1. Introduction

1. Introduction

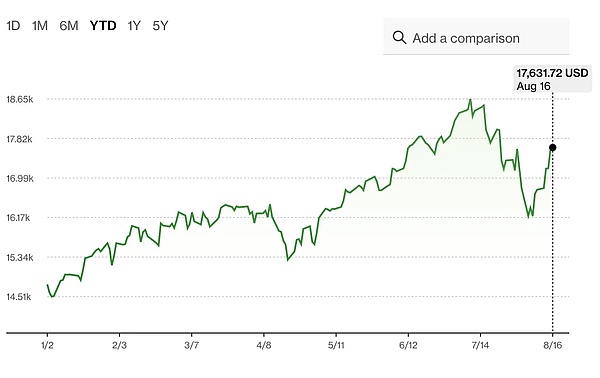

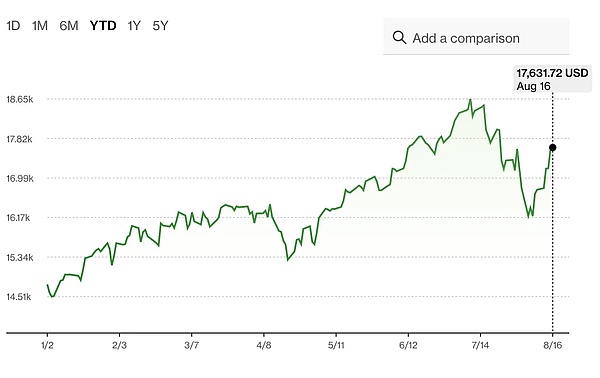

Global economic uncertainty and volatile market conditions continue to influence user decisions. Last week, the risk of yen carry trades once again became the focus of the market, and the policy direction of the Bank of Japan remained in the spotlight. The Fed's policy dynamics remain the main driver of the market, and the core economic data released in August further support the "Goldilocks" scenario, that is, inflation is controlled and does not endanger economic growth. It is worth noting that although the US stock market continues to rebound and the Nasdaq index is close to a new high, the cryptocurrency market has failed to follow the trend of the US stock market, and the prices of Bitcoin and Ethereum have both fallen. Whether Bitcoin can stand firm at $60,000 amid continued market volatility remains the focus of attention.

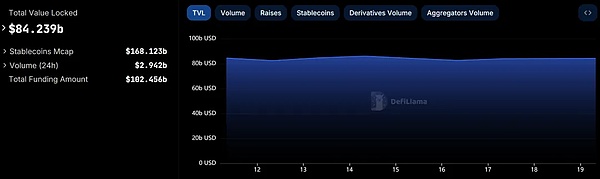

Nasdaq Index (Source: Bloomberg)

2. Macro data performance

In the past week, the Federal Reserve maintained the target range of the federal funds rate at 5.25%-5.50%, and continued to pay attention to the balance between inflation data and economic growth. The latest US economic data, including inflation, unemployment claims and retail sales data, showed the resilience of the economy, further supporting the "soft landing" scenario. This series of optimistic data helped global stock markets recover, especially the rebound after last week's sharp sell-off.

Asian stocks rose across the board last week as investors reentered risk assets, with regional indices posting their best week in nearly a year. Japanese stocks performed particularly well against the backdrop of a weak yen. The yen fell 1.3% against the dollar on Thursday, trading near 149, its worst week since May. The weak yen boosted earnings for Japanese exporters while also easing concerns about the unravelling of large-scale carry trades. As a result, the Nikkei 225 is on track for its best week since April 2020.

In the U.S., the S&P 500 rose for the seventh consecutive day, with a cumulative gain of 6.6%, its best performance since November 2022. The small-cap Russell 2000 index performed particularly well, rising 2.5%. At the same time, the VIX "fear index" fell to around 15, indicating that market sentiment has stabilized. Market optimism continues to grow, supported by strong consumer spending expectations and stable economic data.

In the U.S. bond market, despite a sharp drop in U.S. bonds on Thursday, the Treasury market remained generally stable. Swap market pricing shows that the Federal Reserve is expected to make three 25 basis point rate cuts in the remaining meetings in 2024, which is less than expected at the beginning of this week. This reflects that the market's expectations for the Fed's future policies are gradually becoming more moderate.

