Author: Beosin

Abstract:

Driven by the continuous rise in the penetration rate of global crypto assets and the explosive growth of the user base in Southeast Asia, Indonesia is becoming a key growth pole for the crypto ecosystem in the Asia-Pacific region with its young population structure and rapidly iterating digital financial infrastructure.

This study is based on a randomly selected sample data set of on-chain addresses in Indonesia created from 2017 to 2025 (including more than 20,000 on-chain wallet addresses and more than 800,000 exchange deposit addresses), focusing on the two risk dimensions of black and gray industry capital links and related transactions of sanctioned platforms, and deconstructing the compliance process and potential risk exposure of the country's crypto market.

The study found that the number of new users of ETH, TRON, BNB and other businesses showed a trend of first increasing and then decreasing, and the number of users in the trading market tended to be stable. Among the risk funds in the black and gray industries, gambling funds are active and there is a risk of money laundering. Although the funds of other types are small in scale, they are more difficult to regulate. The sanctioned platforms have a high degree of participation in risk funds, active transactions, and may evade supervision, but their impact on the overall inflow of funds into exchanges is relatively small.

Keywords: Indonesia; Cryptocurrency; On-chain fund flow; Risk analysis

Against the backdrop of the booming global digital finance, the cryptocurrency market has emerged as an emerging force in the financial field. As a major economic power in Southeast Asia, the development of Indonesia's cryptocurrency market has attracted much attention. In-depth research on the on-chain fund flow and risk status of Indonesia's cryptocurrency market has important theoretical and practical significance for understanding the role of emerging economies in the global cryptocurrency landscape, preventing financial risks, and formulating reasonable regulatory policies.

Based on multi-source data, this report uses statistical methods and professional knowledge to conduct a comprehensive analysis of the Indonesian cryptocurrency market.

I. Overview of Indonesia's cryptocurrency market

(I) User situation: the number of new users first increased and then gradually stabilized

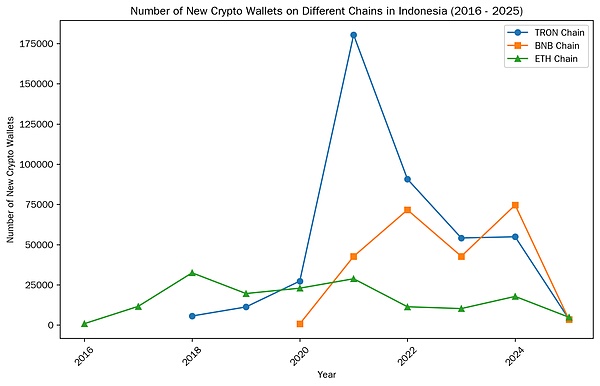

In recent years, the number of users in Indonesia's cryptocurrency market has shown an explosive growth trend. In order to fully understand the currency trading market in the region, Beosin uses the initial handling fee to represent the number of new users, and then reflects the user market quantity in the region over the past nine years. From the perspective of the three mainstream transaction chains, the following market user characteristics are obtained. The comparison chart is as follows:

It can be clearly seen from the line chart that the number of new virtual currency investors in Indonesia showed a significant upward trend between 2017 and 2021. Among them, most people first came into contact with blockchain through the ETH chain, and in 2018, the number of new users reached 32,488, showing an early leading advantage. However, after 2020, the growth rate of new users of the ETH chain began to decline, which may be related to factors such as increased market saturation and intensified competition.

Turning our perspective to the TRON chain, the growth of the number of new users of the chain lags behind the ETH chain by about one year in terms of time. In 2021, the number of new users of the TRON chain increased significantly to 180,412, which is in sharp contrast and echo with the decline in the growth rate of the ETH chain. However, after 2021, the number of new users of the TRON chain also showed a slowing trend, but during the period of 2022-2024, its overall number of new users was still higher than that of the ETH chain.

The BNB chain was officially launched in September 2020 and reached 71,608 people in 2022. However, after 2023, its number of new users also showed a significant decline, similar to the other two chains, showing a trend of first growth and then slowing down.

The regulatory policy of the Indonesian government has undergone significant changes in the past few years. In particular, in 2024, the Financial Services Authority of Indonesia (OJK) and the Commodity and Futures Trading Regulatory Authority (Bappebti) introduced a series of new regulations aimed at strengthening the standardized development of the crypto market. In June 2024, OJK issued the "Regulation of Technological Innovation in the Financial Sector (POJK 3/2024)", under which Indonesia introduced the sandbox mechanism for the first time. The sandbox framework covers many aspects of blockchain technology, including but not limited to virtual asset services, stablecoins, staking, etc. Companies can test in the sandbox for one year, and after the test period expires, if they meet the requirements, they can obtain a full regulatory license. The sandbox not only provides a testing environment for innovative projects, but also ensures consumer protection and prevents unproven technologies from having an adverse impact on the market.

