yields on mid-sized protocols can significantly offset that risk. Therefore, we believe that fully incentivizing limited partners is important to build a strong user base.

1c. Trading

Trading rewards are mainly used to incentivize trading volume because they Mainly emissions, usually the native token of the protocol. Rewards are typically calculated as a percentage of transaction volume/fees to the total program rewards for a specific period.

For dYdX v3, 25% of the total supply reserved for trading rewards was the main source of emissions for the first 2 years. As a result, the amount of trading rewards often exceeds the fees paid by traders, meaning that token emissions are highly inflationary. With little incentive to hold (mainly for the trading fee discount), this resulted in DYDX facing significant selling pressure over time. This change to dYdX v4 will be discussed in the section below

Kwenta also offers trading rewards for traders on the platform, capped at 1% of the total supply 5%. It requires users to stake KWENTA and trade on the platform to be eligible. Rewards are determined by multiplying the percentage of KWENTA staked and the trading fees paid – meaning the rewards will not exceed the user’s upfront cost (staking capital + trading fees). Rewards have a 12-month escrow period and can be reduced by up to 90% if a user wants to cash out their rewards early.

Overall, the obvious benefits of introducing trading rewards are:

Short-term incentive amount

Factors to consider:

The type of users the protocol wants to attract

For dYdX, the ease of earning rewards and lack of redemption terms may attract many short-term users, thus diluting rewards for real users.

For Kwenta, the requirement for upfront capital and vesting terms will make it unattractive to short-term users, which may reduce Dilution of long-term user rewards.

Our Thoughts: Transaction rewards can be an effective way to bootstrap a protocol from the beginning, but should not be used indefinitely , as continued emissions will reduce the value of the token. It should also not be a large proportion of monthly supply and inflation, and redemptions are important for the protocol to spread selling pressure over time.

1d. Value chain accruals

Case study: dYdX

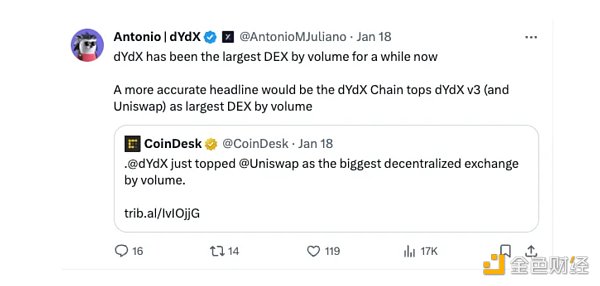

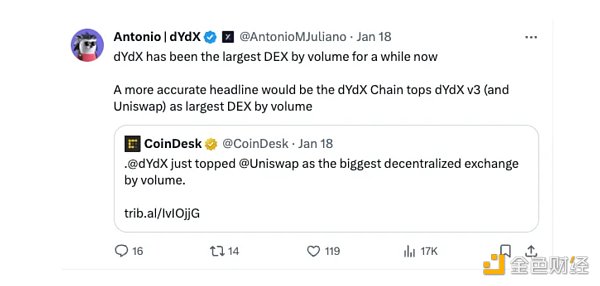

The launch of the dYdX chain marks the A new milestone for the agreement. On January 18, the dYdX chain even surpassed Uniswap and became the DEX with the largest trading volume.

p>Looking forward, we may see more sustainable DEXs follow in this footsteps. Key changes to the updated token economics of the dYdX chain include:

Staking is for support Chain security, not just to generate revenue

In v3: Rewards in the security pool are issued in the form of DYDX token emissions , but was eventually terminated after the community voted for DIP 17

In v4: The dYdX chain required staking of dYdX tokens in order to Validators run and secure the chain. Delegation (staking) is an important process in which stakers entrust validators to perform network verification and block creation

100% of transactions Fees will be distributed to delegators and validators

In v3: all fees generated are collected by the dYdX team, which has always been the community Issues that some people are concerned about

In v4: all fees, including transaction fees and Gas fees, will be allocated to the delegator (stakeholders) and validators. This new mechanism is more decentralized and in the interest of network participants