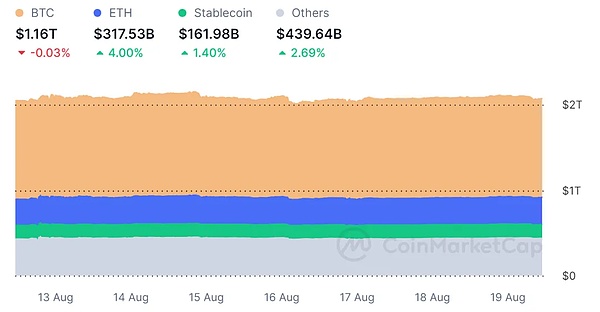

The cryptocurrency market has rebounded, with Bitcoin prices fluctuating around $58,000 and Ethereum prices fluctuating around $2,580. At the same time, more and more listed companies have begun to increase their holdings of Bitcoin through the capital market.

Overall, global markets showed a strong rebound momentum last week, especially in Asia and the United States. The weakness of the yen, the adjustment of Fed policy expectations, and the recovery of the cryptocurrency market have become important factors driving the market up.

2. Industry data sharing

1. Overall market performance

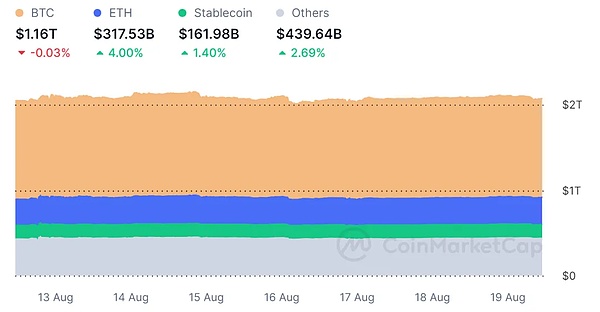

Last week, the overall market performance was flat. After the CPI data in the middle of the week was lower than expected, BTC fell in the short term, but then stabilized, and the market value did not show a significant decline. In the second half of last week, the Federal Reserve reiterated its easing signal, the encryption market received strong support, and ETH and some altcoins showed obvious signs of capital inflows.

