Source: Binance

Key Points

This report explores several key observations about the cryptocurrency market, focusing on valuations, risks associated with centralization, the need for greater transparency in the use of funds, and reasons for project rebranding.

Market participants, including venture capital (VC) funds, centralized exchanges, and individual users, are paying more attention to valuations. This increased awareness leads to smarter investment and operational decisions.

Concentrated token ownership poses risks such as potential vulnerabilities and governance issues. Ensuring decentralized control and broad participation is critical to maintaining the integrity and resilience of cryptocurrency projects and promoting long-term trust and stability.

There is a growing call for greater transparency in the use of project funds. Detailed disclosure promotes responsible financial management and builds trust among stakeholders.

Rebranding can be a strategic move to signal a new focus, attract new investors, and update project goals. However, rebranding must be driven by legitimate business needs and must not be used to cover up or hide certain illegal activities. Investors should conduct a comprehensive and prudent review to fully understand the rationale behind the project's rebranding.

Overview

In recent weeks, we have participated in several cryptocurrency events and had the opportunity to communicate with market participants such as industry leaders, investors, project teams, and individual users. These conversations have provided us with valuable insights into what the community is thinking.

This report aims to share a few insights we gleaned from these conversations, as well as our thoughts on the current industry landscape. Specifically, our conversations spanned four major themes and observations:

Valuations remain high (in certain segments): Some VC funds have either slowed down their deployments or are looking for other sectors where valuations are more reasonable.

Centralization risks are often overlooked: The risks associated with concentrated token ownership cannot be ignored.

Transparency in fund use needs to be improved: Given the direct impact of recent events on both token holders and the community, there are calls for disclosure of how treasury funds are being used.

Rebranding should be done with purpose: Rebranding can be a strategic move to clarify a new focus, attract new investors, and update project goals. However, rebranding should be driven by real business needs and should not be used to cover up or hide some illegal behavior.

1. Valuations are still high

Summary: Although token valuations have declined, valuation premiums are still present in certain market segments.

During discussions with several venture capitalists at Token2049, they repeatedly mentioned that valuations in certain segments of the primary market are still high.

This observation is consistent with our previous research. In our report published in May, we focused on the issue of overvaluation, especially when the circulating supply of tokens is low. In summary, one observable trend is that tokens are issued with high valuations but with limited circulating supply. This trend is particularly evident when compared to tokens launched in recent years. At their peak, the valuations of some newly issued tokens were close to the valuations of large tokens that have been launched on the market for many years.

In addition, the problem of low initial circulating supply is further exacerbated as new tokens are launched. As more and more low circulating supply tokens are launched, a large number of tokens will be unlocked in the future, and the circulating supply of tokens on the secondary market will increase exponentially. For example, if the issuance of most tokens is less than 10% of the initial circulating supply, the industry will face a large number of token unlocks in the next 1-2 years. To absorb these supply increases, capital and investors must increase accordingly, otherwise the performance of many tokens will suffer. Meeting this challenge can provide growth opportunities for the industry and help it adapt to changing market conditions.

Responses

Since we published our report, “Observations and Thoughts on the Current Situation of Highly Valuated, Lowly Circulated Tokens”, there has been a lot of discussion on this topic and, importantly, awareness among market participants has increased. Some of the responses that have been taken include:

Data from the PitchBook Cryptocurrency Venture Capital Fund Report also shows that the time interval between financing rounds has gradually increased, with the median interval between two rounds of financing more than doubling from 1.1 years to 2.4 years. The report highlights that the lengthening of this interval suggests that fund managers are taking longer to return to the market, perhaps because they have devoted more time to managing portfolios during the crypto bear market and have been slower to deploy capital.

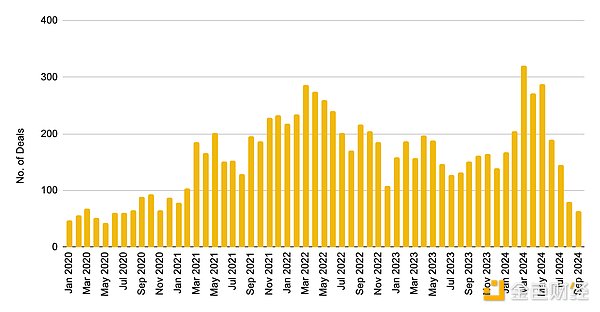

Figure 1: Venture capital deal activity (measured by monthly deal count) falls to four-year low

Source: The Block. Data as of September 27, 2024. Centralized exchanges: Binance and other exchanges call for high-quality projects with low to medium valuations, and tokens that apply for listing with moderate circulation during the Token Generation Event (TGE). In addition, projects should ideally demonstrate product-market fit and sustainable user growth.