PoS stakers (principals) can choose to verify Participants stake their dYdX tokens and receive a share of the revenue from validators. Commissions for delegators (stakers) range from a minimum of 5% to a maximum of 100%. Currently, according to Mintscan data, the average validator commission rate on the dYdX chain is 6.82%

In addition to these changes, the new Transaction incentives also ensure that rewards do not exceed the fees paid. This is an important factor because many of the concerns surrounding v3 focus on inflation and unsustainable token economies that are constantly being updated but have little impact on token performance. The issue of being able to "game" rewards was raised by Xenophon Labs and other community members and has been discussed several times in the past.

In v4, users can only earn transaction rewards up to 90% of the net transaction fees paid to the network. This will improve demand (fees) and supply (rewards) balance and control token inflation. Rewards are capped at 50k DYDX per day for 6 months to ensure inflation is not significant.

Our thoughts: dYdX Chain is at the forefront of industry decentralization The verification process plays several key roles in the new chain: protecting the network, verifying the chain Voting on proposals and distributing staking rewards to stakeholders. Coupled with 100% of fees being allocated to stakers and validators, it ensures that rewards are aligned with the interests of network participants.

1e. Accrual Value of Liquidity Centers

Case Study: Synthetix< /h2>

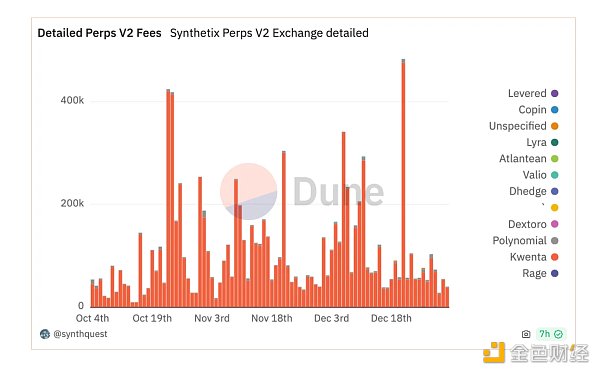

Synthetix acts as a liquidity center for multiple front-ends of perpetual contracts and options exchanges, such as Kwenta, Polynomial, Lyra, dHEDGE. These integrators create their own custom functionality, build their own communities, and provide their users with a trading front-end.

Of all integrators, Kwenta is the leading perpetual exchange, driving the majority of trading volume and fees for the entire Synthetix platform. Synthetix is able to capture the value that Kwenta and other exchanges bring, and that success is due to Synthetix’s token economics. The main reason is:

Staking SNX is the first step to trade on the points merchant< /p>

Even with its own governance token, Kwenta can only quote its asset price against sUSD, which can only be obtained by staking SNX tokens. coins to mint.

In addition to Kwenta, other integrators such as Lyra and 1inch & Curve (Atomic Swaps) also use sUSD as well as SNX tokens . Therefore, Synthetix’s front-end integrator allows the SNX token to increase in value.

Liquidity Center’s reward distribution to integrators

In April 2023, Synthetix announced the exciting news of a large allocation of Optimism tokens to traders. Over a period of 20 weeks, Synthetix is giving out 300k OP per week, while Kwenta is giving out 30k OP per week.

Synthetix will be able to attract higher transaction volumes and fees from the second quarter to the third quarter of 2023. This is a major catalyst for Synthetix's price growth.

It can also be seen from the chart that the amount of pledged SNX TVL is highly correlated with the price performance of SNX. As of January 22, 2022, Synthetix’s staked TVL was approximately $832 million. They have the highest token staking percentage (81.35%) compared to dYdX, GMX, and Gains Network.

Our thinking: For liquidity centers, relationships should be mutually beneficial. While Synthetix provides liquidity to these integrators, it also captures the value of transaction volume fees from these integrators, thereby indirectly driving Synthetix’s TVL. As integrators’ transaction demand increases, this will lead to increased demand for SNX and reduced selling pressure, indirectly driving up the value of the token. Therefore, it would be beneficial for Synthetix and its token holders to partner with more front-end integrators.