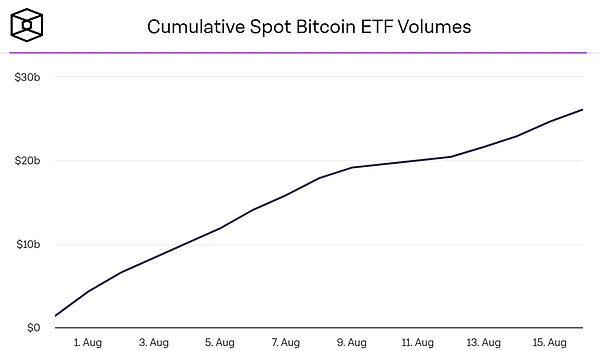

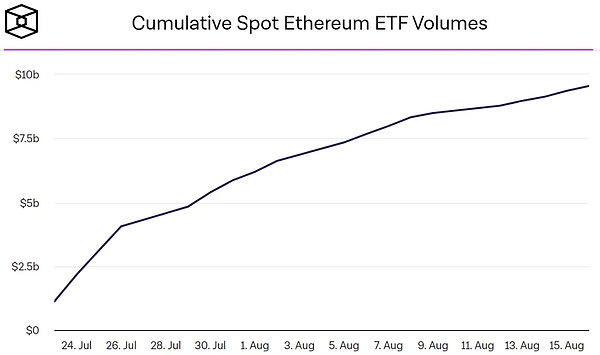

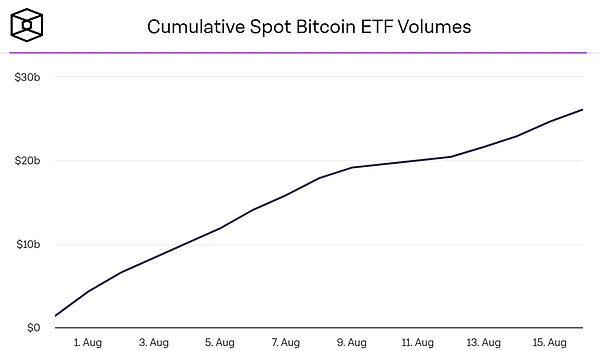

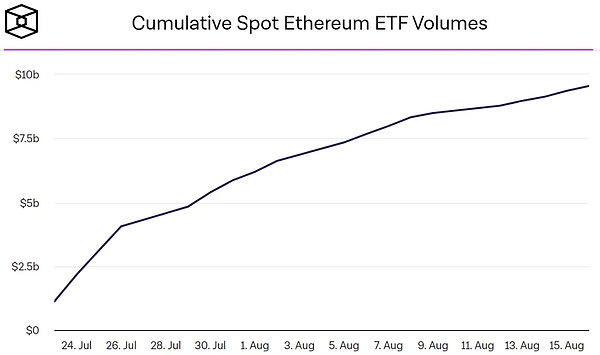

· BTCÐ ETF Volumes

According to the ETF data of BTC and ETH last week, both are in a steady upward trend. OTC ETFs have sent enough signals to the market - slowly buying the bottom. Although the process is not easy to detect and the capital inflow is limited, judging from the trend, the behavior of OTC funds gradually buying BTC and ETH in the current price range has restored confidence for the entire market.

· BTC SPOT price

Although the medium- and long-term trends have stabilized and are optimistic, BTC's short-term trend is still facing the risk of a second bottoming out. This week, we will focus on the effectiveness of the bottom support range of $51,000 to $54,000. If it stabilizes, a rebound can be expected.

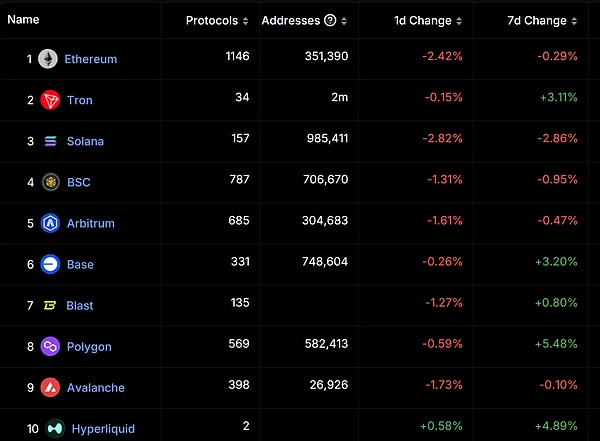

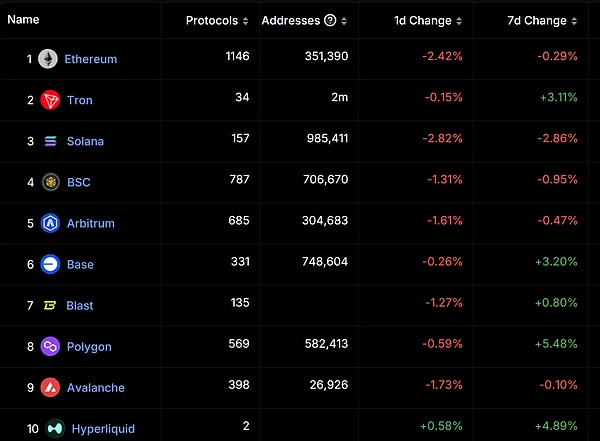

2. Public chain data

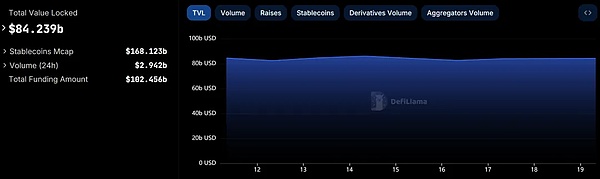

Last week, the on-chain data was stable, and the weekly TVL continued to be stable above 80 billion US dollars. The impact of macro factors in the middle of the week did not affect the chain.

Among the top 10 public chains in the past week, except for Base and Blast, which are rising, only TRON and Polygon achieved positive growth in TVL.

Among them, TRON has set off a wave of market enthusiasm due to its Meme launch platform SunPump. Polygon benefits from its unique innovative market prediction platform Polymarket, and a large amount of capital inflow is mainly concentrated on betting on the US election and a large number of current hot events.

· Airdrop potential protocol

Among the top protocols with airdrop expectations, Symbiotic has achieved a surge in TVL in the past week, which can also reflect from the side that the market is still bullish on the current restaking sector. Web3 users can focus on this project in the future.