On January 10, 2025, the Financial Services Authority of Indonesia (OJK) will take over the regulation of cryptocurrencies in Indonesia from the Commodity Futures Trading Regulatory Agency (Bappebti). As part of its transition to regulate the industry, OJK has developed a three-stage transition plan to ensure a smooth handover of the responsibilities of the Commodity Futures Trading Regulatory Agency (CoFTRA/Bappebti).

The first phase focuses on adopting existing CoFTRA regulations and improving them to align them with international best practices in the financial services sector, ensuring a "soft landing" during the return period and maintaining stability and continuity. Subsequent phases will strengthen the regulatory framework and support the long-term development and innovation of the industry.

The new regulations are designed to ensure that digital financial asset transactions are carried out in an orderly, fair, transparent and efficient manner. It emphasizes the importance of strong governance, risk management, market integrity and consumer protection. As the government's regulatory policies continue to improve, Indonesia's crypto market is growing rapidly and becoming an important player in the global Web3 and digital asset fields.

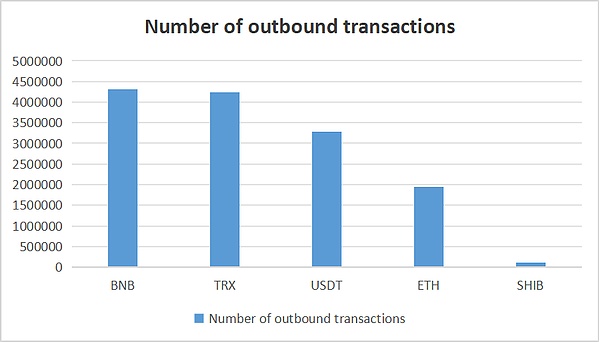

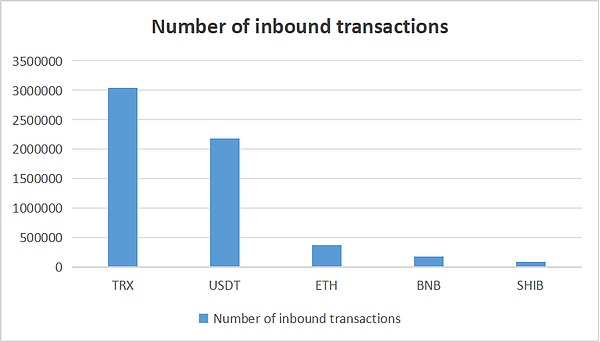

(II) Trading pattern: USDT dominates, followed by TRX

According to Beosin's cross-data statistics on the region's mainstream currencies (top five in trading) and the number of inbound and outbound transactions in recent years, USDT maintains a high level of activity and value share in both outbound and inbound transactions. In Indonesia, it may be widely used to avoid the volatility risks of the cryptocurrency market and to convert between fiat currencies and cryptocurrencies. TRX is active in both outbound and inbound transactions, indicating that it also has a broad user base and high market recognition in Indonesia.

BNB leads in the number of outbound transactions, showing its important position in external transactions for Indonesian investors. It may rely on the ecological advantages of its platform, such as preferential handling fees and participation in platform projects, to attract local investors to use it for cross-border transactions and asset transfers. Although ETH is a world-renowned cryptocurrency, its number of transactions in Indonesia is not as good as that of other mainstream currencies. This may be due to the relatively lagging development and use of ETH-based applications such as smart contracts, or the impact of other competing currencies. SHIB has extremely low numbers of both outbound and inbound transactions, indicating that its market acceptance in Indonesia is limited. Although it has a certain topicality globally, it may not yet have a mature trading ecosystem in the region.

Overall, cryptocurrency transactions in Indonesia present certain characteristics. Different cryptocurrencies have different numbers of outbound and inbound transactions, reflecting the popularity, application scenarios and investor preferences of each currency in the local market. TRX and USDT have high trading activity in the region and have a broad market base; while SHIB and other currencies have low trading activity and market acceptance needs to be improved.