Retail investors: While we do not have data on what actions retail investors have taken, we have observed a lot of discussion on social media about this phenomenon, which suggests that people's awareness has increased and will hopefully encourage more individual users to conduct their own prudent checks before investing.

2. Centralization risks are often ignored

Summary: Centralization risks should not be underestimated. In the worst case, other stakeholders may suffer direct or indirect losses due to centralization risks.

One aspect of cryptocurrency projects that is often overlooked is centralization risk, which we believe cannot be underestimated. In this section, we will share some observations and ways to detect centralization.

Centralization risk has a serious impact on the decision-making process, treasury management, and overall governance. When power is concentrated in the hands of a few individuals or entities, it can lead to a number of undesirable consequences. In the worst case, this concentration of power can lead to vulnerabilities, runaway scams, and other malicious activities that harm the community.

Such incidents not only erode trust, but also jeopardize the long-term sustainability and credibility of the project. Therefore, ensuring decentralized control and broad participation is critical to help maintain the integrity and resilience of cryptocurrency projects.

In contrast, decentralization ensures that no single entity can control the entire network, thereby improving the transparency and security of the network and enhancing trust among users. Decentralization is reflected in the following aspects:

Infrastructure: Hardware is distributed across multiple nodes, data centers, and geographic locations, reducing single points of failure and making it difficult for bad actors to disrupt the network. Decentralized infrastructure also has advantages in terms of network security, availability, and censorship resistance.

Governance: Decentralized decision-making and governance are an integral part of the cryptocurrency industry, empowering the community and ensuring that no single entity can unilaterally control the direction and development of a blockchain project.

Token distribution: Diversified token distribution promotes inclusivity and fairness, fostering a sense of belonging and participation among a large community of users and supporters. In the case of governance tokens, it also facilitates democratic decision-making.

In this section, we will focus primarily on centralization risks associated with token distribution.

Case Study: High Concentration of Token Holders for Memecoin “Z”

For illustration purposes, we will analyze a memecoin project, which we will refer to as “Project Z” to preserve anonymity. In the case of Project Z, multiple indicators indicate that its token ownership is highly concentrated, and on-chain activity may have a detrimental impact on token holders.

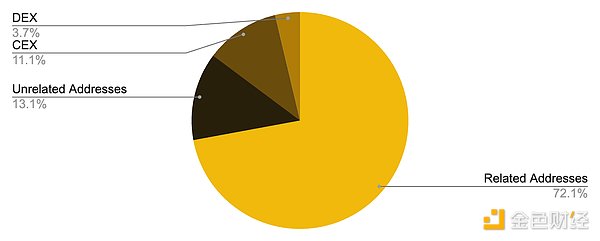

At first glance, Token Z appears to be widely distributed, with the number of addresses holding the token approaching 200,000. However, a closer inspection of on-chain transactions shows that many of these addresses are interconnected, possibly indicating ownership by a single entity. This distribution strategy appears to be designed to artificially inflate the number of token holders.

Figure 2: Most of the token supply is held by interconnected addresses

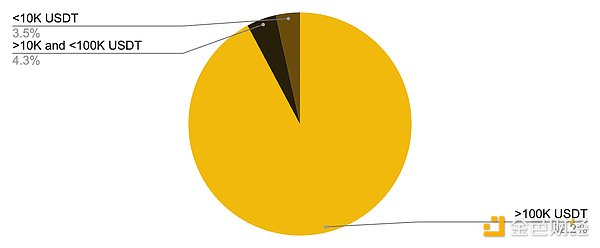

Source: Binance Research.Furthermore, even among uncorrelated addresses, the majority of tokens are held by a small number of large holders, often referred to as “whales.” Retail investors make up only 3.5% of this group and hold only 0.5% of the total token supply.

Figure 3: Among unrelated addresses, the majority of token supply is held by whales

Source: Binance Research. Possible Impact

In this case, we found potential signs of front-running, with a significant portion of the token supply being acquired by interconnected addresses within 1 hour of the token sale. Furthermore, given the high concentration of tokens held by these interconnected addresses, there is considerable risk of selling pressure if this group decides to liquidate their holdings.