2. Repurchase and destruction

Repurchase can use part of the income in the market This is done by purchasing tokens to directly drive up the price or burning them to reduce the circulating supply of the tokens. This reduces the circulating supply of the token, and the price of the token may increase in the future due to the reduced supply.

Gains Network has a repurchase and destruction plan. Based on the collateralization of gDAI, a certain percentage of traders' losses can be used to repurchase and destroy GNS. This mechanism has resulted in the destruction of over 606,000 GNS tokens, equivalent to approximately 1.78% of the current supply. Due to the dynamic nature of the supply provided by GNS through its minting and burning mechanism, it is unclear whether buybacks and burns will have a significant impact on the price of the token. Still, this is one way to combat GNS inflation, which has left the supply hovering between 30-33 million over the past year.

Synthetix recently voted to introduce a buyback and burn mechanism as part of its Andromeda upgrade. The proposal could reignite interest in SNX, as stakers’ staking fees and stance on holding deflationary tokens would be affected both ways. This reduces the risk of pure staking, as allocations from buybacks and burns can be used as backing for any event (such as what happens to TRB).

Main advantages of this mechanism:

- < p style="text-align: left;">Ability to control/reduce supply

2. Incentivize users to hold tokens

However, the effectiveness of buybacks also depends heavily on:

Protocol revenue maintains the meaning of destruction

Our thinking: The burning mechanism may not have a direct impact on the price, but it can promote the narrative of buying deflationary tokens. This works well for protocols that generate strong revenue and have a large portion of their total supply already in circulation (e.g. RLB). Therefore, it is ideal for use on protocols like Synthetix that are already established and don’t have much supply inflation.

3. Token allocation and vesting schedule

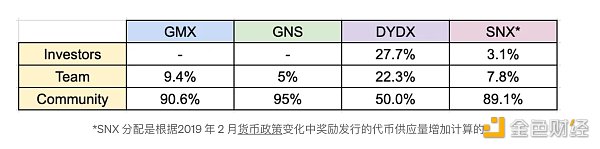

Record the tokens of different stakeholders Coin allocation and vesting schedules are important to ensure parameters are not biased towards certain stakeholders. For most protocols, the main divide between stakeholders is investors, teams, and communities. For community tokens, this includes airdrops, public sales, rewards and DAO tokens, etc.

p>When we look at the allocation and attribution of these protocols, we find a few observations:

< li>GMX and Gains Network are exceptions as they only raise funds through public token sales. Having a “community-owned” protocol reduces users’ concerns about investor management fees and incentivizes them to hold tokens and participate in the protocol.

dYdX and Synthetix both reserve large amounts of supply for investors - 27.7% and 50% (before supply changes). However, dYdX has a ~2 year long cliff, while Synthetix has a 3 month cliff with 4 quarters to unlock after TGE.

Both GMX and Gains Network converted from another token to the current token, meaning that most of the supply was at launch Unlocked. This means that further emissions from future rewards will be a small proportion of the circulating supply.

dYdX and Synthetix both reserve significant amounts of supply (>=50%) as rewards. However, dYdX rewards are pure emissions, while Synthetix gives a partial fee + emissions that vests over 12 months. This reduces SNX’s inflation compared to DYDX.

There is no clear formula for token distribution or vesting, as the stakeholders and mechanisms employed in different protocols vary greatly. . Nonetheless, we believe the following factors will generally result in favorable token economics for all stakeholders.