(III) Regulatory environment: policy adjustments and market growth

In July 2023, Indonesia officially launched Tokocrypto, the world's first state-backed cryptocurrency exchange. In 2024, Indonesia's commodity futures regulator considered adjusting its tax policy and proposed to halve the tax burden on investors to stimulate the growth of the domestic cryptocurrency market. This tax policy adjustment is intended to encourage more investors to participate in the market and promote market activity. Due to the innovativeness and rapid changes in the cryptocurrency market, existing regulatory policies may not be able to fully adapt to the development of the market. At the same time, the frequent adjustments to regulatory policies have also brought uncertainty to market participants and affected the stable development of the market. Therefore, with the rapid growth of market users, the risks of capital flows to the black and gray industries and capital inflows to sanctioned platforms have also grown rapidly.

II. On-chain fund flow and risk analysis

Regrettably, among the more than 20,000 on-chain address analysis samples, more than $100 million of funds were involved in risky entity transactions. In-depth research on the types of these risky transactions and the phenomenon of high-risk fund flows is of great significance for preventing and combating related illegal and criminal activities. Based on the extracted blockchain address samples, Beosin analyzes the capital flow of relevant transaction entities and the flow of risky funds:

(I) Main label types involved

Beosin divides the addresses closely related to the black and gray industries into 5 major categories and 13 minor categories through risk labels. The high-risk categories involved in the transaction samples analyzed this time mainly include:

● Gambling: the type with the largest single risk capital

● Scam: including false investment, Ponzi scheme, pig killing scam and phishing scam, etc.

● Blacklist: including USDT, USDC frozen blacklist and USDT unfrozen list

● Underground Bank: Mainly engaged in illegal financial activities such as money laundering

● Sanctions: Including OFAC, FATF, UK sanctions, etc.

These risky address types involve more than 50 specific black and gray industry entities.

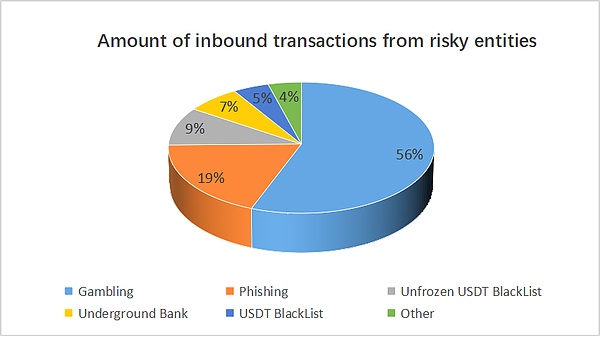

(II) Risky transaction analysis of the source of funds

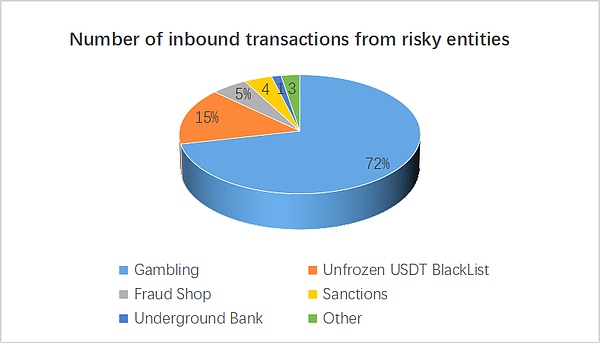

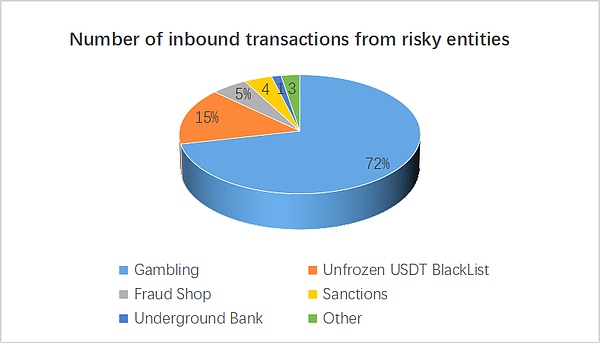

Beosin's analysis shows that when conducting an in-depth study of the funds of 32 high-risk entities involved in the inflow direction, it was found that the number of transactions of this part of risky funds reached 5,557 times, with a total value of more than 40 million US dollars, and an average transaction amount of more than 7,000 US dollars, involving 2.4% of the sample addresses, which were used as early as 2022. This data shows that there is a continuous and large-scale inflow of risky funds in the region. These funds may come from a series of illegal activities, posing a potential threat to local financial order and social stability.