Next Steps: Analyze Token Ownership

It is important to note that it is not uncommon for a small number of internal wallets to hold the majority of tokens, especially in the initial stages of a project’s launch. We are not suggesting that investors should view this characteristic as a red flag and avoid such projects entirely. However, concentrated token ownership does carry higher risks than a more diversified group of token holders, such as the potential for runaway scams and a lack of decentralized decision making. This risk is particularly pronounced for tokens with a speculative nature and low utility, such as memecoins. By analyzing token ownership, investors can gain a more complete picture of the risks associated with a particular token. This can be accomplished with the help of on-chain data visualization and intelligence tools such as Bubblemaps and Arkham.

3. Transparency in the use of funds needs to be improved

Summary: Improving the transparency of the use of treasury funds is conducive to responsible financial management and can also encourage the active participation of governance token holders. We should strive to make the disclosure of detailed fund use a normal practice.

In order to meet operating costs and implement expansion plans, project teams usually need to raise funds through primary markets (such as venture capital funds, initial coin offerings and Launchpad) or secondary markets (such as selling treasury tokens on centralized and decentralized trading platforms).

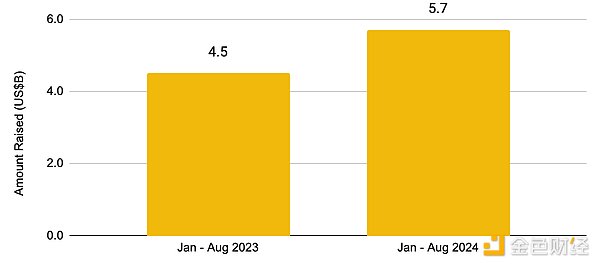

Figure 4: So far this year, venture capital funds in the cryptocurrency industry have raised $5.7 billion, up 26.6% year-on-year

Source: DeFi Llama, Binance Research. Data as of September 26, 2024. However, the use of these funds is often not transparent enough. Although some DAOs or foundations disclose in detail the use of their treasury funds, not all projects follow this practice. While there is no formal obligation to disclose, stakeholders undoubtedly want greater transparency. This is particularly important in cases where entities pay for expenses by selling native tokens, as such actions can directly impact token prices.

We believe that managing a well-run project is similar to running a company. Project teams have a fiduciary responsibility to act in the best interests of their stakeholders, including users, token holders, and investors. Appropriate disclosure, especially about financial matters, further incentivizes project teams to make informed decisions and maximize stakeholder value.

Case Study: Polkadot and the Ethereum Foundation

Polkadot

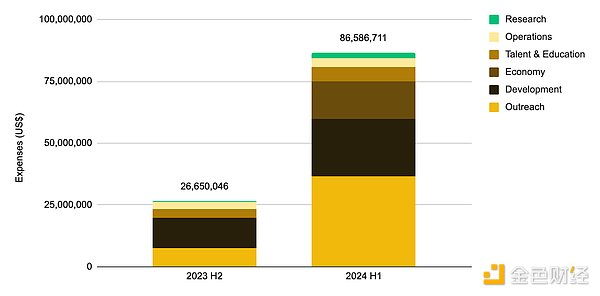

Polkadot has come under extensive scrutiny following the release of its treasury report in July. There are concerns that its financial lifespan may be as short as two years due to a dramatic increase in the rate of spending (tripling in the first half of 2024 alone).

Figure 5: Outreach spending accounts for the majority of Polkadot spending in the first half of 2024

Source: Polkadot, Binance Research. Transparent disclosure plays a critical role in fostering stakeholder trust and encouraging in-depth discussions around spending and project sustainability, thereby reducing the risk of similar issues recurring. In this regard, Polkadot's continued publication of treasury reports is a welcome move.

The Ethereum Foundation

The Ethereum Foundation’s sale of large amounts of ETH (roughly $9.67 million worth of ETH sold so far this year) has sparked speculation about potential motives, especially as market sentiment is already fragile.

While the sales were revealed to be related to treasury management activities that provide grants and salaries, many are calling for more transparency around spending and how funds are used. In response, the Ethereum Foundation’s Josh Stark said the Foundation will publish a report covering its spending in 2022 and 2023.

This event clearly demonstrates the demand for detailed disclosure and transparency, especially for entities that hold large amounts of treasury assets, whose transactions can directly affect token prices. We believe that every step towards greater transparency is a step in the right direction.

Next Steps: Make Disclosure a Regular Thing

While it may not be feasible or reasonable to require all DAOs or foundations to disclose how their funds are used, encouraging voluntary transparency can significantly enhance trust within the community.

It is critical for the entire community to use on-chain monitoring tools to identify large-scale token movements. For users who are less familiar with cryptocurrencies or have limited time, setting up alerts to get notified about such movements can provide timely insights.

