By Stacy Muur

Kaito recently released its Information Markets Ranking, which is more than just a ranking of prediction markets. It’s about the financialization of information—turning data, insights, and predictions into tradable assets.

What does this mean, and how does it differ from traditional prediction markets?

Which participants are worth paying attention to?

What is an information market?

Information markets are an evolved form of prediction markets. Instead of simply betting on the final outcome, they monetize the entire information discovery process.

Traditional Prediction Markets

Binary Outcome: “Will BTC reach $100,000 by the end of the year?” (Yes/No)

Event-focused: Specific, time-bound predictions

Winner-take-all: Correct predictions win, incorrect predictions lose

Information Markets

Continuous Streaming: Real-time data streams, sentiment, and alpha discovery

Process-centered: Rewards information sharing, not just the end result

Value-added: Multiple participants can profit from quality contributions

Think of prediction markets as horse racing betting. Information markets pay the best trainers, jockeys, and analysts—even if their horses don’t win.

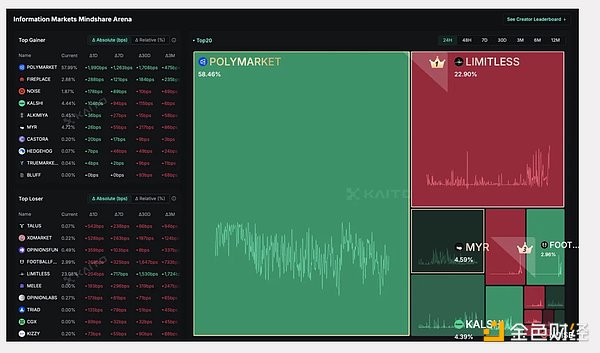

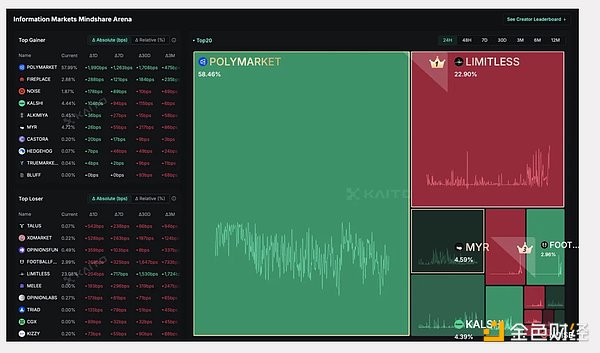

Insight: You don’t just bet on what will happen, you get paid for understanding why things happen and sharing that knowledge. Kaito's Leaderboard: Market Landscape Tier 1: Market Leaders Polymarket — Over $1 billion in monthly trading volume, approved by the CFTC to re-enter the US market. The King of Liquidity. Kalshi — $875 million in monthly trading volume, $2 billion valuation. A Regulated Challenger. Tier 2: High Potential Players Infinity — A social-first, creator-driven marketplace.

Alkimiya — Focused on the Bitcoin mining market.

Talus — AI-native, agents trading with each other.

Layer 3: Niche Platforms

Noise, Myriad, Hedgehog,

TrueMarket — all building domain-specific approaches.

Layer 4: Experiments

Castora, Bluff, opinionsdotfun, XO Market — early experiments worth tracking.

Investment perspective

High risk/high return

Safer institutional investment

Niche Alpha

Key Drivers

Regulatory Clarity: CFTC approval opens the floodgates.

AI Integration: Brokering real-time trading and analysis.

Creator Economy: Analysts and influencers look to monetize insights.

Election Cycles: Forecast traffic surges during political events.

We are shifting from an attention economy to an information economy. People will no longer simply consume content; they will be compensated for creating, curating, and verifying it.

Kaito's leaderboard is more than just a ranking; it's a map of how information is priced, traded, and monetized. This market could be worth over $100 billion, but we're still in the early days of "dial-up internet."

The ultimate winners will be those who build the best refineries for the new era's "oil": information.

Weatherly

Weatherly