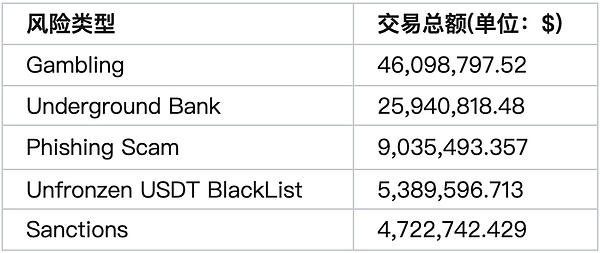

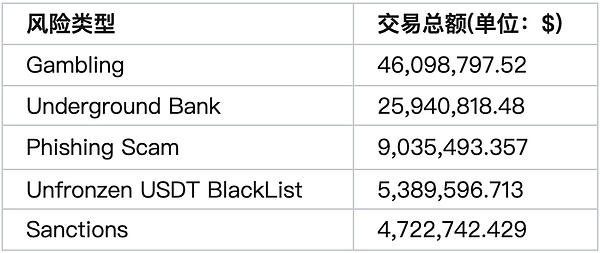

Source risk capital TOP5 list:

Specific risk capital transaction distribution is as follows:

From the dimensions of transaction amount and number of transactions, gambling risk capital occupies a dominant position in the inflow of risk capital and presents a centralized feature. Among the label types after the 32 risk entities are divided, the proportion of the total transaction inflow amount and the total number of transactions in the risk capital data of ‘Gambling’ is 2.3% and 1.6% respectively. 56% and 72%) are much higher than other types of risky funds.

At the same time, funds from sanctioned platforms and underground banks exceeded US$4.5 million. This part of funds may be mixed or laundered through exchanges in Indonesia, further increasing the difficulty of tracking funds and regulatory risks.

(III) Analysis of risky transactions in the direction of capital outflow: gambling and fraud are the hardest hit areas

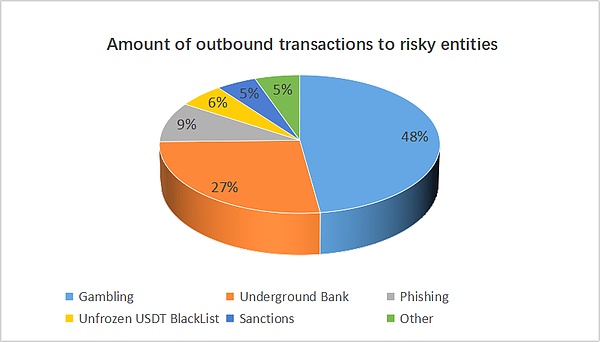

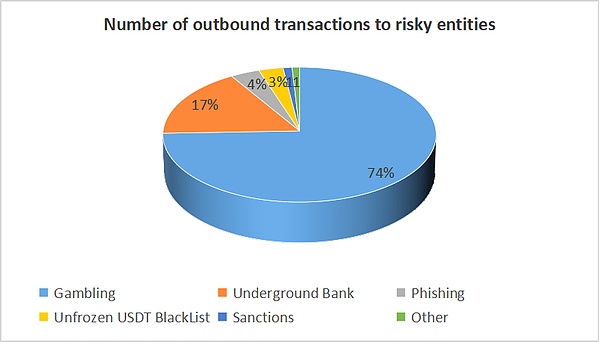

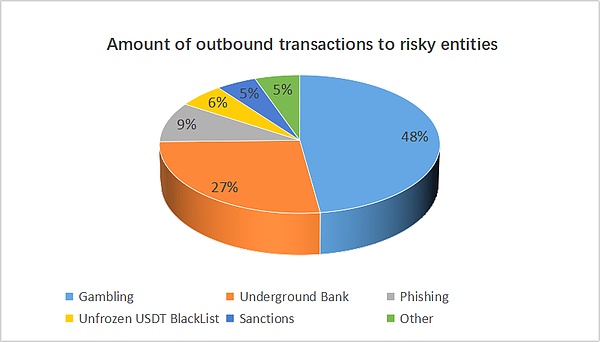

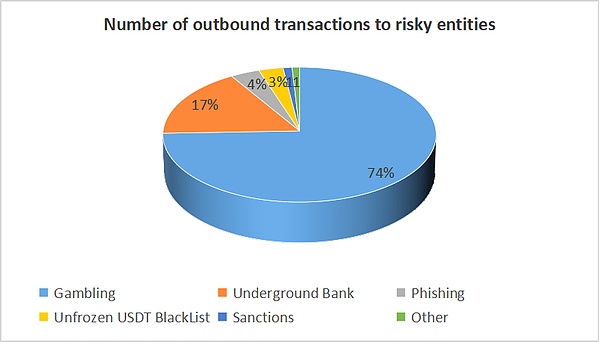

Beosin's analysis shows that when conducting in-depth research on the funds of 49 high-risk entities involved in the outflow direction, it was found that this part of risky funds had more than 33,000 transactions, with a total value of more than US$96 million and an average transaction amount of more than US$2,900, involving 2.6% of the sample addresses, which were first activated in 2019. This data shows that there is a continuous and large-scale outflow of risky funds in the region. These funds may enter a series of illegal activities, posing a potential threat to local financial order and social stability.