· Layer 2

In terms of L2, the top protocol that achieved positive growth in TVL in the past week is still the OP series. Among them, Arbitrum has been active recently. The release of the L3 technology stack has given a glimmer of hope to many Web3 project teams that are suffering from technical difficulties. TVL may continue to grow in the future.

In contrast, the ZK series of protocols is slightly sluggish. Under the negative impact of the relevant management changes in Starknet in the short term, only ZKSync is growing steadily. The innovation on the technical side and the in-depth understanding of ZK make this protocol expected to become the leading project of ZK's explosion in the future.

3. Analysis of hot tracks and projects

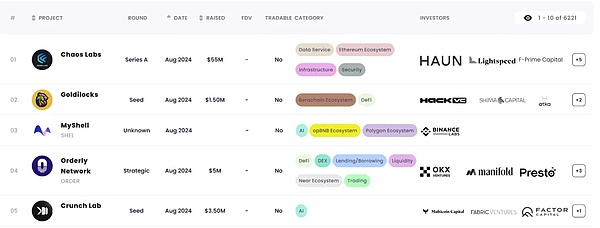

· VC trend

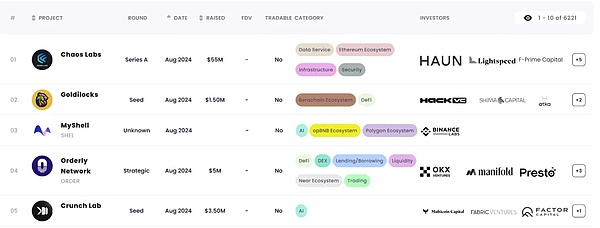

Among the Web3 protocols most favored by VCs this month, infrastructure, DeFi and AI continue to dominate the list, and the amount of financing also ranges from US$1.5 million to US$55 million.

· Hot tracks and projects

SUI: The new generation of high-performance public chain SUI rebounded against the trend by 140% in the past week when the altcoin market was generally sluggish, almost becoming the only dazzling project outside the Meme track. The reason is not that the project itself has made any great breakthroughs or progress, but that Grayscale has intriguingly added SUI's investment trust to its crypto portfolio, which seems to convey to the market the possibility of buying a large amount of SUI in the future, boosting the buying of SUI.

SUI will also face large unlocking in the next few months. The abnormally strong price of the currency at this time may be a trap set by whales to lure more. After all, there are still a large number of tokens waiting to be unlocked in the future, and the possibility of whales raising shipments exists.

Chain Abstraction-ZetaChain: Given that chain abstraction may become the main track that the crypto market focuses on in the future, ZetaChain has achieved good results in project progress in the past week and has also attracted a lot of market attention.

ZetaChain uses its technical characteristics to realize cross-chain exchange of different tokens, and has the ability to allow users to exchange tokens with one click. The current LayerZero and Wormehole only have the ability to seamlessly cross-chain a single token. If you want to convert it into different types, you need to go through the DEX on the target chain for replacement. Therefore, the operation complexity and Gas fee will be higher than ZetaChain. The cleverness of ZetaChain's design lies in the actual process of its cross-chain is to first let the token cross-chain to ZetaChain, complete the transaction on ZetaChain, and then cross-chain to the target chain. The cross-chain process itself is lossless because it does not involve liquidity, it is just a process similar to encapsulation.

On ZetaChain, all tokens need to establish a liquidity pool with ZETA, which means that A token is traded for ZETA, and ZETA is traded for B token. ZETA token becomes an indispensable link in the cross-chain link. Therefore, the more ZetaChain's cross-chain is used, the higher the demand for ZETA. The high demand for ZETA pushes up the price of ZETA, which can further increase the liquidity on ZetaChain, thereby making cross-chain wear and tear lower and the cost lower.

Fractal: In addition, Fractal, a project that natively expands Bitcoin, has also become the focus of some VCs. Its feature is to improve transaction processing capabilities and speed by recursively creating an infinite expansion layer on the BTC main chain using the BTC core code, while maintaining full compatibility with the existing Bitcoin ecosystem.