Our thoughts:

The community should allocate the most tokens

The team’s token allocation should not be too many, and the vesting schedule should be smaller than Most stakeholders are longer as this can show their belief in the project

Investors’ tokens should have a minimum Distributed and vested over a significant period of time

Emissions should be spread over a period of time and include some form of vesting, To prevent severe inflation at any point in time

4. Governance and Voting

Governance is very important for sustainable DEXs because it enables token holders to participate in the decision-making process and influence the direction of the protocol. Some of the decisions that governance can make include:

Protocol upgrades and maintenance

< /li>Sustainable DEXs often require upgrades and improvements to enhance functionality, scalability, and growth. This ensures that the protocol remains up to date and competitive

For example, in GMX's most recent snapshot, governance was adopted in GMX V2 ( Proposal to create a BNB market and GMX v2 fee split on Arbitrum

Risk management and security

Token holders can collectively decide on collateral requirements, liquidation mechanisms, bug bounties, or emergency measures in the event of a breach or exploit. This helps protect user funds and build trust in the protocol

Synthetix recently suffered an incident due to TRB price fluctuations, resulting in stakers Loss of $2 million. This highlights the importance of ongoing review of parameters - adding volatility circuit breakers and increasing sensitivity to skew parameters pricing volatility spikes

Liquidity and user incentives

Token holders can propose strategies and vote to incentivize liquidity providers, adjust fee structures or introduce mechanisms to enhance liquidity supply

For example, dYdX’s governance has passed the v4 launch incentive proposal

Transparent decentralized community

Governance should build decentralized communities with transparency and accountability. The open governance process and on-chain voting mechanism provide transparency in decision-making

For example, DEX such as dYdX, Synthetix, GMX, etc. adopt on-chain Voting mechanism to promote decentralization

Our idea: Through governance, it helps to participate in decentralized sustainable DEX of stakeholders to create a strong and inclusive community. Having an on-chain voting mechanism and transparency in decision-making builds trust between stakeholders and the protocol because the process is fair and accountable to the public. Therefore, governance is a key feature of most cryptographic protocols.

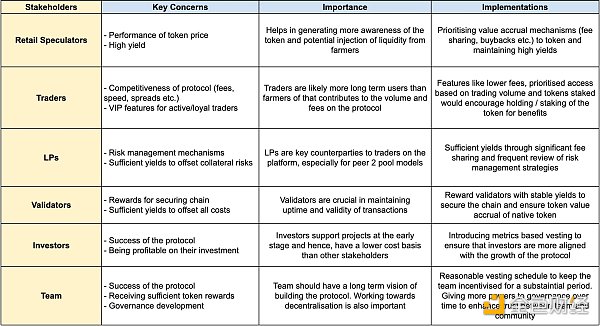

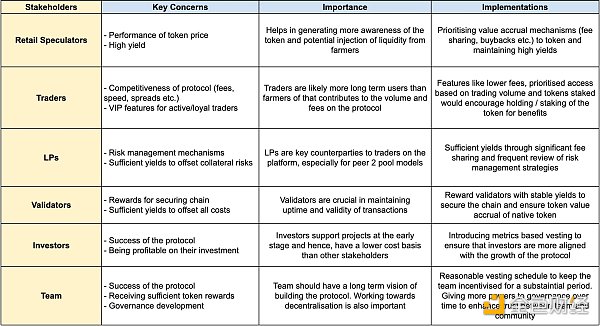

Try new mechanisms

In addition to the above factors, we believe there are many other innovations Methods can introduce additional utility and stimulate demand for the token. Protocols need to prioritize the introduction of new mechanisms based on their target stakeholders and those that are most important to them. The table below shows the main stakeholders and their main concerns:

Given the broad scope of concerns, it is impossible to meet the needs of all stakeholders. Therefore, it is important for protocols to reward the right group of users to ensure continued growth. We believe there is scope to introduce new mechanisms to better balance the interests of different stakeholders.

Conclusion

In summary, token economics are a core part of any crypto protocol. There is no clear formula for determining successful tokenomics, as there are many factors that affect performance, including those beyond a project’s control. Regardless, the cryptocurrency market is rapidly evolving and constantly changing, which highlights the importance of responsiveness and the ability to adjust to the market. As you can see from the examples above, trying new mechanisms can also be very effective in achieving exponential growth.

Xu Lin

Xu Lin