4. Rebranding Should Have a Purpose

Summary: Projects sometimes choose to rebrand as a strategic move to clarify new priorities, attract new investors, and update project goals. However, rebranding should be driven by legitimate business needs and should not be used to cover up or hide some illegal behavior.

Occasionally, projects choose to rename or rebrand their tokens. This can be a strategic move driven by a variety of business, operational, or commercial purposes. For example, a project may announce a shift in strategic direction or an improved product portfolio that makes it easy to restart with a new brand identity. This rebranding strategy can signal a new focus, attract new investors, and align the project's development with its new goals and vision.

A recent example is MakerDAO's rebranding to Sky in accordance with its "endgame" plan. The DAI stablecoin has been rebranded to USDS, with a 1:1 exchange rate between the two. In addition, a new governance token, SKY, was launched as an upgrade to MKR. Each MKR token is redeemable for 24,000 SKY tokens. This rebranding initiative is intended to keep Maker's governance mechanism immutable and ensure sustainable decentralized growth.

However, not all rebranding is driven by legitimate business needs. There have been cases where projects have rebranded their tokens without a clear or justifiable reason, sometimes to disguise or hide certain actions.

For example, a project might rebrand Token A to Token B and simultaneously change the token economics, such as increasing the token supply without providing a corresponding fair exchange rate (e.g., increasing the token supply by 10x but maintaining a 1:1 exchange rate). Such actions can mask underlying issues or cause confusion and potentially result in financial losses for investors.

Next Steps: Careful Review and Active Participation

To navigate the complexities of token rebranding, users should proactively take the following steps:

Analyze the rationale for the rebrand: Potential investors should understand the reasoning behind the rebrand, the project's new direction, and the changes to the token economics. Sources of information include the project's official announcement, whitepaper, and reputable cryptocurrency news outlets.

Participate in governance decisions: Users should actively participate in governance forums and discussions, share their views, and encourage project teams to address community concerns. Existing token holders should be particularly active in voting on rebranding proposals to ensure that the interests of all stakeholders are aligned. This active participation will not only increase transparency, but also help future investors understand the rationale behind the token rebranding and all related issues, allowing them to make more informed decisions.

Monitor on-chain activity: Utilize on-chain monitoring tools to track significant changes in tokens. This can help identify unusual patterns or activities that may indicate potential problems. Setting up alerts for large token transfers can provide users with timely insights and help them stay informed.

Looking back, looking forward

Looking forward, while there is undoubtedly still room for improvement, we remain firmly optimistic about the future of the industry. We believe that addressing the following issues will help the industry reach its full potential.

Achieving Sustainable Valuations: We acknowledge that achieving more reasonable valuations will take time. There will always be areas of the market with higher valuations, either due to a premium assigned by investors or due to the high popularity of certain areas. However, the trend towards more sustainable valuations is expected to continue as investors become more discerning and prefer projects with solid fundamentals and realistic growth prospects over speculative projects. This gradual shift is expected to create a healthier and more stable market environment.

Strike a balance between centralization and decentralization: While some degree of centralization can be beneficial, especially for new teams that need to make decisions quickly or resolve issues such as bugs more efficiently, it is still critical to maintain decentralization. Centralization has advantages in speed and flexibility, but it should not come at the expense of community trust or the integrity of the project. Long-term success requires balancing decentralization with prioritization, especially in areas where centralization can harm the community.

Increase transparency: Transparency will continue to be a cornerstone of trust in the cryptocurrency space. Projects that disclose clear and detailed information about the use of funds and governance will stand out and attract more stakeholders. In addition, initiatives to increase transparency will also help to achieve responsible financial management and accountability.

Purposeful rebranding: A rebranding strategy can be a strategic move to clarify a new focus, attract new investors, and align the project's development with its new goals and vision. However, it is critical that rebranding is driven by legitimate business needs and not used to cover up or hide some illegal behavior. Investors should conduct a comprehensive and prudent review to fully understand the reasons behind the project's rebranding and ensure that it is in line with the project's long-term goals and the interests of the community.

By addressing issues such as valuation, centralization, transparency, and purposeful rebranding, the cryptocurrency industry can build a more robust and resilient ecosystem. Stakeholders at all levels must work together to drive innovation while adhering to the principles of decentralization and high transparency.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Jixu

Jixu Jixu

Jixu Joy

Joy YouQuan

YouQuan Catherine

Catherine Davin

Davin Clement

Clement Kikyo

Kikyo Clement

Clement