In short, Fractal is an extension based on the BTC core code, with the following features: 1. Fast transaction speed: The block confirmation time of the Fractal network is about 30 seconds, and the transaction processing capacity is 20 times that of the BTC main chain. 2. Native compatibility: Fractal Bitcoin is developed based on the BTC core code, so it is fully compatible with existing Bitcoin wallets, tools and mining equipment. 3. Dynamic adjustment: The recursive system based on the BTC main chain can automatically adjust the number of extension layers according to the degree of network congestion. 4. Safe and traceable: All transactions conducted on the Fractal network can ultimately be traced back to the Bitcoin main chain.

Therefore, whether from the perspective of project concept or implementation mechanism, it seems that Fractal, which has always insisted on the orthodox extension based on the BTC main chain, has indeed used creative mechanisms to achieve the native extension of BTC.

3. Regulatory policies

Since the beginning of this year, the crypto market has been affected to some extent by the progress of the US election. On Polymarket, the probability of Trump being elected president has dropped to 48%, while Vice President Harris has risen to 50%. Trump has risen by 4 percentage points compared with last week, while Harris has fallen by 4 percentage points. In the X live broadcast between Trump and Musk on Monday, the expected content of talking about cryptocurrencies did not appear, and the crypto market responded by falling.

On the 15th, Harris' supporter, U.S. Senate Majority Leader and Democratic Senator Chuck Schumer, said at the Crypto4Harris Town Hall Meeting that if Harris is elected president, he will be committed to introducing pro-crypto laws by the end of the year to promote innovation in the crypto field in the United States.

SEC, according to documents, Nasdaq ISE has withdrawn its proposal to list Ethereum and Bitcoin spot product options trading on August 13. Also on the 13th, the SEC accused NovaTech and its principals and promoters Cynthia Petion and Eddy Petio of a $650 million fraud scheme.

In addition, the Indonesian Financial Services Authority (OJK) is preparing new tax adjustments for crypto asset transactions. This is part of the plan to transfer the supervision of crypto assets from the Commodity Futures Trading Supervision Bureau (Bappebti) to OJK in early 2025. According to Hasan Fawzi, CEO of the Financial Sector Technology Innovation Supervision, OJK will work with the Ministry of Finance to implement the new crypto tax. At the same time, OJK aims to achieve a transaction volume of 1,000 trillion rupiah (US$64 billion) in the digital and crypto financial sectors by 2028.

Fourth, Conclusion

1. Summary of Macroeconomic Level and Future Forecast

From the perspective of the Fed's policy goals and the recent statements of officials, it is "highly likely" that interest rates will be cut in September: on the one hand, inflation is falling towards the target of 2%, and the labor market has also cooled down. The overall and core CPI continued to fall year-on-year in July, the unemployment rate rose to 4.3%, and the non-agricultural employment was lower than expected, all of which paved the way for the Fed to cut interest rates in September; on the other hand, the recent speeches of Fed officials were dovish, starting the warm-up of interest rate cuts. In particular, Powell emphasized in many speeches such as the interview with the Washington Economic Club that there is no need to wait until inflation drops to 2% before cutting interest rates, and he is worried that cutting interest rates too late will put pressure on the economy. Therefore, "easing" will become the main theme of the second half of the year, which is good news for risky assets.

2. Market changes and early warnings in the crypto industry

Bitcoin and Ethereum ETFs are showing an upward trend, and the inflow of off-market funds may push prices up, but volatility remains unclear. Especially in the case of a balance between Trump and Harris in the US election, there are still variables in the future of industry regulation.

In the next week, five projects will have a one-time large-scale unlocking of tokens, with a total amount of US$217 million, of which Pixels (PIXEL) is worth about US$7.8 million; Avalanche (AVAX) is worth about US$197 million; SPACE ID (ID), worth about US$6.63 million; Galxe (GAL) is worth about US$1.55 million; and Ethena (ENA) is worth US$4.44 million.

3. Industry and track hot spots

With Bitcoin and Ethereum still dominating the main market, altcoins have performed poorly, but the popularity of the Meme track has added a direction for the industry to focus on. The popularity of Meme has also driven the growth of public chains, including TRON, Solana, etc.

In terms of L2, the leading protocol that achieved positive growth in TVL is the OP field, while the ZK series protocol is slightly sluggish. The Bitcoin L2 ecosystem has attracted much attention from industry insiders, and how to leverage Bitcoin's security and leverage Bitcoin's applications has become a common focus.

In addition, the concept of chain abstraction aimed at improving user experience is becoming a track that the industry focuses on.

Xu Lin

Xu Lin