Top 5 risk capital outflow list:

The distribution of specific risk capital transactions is as follows:

From the perspective of the overall risk capital proportion: the number of risk capital outflow transactions accounts for 7.74% of the number of related entity transactions, and the transaction amount exceeds 3%.

What deserves most attention is that nearly 5 million U.S. dollars of funds have flowed into entities sanctioned by OFAC and FATF. The risk factor of this part of funds is relatively high. It may be used to support the production and operation activities of sanctioned countries or entities. It is a major risk point in virtual currency supervision.

However, in the end, the analysis found that nearly 8.9 million U.S. dollars of funds have flowed into addresses that have been or are being frozen, indicating that part of the risk funds have been traced and frozen, indicating that the supervision of on-chain funds has achieved certain results, but the overall proportion of recovered funds is small, and supervision still needs to be strengthened.

III. Conclusion and Suggestions

(I) Conclusion: Risks in Indonesia’s currency trading market

1. Risks associated with risky funds

In the Indonesian cryptocurrency market, a large number of users participate in transactions, making it difficult to accurately control the flow of funds. From the perspective of the flow of funds in the black and gray industries, gambling funds are extremely active, with nearly US$50 million directly flowing into gambling platforms, with a transaction frequency of more than 24,000 times. Due to the anonymity of cryptocurrency transactions and the complexity of blockchain technology, these funds may be transferred through complex currency mixing services and other means after flowing into gambling platforms, confused with legal funds, and flow to more illegal areas, making it extremely difficult to track the flow of funds, and financial regulatory authorities find it difficult to effectively monitor and control the true whereabouts of funds.

2. Risks associated with sanctioned platforms

The funds associated with sanctioned platforms should not be underestimated. There were nearly 600 transactions related to sanctioned platforms, with a total value of more than 6.3 million US dollars, involving nearly 200 addresses. Many users participated in the transaction, and some of them were inevitably associated with sanctioned platforms. Once the user's funds flowed into the sanctioned platform, they not only faced the risk of losing funds, but also may violate laws and regulations due to participating in transactions on the sanctioned platform.

(II) Suggestions: Construction of regulatory system and improvement of technical regulatory capabilities

1. Strengthen the construction of the regulatory system: policy optimization and cooperation with regulatory agencies

In terms of optimizing policies and regulations, the Indonesian government should formulate systematic and comprehensive regulatory regulations in light of the actual development of the cryptocurrency market. Clarify the legal boundaries of various types of cryptocurrency trading activities, and formulate strict punishment measures for transactions related to black and gray industries and the inflow of funds from sanctioned platforms.

In terms of regulatory coordination and cooperation, a multi-departmental regulatory mechanism should be established to promote information sharing and collaboration among financial regulatory agencies, judicial departments, tax departments, etc. Financial regulatory agencies are responsible for monitoring the flow of funds in the cryptocurrency market and promptly discovering abnormal transactions; judicial departments crack down on transactions involving illegal crimes; and tax departments ensure the effective implementation of tax policies. All departments form a regulatory synergy to improve the effectiveness and efficiency of cryptocurrency market supervision and comprehensively curb the flow of risky funds.

2. Improve relevant prevention capabilities: blockchain analysis technology and risk prevention capabilities

Increase investment in blockchain analysis technology, introduce advanced blockchain data analysis tools, and cultivate professional and technical personnel. Use big data, artificial intelligence and machine learning technologies to conduct real-time monitoring, in-depth mining and risk warning of cryptocurrency transaction data. By building a risk model, identify abnormal transaction patterns, such as rapid and centralized transfer of funds, frequent small transactions, etc., and promptly discover transaction clues of black and gray industry funds and sanctioned platform funds.

At the same time, a regulatory sandbox mechanism can be established to encourage blockchain companies and financial technology companies to conduct innovative business pilots within the sandbox. Test and evaluate new technologies and new businesses in a controllable environment to effectively prevent risks while promoting innovation. Regulators can adjust regulatory policies in a timely manner based on the pilot situation and provide guidance for the compliant development of innovative businesses.

Weiliang

Weiliang